🌎 Bright spots and sunsets in the OBBB #253

One Big Beautiful Bill ushers in new (and old) energy agenda

Measuring investment risk of climate and tilting to action

Happy Monday! Is it us, or was The Weeknd quieter than normal?

In this issue, we bore into Larry Fink’s “climate risk is investment risk” thesis by evaluating the startups dishing up climate risk data to banks and asset managers. As it turns, the variability in ESG assessments, competing methodologies, and mixed modeling and disclosure thresholds make a market ripe for technology, but waiting for regulation to mature.

In other news, EVs zoom into Super Bowl ads (sorry Norway!), Radpower bikes cycle into $150m in additional investment, and France owes 1€ for missing its Paris Accord targets.

Thanks for reading!

Not a subscriber yet?

Last night, veteran quarterback Tom Brady faced-off against up-and-comer Patrick Mahomes in the Super Bowl. A similar battle is unfolding between legacy and new automakers.

General Motors (GM) aired its “No Way, Norway” commercial last night, and Cadillac released a commercial for its all-electric LYRIQ. An incensed Will Ferrell humorously heads to Norway to settle the score (and presumably put GM on the map) after learning that Norway sells more EVs than the US. Indeed, more than half of the new vehicles sold in Norway every year are all-electric, a rate far exceeding that in the US.

The commercial suggests that GM is an EV market leader, when in fact the company’s January announcement that by 2035 it would exclusively produce electric cars took many by surprise. As recently as October 2019, GM joined the Trump administration’s legal battle to resist California’s strict requirements to cut automobiles’ climate-warming pollutants.

With EVs as the inevitable future, GM must play catch-up. While the ad framed Norway as the competition, GM’s real concern should be pure-electric rivals like Rivian, Lucid Motors, and Tesla (which has a market cap greater than that of GM and Ford combined.) Ford also just upped its game, doubling its EV investment to $22B and releasing an all-electric Mustang. To catch up to the pack, it’s no surprise that legacy automakers are splurging on rebranding for the new automotive era as they transform their scale and experience from burdens into advantages.

Who will win the Automakers’ Super Bowl?

🚲 Rad Power Bikes, a Seattle, WA-based e-bike brand, raised $150m in funding from Morgan Stanley’s Counterpoint Global, Fidelity, Rise Fund, T. Rowe Price, Durable Capital Partners and Vulcan Capital. More here.

🔋 Powin Energy, a Portland, OR-based energy storage startup raised more than $100m in funding from Trilantic and Energy Impact Partners. More here.

🍎 Pairwise, a Durham, NC-based startup focused on sustainable food innovation, raised $90m in Series B funding from Pontifax AgTech, Deerfield Management, Temasek, and Leaps by Bayer. More here.

💨Svante, a BC, Canada-based developer of carbon capture solutions, raised $75m in Series D funding from Temasek, Carbon Direct, EDC, OGCI Climate Investments, BDC Cleantech Practice, Chevron Technology Ventures, The Roda Group and Chrysalix VC. More here.

🌱 DroneDeploy, a San Francisco, CA-based enterprise-grade drone data company, raised $50m in Series E funding from Bessemer Venture Partners, Scale Venture Partners, Emergence, AngelPad, Uncork Capital and Frontline Ventures. More here.

⚡ Wallbox, a Spain-based maker of smart charging solutions for electric vehicles, raised $40m in funding from Cathay Innovation, Wind Ventures, Iberdrola, and Seaya Ventures. More here.

🌱Phospholutions, a State College, PA-based sustainable fertilizer startup, raised $10m in Series A funding from Continental Grain Company, Tekfen Ventures, Maumee Ventures, 1855 Capital, and others. More here.

🥛 Sproud, a Sweden-based producer of pea-made milks, raised $6.5m in funding from VGC Partners. More here.

💨Infinium, a Sacramento, CA-based electrofuels startup decarbonization transportation, raised an undisclosed amount from Amazon’s Climate Pledge Fund, AP Ventures, Mitsubishi Heavy Industries, and the Grantham Environmental Trust. More here.

SJF Ventures, a Durham, NC-based venture firm, raised $175m for SJF Ventures V, an impact investment fund.

[We’ve edited the newsletter version lightly for length; visit our website for the full feature]

When Larry Fink pens a letter, people read it. As the head of Blackrock, the world’s largest asset manager, his prose signals a State of the Union for institutional investors. From his January 2021 letter to CEOs, he puts it simply as “climate risk is investment risk” and warns that “no issue ranks higher than climate change on our clients’ list of priorities.”

Indeed, Blackrock is “asking companies to disclose a plan for how their business model will be compatible with a net zero economy” while, at the same time, the pace picks up on federal climate finance appointees. The US Fed tapped Kevin Stiroh to lead the Supervision Climate Committee to study climate’s impacts on banks and financial markets, while Janet Yellen vows to set up a climate team at the Treasury. New Zealand and the UK have already mandated climate disclosures by 2025, and - for the first time ever - the US Fed biannual stability report notes climate change as a material risk.

Fundamentally, finance is a balance of pricing risk versus return. Climate change’s epochal disruption of scientific and societal systems seriously threatens to disturb this balance. Despite work by early movers like sustainability data companies and some insurance players, the financial industry doesn’t yet have a solid handle on incorporating this climate risk (and opportunity!) into their models. Of course, climate change isn’t slowing down; climate poses material risk to both short- and long-term portfolios. Banks and asset managers have a fiduciary duty to incorporate this risk, especially as access to insurance and credit starts to feel the squeeze.

For an industry that is no stranger to regulation, structure, and standardization, the financial sector has so far lacked rigor around measurement of climate risks. National regulation will enforce adoption, likely through existing leading standards such as The Task Force on Climate Related Financial Disclosure (TCFD) and the Sustainability Accounting Standards Board (SASB), which is sending corporates scrambling for technology and resources to meet anticipated disclosure standards. “The TCFD provides a framework for understanding climate risk. In the TCFD, risks are broadly categorized into ‘physical’ and ‘transition.’ Physical are risks to assets (facilities, supply chains, etc.), from hazards like extreme temperature, drought, wildfire, flooding, and more. Transition risk refers to the changing legal, regulatory, and market conditions that can impact a business,” James McMahon CEO of The Climate Service explains.

Supported by expansion of earth science data collection methods such as satellites, drones, and sensors superpowered by ML and AI, a number of companies have emerged which can harness climate data, in combination with physical and financial asset data, to measure and manage the varied impacts of climate change. OS-Climate, hosted by the Linux Foundation, is one such effort to promote open-source data and analytics around climate risk, and recently announced Goldman Sachs joining its ranks. As Amy Francetic, co-founder of Buoyant Ventures, a VC fund focused exclusively on digital solutions for climate risk notes, "we see a tremendous opportunity for new companies to build on, and improve, the work of pioneers in the climate risk intelligence sector to assess physical risk. We are excited to see new entrants developing solutions that can be used to manage risk - both physical and transitional - as we drive towards a decarbonized economy."

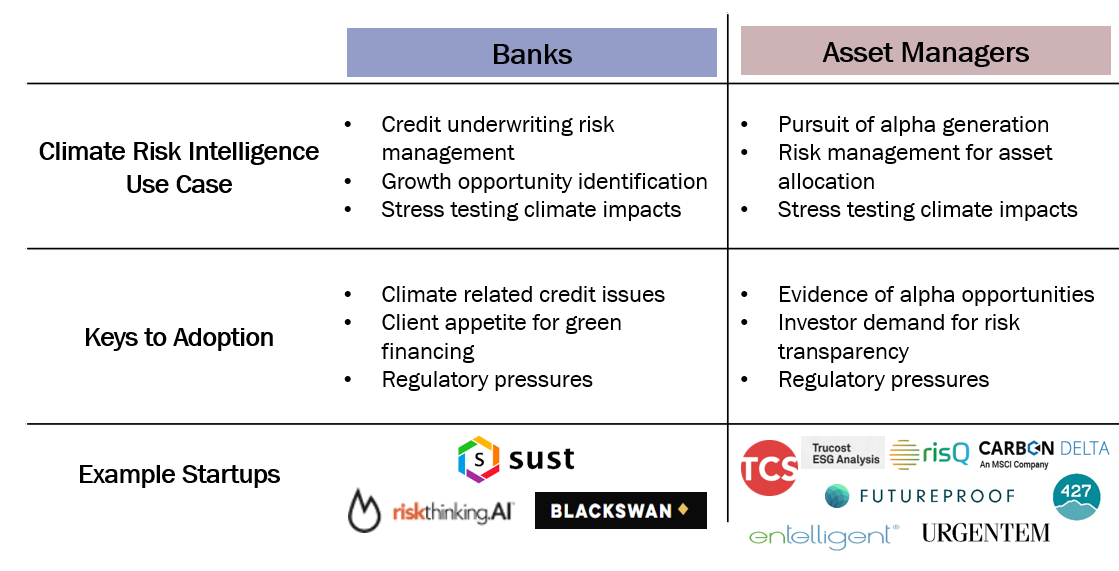

Below we’ve highlighted several innovative startups solving the different pain points within the financial sector faced by banks and asset managers:

Climate Disclosures and Reporting (TCFD): Voluntary set of recommendations for companies to offer disclosure around governance, strategy, risk management, metrics and targets.

Sust Global addresses the inconsistency, low resolution, and complexity of today’s physical climate risk data with the aim to improve that data so it can integrate into day-to-day operations and financial decision-making. They fuse frontier climate models, satellite based observations and geospatial data streams with proprietary machine learning techniques to improve the spatial and temporal resolution of climate data.

The Climate Service built the Climanomics® platform, a SaaS technology which enables climate risk reporting and disclosure aligned with theTCFD framework. Based on principles similar to catastrophe risk models, but driven by climate and socioeconomic data, their methodology employs peer-reviewed climate projections—merged with customer asset data and econometric impact/hazard functions—to model vulnerabilities.

Climate Risk Modeling/ Stress Testing: Data to generate scenarios and measure the financial risk under extreme conditions (stress test).

RiskThinking.AI has developed a data and analytics platform to compute the climate change-related financial risk of portfolios and physical assets for large asset managers, custodians, as well as corporations, and governments. They are releasing a Climate Risk Data Exchange that will be regulatory ready and standards-driven.

Climate-Related Property and Physical Risks: Assessment of sectors which directly face climate-related risks(e.g. mortgage backed securities, municipal bonds)

risQ models a mixture of geospatial catastrophe, climate change, economic and social scenarios. They’re laser focused on the US Fixed Income market - both municipal bonds and mortgage backed securities - because (a) these real-asset backed markets are existentially threatened by climate change and (b) they also have the financial tools, incentives, and structures in place to actually start funding climate action and investments at scale.

Key Takeaways

Special thanks to the team at Buoyant Ventures, a venture firm focusing on digital solutions for climate risk, and Sophie Logan for their thought leadership and expertise.

After feeling the heat from its shareholders, Exxon created Exxon Mobil Low Carbon Solutions (ringing similar to Occidental’s ‘Oxy Low Carbon Ventures’) to invest $3bn through 2025 in 20 carbon capture projects. To put this into context, Exxon spent $21bn on oil exploration last year alone. Not to mention that after being pressured to refresh its board with clean energy experts, Exxon instead added a former Malaysian O&G CEO.

As Europe and Japan step up their hydrogen strategy, a coalition of companies including Shell, Toyota, Air Liquide, and Anglo American called “Hydrogen Forward” is moving to advance US support for hydrogen energy applications.

Failing to put the “Paris” in “Paris Agreement,” France has been found legally responsible for not meeting intended GHG reduction targets. Their fine? A symbolic 1€.

A new Duke Energy subsidiary, eTransEnergy will help cities and companies transition their commercial fleets to electric vehicles.

Our friend, Varun Sivaram will join the Biden administration as a senior advisor, working closely with John Kerry on climate. Likewise, the SEC announced Satyam Khanna to the newly formed position of Senior Policy Advisor for climate and ESG.

How should we value biodiversity? The Dasgupta Review frames nature as an asset – quantifying biodiversity in dollars and cents (or pounds and pence) – and demonstrates how we’re failing as asset managers.

In a new BCG report, companies can curb emissions more effectively by looking at external operations and setting net-zero supply chain goals. The consulting firm found that eight global supply chains account for 50% of global emissions (chart here) and getting some of them to net-zero is surprisingly cheap.

Evolve or die. Recruiting tech co for skilled energy workers, RigUp, rebrands as ‘Workrise’ to reflect its expansion into wind, solar, and other clean industries.

Climate dread got you stuck in bed? You’re not alone. “More than half of Americans are concerned about climate change’s effect on their mental health.” The climate coping industry is here to help.

Listen to The Daily’s new pod unpacking the Biden administration’s environmental proposals and its potential roadblocks.

Who Wants To Be A Green Billionaire?! Bloomberg Green ranks climate tycoons by their “green net-worth.” While Musk tops the list, 80% of the group is in China.

Bloomberg NEF dropped a detailed report ranking the G20 countries on their zero-carbon policies and implementation. White papers got you blue? Check out MIT Tech Review’s interactive green future index.

Now that meatless meat has gone mainstream, Big Food wants in on selling you more plant-based meat and dairy to fight climate change.

💡 Future Hub Sustainability Accelerator: Startups in the EU addressing mobility, food & agrotech, smart cities & energy, supply chain & logistics, or sustainable business & circular economy can apply by February 16th.

💡 Clean Energy Leadership Institute: CELI’s annual 5-month fellowship for working professionals seeking deeper education and community in clean energy. Apply by March 7th.

🗓️ Stanford Energy Seminar: Tune in on February 8th to learn about biomass energy and natural climate solutions’ role in carbon sequestration.

🗓️ BERC Energy Summit: Join 500+ sustainable business practitioners on February 10th for this year’s annual event on “Energizing the Recovery,” focusing on the energy sector’s role in recovering stronger and cleaner in light of the ongoing global pandemic.

🗓️ Sustainable Finance Seminar: Tune in on February 25th with Marc Roston to question how much does it cost to hedge climate risk?

🗓️ Terra.do Climatetech Job Fair: Register for this virtual climate tech job fair in March.

Investor; Intern @G2VP

Associate @Rhapsody Venture Partners

Ecosystem Partner @Prime Movers Lab

EDICT (empowering diversity in cleantech) Intern @Clean Energy Leadership Institute

Marketing & Membership Manager @E8

Relationship Manager @PRI

COO; Managing Director; Sr. Policy Advisor @Elemental Excelerator

Managing Director @Activate

Chemist @Nth Cycle

Geophysics ML Engineer @Google X

ML Engineer @Mobilyze

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond