🌎 Two climate investors on raising in today's tough market

Q&As with Sophie Purdom, who just closed first-time Planeteer Fund I, and John Tough, who recently closed Energize Capital's mega-fund Ventures Fund III

How software and AI could reduce barriers to clean power purchases with Verse

More than one-third of the world’s largest companies have net zero targets, but nearly all of them are on track to miss those deadlines if they can’t double emissions reductions by 2030. Large companies looking to decarbonize have begun pushing for a cleaner grid, but today, most of them still need to buy renewable energy directly.

Let’s back up for a second. Deregulation in the early 2000s led to the evolution of energy markets in the US, which maintain reliability of power grids and create economic incentives for buying and selling power. Each of the six regional markets in the US is managed by one of the independent systems operators (ISOs): ERCOT, MISO, PJM, SPP, CAISO and NYISO.

⚡Wholesale market: Power generators, such as private power plants, sell their electricity to utilities in markets operated by the six independent systems operators (ISOs).

💵 Retail market: Utilities resell the energy bought on the wholesale market to customers who use the electricity.

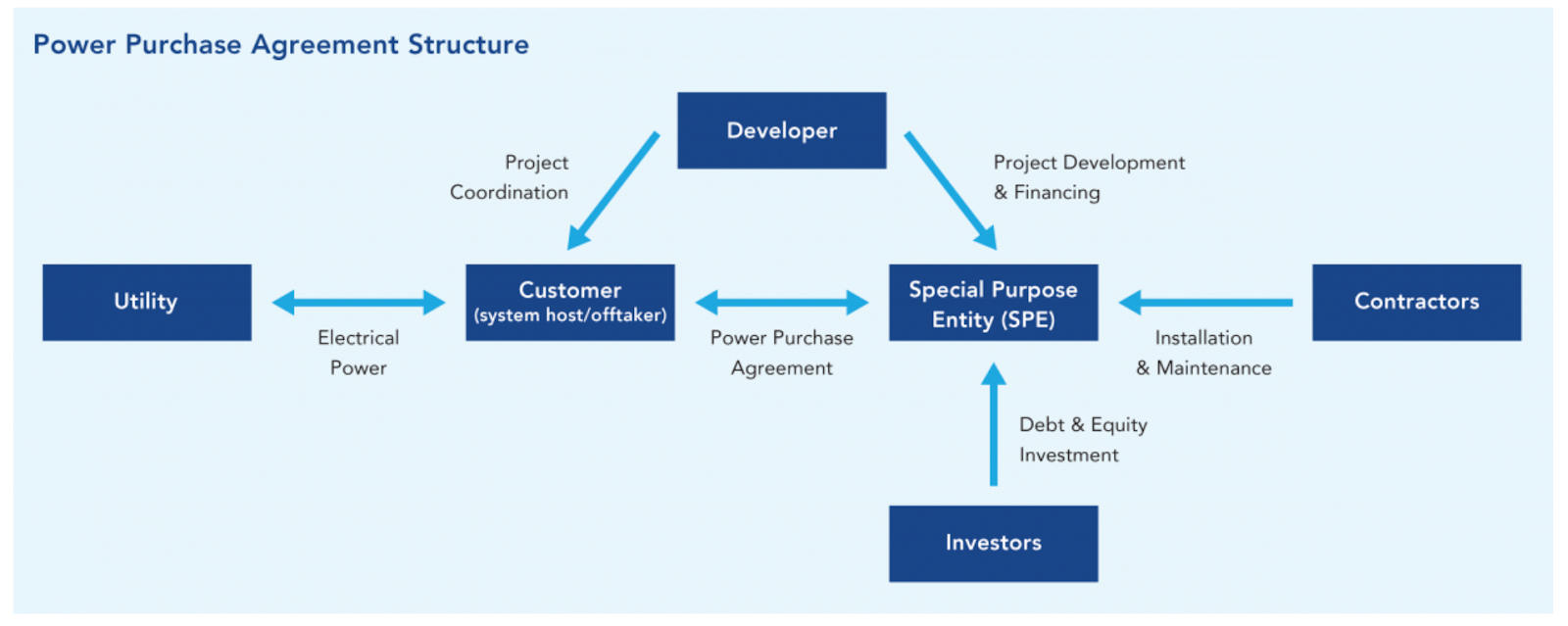

For end-users seeking cleaner and cheaper energy than their local utility can provide through the power grid, there’s a mechanism to side-step these markets and buy carbon-free electricity directly from the source.

Large US tech companies are leading the charge on PPAs for wind and solar, with Amazon, Meta, Microsoft, and Alphabet purchasing the most power globally in 2022. But other firms are interested in doing the same—more than half of US clean power buyers last year were new to the market.

Corporate interest in clean power purchases continues to grow, despite rising PPA prices over the last few years, but it takes a lot of resources to assess and execute these deals.

Verse has raised $5.75M and built an AI-powered software platform that aims to simplify this process and reduce clean power procurement costs. Last week, the San Francisco-based startup launched its first product, Aria, and announced direct air capture company Climeworks as its first customer.

We sat down with co-founder and CEO Seyed Madaeni to talk about the complexities of clean energy transactions, how automation could disrupt this market, and—of course—current AI tailwinds.

What’s your background? How did it lead you to start Verse?

I did a PhD in applied operations research in electricity markets, which means building mathematical models for the purpose of solving problems related to energy. Essentially, I took a chapter of my PhD thesis and converted it into products throughout my career. I started at Pacific Gas and Electric (PG&E) building software and models to trade PG&E’s assets in electricity markets, then did the same at SolarCity. Then I was part of the team that created the autobidder product at Tesla. After that, I joined the startup AMS, a SaaS company taking renewables and monetizing them in the market, as the Chief Product Officer and eventually became the CEO. We launched the product in 2019, grew it, and sold the business to Fluence, where I became Chief Digital Officer. We grew that product to 10-15 gigawatts (GW) in a matter of three years and did an IPO at Fluence, which was a very fun ride and a great experience. But then I saw this massive whitespace. As an entrepreneur, my back started itching again, so I quit my job and started Verse.

How does Verse’s technology fit into today’s energy markets? How does this platform aim to change the way companies purchase clean power?

The first chapter of my career was focused on how to increase the economic viability of these renewables from the perspective of whoever is selling power, but that’s a limited set of entities. A lot of major corporations and even smaller organizations now understand climate change is real, and they're on a mandate to convert to clean electricity. The whitespace that I saw was helping organizations everywhere access direct carbon-free energy while reducing their costs and risks. It’s two sides of the same problem, but this is the customer segment that hasn’t benefited much from clean power previously.

Out of Scope 1 to 3, our focus is on Scope 2, the carbon related to your energy purchases and electricity consumption. There are different instruments to decarbonize that, which have been playing well on a voluntary basis since the early 2000s. There are renewable energy credits, which are mostly carbon credits generated from renewable assets. If you want to step it up a notch, a mechanism called power purchase agreements (PPAs) allows organizations to enter into bilateral contracts with providers of renewable power to help with their decarbonization. The catch is, it's not accessible. So there's a whole host of financial benefits that are attributed to clean power that haven’t been tapped yet. Reducing electricity costs, reducing risk, having more robust energy decisions—our goal is to make that accessible, not to just big organizations, but to the smallest organization that has a decarbonization ambition and would like to do something when it comes to their financial footprint along with their carbon footprint.

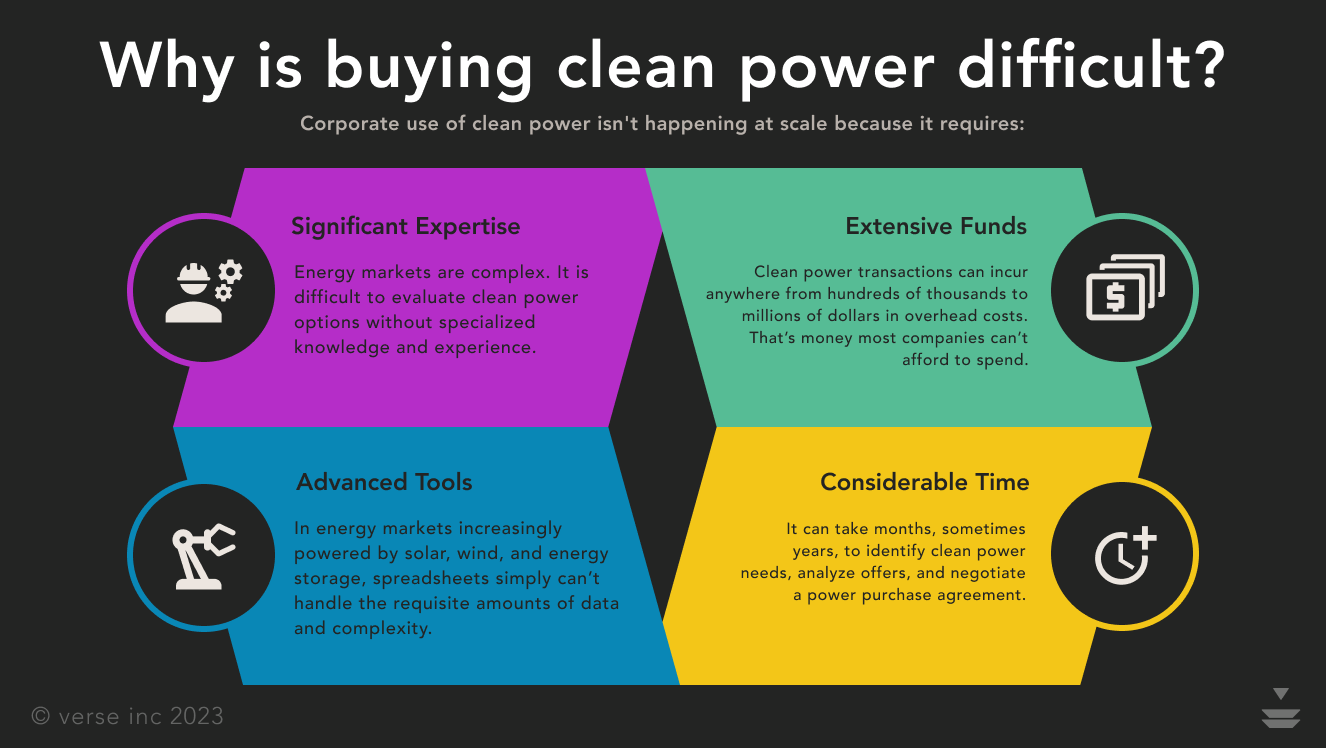

What is it that’s keeping more companies from entering into PPAs today?

The big tech companies started a lot of this movement by voluntarily getting into PPAs to legitimately decarbonize their electricity consumption. They've built teams to make PPAs happen. Only a fraction of US electricity demand has entered into PPAs—below even 1%, and more than half of it has been big tech. Why is that the case? Are PPAs not beneficial for organizations? The answer is yes, they can reduce your costs, they can help you with risk. But the overhead costs of these transactions are skyrocketing, because they’re very sophisticated. We can’t expect companies that are focused on producing commodities or trading or services to be power market experts. That's why these overhead costs of transactions are really high. There are no tools, no processes, no real source of truth and information for these organizations to utilize to enter into these contracts and enjoy the benefits of clean power.

Verse can tremendously reduce the cost of decarbonization when it comes to scope two. We have the skill expertise, the in-house team. We've hired PPA procurement experts out of Google and Amazon. We have an amazing software team that can help us achieve this. If access to direct, carbon-free energy is below 1% today, our goal as an organization is to change it to at least 10% by 2030.

How does Verse specifically as an AI and software platform help solve for some of those overhead costs and challenges?

How do companies understand the risks and rewards of signing into a PPA, which can be a 10-year agreement? The datasets here are very sparse, even the datasets around emissions. What will grid emissions look like five years from now? This type of data information has been extremely proprietary and inaccessible. Even if you have the data, how do you actually think about modeling the implications here? There's been great work by my colleagues from the consulting businesses who've helped organizations thrive in this sector, but we're at a tipping point to achieve scale. We’ve got to think about automation, not necessarily humans in the loop. That's an overhead cost for these transactions, and there's a lot of ongoing manual and bespoke work that needs to happen. The primary platform has been Excel spreadsheets, which are not well-maintained and not really suited to do the job. Overhead costs in transactions are elements that you can quantify, but we're ignoring the implications of getting into wrong decisions for a couple of years in the future. To avoid that, you need to leverage advanced analytics and great AI models to help you understand what decisions you're making. These are the suite of products and processes that a normal organization does not have access to.

How are you aiming to differentiate your solutions? What exactly will the AI and modeling enable for users of the platform you’re working on?

We found the common thread of needs and pain points across many customers when it comes to defining, transacting, and managing clean portfolios. And we've embedded it into software that’s very easy to use—clickable, digestible design that allows an unsophisticated enthusiast of energy and clean power to embark on a very sophisticated journey, without understanding all the sausage-making that's happening behind the scenes. Our product leverages a lot of data models, optimization models, and generative AI to achieve their goals.

A year ago, I didn’t even know what large language models (LLMs) were. Now we are moving full-speed ahead to incorporate these into our product and offer the efficiency it brings to the market. We can take a tremendous amount of data and very sophisticated transacting problems, costs, risks, and emissions that are extremely hard to solve for 10, 15, or 20 years—these required large scale mathematical models two years ago, but we can solve them in a fraction of a second leveraging LLMs and generative AI. In a nutshell, with the click of a button, you can get to seamless, transactable, traceable carbon reductions, and that's been the goal.

What elements are you able to automate in order to drive costs down and increase efficiency compared with today’s PPA transactions?

Think of it as three buckets: data, decision-making, and process automation. With the data, one of the issues is that it's bespoke and it's all over the place. Even if a lot of this data may be public, it's very hard to aggregate and solidify. So our engineering team has consolidated price data, emissions data, forecasting data, and we also work with third parties that can help us with this acceleration.

We are leveraging that data for our decision-making. As opposed to a human driving a spreadsheet, we have generative AI and optimization models embedded in a software product driving these long-term decisions. With more informed decision-making, we can bring even more advanced asset classes to corporate buyers. The PPA market last year was around 30GW, but mostly wind and solar. Why not energy storage? Why not hydrogen? Carbon-free energy can mean a lot of different things, and you can’t model and optimize the way these assets can provide benefits in a spreadsheet.

The third part is process automation, and that's where we eliminate a lot of the overhead costs. You've probably logged into chatGPT as users and worked with LLMs. We can bring the cost of humans involved to the bare minimum with process automation driven by generative AI.

What would that automated decision-making process look like for a company using the platform?

Imagine you're a Fortune 500 company and your business is producing snacks. You're in the snack industry, but you also have the decarbonization ambition. The learning curve is so steep when you come out of big tech—power markets, transactions, cost mitigations, risk mitigations, dispatching for around-the-clock carbon-free energy, 100% renewables, and how the SEC rules and regulations are evolving. You can't do that unless you have a solid team in place. If you don't have your in-house team, you're confined by consultants. That's why the cost of these transactions are high and quite poor. Honestly, the type of decisions that have been made are also not appropriate. Let's say you want to buy a car. I can come to you and say, ‘I'm the Craigslist of buying cars. Buy one of these.’ Or you can have a proprietary agent and model and software that's helping you, starting by asking questions. What's your objective? Do you want to commute from point A to point B every day? How many passengers? Is speed important for you? What about safety or reliability? Going through that journey, and then doing the work for you is what companies need. They don't need to be experts in power markets. They need to understand how much carbon they want to mitigate, what their budget is, and how much exposure they are willing to have. With those three ingredients, we'll make it happen.

Who are your target customers?

Our go-to-market strategy has been focused on three main segments. The most emerging segment is big tech, which has done amazing work as market leaders when it comes to investing in carbon-free energy on a voluntary basis. But as they are growing their needs, they're also thinking about advanced procurement options. Philosophies like 24/7 carbon-free energy or emissions first are more sophisticated than just 100% renewable energy goals. Therefore, the nature of these transactions can be more sophisticated, and our tools and processes can really serve them. The second area of focus is organizations that have commitments to net zero. A lot of Fortune 500 and Fortune 1000 companies that are either very early in their PPA journeys or in later stages could benefit from Verse products, because we bring a lot of great decision-making and automation that doesn't require them to build massive teams to transact in carbon-free energy. The third area is all of these emerging technologies, which are doing great things when it comes to decarbonization, but are also dependent on electricity. Think about the direct air capture (DAC) segment or aviation fuels—companies and organizations that were not around five years ago, but now they are doing amazing work and they need clean power. Our first customer is Climeworks, which is a DAC company. So far, the relationship has been great, and we have a very strong hypothesis to help with their decarbonization journey.

Tell us more about the funding you raised and who was involved.

We raised a $5.75M seed round. We were very fortunate to work with Coatue as our lead investor. They've helped us to not only define the mission, but also been a design partner. They have a great view and mindset towards adoption and growth, which is something that our industry needs. The energy industry has been very bespoke, and has yet been kind of intrigued by numerous software technologies that can make a change. I think we're here for that change. Along with Coatue, we're fortunate to have many great investors in our cap table. We have Twine Ventures, which has been amazing to introduce us to new commercial partners. We were working with Firstminute Capital, My Climate Journey, and Collaborative Fund. We’re very pleased with Incite.org and the work that Matt Rogers has been doing to support us on our decarbonization journey, and many more. We are extremely happy and fortunate about this investor base.

Looking to slim down your company’s scope two emissions? Reach out to [email protected] to learn more about test-driving the Aria platform.

Q&As with Sophie Purdom, who just closed first-time Planeteer Fund I, and John Tough, who recently closed Energize Capital's mega-fund Ventures Fund III

A Q&A with Precursor's David Yeh and Mark1's Julian Ryba-White, new strategic partners in the ecosystem

A Q&A with the DOE LPO director Jigar Shah and Solugen CEO Gaurab Chakrabarti