🌎 Taxing times for CCUS #254

OBBB blows tailwinds through CCUS, but takeoff stalls

Breaking down carbon dioxide removal's major announcements and remaining gaps

Happy Tuesday!

Happy Easter and Chag Sameach! 🐣🌸

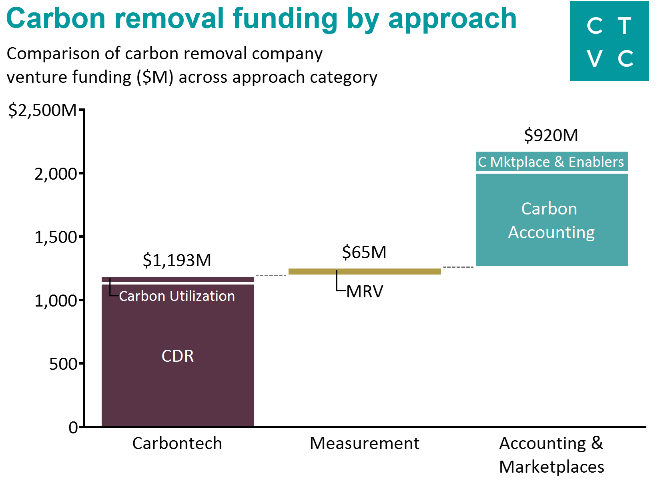

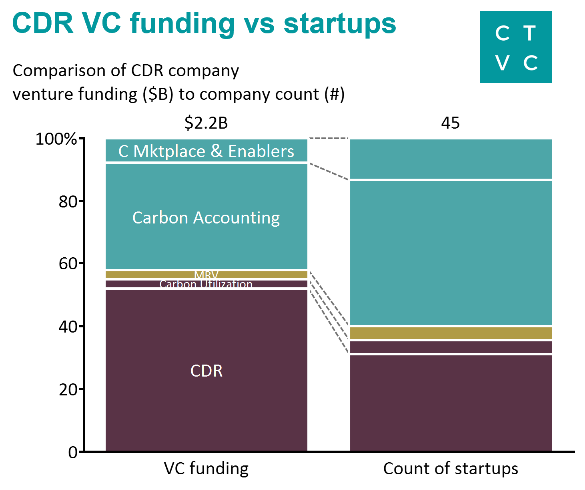

In this issue, we follow on to our chat with Nan to go deep on carbon dioxide removal - even though the space needs active removals and storage of carbon, the vast majority of investment dollars to date have gone to accounting for it.

Comparatively, a smaller amount has gone to measurement and verification and only recently (e.g. with Climeworks’ mega round) has removal picked up volume (of dollars, though not of start-ups). All in, this presents both opportunities and questions: where will the carbon go, and how will we know it’s there?

In funds this week, Lowercarbon announces their $350m carbon removal fund, China drops its’ first nation-wide climate transition investments, and Invert, Ripple and Carboncure announce the world’s largest carbon removal agreement.

In the news, Biden appoints more climate folk, New York commits to more wind and solar, as well as electric school buses.

Thanks for reading!

Not a subscriber yet?

Carbon dioxide removal (CDR) has been a fringe group for years, even as the IPCC sounded the scientific bullhorn that CDR is “required” to keep us below catastrophic climate tipping points.

Then suddenly, almost $2B has been announced in the carbon dioxide removal (CDR) space over the past few weeks – making history:

💨 Climeworks raised $650M in the biggest carbon removal startup deal ever

🏦 Stripe, Alphabet, Meta, Shopify, and McKinsey team up to launch Frontier Climate and catalyze the carbon removals market with nearly $1B of advanced commitments

🏰 Lowercarbon Capital pulls the wraps off a $350M new CDR-exclusive venture fund

🏛 The DOE invested $14M in pilot projects to scale up direct air capture and storage technologies

🇺🇸 US Representatives introduced the first federal carbon removal procurement legislation to Congress

Spanning startups, venture, corporates and governments, these announcements indicate the start of a new era for CDR. Within the carbon removal ecosystem, key actors have generally broken down into three approaches:

Carbontech - picks and shovels technology players making up various carbon removal pathways (e.g., Climeworks, Heirloom, Brilliant Planet)

Measurement, Reporting, and Verification - tools and methodologies enhancing the accuracy and transparency of carbon sequestered (e.g., Sylvera, Cloud Agronomics, Regrow)

Accounting & Marketplaces - underlying infrastructure for enterprises & individuals to account for emissions and purchase/ trade carbon removal credits (e.g., Patch, Persefoni, NCX, Watershed)

Key Takeaways:

☀️ Guangdong Gaojing Solar Energy Technology, a China-based solar energy technology company, raised $251m in Series A funding from IDG Capital, Huafa Group, Zhuhai City, Guangdong Finance Fund Management, Shenzhen Investment Holdings, China Life Investment Management, and others.

♻️ Enerkem, a Canada-based company producing renewable fuels and chemicals from waste, raised $105m in funding from Repsol and Monarch Alternative Capital.

🧶 Natural Fiber Welding, a Peloria, IL-based maker of plant-based textile materials, raised $85m in Series B funding from Evolution VC Partners, Tattarang, Lewis & Clark AgriFood, Collaborative Fund, AiiM Partners, Engine No.1, Raga Partners, Tidal Impact, Scrum Ventures, Gaingels, BMW i Ventures, Ralph Lauren, Advantage Capital, and Central Illinois Angels.

⚡ Ohmium, a Fremont, CA- and India-based green hydrogen company that designs, manufactures, and deploys PEM Electrolyzers, raised $45m in Series B funding from Fenice Investment Group and Energy Transition Ventures.

⚡ GridX, a Milpitas, CA-based enterprise rate platform provider for utilities and energy tech companies, raised $40m in Series C funding from Energy Impact Partners, Moore Strategic Ventures, Sunfox Capital, and NGP ETP.

☀️ Raptor Maps, a Boston, MA-based provider of solar lifecycle management software, raised $22m in Series B funding from MKB, Microsoft Climate Innovation Fund, Blue Bear Capital, DNV, Buoyant Ventures, Congruent Ventures, and Data Point Capital.

🌊 Terradepth, an Austin, TX-based ocean data portal powered by its autonomous underwater vehicles, raised $20m in funding from Giant Ventures and Nimble Ventures.

🌱 Vertical Harvest, a Jackson, WY-based hydroponic vertical farming company, raised $8.35m in Series A funding from Nicoya AB, Raiven Capital, Bain Capital Ventures, and Raiven Capital.

🌱 Advancing Eco Agriculture, a Middlefield, Ohio-based regenerative agricultural systems startup, raised $4.7m in Seed funding from Tree Trunk Light.

💧 Aclarity, a Hadley, MA-based water treatment startup, raised $3.3m in Seed funding from Burnt Island Ventures, DCVC, MassVentures, and the UMass Maroon Fund.

⚡ Nuventura, a Germany-based developer of switchgear technologies that help eliminate sulfur hexafluoride, raised an undisclosed amount in Seed funding from ADB Ventures, Cycle Group, Future Energy Ventures, Doen Participaties, IBB Ventures, and others.

🌱 Util, a UK-based machine learning ESG metric investment tool, raised an undisclosed amount in Seed funding from Eldridge, Oxford Sciences Enterprises, and others.

You know the drill by now, Gen Z’s go here: TikTok and Instragram deals of the week.

VC firm Lowercarbon Capital launched a $350m fund dedicated to carbon removal startups.

VC firm Emerald Technology Ventures, along with Beiersdorf, Chevron, Henkel, and WM, launched a fund focused on sustainable packaging, making it one of the first venture-backed investment vehicles targeting the full packaging lifecycle.

Impact Science Ventures launched as a VC firm looking to invest in fundamental scientific breakthroughs that solve industry's hardest problems in critical impact sectors.

Green Rock Energy Partners launched as a New York-based sustainable infrastructure-focused PE firm which is looking to target projects that produce renewable natural gas, renewable diesel, and renewable fertilizer.

Representatives Paul Tonko and Scott Peters introduced the Federal Carbon Dioxide Removal Leadership Act to Congress which would bring the US government’s purchasing power prowess to carbon removal procurement. If fully implemented, the bill could provide more than $8B of carbon credit pre-purchases (~9x that of Frontier Climate today).

It’s been a whirlwind of funding for DAC and even the US government wants a piece of it—The Department of Energy allocated $14m to fund pilot DAC projects that can capture and store carbon with high permanence.

New York approved more than 500 miles of transmission lines, specifically delivering Quebec hydro and Delaware solar and wind to New York City. The city’s electricity consumption has been notoriously challenging to decarbonize given its land constraints and massive population. Using these lines to reduce reliance on fossil fuels by 50%+ by 2030 would put NY’s climate goals (CLCPA) and building electrification (LL97) goals well within reach. In more NY climate fwd news, Governor Kathy Hochul committed $220B to make the state’s 50,000 school buses 100% electric by 2035.

Across the Pacific, China’s first nation-wide $14B climate transition fund issued its initial round of investments, joining forces with China’s largest steelmaker Baowu Steel to set up a $7.8B private equity fund focusing on decarbonising the steel sector.

Web3 is trying to clean up its act. Blockstream and Block (prev. Square) jointly co-financed a $12m pilot solar-and-storage bitcoin mining project. Meanwhile, Invert, a specialized emissions reduction and offsetting company, and Ripple, a crypto payments provider, signed a $30m carbon credit purchase agreement with CarbonCure for permanent CO2 storage through carbon mineralization in concrete and Polygon, an Ethereum scaling platform, and KlimaDAO announced their “Green Manifesto” to go carbon negative by the end of this year.

BNEF announces its 2022 Pioneer award winners, featuring Kairos Power, Carbfix, and Twelve.

New digital mapping tools could help save kelp forests, which absorb CO2 5x more efficiently than land plants.

The new Mercedes-Benz Vision EQXX concept car traveled more than 600 miles on a single charge, surpassing any EV in the current market.

How to track thriving penguin populations in Antarctica? Look for ice.

Life imitates art. Check out this eerie side-by-side of Don’t Look Up and a recent interview with climate scientists on Good Morning Britain.

A satirical ad on Australia’s carbon credits scheme highlights problems with existing offsets.

Shayle Kann and Azeem Azhar discuss venture capital and deep decarbonization on the Harvard Business Review podcast, while Obvious Venture kicks off its new podcast with a mini-series on climate tech. Sophie digs into the intersection of industrial x climate venture investing on the Heavy Hitters podcast.

TPG Co-founder and Executive Chairman Jim Coulter shared his perspective on the next industrial revolution that's happening in climate tech with Sophie on Overture Insights.

Even when they run on gas-generated electricity, heat pumps save gas compared to traditional boilers.

Climate change stinks. Rising sea levels and floods wreck septic tanks.

Researchers at MIT have designed a thermal heat engine that could be more efficient than traditional steam turbines.

💡 Carbon2Value Initiative: Apply by Apr 29th to this six-month accelerator seeking carbontech companies and earn the opportunity to work with C2V’s partner, Fluor, in scaling developing carbon removal technologies.

💡 Investing in Activate: Activate is offering investors and funds the opportunity to apply to invest in their summer cohort of climate tech companies by May 13th to engage in a unique VC Partner Program.

💡 Toyota Ventures Accelerator: Apply by May 31st to the 2022 Toyota Ventures Call for Innovation to enhance scalable solutions to modernize manufacturing, advance sustainable production and help make the factory of the future a reality sooner.

💡 The Giant Prize: Apply by Sep 30th for the Giant Prize for climate innovation which rewards the most ambitious Danish climate entrepreneurs with 5M DKK.

🗓️ Sustainable Investment Forum: Join in-person in London or virtually on Apr 26th and May 4th-5th as the fifth annual European Sustainable Investment Forum kicks off highlighting a whole host of keynotes, panels, and networking opportunities centered around the ways that investors can contribute to a net zero carbon economy.

🗓️ Evergreen Climate Innovations: Join on Apr 28th to hear from Allison Myers (Buoyant Ventures), Josh Whitney (Accenture), and Morgan Sheil (Energy Impact Partners) as they discuss the impact that the SEC’s new disclosure regulation has on climate ventures and innovations.

🗓️ Energy Tech Summit: Join in Warsaw, Poland or virtually from Apr 26th - 28th to engage in exclusive, deep-dive conversations covering nine energy verticals and hear from some of the most influential experts in each respective sector.

Senior Technical Recruiter @Mitra Chem

Sr. Director of Client Success @Shifted Energy

Associate @Voyager Ventures

Associate @DCVC

Venture Principal @OGCI

Senior Investment Associate @Unreasonable Group

Vice President - Climate Tech @HolonIQ

Principal Soil Scientist @Yardstick

Senior Customer Success Manager @SINAI Technologies

Founding Business Lead @RightHandGreen

Community Manager @Ecosapiens

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

OBBB blows tailwinds through CCUS, but takeoff stalls

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook