🌎 H1 2025 Climate Tech Investment: Capital stacking up for energy security & resilience

Get Sightline’s signature H1’25 investment trends report inside

Part I: Accelerating climate tech deployment depends on clearing the massive backlog of renewables projects

The promise of a clean energy future is predicated on abundant, cheap, green electrons. The pace of cleaning up the grid sets the speed limit for the race to net zero. While announcements about new renewable energy capacity feel like an industry sprint, actually building projects is a marathon, and many aren’t making it across the finish line.

The good news for an abundant green electron future is the technologies for solar and wind are largely de-risked.

All in, by the end of this year, the EIA estimates projects in the pipeline could add ~26G W of utility-scale solar capacity to the US grid—nearly doubling the record of 13.4G W installed in 2021.

These projections are exciting but capacity estimates =/= clean electrons flowing into the grid.

To reach 100% clean electricity by 2035, the US needs to add ~70 GW of renewables each year, but it’s taking longer than ever to get projects from inception to operation. While 2022 was a record year for residential solar in the US, installations of utility-scale capacity actually dropped compared with 2021—the first YoY decline since 2018.

In January 2022, the EIA expected 19.5 GW of new US utility-scale solar by the end of the year. 12 months later, just 10.5 GW of solar had made it online—if the EIA was in the business of giving out performance report cards, solar capacity would get a failing grade. What happened to the 46% of missing capacity?

