🌎 Bright spots and sunsets in the OBBB #253

One Big Beautiful Bill ushers in new (and old) energy agenda

Public market tech stocks tumble, wheretofore climate?

Happy Monday! As the world frets over equities tumbling, it’s worth wondering if just like that the comeuppance will rise for earlier stage companies and climate tech more broadly.

In this week’s issue, we look back at climate SPAC performance (or lack thereof), collect a handful of market prognostications, and dig into more recent deals data. Tl;dr - earlier stage seems safe (for now), though valuations will price in the cost of pricier capital quickly.

Not to be thwarted by the headlines, five deals this week weigh in over nine figures - topping the list, Arcadia’s energy data play raises $200m in Series E funding, Li-Cycle raises $200m for batteries recycling and Carbon Clean captures $150m for carbon capture.

In the news, more coverage of brownspinning with a EDF report, North Carolina decides on its offshore wind partners, and Atlassian CEO prevails in getting ~11% stake in Australia's largest energy provider and carbon polluter (after two failed takeover attempts).

Thanks for reading!

Not a subscriber yet?

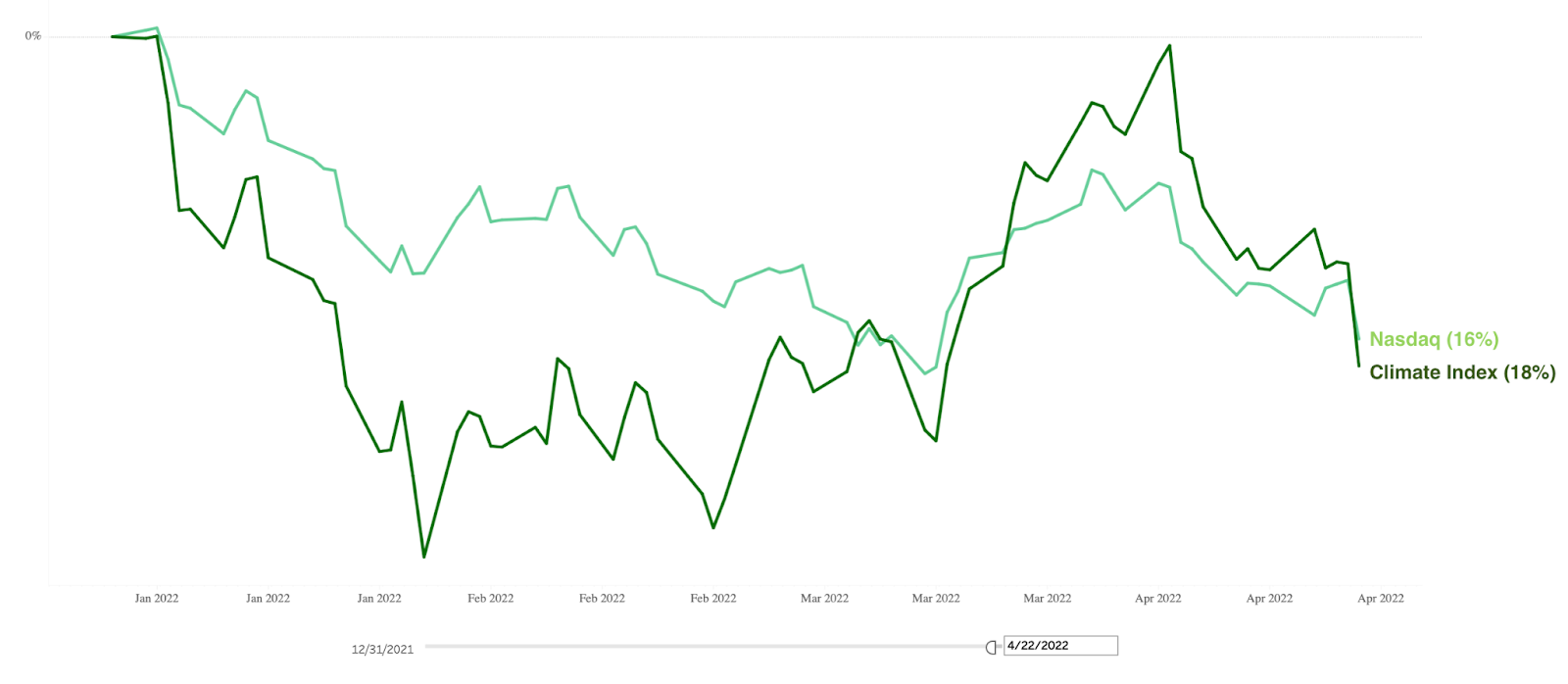

The market has veered towards correction territory, with public climate companies losing ~20% since the start of the year - while the broader NASDAQ staggered back 27% with many companies in far greater decline.

We’ll release our CTVC mid-year report soon, and expect the story to reflect the trend in overall US VC Q1 funding. Read: down 10% YoY and 24% off the Q4’21 peak.

The questions on everyone’s mind: is this a momentary (probably healthy) valuation correction, or a capital-C Correction? And what does Big Tech Cos’ reckoning mean for climate tech? We dig into the data, look back to history, and interview investors & founders on the frontlines to attempt an answer.

📊 Let’s start with the data. The EIP Climate Tech Index of public cos primarily involved in providing decarbonization tech is down ~20% since the start of the year (note: updated as of April 22nd so not including the past 3 weeks’ market rout).

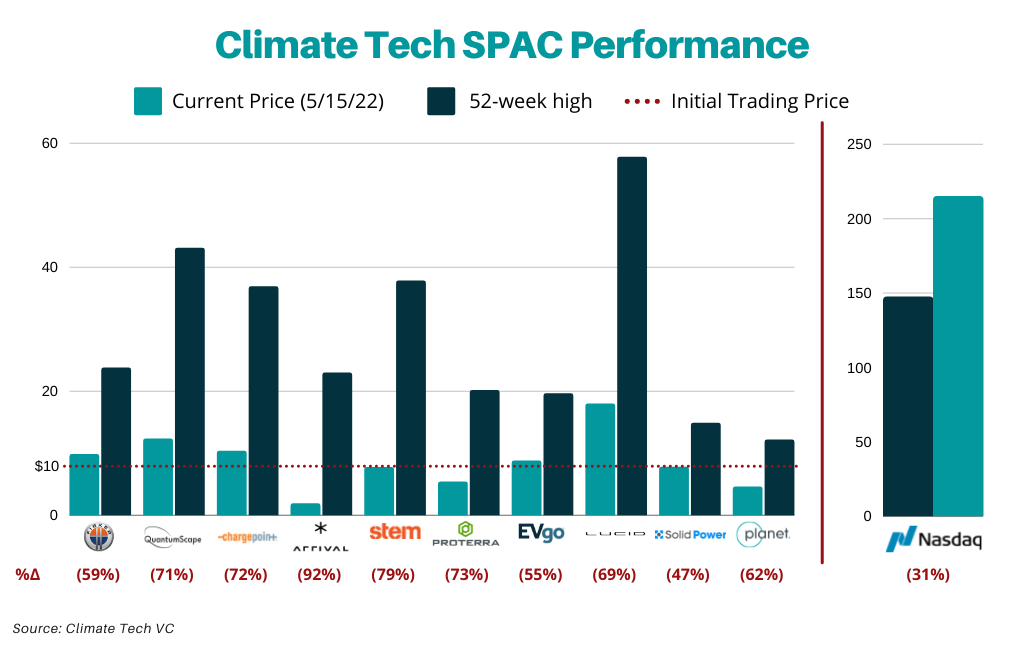

Many companies included in the Index are vestiges of the 2021 SPAC hype. All are significantly below their 52-week high. Even previous climate SPAC darlings like QuantumScape, ChargePoint, and Stem have come spiraling down to barely above their $10 initial IPO price. This SPAC underperformance is hardly limited to climate companies, though perhaps signaling hard lessons learned for hardware cos trying to build while public with wildly optimistic projections.

🔍 Now, let’s look back to history. How does the state of the private climate tech market today shape up to that of ‘01-’02 and ‘08-’09’s capital-C Corrections?

In ‘01-’02, underlying company fundamentals were distorted by the boom itself with flawed business models propped up by lots of free cash.

Climate tech cos today have benefited from an undeniably robust capital market environment, though unlike the late ‘90s there’s limited recycling of capital between startups (e.g. buying software from one startup, which then fundraises to buy software from another startup). Instead, large corporates have shelled out much of the green dough from their somewhat uncorrelated bank accounts.

In ‘08-’09, a large cohort of startups were growing quickly, but were exposed to a reliance on additional capital to fuel that growth and didn’t shore up their burn rates fast enough.

Climate tech cos today are certainly reliant on additional capital - and longer timelines. Indeed, few are profitable (Gigacorns not excluded). If capital becomes more scarce, these companies will need more, more expensive capital - penalizing founders and VCs alike, even in scenarios with successful exits. Anticipate more M&A outcomes. Though, with 50+ new climate funds launched just last year, there’s more than enough AUM to go around for the interim.

🎙️ Finally, we spoke with founders and investors across the climate tech spectrum to bring perspective on how the impending public market downturn will impact early-stage, climate tech:

“We are in an interesting time where the undeniable macro tailwinds behind the need for climate tech solutions are competing with the undeniable macro headwinds of the current state of the economy. While we expect to continue to see valuations retreat from their 2021 highs, we also believe considerable capital will continue to flow into the space.” - Cassie Bowe, Energy Impact Partners

“The public market meltdown is part of the broader economic picture of high inflation, rising interest rates, supply chain and energy markets disruption, and, of course, war. Companies will and should be focused in the coming months on financial metrics like revenue, gross margin, and EBITDA. Early stage climate tech companies looking to solve big problems will still get funded, because of all the dry powder in climate VC-land, but later stage companies who can be expected to have revenue at margin will be pinched if they can’t produce. The days of triple digit rounds to later stage companies led by generalist and crossover funds are likely over for a while. Those companies should conserve cash and make hard choices early, because the choices are only going to get harder if they wait too long.” - Gabriel Kra, Prelude Ventures

“The fundamentals behind climate tech remain incredibly strong in the long term - new energy systems and sustainable ways to make every part of our civilization will continue to be the best way to build the billion dollar businesses of the future. However, that by itself would be too flippant of a view - founder friendly investors will also recognize that many aspects of being a founder will be more difficult in the next year. Raising rounds will take much longer than usual, and founders will be forced to take additional dilution. Good partners will double down and work closely with their teams to ensure that the massive long term value isn't derailed by this bump in the road.” - Shuo Yang, Fifty Years

“Climate is a problem we’ve got to tackle over many decades. As we think about the size of the problem and the size of the opportunity here in re-shaping our global economy, these jitters will not matter in the long term. I think more and more capital will flow to high quality critical applications and climate technologies, including what we’re working on WeaveGrid. This might actually be an even better market for private climate companies as investors move back from NFTs to stuff that actually matters.” - Apoorv Bhargava, Weave Grid

“We are definitely seeing an adjustment in early stage valuations and a softening in the Climate tech markets - which is helping to normalize valuations. Revenues matter. Especially Annually Recurring Revenues. Yet climate tech is still urgent, and it will take a global concerted effort to make a dent. We’re playing the long game.” - Amy Francetic, Buoyant Ventures

“More investors may shed their focus on previously hot areas such as SaaS and web3, shifting to climate tech as the globe’s “white hot” (pun intended) sector. With valuations and revenue multiples collapsing for traditionally hot areas, substantial downstream capital flowing into climate tech from late stage funds, and investors’ own personal dispositions shifting to make better use of their position and influence as capital allocators, more early stage (seed/A) investors may indeed turn to climate tech as the next attractive category of hope, bringing their respective areas of expertise in SaaS, consumer, biotech, and/or deep tech to the climate fight ahead. And the best reason of all? Investors will wake up to the fact that many of the very best founders will be leaving those areas to start generational climate tech future unicorns.” - Zal Bilimoria, Refactor Capital

"Let’s start with what’s driving stocks down. Inflation and uncertainty are up because energy prices are through the roof, supply chains are monumentally screwed, and there’s a land war in Europe (!) limiting supplies of critical materials for everything from EV batteries to fertilizers. These are all problems that climate tech is solving, by expanding access to cheap renewables, advancing new manufacturing techniques that can be reshored, and unlocking better, cleaner chemicals thanks to synthetic biology and electrochemistry. Cheaper, better, faster, safer wins. That doesn’t mean climate tech would be impervious to a recession, but the urgent utility of what we’re building buoys this space unlike, say, a verification protocol for jpegs. Valuations will dip and round sizes shrink, but the fact remains that there has never been a better time to start and build a climate tech company." - Clea Kolster, Lowercarbon Capital

⚡ Arcadia, a Washington, DC-based startup sourcing energy data from smart meters, raised $200m in Series E funding from JPMorgan, Triangle Peak Partners, Camber Creek, Tiger Global Management, Wellington Management, and Drawdown Fund.

♻️ Li-Cycle, a Canada-based battery recycling startup, raised $200m in funding from Glencore.

💨 Carbon Clean, a UK-based carbon capture technology startup, raised $150m in Series C funding from Chevron, CEMEX, Saudi Aramco, and Samsung Ventures.

🛴 Ather Energy, an India-based electric scooter maker, raised $128m in funding from National Investment and Infrastructure Fund and Hero MotoCorp.

🌱 6K, a North Andover, MA-based developer of an advanced microwave-based plasma technology for sustainable engineered materials, raised $102m in Series D funding from Koch Strategic Platforms, Energy Impact Partners, Albemarle, HG Ventures, and others.

☀️ Solfácil, a Brazil-based startup that provides credit lines for installing solar energy, raised $100m in Series C round funding from QED Investors, SoftBank, VEF, and Valor Capital Group.

⚡ SkySpecs, an Ann Arbor, MI-based startup monitoring renewable energy assets like wind turbines, raised $80m in Series D funding from Goldman Sachs, NextEra Energy Resources, Statkraft Ventures, Equinor Ventures, Evergy Ventures, UL Ventures, and Huron River Ventures.

⚡ Ambient Photonics, a Mill Valley, CA-based developer of photonics energy harvesting technology, raised $31m in Series A funding from Amazon, Ecosystem Integrity Fund, Future Shape, and I Squared Capital.

🌱 Sencrop, a France-based provider of weather analytics services for agriculture, raised $18m in Series B funding from Jerusalem Venture Partners, EIT Food, Stellar Impact, IRD Management, BPIfrance, Demeter IM, and NCI Waterstart.

🏠 Common Energy, a New York, NY-based provider of a SaaS platform to manage and monetize complex, multi-tenant distributed generation projects for project owners, raised $16.5m in funding from S2G Ventures.

⚡ Versogen, a Wilmington, DE-based developer of electrolyzers to produce green hydrogen at scale, raised $14.5m in Series A funding from Doosan Corporation, HyAxiom, The Chemours Company, TechEnergy Ventures, Wenstone H2Tech LLC, TOP Ventures America LLC, and others.

🚲 GetHenry, a Germany-based provider of electric last-mile delivery bikes, raised $10.4m in Seed funding from LocalGlobe, Visionaries Club, Founder Collective, EnBW New Ventures, GreenPoint Partners, SpeedUp Ventures, and Third Sphere.

🏠 Landgate, a Denver, CO-based startup that enables purchasers to evaluate land energy resources, raised $10m in Series B funding from NextEra Energy Resources and Kimmeridge.

☔ FutureProof Technologies, a San Diego, CA-based climate risk analytics platform, raised $6.5m in funding from AXIS Digital Ventures, Innovation Endeavors, and MS&AD Ventures.

🍎 Full Harvest, a San Francisco, CA-based marketplace for surplus and imperfect produce, raised $5m in extended Series B funding from Food & Agri Innovation Fund and JAL Innovation Fund.

🚗 MoEVing Urban Technologies, an India-based operator of electric mobility technology platform, raised $5m in additional Seed funding from BeyondTeq Venture Capital, Gulf Cooperation Council, Middle East family offices, Stride One Capital, TradeCred, N+1 Capital, Nazara Tech, and others.

♻️ Kaltani, a Nigeria-based clean-tech plastic recycling and waste management company, raised $4m in Seed funding from undisclosed investors.

Silicon-anode batteries maker Amprius Technologies Inc. is going public via merger with transportation-focused SPAC Kensington Capital Acquisition Corp. IV, valuing the company at $1.3b.

Emerald Technology Ventures raised $264m for its new European Transformation Fund, investing across energy, water, industrial technology, food, mobility, robotics and advanced materials and packaging.

Total Energies is shuttering its climate tech investment arm TotalEnergies Ventures.

Brownspinning is in the spotlight with a major new report from EDF tracking who’s buying and selling fossil fuel assets. Over the past five years, upstream oil and gas assets, in aggregate, moved from relative climate industry leaders to laggards, and from public to private markets - weakening disclosure and climate risk governance.

TotalEnergies and Duke Energy won the North Carolina offshore wind lease auction to develop two possible sites - paying $315m for the estimated 1.3W of offshore wind potential.

Offshore solar plants? China’s trying them out in Shandong. They aim to energize the populous province with enough solar panels to power New Zealand.

Recognizing the massive infrastructure buildout required to meet climate goals, the Biden administration released a permitting action plan that aims to accelerate and deliver long lead-time projects, mainly looking at supply chain issues for infrastructure projects.

AGL could be out of luck. After two failed attempts to buy Australia’s biggest power company and largest carbon polluter, AGL, Atlassian co-CEO Mike Cannon-Brookes is back again now with an 11% ownership stake to force cleaner operations.

Deploy. Deploy. Deploy. Prime Coalition publishes an insightful report on the barriers to timely deployment of climate infrastructure and the role of catalytic capital.

Tony Fadell’s tax tweak to use capitalism (and QSBS) to solve the climate crisis.

In a comparison of EVs' total cost of ownership vs fuel cars’, EVs win - in every single case.

“We’re not doing this for the children… We’re doing this for us!” was an audience member’s response to Nancy Pelosi’s comments at the Aspen Climate conference this week. Robinson Myers sums the Dem’s position as such: the party doesn’t even seem to realize that it’s blowing a once-in-a-decade chance to pass meaningful climate legislation.

Heads or tails? In any event, there’s a 50% chance that the world will cross the 1.5ºC threshold, in the next five years, according to an update from the UK Meteorological Service.

Where Lawns Are Outlawed (and Dug Up, and Carted Away) - a headline that we won’t prune from the NYTimes.

Ghost forests haunt the Outer Banks as sea levels rise and storms become more intense.

💡 Urban Future Lab Prize: Apply by June 6th to Urban Future Lab’s sixth annual climate tech competition which awards $50k to two leading startups and automatic access to the ACRE Incubator with the support of The New York Community Trust, MUFG, and NYSERDA.

💡 IFundWomen Entrepreneur of the Year: Apply by June 8th to be eligible for one of IFundWomen’s prizes awarding female entrepreneurs for their impactful businesses and earn up to $100k in the form of an equity investment or $5k in cash grants.

🗓️ Industrial Climate Tech Summit: Join on June 1st to hear from investors, policymakers, corporations, incubators, and entrepreneurs who are developing innovative solutions for the industrial sectors.

🗓️ Carbon to Value Initiative Kickoff: Join the C2V Initiative on June 8th in Houston, TX as they announce their second accelerator cohort of carbontech startups.

**Managing Editor @Climate Tech VC

Accelerator Program Manager @The Clean Fight NY

Associate in Climate @Deep Science Ventures

Climate Associate @Second Muse

Head of Communications & Marketing @The Engine

Investor, Frontier Fund @Energy Impact Partners

Senior Analyst/ Associate @Angeleno Group

Investor @Overture VC

Climate Tech VC Fellowship @World Fund

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond