🌎 FEOC in focus #283

Stricter foreign sourcing rules reshape clean energy tax credit eligibility

The 2025 Climate Tech Investment Trends report is out now

Happy 2026 🎉 A new year brings perspective, and that’s exactly what we’ve got in our latest report: Sightline’s 2025 Climate Tech Investment Trends report, out now.

It’s our fifth year publishing this report, and we’ve seen the climate capital stack widen and mature over the past half-decade (!). Still, venture and growth capital do a lot of the heavy lifting, helping fund the jump from lab to deployment. This report breaks down exactly how much capital did that work last year.

The 2025 Climate Tech Investment Trends report covers funding and deal activity by stage, vertical, and product type. Sightline Climate clients can access a deeper layer of analysis, from predictions and sector-specific trends to notable deals and exits and investor activity breakdowns, alongside the full underlying data set, on the platform here. If you’re interested in becoming a client, talk to our team here.

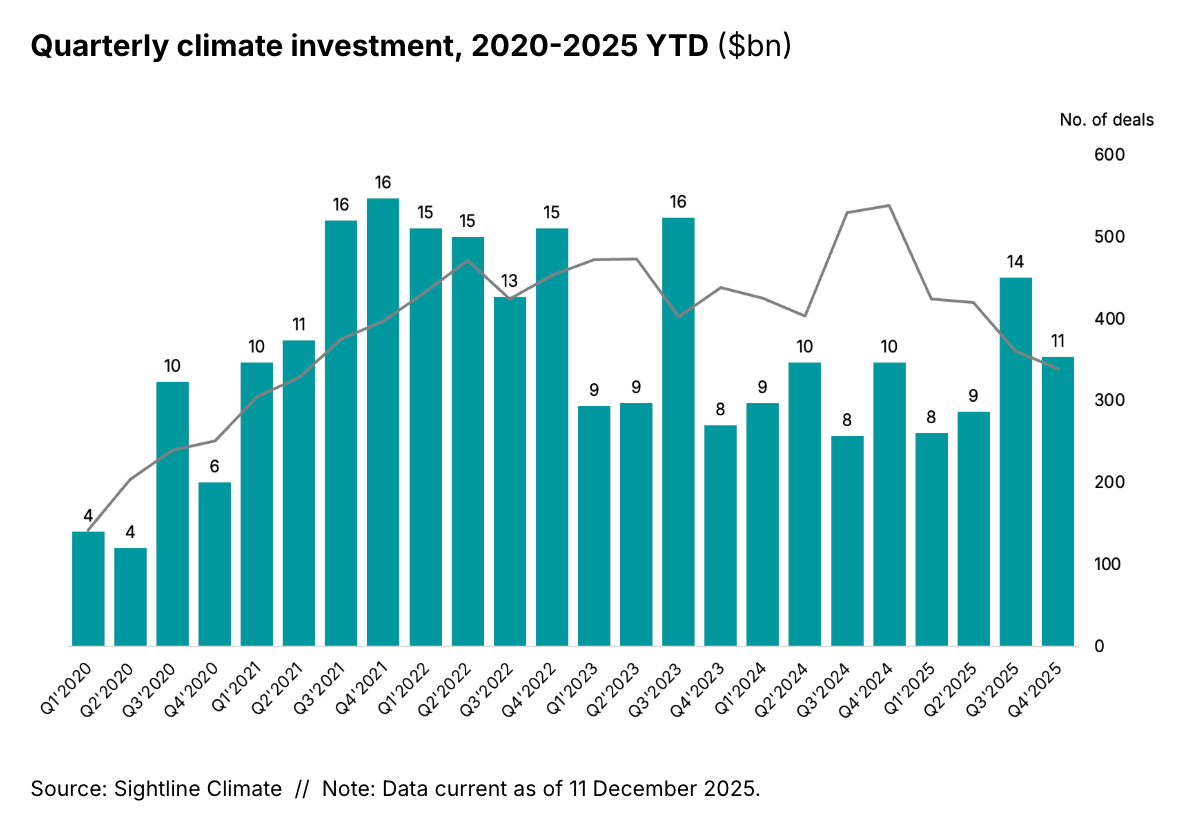

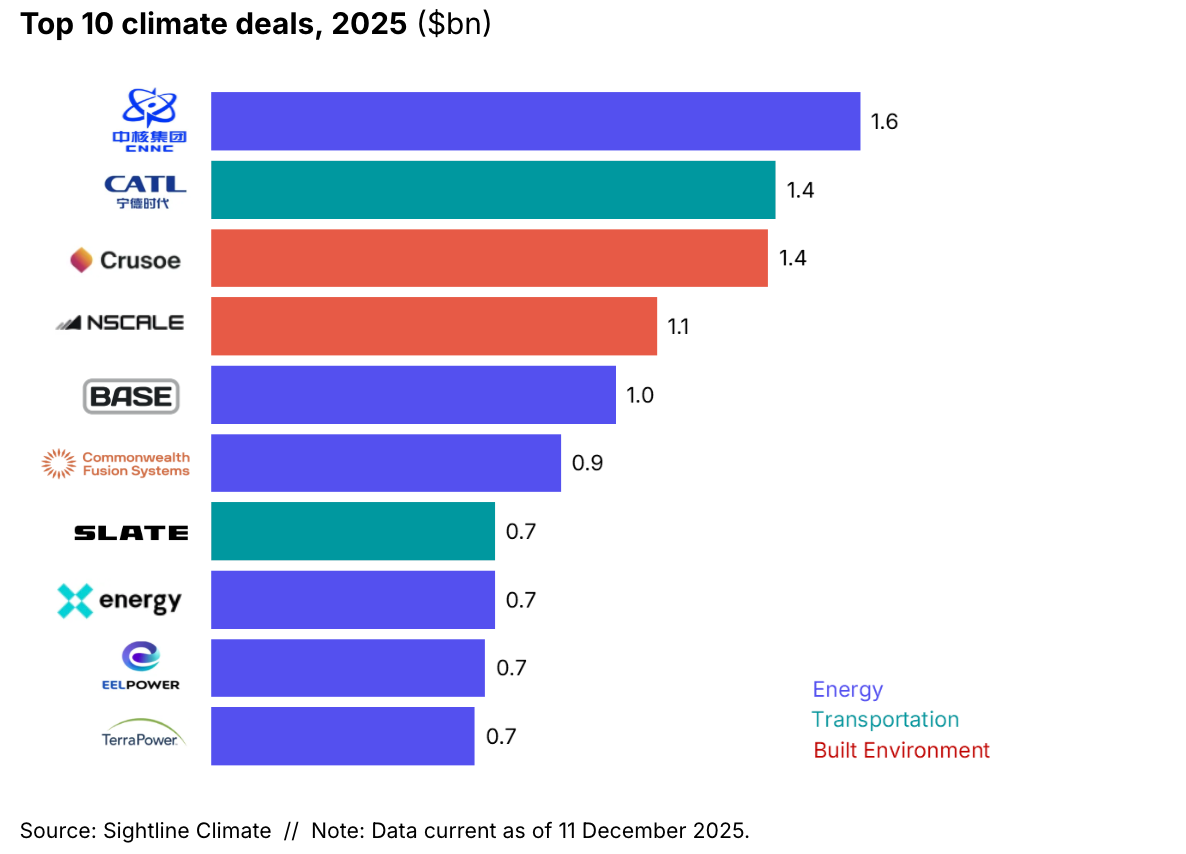

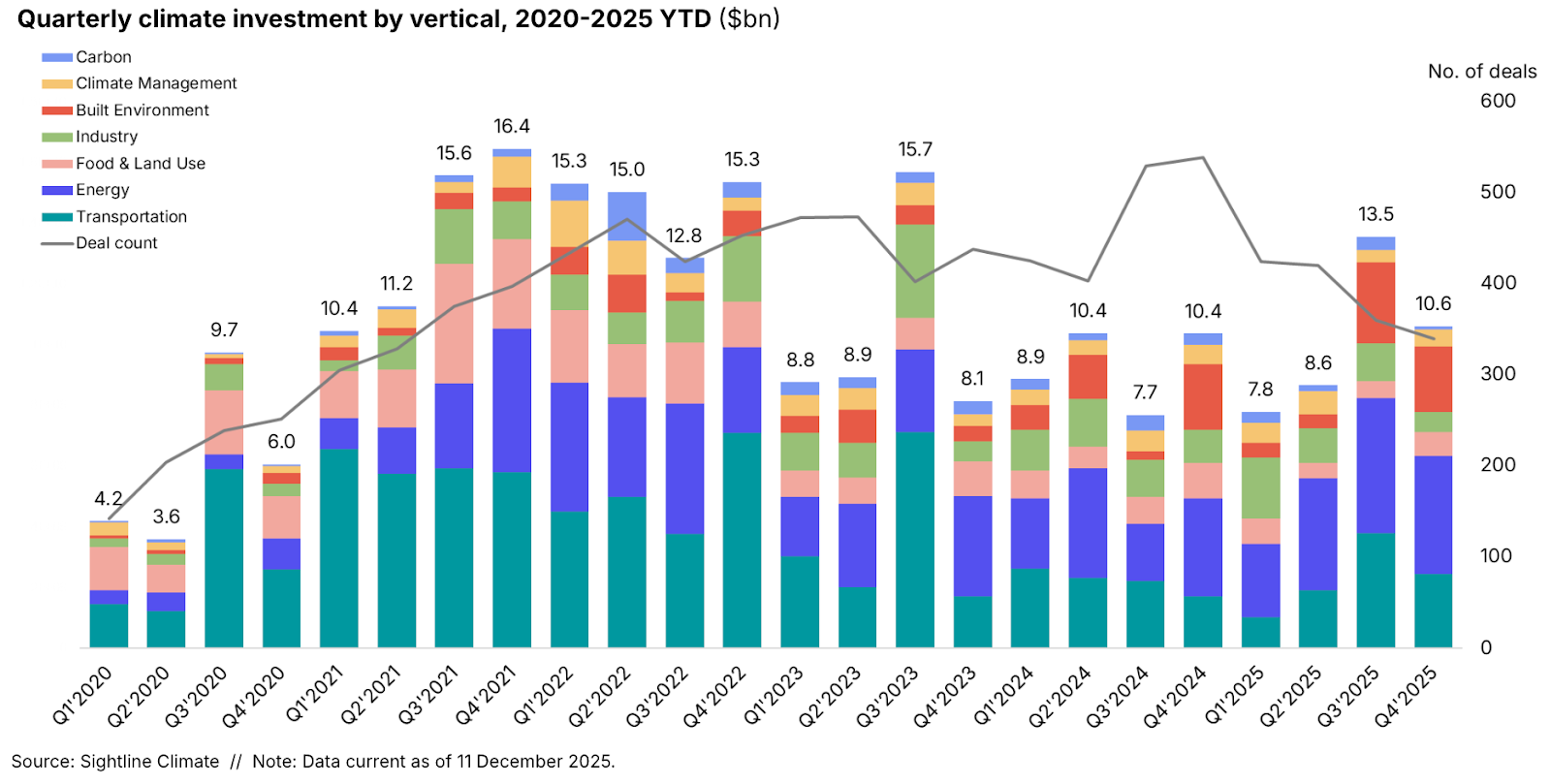

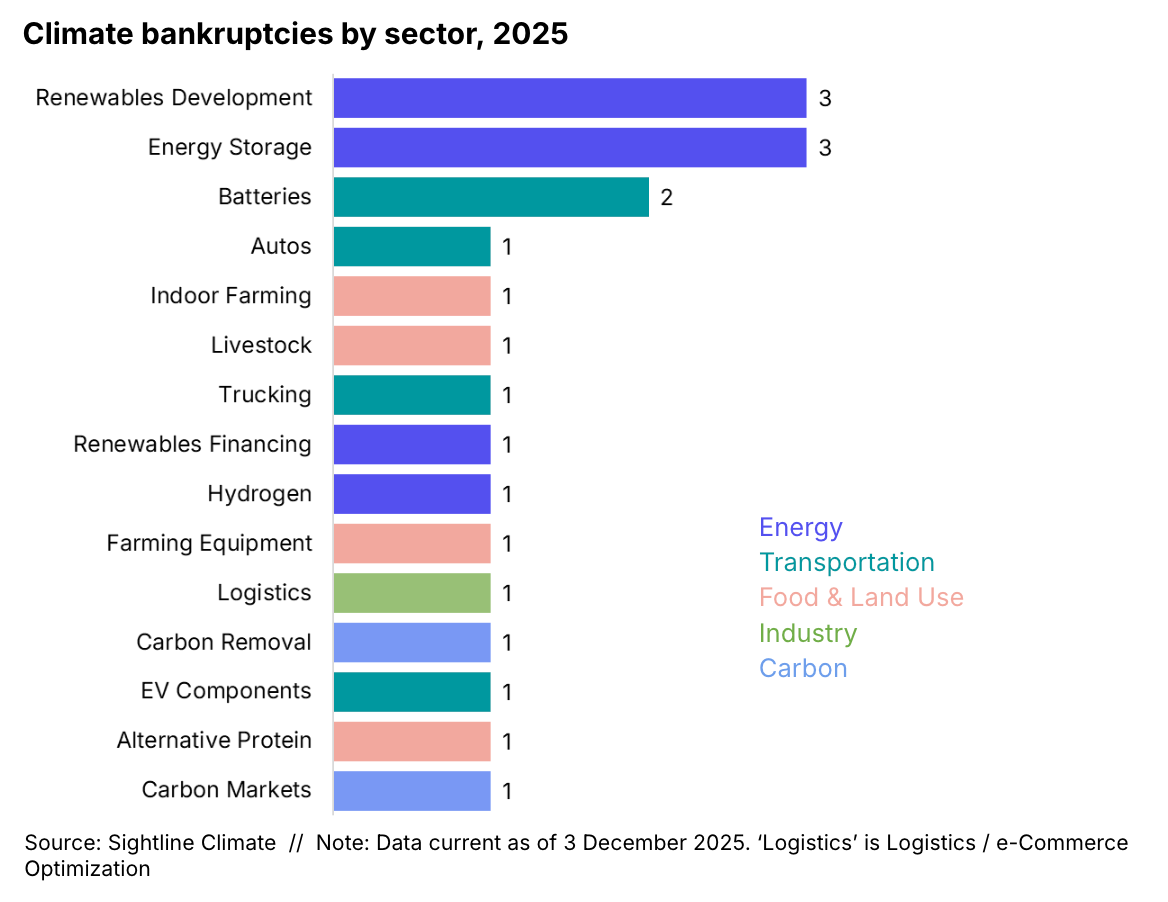

📊 So what do the numbers actually say? Even though politics and pullbacks dominated the narrative in the first half of 2025, the market certainty everyone was waiting for took hold in H2 as AI took over. For the first time since the boom years, climate tech investment rose, particularly driven by gains in Growth and Series B funding. That’s despite slowing deal activity and early-stage investment. Fewer, but bigger, checks came in amid a “feast-or-famine” vibe shift. Investors have made their bets in crowded markets and are doubling down on a small cohort of category leaders: the emerging winners with proven tech, viable business models, and credible paths to deployment, rather than new entrants.

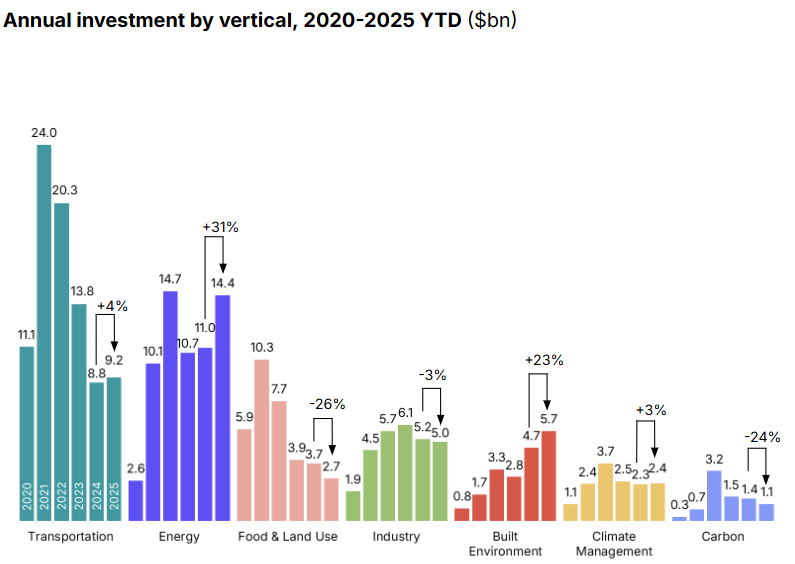

At the same time, the demand signal has changed. Climate tech investment is increasingly anchored to electrons, not emissions. Rapid growth in energy demand, led by buzzy AI and data centers, is pulling capital toward gridtech, virtual power plants, and flexibility solutions that can deploy quickly, while renewables, batteries, and nuclear scale on longer timelines. Together, these forces reward scale, certainty, and execution. The open question is durability. If AI demand falters, there is no obvious replacement waiting behind it.

Below is the report's highlight reel. The full public version offers the extended cut, with more charts and commentary, available here.

And if you want to press pause and unpack it properly, join our webinar on January 15, at 11 am EST. Hear firsthand from Sightline co-founders, Kim Zou and Mark Taylor; Sightline research director, Julia Attwood; and CTVC co-founder, Sophie Purdom. Sign up here.

💰 2025 investment: Climate tech venture and growth investment totaled $40.5bn in 2025, up 8% from 2024.

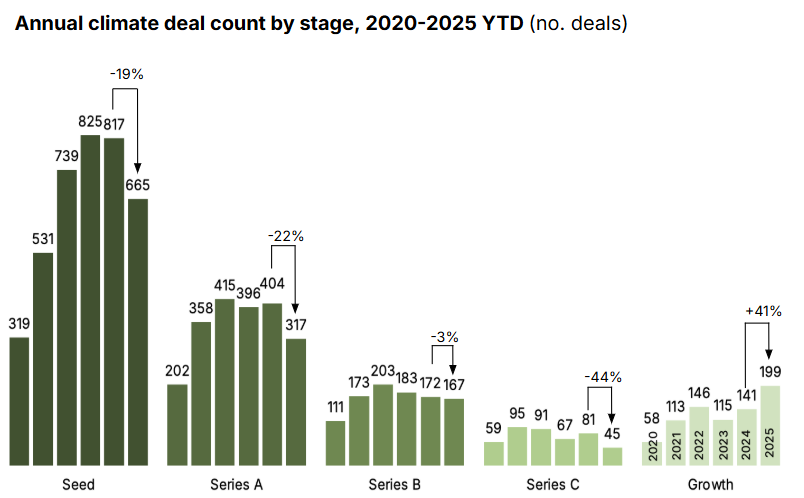

🤝 Deal count: Meanwhile, deal count fell 18% in 2025, reflecting market consolidation into fewer select bets.

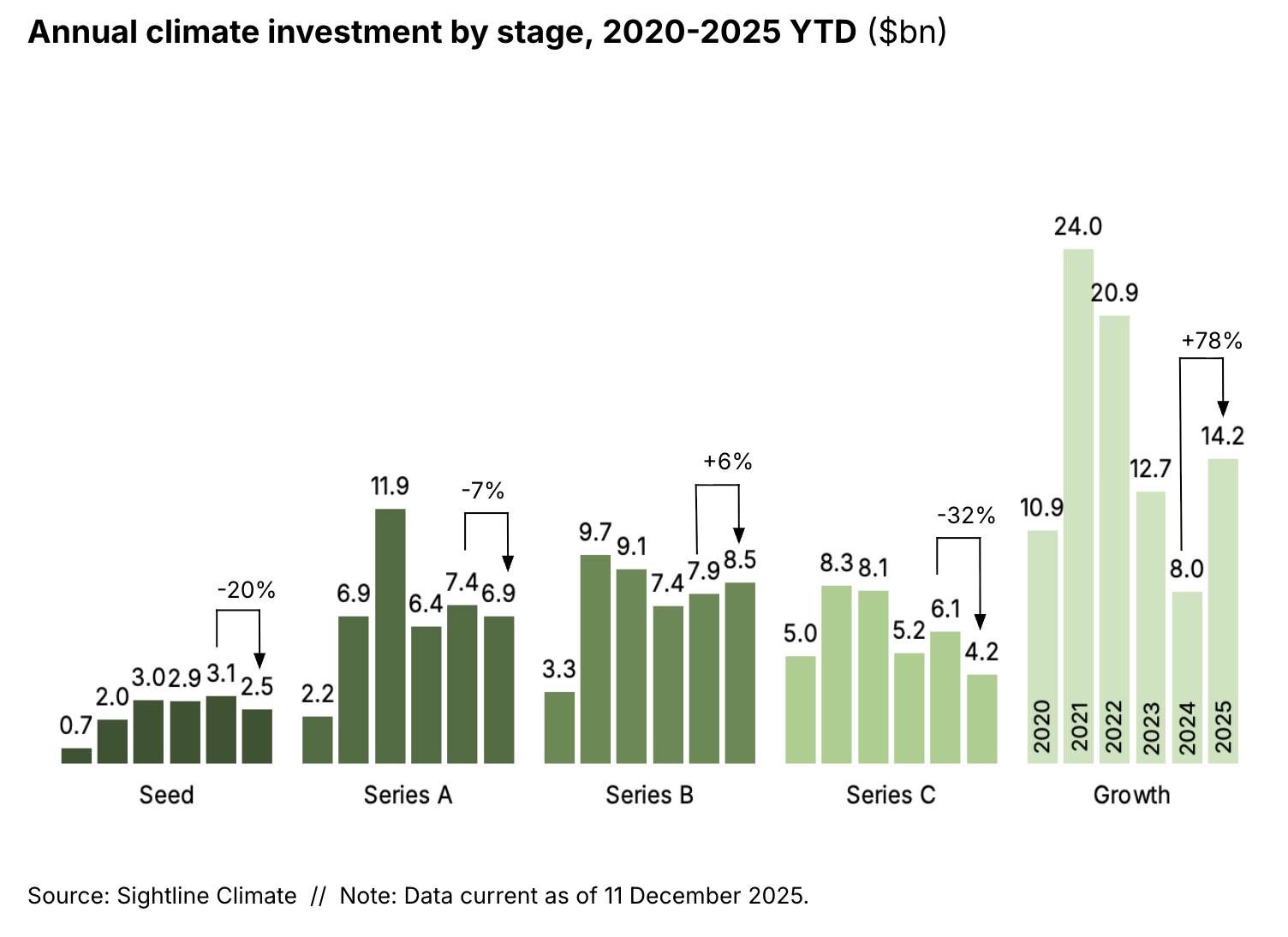

📉 Early: Seed and Series A investment totals fell 20% and 7% respectively, but Series A deal counts fell by 22%, pushing deal sizes up to 2021 levels. Series B investment ticked up slightly (7%) off the back of a few mega-deals and is starting to look a lot more like late-stage funding.

📈 Late: Series C is the new valley of death, as deal counts hit an all-time low, with investment down 32%. Growth investment was the clear standout, jumping 78% in investment compared to 2024, and 41% in deal count, as average deal size rose as well.

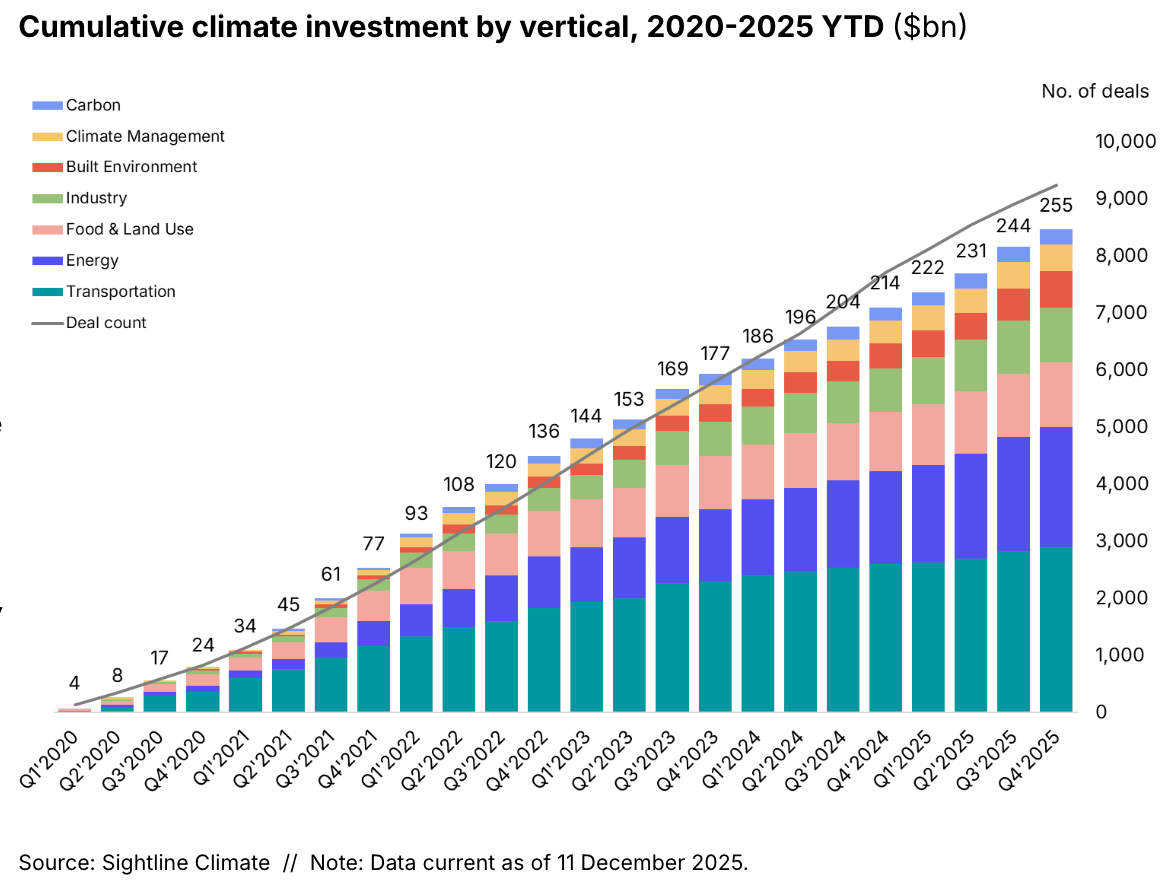

⚡Verticals: Energy stayed at the top, making up 36% of 2025’s total. It grew 31% to $14.4bn, reaching a three-year high. Transportation managed to reverse three years of drops with a modest 4% increase.

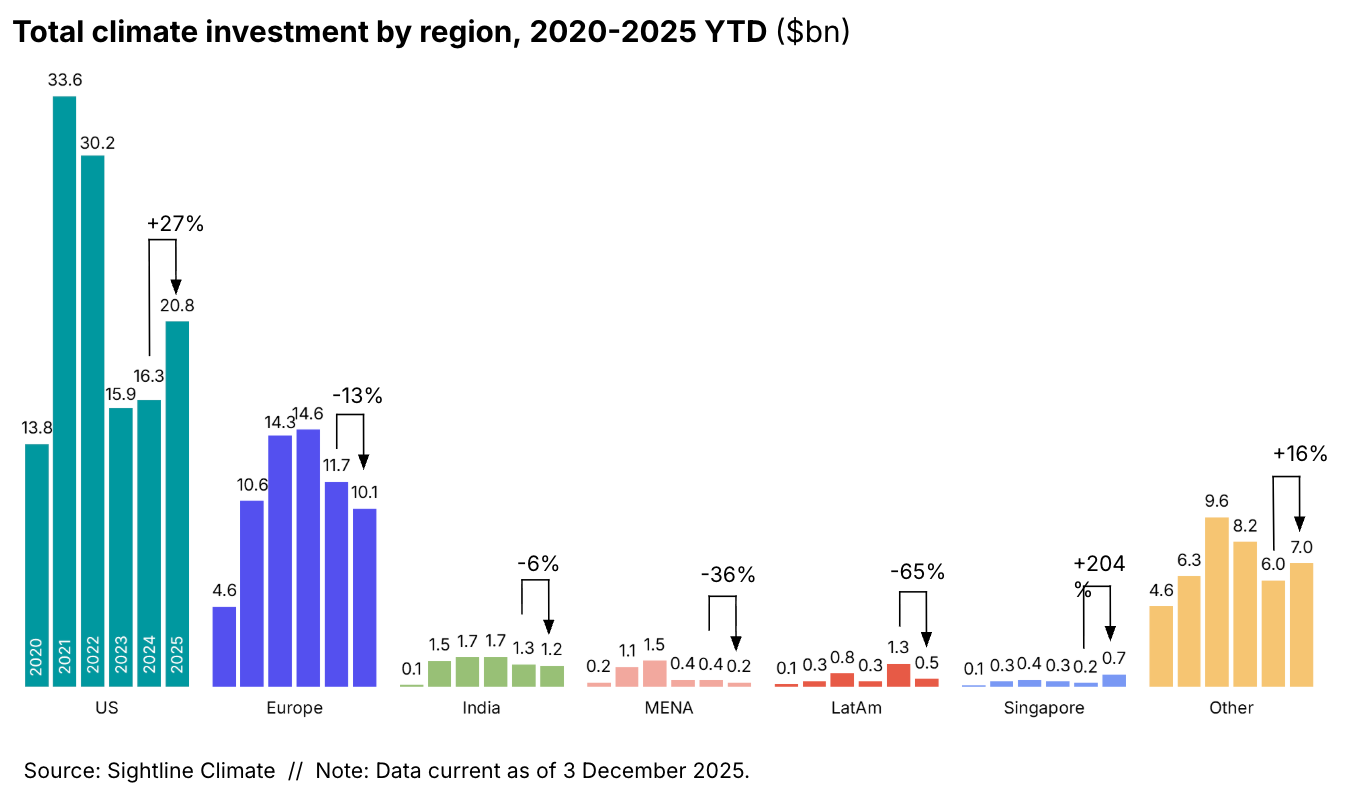

🌎 Regions: The US blew past all other regions to grow 27%, while Europe dropped 13%. Mega-deals continued to bolster US investment, but low-carbon data centers are now tipping the balance in other regions.