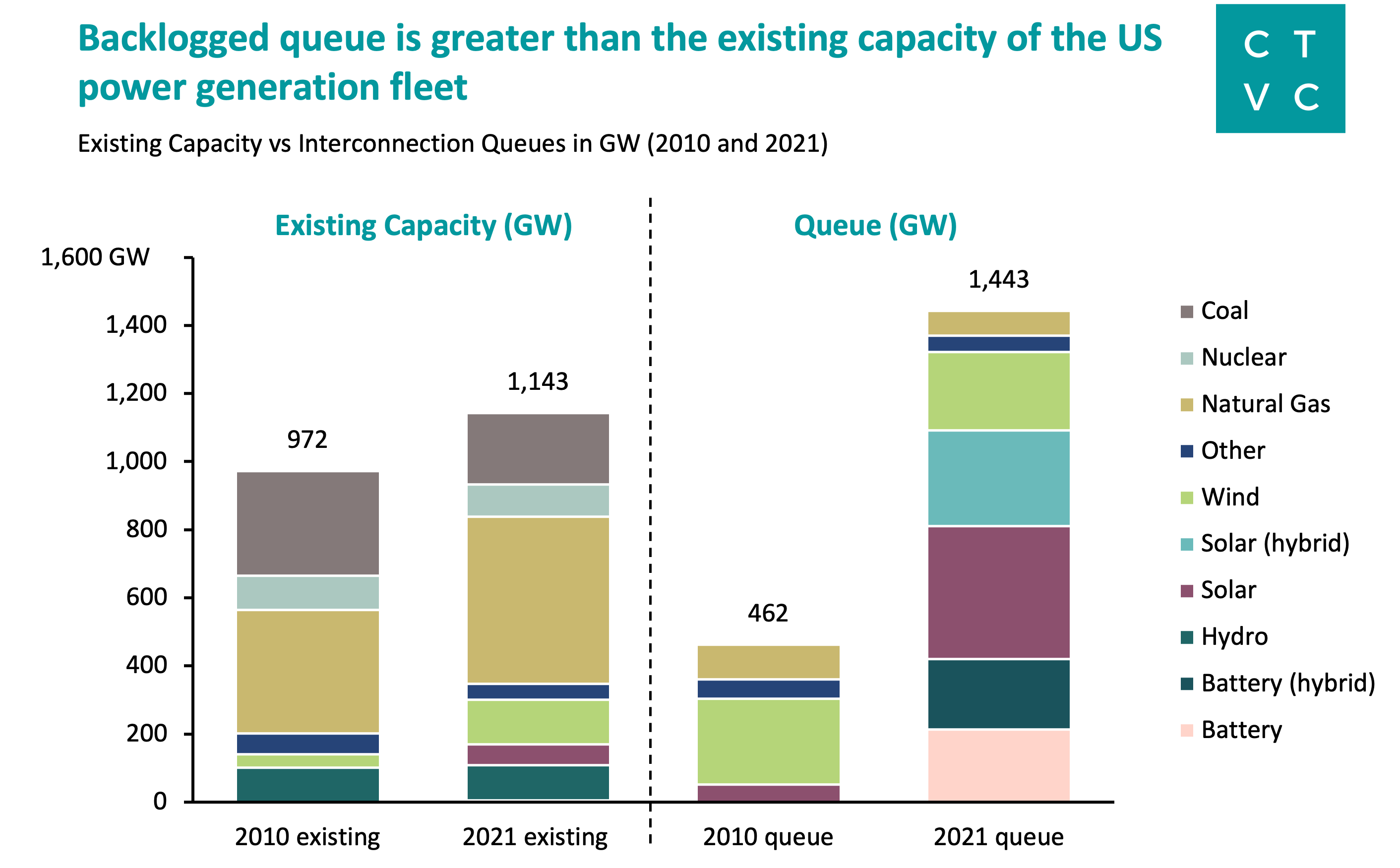

It's common knowledge that the interconnection queue is backed up, but the actual statistics are staggering: Projects waiting for the green light to begin construction added up to more than the grid’s entire existing capacity at the end of 2021. Even then, the energy mix of proposed projects looks completely different, with solar, wind, and storage making up ~95% of the queue.

The multi-billion dollar question: why is the queue so backed up? And more specifically, how do we get it to move faster?

TLDR; Interconnection is the key unlock to renewables deployment at-scale, but there’s no one silver bullet to solve it.

Bottlenecks in the solar project pipeline start pretty much immediately.

The grid is an outdated, sprawling network, and the process of connecting into it—interconnection—is no simple task. Before developers can break ground, grid operators have to determine how this new source of energy generation changes the complex transmission equation.

The engineering studies undertaken to connect any large energy project, from fossil fuels to nuclear to renewables, are used to predict how it will affect grid reliability: Will this new project overwhelm existing transmission capacity? And what needs to be done to mitigate those potential problems?

Each of the seven independent systems operators (ISOs) in the US handles its own interconnection requests and the rapid growth of renewables projects over the last few years created a pile-up in those queues. The aim isn’t for grid operators to approve or halt a project, it’s to identify issues that could arise from connecting new energy generation to the grid in a certain location and allocate the costs of the equipment needed to address them among developers.

The process might find that connecting a new solar project requires building new transmission lines, which is extremely expensive. For context: There’s ~$5B for transmission line construction in the IRA, but grid operator MISO plans to spend more than $10B on just 18 new transmission projects.

Developers are frustrated. The interconnection process is the top reason projects don’t move forward.

A big part of this problem is simply volume: The spike in projects seeking interconnection requests caused the time from submitting to commercial operation to double from ~2 years for 2000-2010 to ~4 years over the most recent decade.

“The vast majority of that time is spent in this interconnection queue doing a series of studies,” Joe Rand, Senior Scientific Engineering Associate studying electricity markets and policy at Lawrence Berkeley National Laboratory (LBNL), told us.

The Federal Energy Regulatory Commission (FERC) first implemented the current interconnection process in the early 2000s. Regulators designed it to handle big, centralized power-generation projects, like coal and natural gas plants.

