🌎 Overheard at LCAW #252

Climate, capital, and carrots in London's new playbook

Celebrities getting in on climate tech and the voyage for sustainable seafood

Happy Monday!

In this week’s issue, we go deep on the carbon costs of fish, shrimp and all manner of edible fruit of the sea; as it turns out, industrial fish farming and trawling oceans for their plentiful fauna has lots of carbon costs as well as an emerging batch of climate-better solutions.

In the news this week, the Fed and SEC continue their climate risk/ ESG push and a new Climate Crisis board game to look forward to when you’re done playing Pandemic.

Thanks for reading!

Not a subscriber yet?

“If a year ago you would’ve told me that Odesza and Japanese Dad are pledging a portion of their NFT sales to support our fundraising efforts, I would’ve said, ‘… What?” The Atlantic’s Robinson Meyers breaks the grateful disbelief of Noah Deich, CEO of Carbon180, in a very 2021 story about celebrities’ donations of their profits from NFT art sales to the 15-person carbon removal nonprofit. Despite “Carbon180 [having] “no preexisting relationships with famous people,” funding is pouring in from a rockstar list including Grimes, Halsey, Odesza, and Japanese Dad. The link? A somewhat shaky one that the profits came from non-fungible tokens (NFTs), which are hosted on the blockchain and have an increasingly contested carbon footprint that celebs want to negate.

Even Iron Man has gone green with the launch of two sustainability venture rolling funds, which will employ Robert Downey Junior’s fame to attract investors and help companies that the Footprint Coalition invests in. While celebrities are no stranger to the environmental movement (Leonardo DiCaprio is a UN messenger of peace focused on climate; Meryl Streep protested to create stronger pesticide regulations; David Attenborough and Sigourney Weaver narrated Planet Earth; and Sting established the Rainforest Foundation), in this newest iteration, celebrities are focusing more on putting investment and charity dollars behind climate tech and hopefully heralding a move towards innovation over single issue inoculation.

🌱 Eat Just, a San Francisco, CA-based food tech startup, raised $200m in funding from Qatar Investment Authority, Charlesbank Capital Partners and Vulcan Capital.

🥩 Meatable, a Netherlands-based cultivated meat startup, raised $47m in Series A funding from Dr. Rick Klausner, Section 32, Dr. Jeffrey Leiden, and DSM Venturing.

⚡ Sympower, an Amsterdam-based demand response energy startup, raised $6.1m in Series B funding led by Kees Koolen.

💨 Airly, a New York-based air quality detection company, raised $3.3m led by firstminute capital.

🌿 AlgiKnit, a New York-based startup turning ocean algae into bio-yarn, raised $2.1m from SOSV, Horizons Ventures, and Fashion For Good.

⚡ Dynamhex, a Baltimore, MD-based energy and carbon footprint software startup, raised $1.5m in seed funding from the Maryland Momentum Fund.

AeroFarms, a Newark, NJ-based vertical farming company plans to go public via a reverse merger with Spring Valley Acquisition Corp.

[We’ve edited the newsletter version for length; visit our website for the full feature]

Seafood has long been seen as the healthier option - for diets and for the planet. But the true emissions impact and biodiversity loss of seafood may be much fishier. Last week, a mindblowing report from Nature found that emissions from bottom trawling releases as much carbon dioxide as global aviation! Said another way, if trawling for fish were a country, it would be the 6th most polluting global industry. For the past 50 years, global demand for fish has doubled the growth rate of the world’s population. Demand is only increasing, meanwhile we’ve exploited 90% of wild fisheries to (or past) their limits. Scientists predict that continued wild fishing will turn our oceans into virtual deserts in less than 35 years.

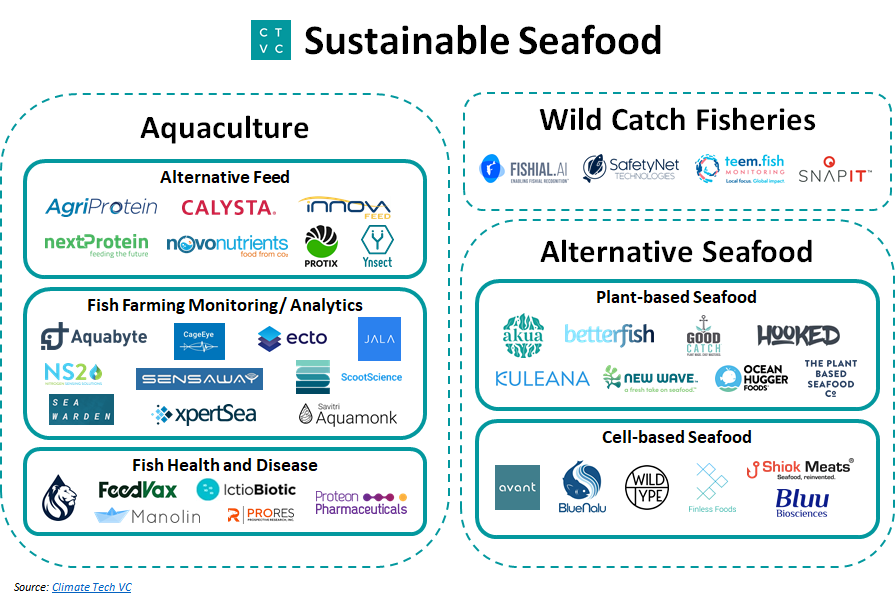

The finding on emissions from trawling and disappearing wild fish stock add new urgency to the shift away from wild catch fishing and toward improvements like aquaculture and alternatives like plant- and cell-based seafoods, where a bevy of oceantech entrepreneurs are hard at work innovating to protect our blue planet.

As the saying goes, there’s a lot of fish in the sea - but humans consume just four types of seafood species: fish, crustaceans, bivalves, and seaweed. As it turns out, the emissions range of seafood varies incredibly by species and production process.

🐟🦐 Fish (tuna, salmon, cod) and crustaceans (shrimp, crayfish, lobster). Americans eat more shrimp than any other seafood species per year (with salmon a strong second) and demand is growing - production increased 500% over the last 20 years. Shrimp may be small, but their environmental footprint is mighty: farmed prawns emit 3x the GHGs of farmed fish. Shrimp aquaculture is also estimated to have destroyed mangrove habitats, a biodiversity and storm hazard. Shockingly, the carbon footprint of these farmed shrimp produced on lands former occupied by mangroves is higher than that of beef! (1603 vs 1440 kg CO2e / kg meat).

🐚🌿 Bivalves (clams, oysters, mussels) and seaweed (microalgae and macroalgae). These slippery, less sentient seafood cousins conversely have a mostly positive environmental impact, as shelled mollusks and seaweed don’t require food to grow and provide added water filtration benefits. To boot, seaweed trumps terrestrial plants in its ability to absorb CO2 while helping de-acidify water, supporting other nearby species including - you guessed it - bivalves. Commercially, seaweed is gaining attention for its growth rate which is between 10-30x faster than terrestrial plants. (The recent market action in seaweed for feed, alternative protein, materials, and as a carbon sink is outside the scope of this feature - but may warrant a future one!)

🎣 Wild Capture Fisheries

Half of global seafood consumption is still produced the old way - wild and straight from the source. In developing countries where 97% of fishermen live, wild capture fisheries constitute a higher ratio of production and are an essential part of the economy. With 90% of marine fish stocks now fully exploited, overexploited, or depleted, the industry itself is at risk of collapse. Fuel to travel to and from fishing grounds accounts for the primary source of emissions in wild capture fishing, and as fish stocks wane, fishermen must burn more fuel to travel further from the coast. During the hunt, global fishing fleets dump approximately 10% of the fish they catch back into the ocean as discards.

Novel tools are empowering fishermen with technology to bring down their costs while reducing bycatch waste and capturing data on global fish stocks.

Innovators: SafetyNet Technologies, Teem Fish, SnapIT, Fishial

💧 Aquaculture

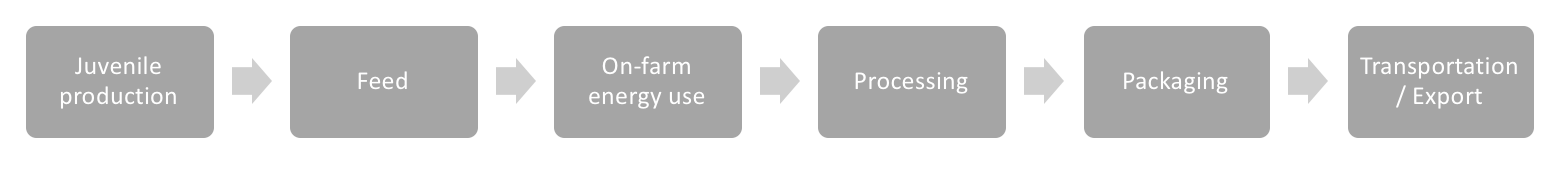

Aquaculture production has tripled in the last two decades, and is expected to continue taking share from wild capture fisheries. Fish farming either takes place in the ocean or freshwater using open-net pens or cages (net-based) which allows for free exchange of waste, chemicals, parasites and disease, or in closed land-based systems which requires significant energy and water to recreate ideal aquatic conditions. Aquaculture’s production emissions are primarily driven by feed and energy use - but vary widely by type of operation. Startups are improving the sustainability of aquaculture via technology for feed, precision farming, and fish health.

New feed alternatives. Feed contributes 57% of aquaculture emissions through ingredient production, processing, and transportation. Historically 20%-35% of wild fish capture was converted into fishmeal for feed which meant that aquaculture exacerbated rather than relieved pressure on wild fish populations. Fish farms are increasingly transitioning to plant-based feed, meaning “that salmon on your plate might have been vegetarian.” Still, land used to grow the crops to feed the fish accounts for 39% of aquaculture’s GHGs. A school of startups are working to solve the emissions-intensity of fish feed by replacing crop-based feed with insects and even captured carbon dioxide emissions.

Innovators: nextProtein, Ynsect, AgriProtein, NovoNutrients, Protix, Calysta, Innova

Remote fish farm productivity monitoring. Precision farming tools have turned the tide on land and now emerging data tools leveraging IoT and AI/ML are driving more productive and sustainable fish farms. Aquatic farms face unique challenges (e.g., toxic nitrogen levels from fish waste, algae blooms, shifting oceanic temperatures and acidification). Remote monitoring detects these farm conditions, while predictive data analytics optimize for better yields. Efficiency is the name of the game where fuel-intensive aquaculture maintenance routines by boat constitute ~20% of farm emissions.

Programs to certify responsibly farmed seafood hinge on annual in-person audits and as a result, certification is astonishingly low (<2,000 certified shrimp farms). Likewise, most aquaculture establishments are smallholders, who lack crucial support services such as local feed and equipment suppliers. Sea Warden is improving farmer access to climate smart production resources. “Our platform uses satellite technology to optimize the delivery of critical resources and technicians to at-risk shrimp farms. We also provide shrimp farmers with remote monitoring as an effective, low-cost verification tool to ensure aquaculture production is conducted responsibly and improve farmer access to certification,” CEO Zack Dinh explains.

Innovators: Aquabyte, Sea Warden, Sensaway, Savitri Aquamonk, Jala, Scoot Science, Nitrogen Sensing, Ecto, XpertSEA, CageEye

Fish health is sustainability. Around 20% of fish die during production. Disease and lice can dramatically swing aquaculture’s resource efficiency and emissions - not to mention welfare of the farmed fish, or potential infection of wild populations. Norway’s salmon farming industry boasts the gold standard of fish farming health and sustainability through their mandatory sea lice reporting and the virtual elimination of all antibiotics. Startups are spreading the best practices to fish farmers worldwide through tools to monitor sea lice, detect risk of disease and oxygen levels, and through fish vaccines and oral biotherapeutics that reduce the need for antibiotics and chemicals. Manolin uses machine learning to build fish disease detection models to warn farmers of disease risk with more than 93% accuracy. “During our time in Norway, we found that salmon farmers already collect an enormous amount of data, but it’s inconsistent, incomplete, and sits in silos. We saw this as an enormous opportunity to improve sustainability and collected thousands of data points on farm activity to fuel our disease prevention models,” Tony Chen, CEO of Manolin explained.

Innovators: Blue Lion Labs, FeedVax, Manolin, Prospective Research, IctioBiotic, Proteon Pharma

Plant-based seafood

“The last frontier” of plant-based meat is in seafood, making up only ~1% ($9.5m) of US plant-based meat sales. “That’s partly because consumer packaged goods have tended to favor burgers, hotdogs, chicken nuggets and other foods. Kuleana goes beyond the fish stick approach. We’re enabling professional chefs and home chefs alike to make sushi rolls and poke bowls that have the right texture, flavor, and appearance” noted Jacek Prus, CEO of Kuleana which makes plant-based sashimi-grade tuna. While soy and peas remain common ingredients, a few plant-based seafood producers have formulated their seafood meat substitutes with environmentally-friendly and nutrient-rich seaweed.

