🌎 Taxing times for CCUS #254

OBBB blows tailwinds through CCUS, but takeoff stalls

Plus, opening the floodgates to climate insurtech

Happy Monday!

The news is hype for EVs, propelled by Tesla’s runaway growth and institutional investors seeking that next electric buzz. While this is a positive trend overall, the frothiness portends a time where EV investment may rue its own ‘dot com’ level bubble if these valuations come to fade. We also consider other less sparky but equally significant investments in insurtech, while highlighting a series of other exciting deals, opportunities, and climate tidbits worth being in the know on. Thanks for letting us keep it pun.

Thanks for reading!

Not a subscriber yet?

When we started this newsletter, we didn’t expect to be writing about electric vehicles every week - but if 2020 has been one thing, it’s been unpredictable. With the constant headlines (including this week’s Tesla vs Rivian lawsuit) we buckled in to bring some clarity to the chaos.

Catch me up, what’s happening with the US EV market?

There are 20-something electric vehicle manufacturing startups in the US, though many of the companies are more of a business plan than a business. Tesla dominates ~75% of the EVs on the roads today, and established automakers have rolled out EV models of their own.

Tesla’s stock is red-hot (its market cap sped past GM, Ford, and Fiat combined), and cleared the hurdle for listing on the S&P 500 after posting its fourth consecutive quarterly profit (fueled by income from emissions credits and savings on employee salaries during shutdown). The aspirational story has enamored the private markets as investors pour money into EV upstarts with the dream that they’re the “next Tesla.”

TLDR; the EV foothold is real, but the amount of funding vs number of cars delivered is staggering.

Where’s the money coming from?

Why now?

Is the market big enough for all of the players?

So, is this a bubble?

🚗 Xpeng Motors, a China-based EV startup run by former Alibaba executive He Xiaopeng, raised $500m in Series C funding from Aspex, Coatue, Hillhouse Capital, and Sequoia China. More here.

🍎 Misfits Market, a Philadelphia-based subscription service for “ugly produce,” raised $85m in Series B funding from Valor Equity, Greenoaks, Third Kind, and Sound Ventures. TechCrunch has more here.

🐮 The Not Company, a Chile-based plant-based meat and dairy producer, raised $85m in funding from Bezos Expeditions, The Craftory, IndieBio, and SOS Ventures. More here.

🌱 Taranis, an Israel-based agricultural intelligence startup, raised $30m in Series C funding from Vertex Growth, Orion Fund, Hitachi, Mitsubishi, Finistere, and others (including crowdfunding!). The company uses data imaging to identify, analyze, and treat early signs of crop threats to maximize yield and efficiency.

🚲 Cowboy, a Brussels-based electric-bike maker raised $26m in Series B funding from Exor Seeds, HCVC, Isomer Capital, Future Positive Capital, and Index Ventures. TechCrunch has more here.

🍎 Afresh Technologies, a San Francisco-based startup with an AI-enabled food supply chain optimization platform, raised $12m in Series A funding from Innovation Endeavors, Food Retail Ventures, Maersk Growth, Impact Engine, and Baseline Ventures. More here.

🍎 Shelf Engine, a Seattle-based company that optimizes the shelf-stocking process in grocery stores, raised $12m in funding from Initialized Capital, GGV, Foundation Capital, Bain Capital, and 1984. More here.

🐔 Cooks Venture, a New York-based heirloom poultry startup, raised $10m in Series A funding from SJF Ventures and Cultivian Sandbox. The company breeds hardy chicken which can live in a wider range of climates and live on a significantly more diverse diet.

⚡ Moixa, a UK-based energy storage management platform, raised $6m led by Itochu, a Japanese conglomerate and battery maker. Moixa’s GridShare software orchestrates more batteries in Japan than were installed in California as of 2019. More here.

☀️ Solfácil, a Brazil-based solar energy financing platform, raised $4m in Series A funding led by Valor Capital Group. The company offers loans which help democratize solar energy. More here.

🚲 Dance, a Germany-based e-bike subscription company founded by the creators of SoundCloud and Jimdo, has raised an undisclosed amount from BlueYard and fellow startup operators including Kevin Ryan (AlleyCorp) and Neil Parikh (Casper).

⚡ Station A, a San Francisco-based software startup automating clean energy development, raised an undisclosed amount from Renewal Funds, Schneider Electric, and Powerhouse Ventures. The company aims to create the world’s first clean energy marketplace to introduce a cleaner and more resilient grid. More here.

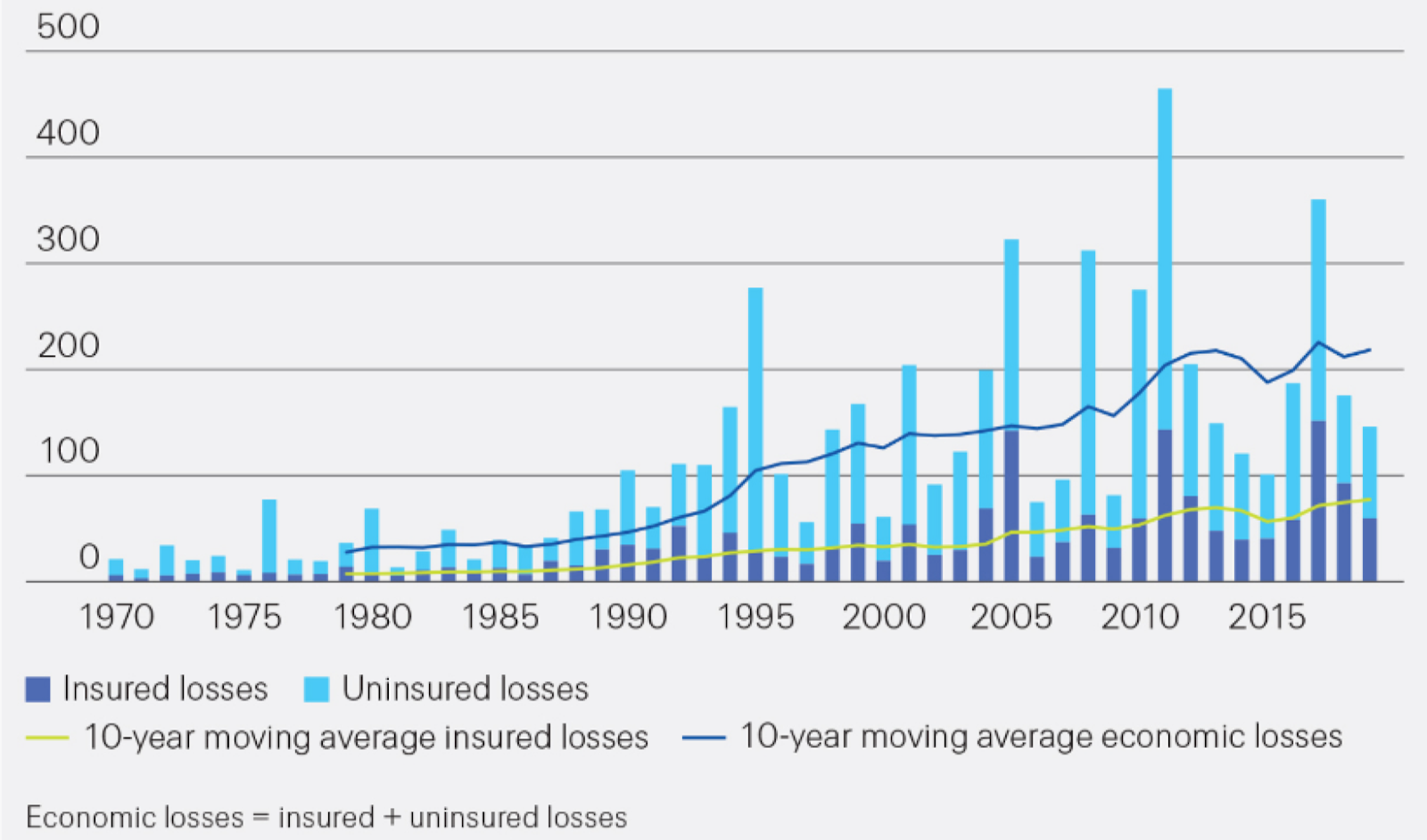

Climate change poses an increasing risk to insurers and their customers. The costs of climate change-driven weather-related disasters have been rising. In 2017, losses totaled more than $306 billion in the U.S. The 2018 California wildfires alone resulted in $24 billion in losses. Flooding risk in Florida could devalue exposed homes by $30 to $80 billion, or 15% to 35%, by 2050.

Insurers and reinsurers are reacting differently to these growing climate change risks. Most insurers are not factoring rising climate change risks into their premiums. Instead, they have assumed that the risks are static and will follow historical patterns. By contrast, reinsurers, which bear most of the risk of catastrophic losses that these events produce, have prioritized understanding and adapting to climate change. While insurance companies typically do not employ full-time climate scientists, many reinsurers do. This in-house expertise helps them quantify and respond to climate risk.

As climate-change-related losses mount for insurers, their profitability and even their viability could be at risk. They will be forced to respond by halting coverage of vulnerable areas or by raising premiums. These rate increases could be substantial and render insurance unaffordable for ordinary citizens. Government agencies have begun regulating rate increases and offering state-based insurance programs for flooding and select other disasters.

Some reinsurers are a step ahead, offering reduced premiums to customers (i.e., traditional insurers) that take steps to mitigate climate change effects or that discourage building at high-risk locations.

Determining the components of climate risk

Climate risk is comprised of three risk categories:

Many US state insurance regulators expect all three types of risks to increase over the medium- to long-term. Thus, it is critical for insurers to be able to measure these risks accurately.

Predicting the timing and impact of natural disasters is difficult, to say the least. Using historical data and trends to measure climate risk requires rigorous analysis (just ask the IPCC). Translating this data into financial terms and prices poses an even greater challenge. Moreover, even if a model worked today, it would change as climate conditions evolved.

To help with these measurements, the government provides certain risk estimates, but there is evidence they may be flawed. A recent study found that the government significantly underestimates flood risk across the country (Government’s flood maps show homeowners where and how to build to reduce flooding risk and whether to buy flood insurance).

How does climate technology fit in?

Insurers, reinsurers, and consumers need to be able to identify, quantify, and monitor climate-related risks. Climate technology can help perform these functions.

Some tech companies help insurers understand climate risk. Jupiter Intelligence, established in 2017, seeks to quantify the risk and potential economic impact of more than $100 trillion in global infrastructure and provide insights for resiliency and disaster planning. Cities and businesses pay for Jupiter’s predictive and analytics technologies to prepare for the climatological challenges they’re going to face.

New technology is necessary to collect climate data (as discussed in a previous newsletter), convert that data into actionable climate risk insights (e.g., likelihood of flooding), and price that risk. The number of companies offering a bundle of these services is even more limited. In fact, in its Climate Risk and Response report, McKinsey cited risk management technologies that can quantify and price risk as one of the few opportunity areas that will emerge from a changing climate.

To assess and potentially hedge climate risk factors, companies are likely willing to pay for any data that helps inform these decisions. For example, the credit rating service Moody’s bought a majority stake in Four Twenty Seven last year to enhance its climate risk assessment capabilities.

As traditional insurers face greater risk from planetary warming, they will need to enhance their climate risk assessment capabilities. The market potential for such services is substantial since insurers are also some of the largest investors.

Apple: Apple lays out plans to become 100% carbon neutral for its supply chain and products by 2030. The company, already carbon neutral for corporate emissions worldwide, is now establishing an Impact Accelerator to focus on investing in minority-owned businesses to support communities disproportionately affected by environmental hazards.

Bayer: Through its Carbon Initiative, Bayer will compensate ~1,200 farmers in the US and Brazil for generating carbon credits through regenerative ag practices. Oddly, Bayer will reward the farmers through “assistance in implementing climate-smart agricultural practices” (we assume that means free / low-cost inputs) while “Bayer will acquire the carbon removals” (aka own and sell the offsets).

Resources for the Future: As many as 3 million oil and gas wells nationwide sit abandoned and invisibly leaking methane. Properly plugging these orphaned wells is a 100K+ jobs opportunity to “build back better”, not to mention a huge GHG reduction lever.

NYTimes: Big tech has begun to address its role in climate issues, and is now being urged to use its influence to support environmental policies such as the Green New Deal as well.

Bloomberg: EU member states unanimously approved a 750 billion euro coronavirus relief package, with nearly ⅓ of funds dedicated to fighting climate change. We covered the stimulus plan, and how it sizes up to efforts in other regions of the world, in a previous issue here.

Politico: Morgan Stanley will be the first US bank to disclose its loans and investments for climate impact in order to bring more transparency to its financed emissions.

Chamath Palihapitiya of the famed Social Capital is seeking help allocating “a few $B” into decarbonization, sustainability, and climate change.

Raise Green, an equity crowdfunding platform for clean tech projects, offers its first marketplace listing.

The Sierra Club, the nation’s oldest conservation group, and other environmental organizations are reckoning with their racist histories and current practices.

Don’t be this guy. Or is Householder just a pawn in a (very) broken system?

While this is not climate tech news, kudos to FirstRound for leading with transparency in their Partner hiring process. “People can’t get a job that they don’t know exists.”

[Opportunity] Accelerate at Circularity 20: Apply by August 1 to pitch to a virtual audience of over 10,000 business, government and thought leaders.

[Opportunity] F³ Tech Accelerator: Apply by August 1 for the F³ Tech Accelerator Program, which provides funding for early-stage companies to prepare them for potential investment.

[Opportunity] Clean Energy Trust: Apply by August 3 if you’re an early stage cleantech company based in the midwest looking for $100k-$300k funding.

[Event] Activate Info Session: Join for an info session on the Activate fellowship, Tues 7/28 @12pm EST.

[Event] AWS: Join the conversation at the Renewable Energy, Sustainability, and Blockchain Virtual Panel, Wed 7/29 @3pm EST.

[Event] Tech Lemonade 2.0: Joules Accelerator hosted a discussion on July 8th about the progress towards a net-zero economy including perspectives from corporate partners such as Duke Energy and Microsoft, as well as the graduating cohort 6. Check out the full recording here.

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

OBBB blows tailwinds through CCUS, but takeoff stalls

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook