🌍 Data center electricity demand goes nuclear #193

Tech companies and utilities cover their bases as data center electricity demand skyrockets

As memes make markets, we look at climate’s fundamentals

Happy Monday!

Big news week for COP: US, Canada, France and developed nations aren’t pulling their weight in capital contribution towards climate; and only 24/193 countries deliver climate plans at all. Meanwhile, the US midterms count down the votes with Dems locking in the Senate to keep Biden’s climate agenda alive.

In fundings this week, a French ag e-commerce platform raises $62m, an SF EV subscription service raises $60m, and a Swedish sustainable packaging solutions business raises a $32m Series D.

In the news, Bloomberg and Three Cairns launch a sustainability ratings system for infrastructure projects, Biden presses O&G majors to detect methane leaks, and the White House publishes its $25b ‘nature based solutions’ roadmap for climate.

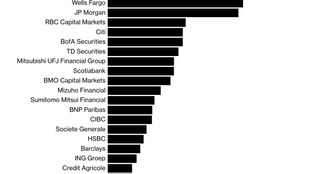

Our dry powder and new funds analysis picked up some buzz over the weekend! For those asking, we’ve added a higher rez logo chart as requested. Nerd out! Speaking of… are you a software engineer and obsessed with climate data and analytics like us? We’ve got more to come, reach out to us here!

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter here.

💼 Find or share roles on our job board here.

As FTX evaporates, Twitter and big tech layoff new waves of employees, and a blotty earnings season hampers hopes for a transitory recession it’s easy to imagine that the sky is falling… especially when blue check marks can liquidate billions in public market value for just $8/month. Large-cap stocks in the S&P 500 index have lost more than $7T in market value this year; crypto recently became responsible for the fifth-worst collapse of an asset in financial history; and the global housing market now braces for the broadest slowdown since the financial crash.

But for climate, it need not be all dour; even if the past year or so of investment does wind up looking like a “1x bubble” with limited returns for the most marked-up of startups, climate tech’s prospects remain firmly net positive.

🌾 Agriconomie, a France-based ag marketplace including regenerative inputs for farmers, raised $62m in Series B funding from Treïs, Temasek Holdings, Aliment Capital, and Eurazeo.

🚗 Kyte, a San Francisco, CA-based company providing electric vehicle delivery subscription services, raised $60m in Series B funding from InterAlpen Partners, Valor Equity Partners, Anthemis, Citi Ventures, Hearst Ventures, DN Capital, 1984 Ventures, FJ Labs, and Urban Innovation Fund.

♻️ Pulpac, a Sweden-based company developing sustainable packaging solutions, raised $32.m in Series D funding from Aliaxis Next, WPP, Teseo Capital, Stora Enso, PP Intressenter, DryFiber Holding, and Amcor.

🚗 Infinitum Electric, a Round Rock, TX-based developer of sustainable air core motors, raised $30m in from Riverstone Holdings Latin America, Alliance Resource Partners, Caterpillar Venture Capital and the Cottonwood Technology Fund.

🥩 Roslin Technologies, a UK-based company providing animal cell lines for cultivated meat production, raised $13m in Series A funding from Novo Holdings, Kairos Capital Group, Nutreco, Future Planet Capital, Esco Lifesciences, and Alchimia.

🚗 MTA E-Mobility, a India-based electric mobility company, raised $12.4m in Seed funding from MT Autocraft.

🐝 Alvéole, a Canada-based beekeeping solutions company, raised $8.1m in Series A funding from Round13 Capital.

🏭 TOffeeAM, a UK-based software design platform for sustainable additive manufacturing, raised $5.7m in Series A funding from Presidio Ventures Europe, East Innovate, IQ Capital, Exor Seed, Type One Ventures, and Excellis.

💨 Airly, a Poland-based company providing air quality sensors, raised $5.5m in Series A funding from Pi Labs, Firstminute Capital, AENU, Untitled, Semapa Next and TO Ventures.

☀️ Sunsave, a UK-based solar and storage subscription service, raised $5.7m in Seed funding from Neurone Ventures and Plug & Play Ventures.

🏭 CarbonRE, a UK-based operational efficiency platform for energy-intensive industries, raised $4.8m in Seed funding from Planet A Ventures, University of Cambridge Enterprise, UCL Technology Fund and Clean Growth Fund.

🪟 AeroShield, a Cambridge, MA-based company developing transparent insulation for energy-efficient windows, raised $4m in Seed funding from MassVentures and the Massachusetts Clean Energy Center.

