🌎 Bright spots and sunsets in the OBBB #253

One Big Beautiful Bill ushers in new (and old) energy agenda

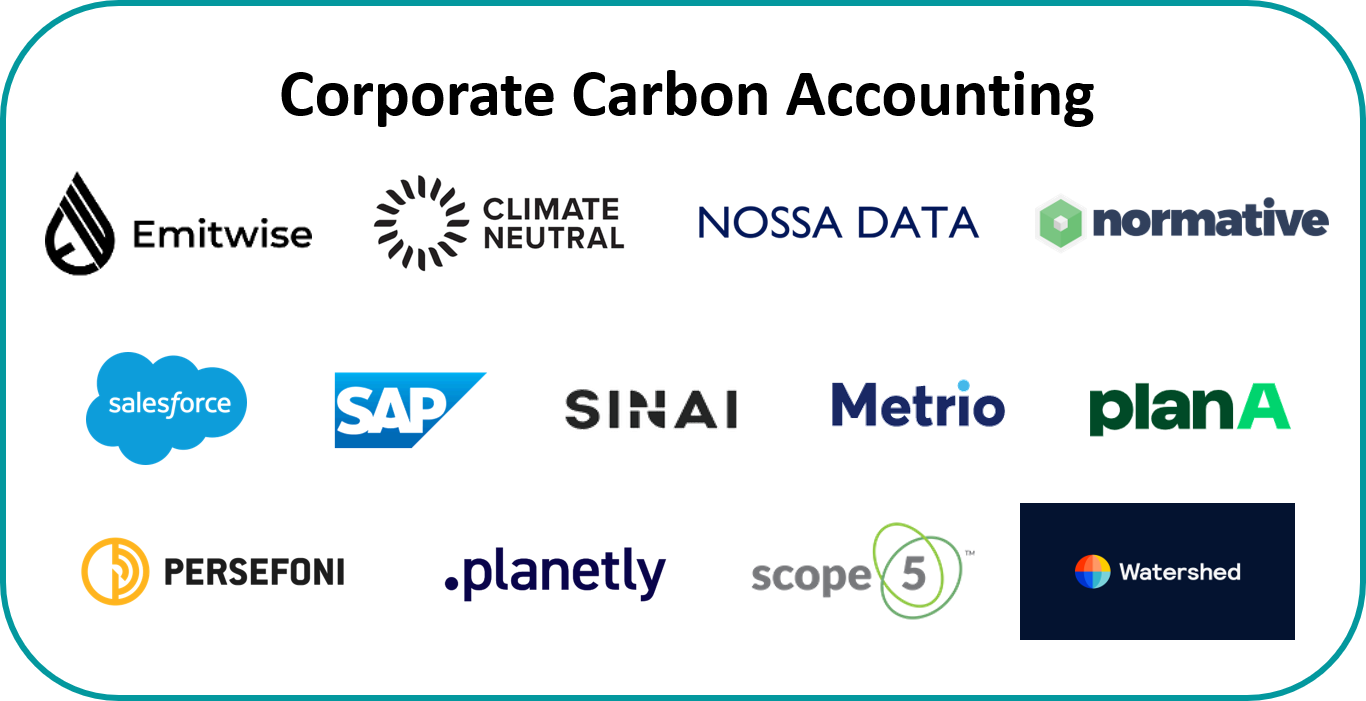

EV lobbying for greener roads and carbon accounting for greener corporates

Happy Monday! If you’re a climate and accounting nerd, you’re in luck! This week we feature a deep dive on the corporate carbon accounting market, and evaluate how innovation there can lead to more innovation in reducing carbon overall.

We also go deep on the newly formed ZETA EV lobbying group, share new fundings of technologies like Form Energy’s long duration storage, and highlight USV’s new climate-tech focused venture fund. Other news includes VW’s big electric commitment and Bezos dropping his first climate dollars.

Thanks for reading! We’ll be taking a Thanksgiving break next week, but may be back at it with a special issue yet - stay tuned!

Not a subscriber yet?

More than two dozen automakers, utilities, EV-charging firms, and lithium companies have joined forces to form an EV lobbying group: Zero Emission Transportation Association (ZETA). The coalition advocates for national policies that will promote easier EV operation in the light-, medium-, and heavy-duty sectors by 2030 (find the full list of members here).

Most notably, ZETA has excluded legacy automakers like Ford and GM (who are separately in an existing EV trade group called the Electric Drive Transportation Association). While legacy automakers have deep pockets to invest in electrification – GM plans to invest $27 billion by mid-decade while Volkswagen committed to $86 billion in the next five years – they occasionally run counter to the zero emissions push, as demonstrated when they tried to play both sides in Trump’s auto emissions standards rollback.

ZETA is expected to have an easier time promoting its agenda with a Biden administration, which seeks to create a million new jobs in the auto sector and to “position America to be the global leader in the manufacture of electric vehicles and their input materials and parts.” Other climate tech lobbying efforts likely benefitting from Biden’s climate plan include:

💻 This week, Microsoft partnered with Lot Sixteen to lobby on climate and environmental issues. The filing states the effort aims “to improve sustainability outcomes.”