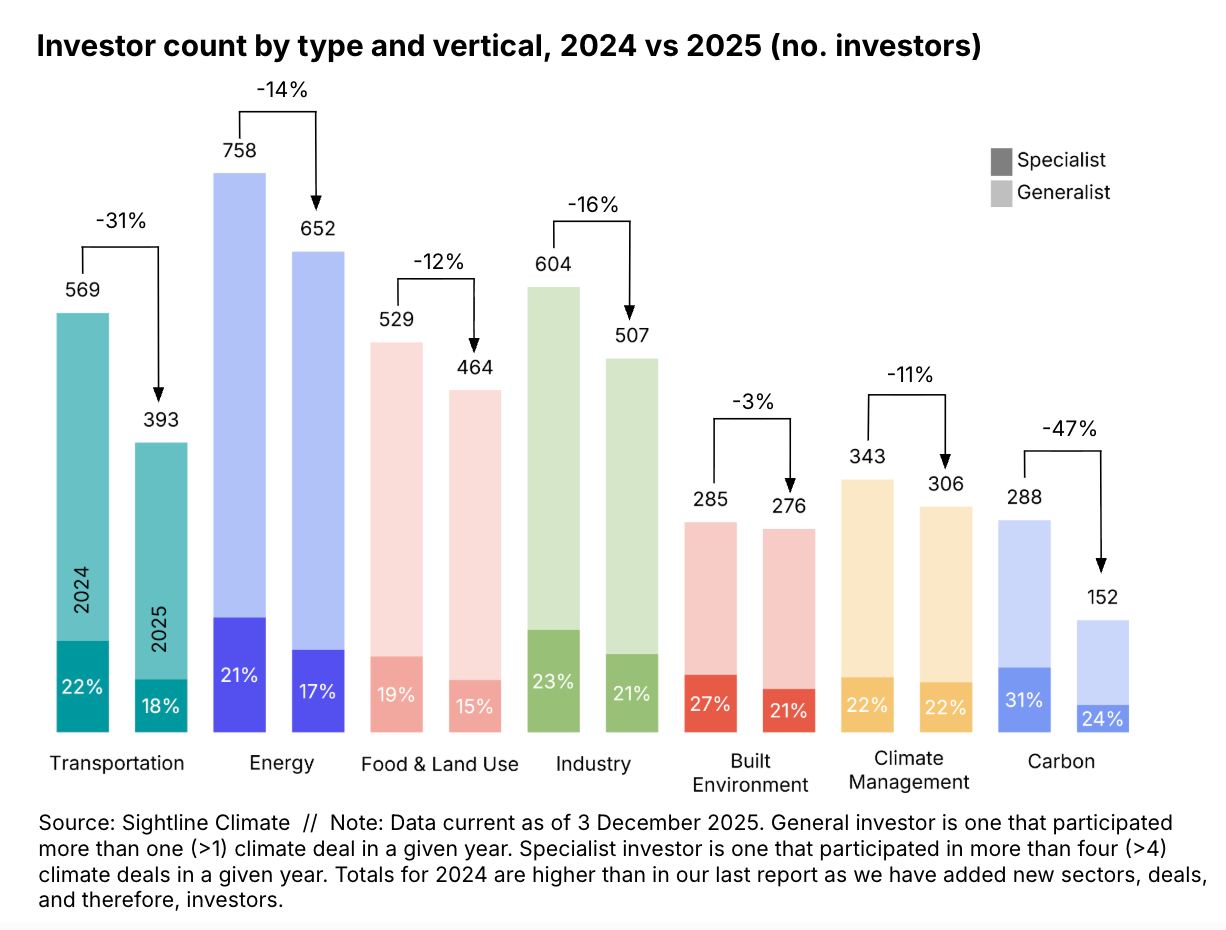

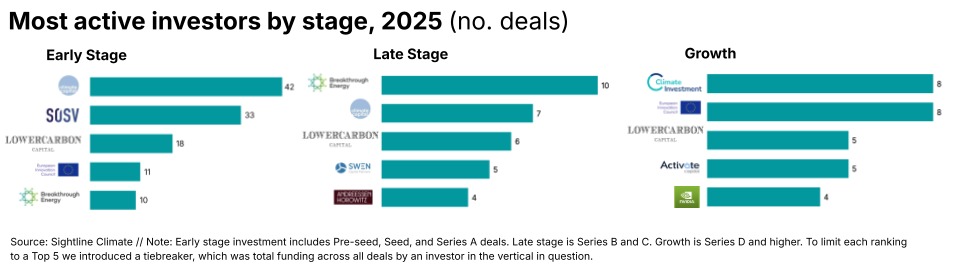

💤 Fewer investors: Total climate investors across all stages fell 11% in 2025. But government and corporate investors made an appearance in our updated top investors list. Fewer deals by just about everyone meant the number of specialist investors dropped, and the number of investors by stage fell across the board.

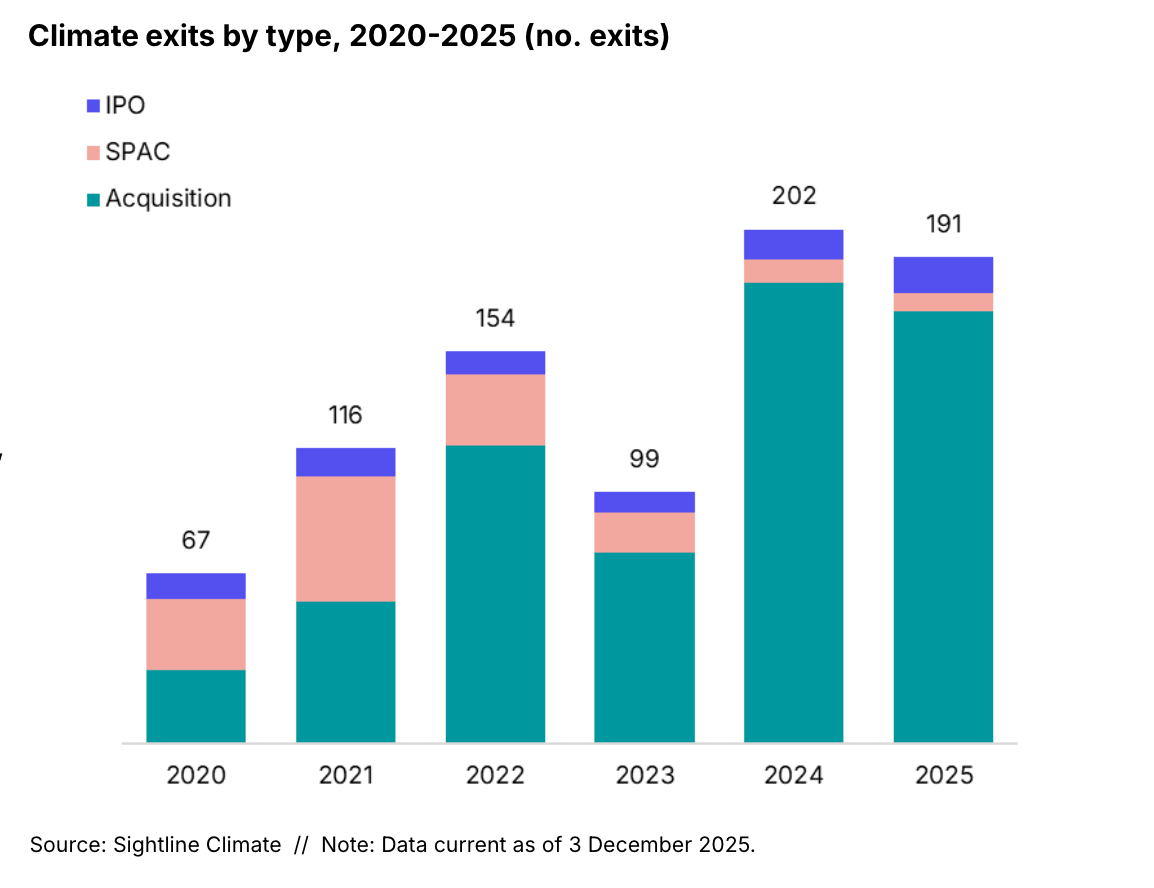

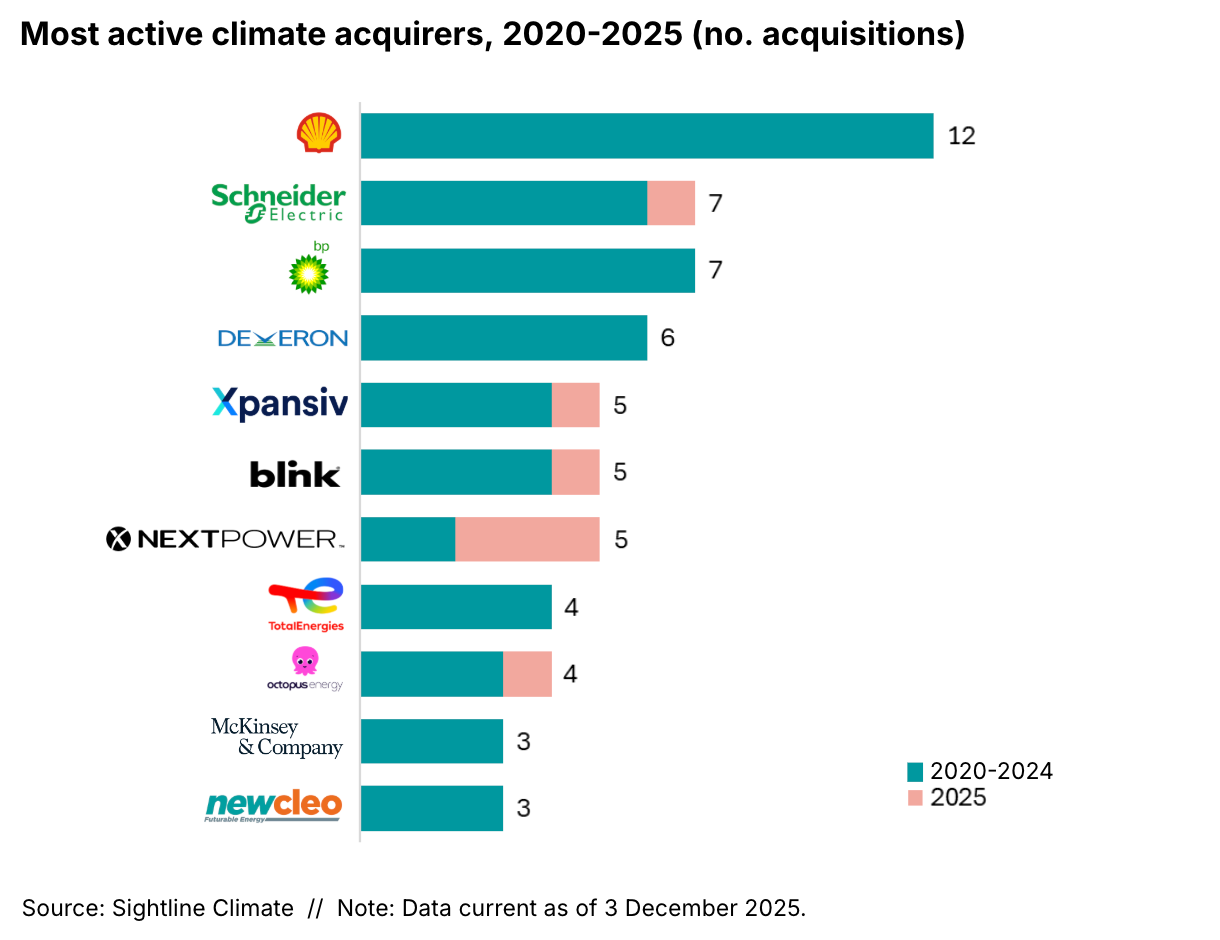

🚪 Exits: Exits dropped 5% overall in 2025, mostly driven by a small decline in acquisitions, which made up 89% of all exits. It continues to be a buyer’s market, with larger companies picking up smaller players in (or adjacent to) their core markets for access to their capacity and projects.

🎉 Cumulative investment: Cumulative investment since 2020 increased by 19% to $255bn in 2025, similar to the 2023-2024 increase of 21%, but nowhere near the double-digit quarterly growth of the 2020-2023 boom period.

A note on methodology: This funding report captures only Venture Capital and Growth Equity deals that have been publicly announced through regulatory filings or press releases as of December 11, 2025. Read more about methodology and definitions in the report.

Investor participation fell 19% YoY in 2025 across all climate verticals, with the steepest pullbacks in Carbon (-47%) and Transportation (-31%). Specialist investors retreated faster than generalists, signaling fewer, more selective bets rather than an exit from the space.

Climate-focused investors still led deal activity, with dedicated firms like Breakthrough Energy, Lowercarbon Capital, and Climate Investment topping the rankings. But the investor mix is shifting, as some climate funds broaden their mandate toward AI, robotics, or food security, while corporates and governments step into growth-stage deals once dominated by traditional investors.

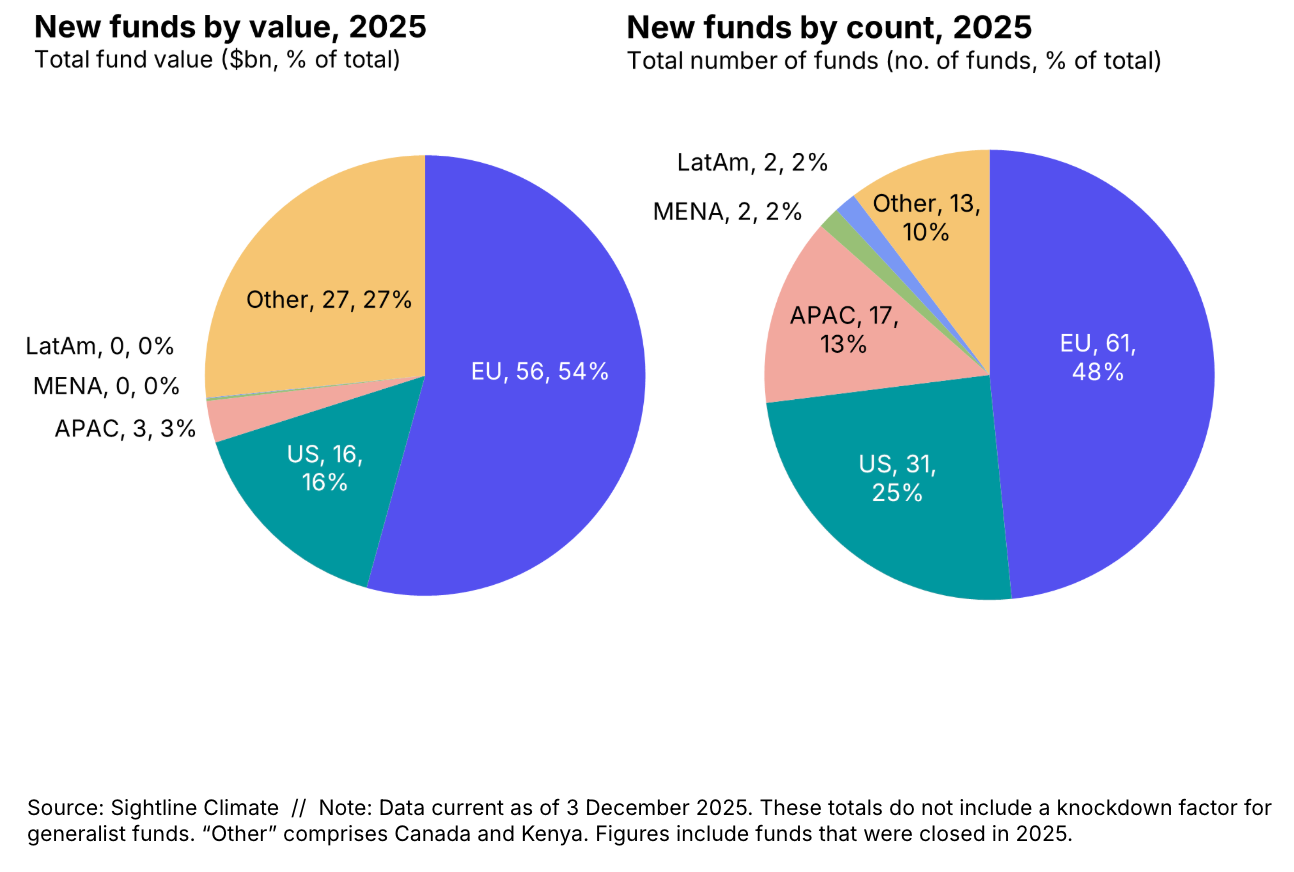

New climate funds raised $103bn in 2025, led by Europe at 54% of capital, while the US contributed just 16% amid weaker climate mandates. Only 60% of targeted capital closed, leaving $69bn potentially in the pipeline, with fundraising toughest outside Europe and Canada, especially in APAC and the US.

For a detailed explanation of the methodology, please download the report and refer to the methodology section at the end.

NOTE: You may notice that some of our numbers are larger in this update than previous editions. We constantly update the dataset to have the most accurate data possible, including adding post-dated deals.

🎁 Now that’s a wrap on the TLDR! If you’ve got this far in the email and haven’t yet clicked, get the full report here.

Have a different take on what’s driving these trends? Or questions about our analysis? Drop us a note at [email protected] if you’re looking to dig deeper into the 2025 investment numbers.

Stricter foreign sourcing rules reshape clean energy tax credit eligibility

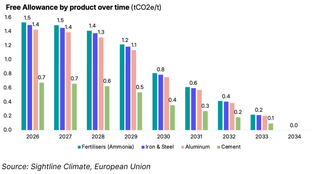

We did the EU carbon math

With long duration energy procurement surging, new rankings reveal who's pulling ahead