🔋 Electric Era, a Seattle, WA-based provider of storage systems for EV charging stations, raised $4m in Seed funding from REMUS Capital, Proeza Ventures, Liquid 2 Ventures, and Blackhorn Ventures.

🔋 LiNa Energy, a UK-based sodium-ion battery developer, raised $3.6m in Seed funding.

♻️ Ecohelix, a Sweden-based company providing high performing biopolymers, raised $3.1m in funding from Molindo and Almi Invest GreenTech.

🏭 Hyperion Robotics, a Finland-based company 3D printing sustainable concrete, raised $3.1m in Seed funding from Lifeline Ventures, Impact VC Übermorgen, Goldacre, and Katapult.

⛓️ Return Protocol, a San Francisco, CA-based blockchain climate platform, raised $2.5m in Pre-seed funding from Cherry Ventures Blue Bear Capital, Possible Ventures, Slow Ventures, Allegory, Not Boring Capital, Climate Capital, and Eniac Ventures.

⚡ Embue, a Boston, MA.-based company providing energy efficiency solutions for buildings, raised $2.3m in Seed funding from Shadow Ventures, Avesta Fund, and Leder Investments.

⚡1s1 Energy, a Portola Valley, CA-based company develping green hydrogen production, raised $2.2m in Seed funding from Faber, CSN Inova Ventures, Gibson Lane, Ecoa Capital, Asiri, and Aquarius Capital Management.

♻️ Biotic, an Israel-based company providing bio-based plastic alternatives, raised $2.1m in Seed funding from UM6P Ventures, The Yield Lab Asia Pacific, TenNine.vc, Paseo Rosales, Norfolk Green Ventures, Cambridge Agritech, and Rockstart.

☀️ Over Easy Solar, a Norway-based company developing solar cells for ‘green’ roofs, raised $1.4m in Pre-seed funding from Stratel and Hafslund Venture.

☀️ Stemy Energy, a Spain-based provider of community solar, raised $1m in Seed funding from Capital Energy Quantum.

⚡ Serentica Renewables, an India-based renewables provider for hard-to-abate industrial sectors, raised $400m from KKR.

⚡ Aspen Power Partners, a Dallas, TX-based provider of community and C&I solar and storage, raised $350m from Carlyle Global Partners.

⚡Alight, a Sweden-based solar project developer, raised $155m in funding from DIF Capital Partners.

💨 CF Pathways, a UK-based company in carbon credits and risk management provider in the energy and environmental markets, raised funding from Ara Partners.

⚡ Zhero, a Netherlands-based developer of green energy including hydrogen and renewables, raised funding from Three Cairns, Galvanize Climate Solutions, and Fortescue Future Industries.

VoLo Earth Ventures, raised $90m for its inaugural fund investing in Pre-seed to Series B investments in electricity, mobility, buildings, and embodied carbon.

Wavemaker Impact,a Singapore-based fund, raised $25m to identify innovative climate tech and pair entrepreneurs to build startups.

International climate finance was the topic du jour of COP with poor countries demanding developed countries for loss and damages caused by climate change. Carbon Brief kicked off the week showing the US was $32B short of its proportionate contribution to the global $100B climate finance target.

Only 24 out of 193 nations submitted updated climate plans to the UN in preparation for COP27. At last year’s Glasgow summit, nations had agreed to deliver stronger pledges in 2022.

U.S. Climate Envoy John Kerry, along with the Rockefeller Foundation and Bezos Earth Fund, announced the “Energy Transition Accelerator” - a not-so-new idea to sell carbon credits to businesses to fund clean energy projects in the developing world. Ironically, the official announcement came a day after a UN report warning about greenwashing via carbon credits.

In more carbon credits news, the African Carbon Markets Initiative was launched to expand Africa’s participation in the voluntary carbon markets with the goal to produce 1.5B credits per year in Africa by 2050. Exchange Trading Group, Nando’s and Standard Chartered will be the first to set up AMCs for high-integrity African carbon credits.

Bloomberg Philanthropies and Three Cairns Group announced the launch of a new oversight body, the Global Carbon Trust, to bring more transparency and accountability to voluntary carbon markets. Bloomberg will also lead implementation of a sustainability labeling system (think LEED ratings) for infrastructure projects.

During Biden’s brief stopover at COP, he expanded on the existing Global Methane Pledge to require domestic O&G operators to detect and fix methane leaks. The proposal would establish a “Super-emitter response program” allowing credible third parties to report on leaks.

The UN unveiled a $3B roadmap for their “Early Warnings for All initiative” to detect climate disaster risk. Simultaneously, Biden announced $150M for an early-warning system for Africa.

Speaking of roadmaps, The White House published its first roadmap for “Nature-Based Solutions” including a $25B commitment.

The US and Japan are leading a climate finance deal worth $15-20B to help Indonesia shift from coal to clean energy (to power the world’s largest nickel producer).

Macquarie launched Eku Energy, a $2B battery storage business to develop a 3GWh storage project pipeline across the UK, Australia, Japan and Taiwan.

Hawaii is the first state to move to responsive utility rates to shift consumption based on solar generation. Guided by time of use, electricity in the evening peak hours will cost 3x more than it does in the sunny hours of booming solar production.

Energy-efficient heat pumps will be required for new homes in Washington state in July 2023, as part of Washington’s ambitious efforts to curb carbon emissions.

Also starting in July 2023, France will require all parking lots for 80+ vehicles to be covered by solar panels which could generate up to 11 GW of clean energy or the equivalent of 10 nuclear reactors.

Calling all tech workers, climate tech is hiring! Check out Climate Draft, Breakthrough, Lowercarbon, and our own job board.

Inside SCiFi Foods’ quest for the “third way” of hybrid meat production.

AgFunder released its must-read state of the agrifoodtech investment report. Tl;dr VCs pumped $51.7b into agrifood tech, an 85% increase over 2020.

“Hey Google: How can I save on gas?” Google launches a new feature, containing actionable information, to help people navigate the energy crisis in Europe.

Stunning visuals from Bloomberg in this deeply researched journey into Africa’s copper supply chain.

As shoppers prepare to whip out their wallets for Black Friday, Shopify drops some sustainability stats: 40% of shoppers are willing to pay extra for climate-conscious products and 63% are more likely to recommend a product if they know it’s less environmentally harmful.

Talk about dry powder…TPG expects climate-related deals to be a major opportunity for its record $46.4b (!) in available capital. Says Jim Coulter, “I don’t think there have been many times in my career that I’ve seen as much of an imbalance between the amount of specialized capital needed and the amount of specialized capital that’s been formed.”

Climate TRACE says it can project emissions for whole countries, industries, and individual polluting facilities. Its data cataloging ~73,000 steel and cement factories, power plants, oil and gas fields, cargo ships, cattle feedlots is the talk of the town at COP.

TIME’s best innovations of 2022 were naturally stacked with climate tech favorites including Gradient, Sila Nano, Aclima, Perennial, Twelve, Watershed, and ClimateAI.

Barcelona students protest for 7 days to… make a climate crisis course mandatory.

Bitcoin rigs get stranded as the electric price for mining exceeds the coin bounty.

🗓️ Accelerating Black Leadership in Climate Tech: Register for this free webinar on Nov 16 that brings together leaders of color in various areas of climate tech and clean tech to discuss how to grow and elevate diverse leadership going into 2023.

🗓️ Carbon to Value Year 2 Showcase: Register for this online and in-person event in NYC taking place on Dec 1 to hear from eight promising C2V carbontech startups and meet the growing New York carbontech and carbon removal ecosystem.

💡 NREL Industry Growth Forum: Submit applications by Dec 6 for a chance to be one of the 40 presenters to pitch live to a wide audience of investors and corporate partners at this in-person clean tech showcase in Denver on May 2-3, 2023.

🗓️ Australian Climate Tech Festival: Register for this event taking place on Dec 7 in Sydney to hear from a wide range of expert speakers in climate tech and learn about Australia’s positioning to be a world leader in the space.

🗓️ Greenhouse Startup Demo Day: Register for Demo Day to hear pitches from and engage with The Greenhouse’s Cohort three and other expert speakers on Dec 8 in the Royal Institution, London.

Senior Associate, Princeville Capital Climate Tech @Princeville Capital

Head of Business Development and Venture Capital (Climate) @Deep Science Ventures

Portfolio Management Associate @Generation Investment Management

VP, Climate Tech - CIB Digital Innovation @JP Morgan

Analyst @Keyframe

Head of Climate Special Projects @Entrepreneur First

Business Development Manager/Director @Shifted Energy

Junior Researcher (Seaweed) @Greener Grazing

Head of Content & Communications @Seven Seven Six

Senior Full-Stack Software Engineer @Arch

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Tech companies and utilities cover their bases as data center electricity demand skyrockets

A new green bank to finance climate projects

Larry Fink’s pragmatic proposition