Innovators: New Wave Foods, Kuleana, Plant Based Seafood Co., Hooked Foods, Good Catch, Betterfish, Ocean Hugger Foods, Akua

Cell-based seafood

At the frontier of the frontier, cell-based seafood is in even earlier days. The entire cell-based product can be consumed with no by-product waste, and without the need for any plant inputs resources. However, cell-based meat has a longer timeline to production at commercial scale.

Innovators: Finless Foods, Shiok Meats, Avant Meats, BlueNalu, Bluu Biosciences, Wild Type

Special thanks to Pale Blue Dot, a Sweden-based climate tech venture firm investing in startups that reduce and reverse the climate crisis and help us prepare for a new world, especially Alice Carlson.

Biden will soon unveil the $3-4T infrastructure bill that plans to tie America’s economic recovery with the climate crisis through building and investing in things like electric power lines, EV charging stations, public transportation, and energy-efficient housing units.

The Financial Times joins the conversation on the evolution of Clean Tech 1.0 into climate tech today, featuring Climate Tech VC alongside Vinod Khosla and others.

Climate stress tests for banks could be closer than we think. Right after establishing the Supervision Climate Committee, the Fed is amping up their climate ante by creating a Financial Stability Climate Committee to focus on macro climate risks across the broader financial system. The SEC is also setting the stage with a newly launched web page on ESG.

To align with COP26, Britain has bumped forward their mandatory climate-related financial disclosures from 2025 to 2022.

India is trying to play catch up in EVs after its last efforts fell flat (156K in actual EV sales vs its 2020 target of 7M!). The new plan is putting forth $8B in funding and incentives for EV makers over the next 5 years but the 3rd most emitting country still has yet to put forth any net zero target.

First record-setting fires, now record-high floods, the apocalypse feels nigh in Australia.

In a rush to electrify everything and decarbonize, US electricity demand is expected to double by 2050 - the same demand growth which the grid supplied successfully once before from 1975 to 2005.

Compelling narrative and analytics on the unsustainable overvaluation of the entire EV market: “The hallmark of a big market delusion is when all the firms in an evolving industry rise together even though they are often direct competitors.”

Rolling Stone explores whether Democrats can learn from climate policy missteps of the past.

Tired of playing (the board game) Pandemic? The star developer is making a new board game called Climate Crisis, and he needs critical reviewers.

NYTimes exploration of the alchemy of ArcelorMittal’s journey to clean up steel.

As companies begin to explore returning to the office, Watershed released a free tool to help companies model remote and hybrid work models and their carbon impact.

It’s almost time to start a separate division on Climate Tech VC: New Electric Vehicle Designs. This week - Jeep’s all-electric Wrangler which is never planned to go into production?

Meanwhile, this adorable tiny cube-shaped EV has stolen the crown from Tesla as the world’s best-selling EV of 2021 so far.

Taylor Swift, the new conservation heroine?

Thoughtful post on “the missing piece” of founder mental health from Juliette Devillard at deep tech accelerator, Activate.

🗓️ Mind the Climate Gap: Is Finance Stepping up on Climate as Governments fail?: Tune in for the panel event on April 20th with Rodrigo Prudencio (Amazon), Lila Preston (Generation Investments), and others.

💡 Ocean Solutions Accelerator: Apply to the Sustainable Oceans Alliance summer and fall cohorts by April 12th.

💡 Clean Energy Business Incubator: Apply to New York’s premier incubator helping scale up climate tech startups by April 15th.

💡 Apple Impact Accelerator: Apple is launching an Impact Accelerator for Black- and Brown-owned businesses that are helping to build a carbon neutral feature. Apply by April 30th.

Venture Capital Analyst @Macquarie Green Investment Group

Investment Director @Katapult Climate

Analyst @General Catalyst

MBA Intern @Equal Ventures

NatureVest Portfolio Manager @The Nature Conservancy

Chief of Staff @Bedrock Ocean Exploration

Energy Executive in Residence @InventWood

Full Stack Engineer @SINAI Technologies

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond

Groundbreaking results from the geothermal developer’s main project