🌍 Data center electricity demand goes nuclear #193

Tech companies and utilities cover their bases as data center electricity demand skyrockets

It's hopefully going to be a happy Monday after a hellish past 4 days for founders and funds caught up in the Silicon Valley Bank collapse. With nearly half of US venture-backed tech companies banking with SVB, and the bank's particularly important role in climate, we know many of our readers are feeling the ripple effects in some way. Sunday evening brought assurance from the Federal Reserve that the FDIC would cover even uninsured deposits at the start of business today, but the fate of SVB is still TBD.

Once everyone's caught their breath, the (good) news marches on. Countries reached an historic agreement to protect marine life in international waters. Iran just found a lot of lithium. CERAweek takes abound.

In deals this week, $125M for solar panels built in North America. Geothermal tech raises $37M and lower-carbon fuels for heavy-duty vehicles land $30M.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter here.

💼 Find or share roles on our job board here.

In a more encouraging historic moment this week, more than 190 countries reached an initial agreement to protect a significant portion of the ocean after almost 20 years of negotiations.

“The ship has reached the shore,” Rena Lee, president of the Intergovernmental Conference on Marine Biodiversity of Areas Beyond National Jurisdiction, announcing the treaty at the UN headquarters.

💨 Emissions and equilibrium. The ocean absorbs ~25% of the CO2 emissions created by humans, regulating the planet. A report from 2014 claims that fish and aquatic life remove 1.5 billion tons of CO2 per year, a service valued that year at ~$148B.

⏰ Overdue update. It’s been 40 years since the last agreement of this kind—the UN Convention on the Law of the Sea signed in 1982. A long delay on protection for the open ocean, which covers ~75% of our planet’s surface.

🐙 Biodiversity conservation. The high seas are home to many marine species. The treaty aims to conserve marine life, 10% of which is at risk of extinction. About 40% of those species are threatened by higher ocean acidity, more frequent marine heatwaves, and other effects of climate change.

⚓️ Deep sea mining debate. Extracting minerals from the deep seabed, which could cause disturbances to breeding grounds and prove toxic for marine life, is a topic of ongoing discussion. While developed countries are exploring this mining strategy, its impacts on the ocean would be shared.

🧪 Research. The treaty aims to ensure equal benefits from discoveries of genetic marine resources for uses like R&D in the pharmaceutical industry.

🔦 Protecting what we don’t know. The vast majority of life in the ocean is still a mystery. “We've recorded about 230,000 species in the ocean, but it's estimated that there are over two million," Dr. Robert Blasiak, ocean researcher at Stockholm University, said.

⚡ Palmetto, a Charleston, SC-based clean energy marketplace, raised $150M in growth funding from TPG Rise Climate.

☀️ Silfab Solar, a Mississauga, Canada-based photovoltaic (PV) module developer and manufacturer, raised $125M from ARC Financial, BDC Capital Cleantech Practice, CPP Investments, Common Fund, Manulife Financial, and Ontario Power Generation.

🚗 ClearFlame Engines, a Woodridge, IL-based startup powering heavy-duty engines with low-carbon fuels, raised $30M in Series B funding from Mercuria, WIND Ventures, Rio Tinto, and Breakthrough Energy Ventures.

⚡ Airex Energy, a Laval, Canada-based producer of biochar, biocarbon, and biocoal, raised $27M in Series B funding from Cycle Capital, Fonds de solidarité FTQ, Investissement Quebec, Desjardins-Innovatech, and Export Development Canada.

⚡ Banyan Infrastructure, a San Francisco, CA-based project finance platform, raised $25M in Series B funding from Energize Ventures, SE Ventures, Elemental Excelerator, VoLo Earth Ventures, and Ulu Ventures.

⚡ XGS Energy, a Palo Alto, CA-based geothermal harvesting technology, raised $19M in Series A funding from Anzu Partners.

⚡ Geothermal Engineering, a London, United Kingdom-based developer and operator of geothermal energy plants, raised $18M from Kerogen Capital and Thrive Renewables.

♻️ Selfrag, a Kerzers, Switzerland-based waste-to-value company, raised $16M from Technology Fund and UBS.

🛵 Evera, a New Delhi, India-based EV cab service, raised $7M in Seed funding from Devonshire Capital, IEG Investment Banking Group, and Westova Capital.

☀️ Roofit.solar, a Tallinn, Estonia-based rooftop solar company, raised $7M in Series B funding from BayWa r.e. Energy Ventures and EdgeCap Partners.

🚢 Zero Yachts, a Barcelona, Spain-based zero-emission yachting service, raised $6M in Series A funding from Ocean Zero.

🥩 WNWN Food Labs, a London, UK-based company producing cocoa-free chocolate through fermentation , raised $5M in Seed funding from Geschwister Oetker, HackCapital, Investbridge AgriTech, MSM, PeakBridge, and PINC.

⚡ Shifted Energy, a Honolulu, HI-based distributed energy resources (DER) platform, raised $4M in Seed funding from EPIC Ventures, Kapor Capital, Buoyant Ventures, Startup Capital Ventures x SBI Fund, and Hunt Development.

💨 ViridiCO2, a Southampton, UK-based developer of carbon utilization tech that converts CO2 into high-value chemical intermediates, raised $4M in Seed funding from EQT Ventures.

🌳 RenewWest, a Denver, CO-based developer of nature-based carbon removal projects, raised $3M in Seed funding from Clear Sky Advisors, Aspiration, and One Small Planet.

🏭 DexMat, a Houston, TX-based producer of carbon nanotube fibers and films, raised $3M in Seed funding from Shell Ventures, Overture Ventures, and Climate Avengers.

🌱 The GrowHub Innovations, a Singapore-based Web3 platform for food traceability, raised $3M in Seed funding from Lester Chan.

⚡ Pointo, a Kolkata, India-based EV ecosystem for 2 and 3 wheelers, raised $3M in Seed funding from Mufin finance.

⚡ trawa, a Berlin, Germany-based sustainable electricity procurement platform, raised $3M in Pre-Seed funding from Alexandre Berriche, Anna Alex, Julian Teicke, Kai Klapdor, Magnetic, Matthias Ernst, Maximilian Both, Moritz Poewe, Speedinvest, The Delta, Tiny VC, and Tobias Schuett.

♻️ ScrapBees, a Neuss, Germany-based scrap metal recycling and disposal service, raised $2M in Seed funding from BonVenture, Cohors Fortuna Capital, and Faraday Venture Partners.

⚡ itselectric, a Brooklyn, NY-based curbside EV charging company, raised $2M in Pre-Seed funding from Brooklyn Bridge Ventures, The Helm, XFactor Ventures, Graham & Walker, Clean Energy Venture Group, and Pericles.

🌾 Agurotech, an Amsterdam-based data-driven arable farming solutions startup, raised $2M in Seed funding from Navus Ventures and ROM InWest.

🏗️ Adaptis Technologies, a Toronto, Canada-based net-zero building adoption and optimization platform, raised $1M in Pre-Seed funding from 2048 Ventures, Blue Vision Capital, and Powerhouse Ventures.

🏠 ExerGo Sàrl, a Sion, Switzerland-based provider or heating and cooling services, raised $1M in Seed funding from Baker Hughes and EREN Groupe.

Moonshot, a San Francisco, CA-based producer of climate-friendly snacks, was acquired by Patagonia.

Proud Source Water, a McKay, Idaho-based sustainable bottled water company, was acquired by SOURCE Global.

DroneSeed has rebranded to Mast Reforestation and acquired seedling supplier Cal Forest.

Enerqos Energy Solutions, a Milan, Italy-based renewable energy and energy efficiency company, was acquired by Ameresco.

Clearly Clean Products, a South Windsor, CT-based packaging and containers company, was acquired by Blue Sage Capital and Insight Equity.

Mulilo Energy Holdings, a Cape Town, South Africa-based renewable energy developer, was acquired by Copenhagen Infrastructure Partners.

Everfuel, a Denmark-based green hydrogen company, and Hy24, an investment platform focused on clean hydrogen infrastructure, raised a $212M joint venture fund for accelerated deployment of electrolyzers.

Matterwave Ventures, a Germany-based VC firm, raised a $79M industrial technologies fund.

Muus Climate Partners, a New York, NY-based investment firm, raised a $50M fund to support climate tech companies on the cusp of commercialization.

Startup-focused Silicon Valley Bank became the largest bank to fail since the 2008 financial crisis. As it tried to raise capital to offset fleeing deposits, the bank lost $1.8B on Treasury bonds whose values were torpedoed by the Fed rate hikes. SVB served as a banker to dozens of climate and energy-tech companies—more than 60% of community solar financing nationwide was involved with SVB.

Vibe shift at CERAweek. As energy professionals gathered in Houston to discuss the future of oil and gas, the message from Biden admin officials was clear: Do more to cut the GHG emissions that cause climate change, we’ve got plenty of incentive money available for you to do so. Check out CTVC's recap here.

Iran discovered what may be the second-largest lithium deposit in the world. Officials say the deposit holds 8.5M tons of the vital mineral for EV batteries.

The U.S. Department of Energy found that U.S. transmission capacity will need to increase by more than 50% by 2035 to accommodate clean energy growth. The interconnection process is the top reason renewable projects don’t move forward, read more in CTVC’s recent feature.

Constellation Energy’s nuclear plant in New York has begun producing hydrogen at demonstration scale, using 1.25 MW of energy per hour to produce 560 kg of clean hydrogen per day. The plant is the first of four nuclear-powered hydrogen projects that received funding from DOE for clean hydrogen to come online.

Ohio decided natural gas is now “green energy”—the latest in a decade-long series of moves from oil and gas lobbying aimed at recentering the industry in the state while undermining renewable energy legislation.

TikTok and the WSJ agree: We need more electricians! Clean energy companies say hiring engineers, mechanics, technicians and others to build and install clean energy equipment is limiting their ability to capitalize on IRA incentives.

Geothermal startup Eavor received a $96M grant from the EU Innovation Fund for a project in Germany, a sign of growing support for geothermal power and heat.

The EU unveiled measures to boost the bloc’s clean-tech industry as a response to US climate subsidies, prioritizing investment support for manufacturing batteries, solar panels, wind turbines, heat-pumps, electrolyzers, and carbon capture usage.

Zero-emissions maritime shipping: The Aspen Institute, Patagonia, Amazing, and Tachibo formed the Zero Emission Maritime Buyers Alliance (ZEMBA) so companies can access zero-emission shipping solutions that are not currently available.

Lithium batteries erupted in dangerous fires in London and NYC last week. In response, congressman Ritchie Torres is proposing new legislation for New York to help prevent lithium-ion battery fires.

Scientists found an enzyme that can absorb hydrogen from the air and make electricity.

A new study suggests we are all breathing unhealthy levels of “fine particulate matter” from windblown dust, soot from wildfires, pollution from cooking fires, and the burning of coal and other fossil fuels.

The vertical farming bubble is finally popping.

Conservative U.S.A. has the most to gain from IRA clean heating technology carrots. Is Progressive Northwest and Midwest too drenched in oil and natural gas, to buy into Biden’s clean heating plans?

Germany lost €40 billion in 2021 from flooding. That’s small schnitzel compared to the €900 billion it’s set to lose by 2050 due to climate-related damages.

If you loved For All Mankind, we recommend the Mutant Seed Space Race. The International Atomic Energy Agency is launching seeds on rockets and exposing them to orbital radiation to make them drought resistant and “non-gmo.” No Apple TV required.

Take the gun, leave the… lithium batteries. The Tesla Mafia is strong, and everywhere.

We couldn’t stop watching this two-minute viral video of a 3D-printed frog house upgrading from an apartment to a mansion with a predator-proof safe room and Jacuzzi. #habitat restoration.

A tunnel in Paris known as “the world’s wine cellar” might be rezoned. An ecologist wants to stop rezoning, and repurpose the cellar as a cooling shelter during heat waves.

Lightship dropped a new EV RV. Take a look inside.

Did AgTech get hit harder by the market slowdown than other climate tech sectors? AgFunder’s Global Investor report finds investment in 2022 was down 44% from record-breaking levels in 2021.

It’s time to invite the fungi to the party. TIME reports on why Fungi needs a seat at biodiversity tables.

Why the EU can’t get away from Russian nuclear fuel and reactors.

Renewable developers are pushing for new projects across the U.S, in some cases on native land. Tribal leaders are pushing back, resulting in a new phrase: “green colonialism.”

This week’s installment of acronym soup: MCJ ON ERCOT.

If you missed it, watch this webinar recording: How contractors can win with the IRA.

🗓️ Climate Tech Meetup: RSVP to join a climate tech meetup hosted by Mercury, Leap Forward Ventures, and Giant Ventures on Mar 15th.

🗓️ MCJ Monthly Idea Jam: Energy: Register to join MCJ’s monthly idea jam on Mar 17th, and listen to investors, entrepreneurs, and innovators gain advice on their climate ideas.

💡 IgniteX: Apply to the IgniteX Climate Tech Accelerator by March 24th and partner with Black & Veatch on building your climate tech solutions.

🗓️ Techonomy Climate Conference: Register by Mar 28th to join the Technology Climate Conference, a one-day event in Silicon Valley featuring climate experts, entrepreneurs, and investors.

💡 Climate Solutions Foundation Congressional Fellowship: Apply by Mar 31st for this one-year fellowship to gain political experience and develop policy climate change solutions.

💡 Go Energize: Apply by April 4th to the Go Energize program supporting startups within the offshore wind industry with a TRL level of three or higher.

🗓️Innovation Zero: Register to join Innovation Zero on May 24th-25th to hear from over 7000 policymakers, funders, investors regarding innovations in decarbonization. Kim will be speaking at this conference!

Associate - Climate @Entrepreneur First

Head of Nature Based Climate Solutions @TIAA (Nuveen)

Chief of Staff @Generate Capital

Senior Product Manager @Regrow Ag

Carbon Demand @Eion

Finance @Eion

Program Manager, Frontier @Stripe

Diligence Lead, Frontier @Stripe

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

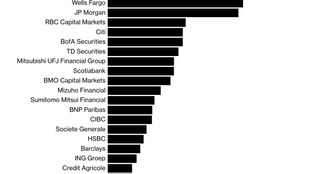

Tech companies and utilities cover their bases as data center electricity demand skyrockets

A new green bank to finance climate projects

Larry Fink’s pragmatic proposition