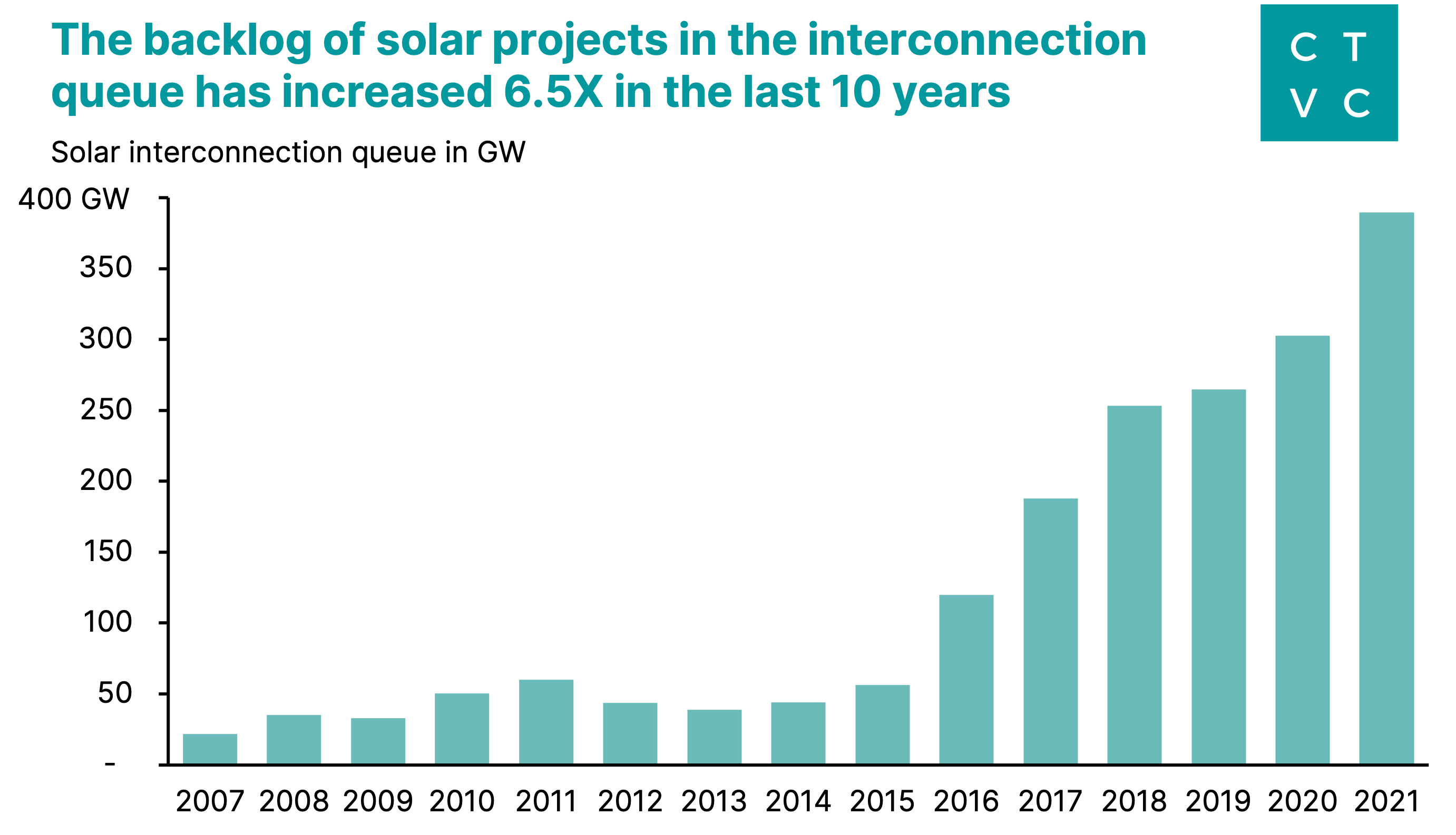

Since then, renewables have come down the cost curve and decarbonization targets adopted by corporations, utilities, states, and the federal government sent signals of rapidly increasing demand to investors and developers. This caused the number of interconnection requests to skyrocket, especially since adding more wind and solar to the grid means building many smaller projects rather than a few large ones.

Solar projects totaling more than 100 GW of new capacity have joined the queue annually since 2017, up from ~24 GW on average each year in the decade before that. The surge of requests overwhelmed approval systems that worked at lower volumes and by the end of 2021, the cumulative capacity of solar projects stuck in this process had ballooned to ~390 GW.

“The pace of maintaining and updating, expanding—proactively expanding—our transmission system, especially regionally and inter-regionally, is not keeping up with the pace of the energy transition,” Rand said.

Many frustrated developers are walking away. Only 23% of renewable energy projects that entered the interconnection queue between 2010 and 2016 made it to commercial operation. And that success rate is likely declining, LBNL found.

A case study in queue overload: For PJM, the largest grid operator in the US, a lack of precedent for assessing renewable energy interconnection threatened to shut the process down entirely.

The interconnection problem isn’t just about the waiting game. To some degree, developers who enter the queue are going in blind—beginning the process with no way to effectively estimate the final costs, which can range into tens of millions of dollars.

Interconnection studies are conducted in batches—a cluster of projects in the same region that submitted requests around the same time will all be considered in a model of how that new solar capacity will interact with the grid. But the decisions made about solar projects further ahead in the line could drastically change the cost of projects that come after them.

Some grid operators are still studying projects submitted in 2017 or 2018.

“The slower these processes are, the more uncertainty project developers have,” David Bromberg, CEO at Pearl Street Technologies, told us. “If you're not getting your study results for years, that's a lot of risk and uncertainty. So to hedge your bet as a developer, you may submit multiple positions into the interconnection queue in the hopes that one of them pays off.”

Once developers finally clear the interconnection hurdle, they’re then hit with equipment shortages and cost overruns. Supply chain challenges—including US tariffs on solar panel components made in China—were a significant limiting factor in the speed of bringing new projects online last year.

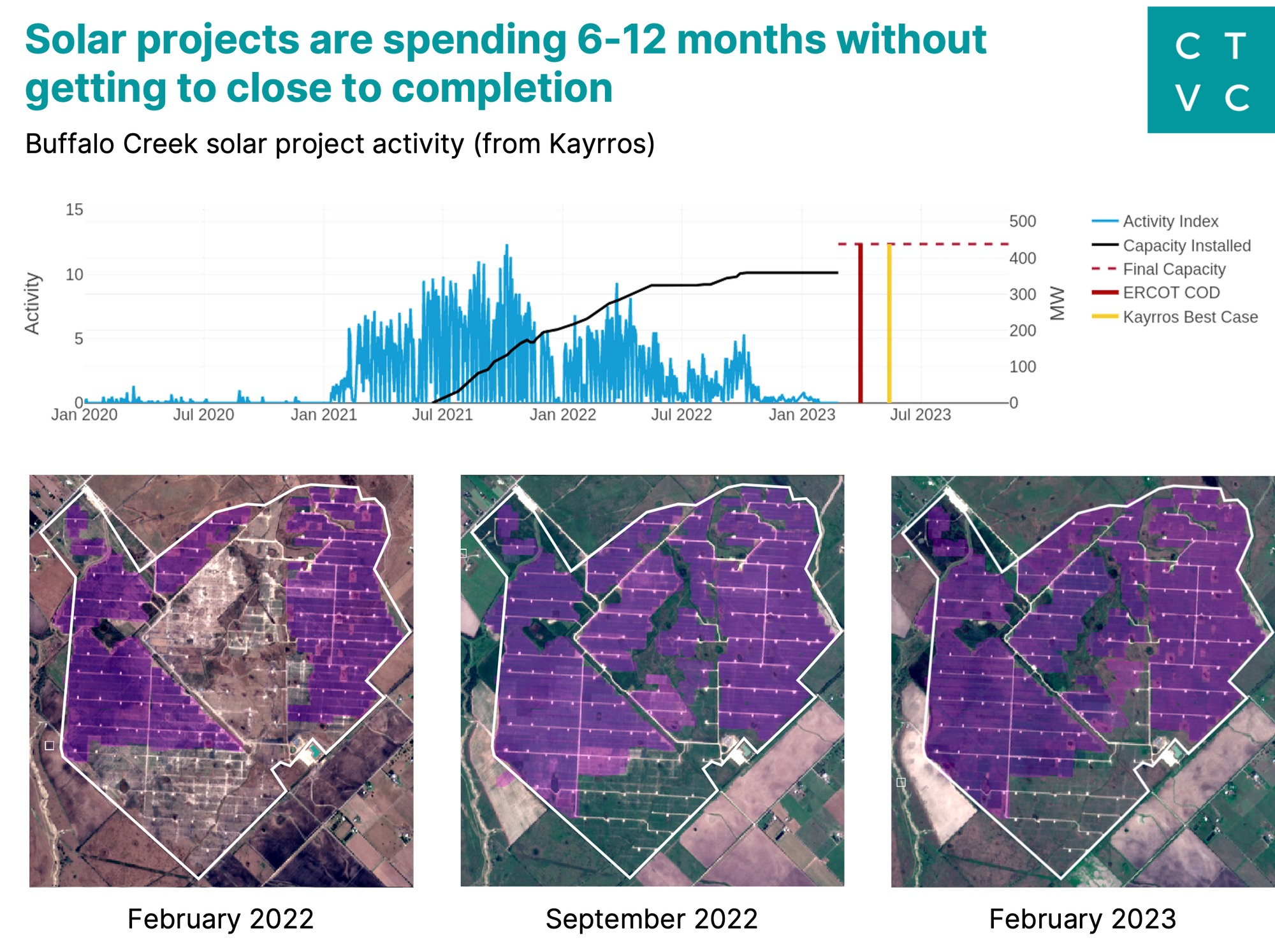

The Buffalo Creek solar project in Texas is a clear example of projects underway hitting supply chain issues and delays. Kayrros is an earth observation startup that uses satellite imagery to track solar construction progress. In the chart, the red vertical line signals the expected commercial operation date (COD) submitted to ERCOT but the yellow line indicates the best-case scenario predicted by Kayrros, which has fallen behind. Even despite the approaching COD, project activity (shown in blue) looks to have slowed to a halt at the start of the year.

Without enough panels to go around, developers had to decide which projects would move forward. Even NextEra Energy, one of the largest renewables companies in the US, expected 2-3 GW of solar and storage projects to be delayed by supply constraints.

To address this, President Biden hit pause on solar tariffs for two years in June. The solar industry is working to build out a domestic supply chain during that grace period and since the passage of the IRA, the US has seen 18 announcements for additional solar manufacturing capacity.

Another potential source of delays for these projects is local resistance to building them.

In many communities, the vast majority of people’s attitudes toward renewable energy projects are neutral-to-positive, LBNL found. Opposing voices are often overrepresented in public discussions. Some rural areas have even experienced coordinated campaigns to spread misinformation and ban solar projects.

That said, the renewables industry needs to remains receptive to input from project neighbors in order to ensure local residents feel involved in the decision-making process. Community-subscribed projects are one avenue some developers are exploring.

“Thinking about ways to improve the fairness of distributing the benefits is an area for innovation,” Rand said.

These problems are complex and while tech is literally part of our name, an interdisciplinary approach will be essential to solving them. As with many other social and institutional challenges, tech is a multiplier—not a salve.

Transparency: More accurate predictions of interconnection study timelines and costs will decrease delay frequency and duration for project developers.

Automation: Using algorithms that can do some of the heavy-lifting on engineering models and creating a replicable process for these assessments shortens the interconnection study timeline while simultaneously freeing up human resources.

“Grid-enhancing” tech: Maximizing the amount of power that existing transmission lines can handle limits the proportionate amount of time spent in the interconnection backlog.

Policy: Regulators recognize that the interconnection process in the US is broken and there are some ways to improve it.

ICYMI, this is the first installment of our series on climate tech project development. Check out our other deep dives:

Questions or comments about what we covered or what we missed in this post? Reach out at [email protected]

Get Sightline’s signature H1’25 investment trends report inside

Survey results: what’s working, what’s stalled, and what’s missing

A sneak preview from Sightline’s exclusive client-only webinar