⚡️ Some big clean energy companies (e.g., NextEra and Avangrid) formed the lobbying group American Clean Power Association, which will merge with the existing AWEA.

🌐 Coefficient Group has registered to lobby for the Digital Climate Alliance – a group of big companies (e.g., Intel) and startups (e.g., Nautilus) planning to fill climate and energy data gaps.

⚡ Form Energy, a Somerville, MA-based developer of long duration energy storage systems, raised $70m in Series C funding from unnamed investors. More here.

⚡ Tibber, a Norwegian-based digital electricity provider, raised $65m in Series B funding from Balderton Capital, Eight Roads Ventures, and Founders Fund. More here.

🍄 MycoWorks, an Emeryville, CA-based company producing a fungal-based leather alternative, raised $45m in Series B funding from DCVC, Valor Equity Partners, Novo Holdings, 8VC, SOSV, AgFunder, Wireframe Ventures and individual investors including John Legend and Natalie Portman. TechCrunch has more here.

💨 Aclima, a San Francisco, CA-based air pollution and greenhouse gas measurement startup, raised $40m in Series B funding from Clearvision Ventures, Robert Bosch, Microsoft, and others. TechCrunch has more here.

⚡ Wattbuy, a New York, NY-based online electricity marketplace, raised $3.3m in Series A funding from Evergy Ventures, Updater, and Avesta Fund. More here.

🚗 Ecolution kWh, a Naples, FL-based e-mobility technology company, raised $3m in Seed funding from Brown Venture Group. More here.

💵 YvesBlue, a New York, NY-based provider of automated ESG reporting for portfolios, raised $2m in Seed funding from Illuminate Financial Management, SixThirty, Tribeca Early Stage, and others. More here.

Arrival, a London, UK-based maker of electric vans and buses, is going public via merger with SPAC CIIG Merger Corp, with the deal valuing the company at $5.4bn. More here.

Astanor Ventures raised $325m for its debut fund focused on European agri-food tech startups. TechCrunch has more here.

Union Square Ventures plans to raise between $100m to $200m for its first climate-tech focused venture fund. WSJ has more here.

Change happens gradually and then all at once. For years, a quiet revolution has been brewing in ESG corporate disclosure advocacy. With voluntary standards like CDP and metrics guidelines like SASB, leading corporates have opted in to environmental performance transparency. With 42% of companies above a $10bn market cap already disclosing some climate-relevant information, this shift has been happening slowly - and, now, seemingly all at once.

Earlier in November, the UK started the countdown to require all companies to disclose the climate change impacts of their business by 2025. The ruling leans on recommendations from the TCFD (Task Force on Climate-Related Financial Disclosures), an initiative of the Financial Stability Board to promote climate risk assessment. Already, 1,500 organizations have signed on, most in 2020.

Accounting isn’t known as a hotbed of innovation and corporates’ adaptive approaches to climate accounting range from sophisticated (high margin) corporates, like Amazon, which have developed in-house software solutions, to SMBs which have hacked together a hybrid solution of consultants and Excel sheets. In response, a new crop of startups are hot to the scene of this new market opportunity, building off-the-shelf SaaS platforms to automate and standardize the carbon accounting process.

Where to play? The startups are carving up the addressable pie (with some biting off more than others) but all must start with measurement.

Measure: Corporates must filter through internal data silos and synthesize climate-relevant metrics such the GHG emissions of different units and/or geographies of their business.

Scope 5 is a sustainability measurement tool to gather data and build an emissions inventory.

Report: While TCFD has evolved as the most widely-used disclosure, other ESG reporting frameworks such as CDP, GRI, SASB, and the SDG are also prevalent, creating some inconsistency in standards and frequency of reporting.

Emitwise offers an end-to-end platform for measuring, reporting and (most importantly) reducing corporate carbon emissions. Co-Founder and CEO, Mauro Cozzi explains “Our product ethos boils down to precision, reliability and trust. Our mission is to accelerate the transition to a net-zero carbon world by expediting how enterprises respond to the climate emergency. Our customers, therefore, represent a multitude of industries that have high impact across large supply-chains. They are united by a need for a system they can not just rely on for compliant reporting, but also to identify high-impact carbon reduction opportunities.”

Manage: You can only manage what you measure. Post-reporting, companies are increasingly going a step further to actively mitigate their emissions, e.g., like Microsoft’s internal carbon price.

Watershed, whose team previously worked on Stripe’s climate initiatives, is a carbon management platform. Co-Founder, Taylor Francis, describes Watershed’s “mission is to help businesses dramatically cut their carbon emissions. Watershed's software makes it easy for businesses to measure their footprint, take high-impact steps to reduce it, and report on progress to employees and investors -- all in one place. We're working with companies in software, hardware, food, logistics. Their most powerful climate lever is to drive carbon reductions through their supply chain.”

Offset: As corporate net zero commitments have proliferated, carbon offsets have become a necessary (and preferred) method of nullifying emissions that can’t be directly mitigated.

Plan A offers a vertically integrated software solution to measure, monitor, reduce, and offset emissions.

Who to serve? Beyond determining what size and complexity of customer to go after, not all corporate carbon footprints are created equal - therefore carbon accounting SaaS startups must consider their customers depending on two differing emissions profile characteristics: 1) corporates’ carbon intensities and 2) emissions types.

⚖️ Light vs Heavy: Carbon risk materiality varies by emissions amount. Put simply, heavy emitting businesses are most at risk from climate (and regulation), and need the most help. Carbon accounting startups are developing and pricing their software solutions accordingly.

#️⃣ Scope 1, 2, 3: Even within intensity bands, emissions profiles vary depending on where the GHG is produced. For heavy scope 1 emitters, think of O&G majors and industrial cos with direct emissions from production. For heavy scope 3 indirect emitters, think of huge value chains like Apple’s. Most software cos’ (relatively small) emissions footprint leans scope 2, from purchasing electricity and HVAC.

Volkswagen commits a staggering $86bn to EVs over the next 5 years as the world’s largest automaker races to overtake Tesla as the leading maker of electric cars.

The UK bans the sales of gasoline and diesel vehicles by 2030. Meanwhile, Boris Johnson lays out an epic plan for a “Green Industrial Revolution” in the UK. Most say it’s still not enough…

Oxford launches an initiative, Oxford Net Zero, to bring academic rigor to the global ‘race’ to net zero by governments and industry.

Tesla will join the S&P 500 on Dec 21st. The news sent Tesla’s stock skyrocketing (due to index fund eligibility), even as others voice concerns over retirees fronting the bill on such a jacked up valuation.

Bezos has officially announced the first $791m in donations from his $10bn Earth Fund, playing it safe with environmental nonprofits like the Environmental Defense Fund and The Nature Conservancy. Credit to Robinson Meyer at The Atlantic for calling it weeks early.

Google CEO Sundar Pichai said 2021 will be the most significant year yet for combating climate change. He argues there are two primary reasons: (1) we are starting to feel the impacts of climate change (e.g., historic wildfires and flooding globally) and (2) promising technologies (e.g., AI and satellite imagery) and policies that make carbon-free energy attainable.

John Kerry asserted that we need to put a price on carbon to change behavior and incentivize climate action. He writes, “With carbon pricing, those causing emissions pay for the cost of damage. Without carbon pricing, we all pay the cost.” At least he’s consistent.

A little over a decade ago, the American Farm Bureau Federation declared open war on pro-climate change legislation. Now, AFMF is part of a coalition pushing dozens of policy changes that would incentivize farmers to reduce emissions.

The Onion *sorry* The Financial Times ran a piece suggesting that reducing unnecessary emails is a legitimate strategy for solving climate change. To be clear: it’s not. We need to stay focused on the goal, distraction hurts!

Over 100 Clean Energy for Biden volunteers wrote 48 white paper policy recommendations, clocking in at 442 pages, plus a rainbow matrix.

Politico explores “The Tech We Need” in order for the European Union to become climate neutral.

Two years of collaboration between Lawrence Livermore National Laboratory, Total, and Stanford created GEOSX, an open-source, high-performance simulator for geological subsurface carbon dioxide storage.

A climate data scientist lays out how climate risk intelligence can inform location-specific risk.

Scientists are using CRISPR to save coral reefs from climate change.

🗓️ 12/10 DEIC Accelerate Demo Day: Meet the first cohort of 7 Virginia-based cleantech startups from the Dominion Energy Innovation Center's fall program.

💡 Los Angeles Cleantech Incubator: LACI’s Incubation Program is back recruiting for its second cohort! Apply by January 8th if you’re a cleantech startup in Southern California with a solution for clean energy, zero emissions transportation, or smart and sustainable cities.

💡 Wonderful Innovation Challenge: The Wonderful Company is offering up to a total of $1M in funding for innovative, pilot-ready solutions to turn 50K tons of pomegranate husks into a value-added resource that will positively impact both their business and the planet. Apply by January 29th.

Product Designer, Data Engineer @Watershed

Aerospace Engineering @Wright Electric

Data Scientist @Myst

Software Engineer @Myst

Business Development Manager @75F

Business Development Manager @Aker

Business Development Intern @Agentis

Research Associate @Boston Meats

Senior Investment Manager @Triodos Organic Growth Fund

Climate Change Lead @Wells Fargo

Analyst @Eniac Ventures

Entrepreneurial Program Lead @Chain Reaction Innovations

Mixing it up… one for employers! Now that we’ve counted (and recounted and recounted) the ballots, +150 digital media and strategy folks from Biden For President have shared their resumes in this directory as they look for their next career campaign.

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond