🌎 Overheard at LCAW #252

Climate, capital, and carrots in London's new playbook

Biden surges towards 2030 objectives with an 80% clean energy standard

Happy Monday!

Right as we hit send on our Friday feature on foundational technologies decarbonizing the cement industry, sustainable cement player Solidia announced $78m in new funding before our set dried. Do you ever get the feeling that you should have left a handprint somewhere?

In this week’s big news, the White House pushes for 80% of retail power to come from zero-emission sources by 2030 and recharges the grid with $8b to build transmission lines.

We also cover the latest fundings - including Modern Meadow’s $130m Series C for biofabricated textiles and Crusoe’s $128m Series B for gas-to-energy bitcoin - and feature new internships and jobs from Fifth Wall, Energy Impact Partners, and Wells Fargo.

Thanks for reading! Not a subscriber yet?

As former CA Gov. Arnold Schwarzenegger once said, “You could have all the renewable energy in the world. But if you don’t have the transmission lines, you have nothing.” A renewables-heavy grid will require triple the amount of transmission (equal to thousands of miles) and more than $100bn of investment. But financing, siting, permitting and overall bureaucratic slog have prevented any interregional transmission project from being built for decades.

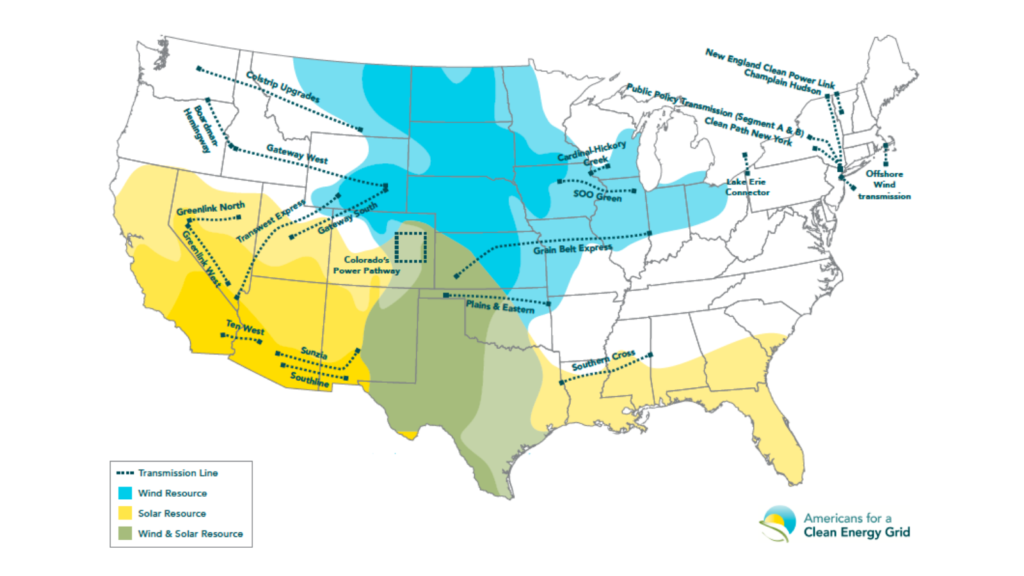

Recharging the grid with transmission line projects. As part of improving America’s aging electric grid and meeting the Biden administration’s ambitious clean energy goals (80% of grid power to come from emissions-free sources by 2030), the federal government opened an $8b tab to (re)build and improve the nation’s transmission lines. The White House announced 22 shovel-ready transmission projects to spur $33b in investment and create 600k jobs.

An $8b open tab to power innovation and renewables. “Innovative” projects owned by tribal nations or Alaska Native Corporations has $5b in loan guarantees from the DOE, and the Western Area Power Administration (WAPA) will receive the remaining $3.25b.

🚧 Innovation ($5B): Think high-voltage direct-current (HVDC) systems to connect offshore wind plants and infrastructure located along railroad and highway routes (with the lines running underground). In a prime example of DoE x DoT collaboration, Transportation Secretary Pete Buttigieg announced the use of public highways and other transportation rights-of-way to speed siting and permitting of transmission lines.

💨 WAPA ($3.25B): Apply for project development support and low-cost capital for power lines to unlock renewable energy in the West. Eventually western utilities could access abundant wind energy in the Midwest.

Growing the program. While $8.25bn is nothing to scoff at, the question remains: “is this enough?” Some quick math. Assuming a construction cost of $3m/ mile of 500kV line, the entire $8.25b budget could construct ~2,750 miles of line. Sure, that’s longer than the distance between Boston and LA, but the grid doesn’t run in a straight line.

Bolstering the initiative. Clean energy and technology tax credits are also expected to play an important role in achieving 50% by 2030. In particular, the Clean Energy for America Act could give some extra oomph to transmission line projects by consolidating current energy tax incentives into emissions-based provisions, available to all energy technologies (as long as they meet emissions reduction goals.) Traditionally, the power sector’s major clean energy tax credits – the investment tax credit (ITC) and production tax credit (PTC) – were exclusive to solar and wind tech. Under this new bill, investments in critical grid improvements like high-capacity transmission lines are fair game.

A startup springboard. Transmission and distribution costs are some of the biggest drivers of zero-carbon electricity prices. Yet innovating at the grid-level can be daunting for disruptors. Hopefully the $8b open tab and further ITC & PTC incentives will attract more startups to the space. Already up for the grid challenge, we’ve got our eyes on the following companies: LineVision (overhead line monitoring sensors), Veir (high-voltage superconducting transmission lines), Smart Wires (power flow control technology to increase transfer capacity), NewGrid (transmission topology optimization).

Curious about why everyone’s so amped on transmission? David Roberts breaks down transmission wonkiness in his Volts newsletter.

🌱 Modern Meadow, a New York, NY-based producer of biofabricated textiles, raised $130m in Series C funding from Key Partners Capital, Astanor Ventures, Horizons Ventures and Cape Capital.

⚡ Crusoe Energy Systems, a Denver, CO-based flare migration startup converting gas into energy for bitcoin mining, raised $128m in Series B funding from Valor Equity Partners, Lowercarbon Capital, DRW VC, Founders Fund, Bain Capital Ventures, Coinbase Ventures, Polychain Capital, KCK Group, Upper90, Winklevoss Capital, and more.

⚡ Solidia, a Piscataway, NJ-based developer of low-carbon cement and concrete, raised $78m from Imperative Ventures, Zero Carbon Partners, CPP Investments, Breakthrough Energy Ventures, Prelude Ventures, Piva, OCGI Climate Investments, and insiders John Doerr and Bill Joy.

🔋 ZincFive, a Tualatin, OR-based rechargeable nickel-zinc batteries solution, raised $33m in Series C funding from Helios Capital Ventures and others.

🚂 IRP Systems, an Israel-based developer of electric powertrains, raised $31m in Series C funding from Clal Insurance, Altshuler Shaham, Samsung Ventures, Carasso Motors, and Shlomo Group.

☄️ Fervo Energy, a Houston, TX-based geothermal tech developer, raised $28m in Series B funding from Breakthrough Energy Ventures and Capricorn Investment Group.

🏠 Posigen, a New Orleans, LA-based provider of renewable energy and efficiency solutions for households, raised $27m in its second close of Series D funding from Activate Capital, SJF Ventures, and Kayne Anderson.

🌲 Pachama, a San Francisco, CA-based marketplace for forest carbon credits, raised $15m in funding from Breakthrough Energy Ventures, Amazon’s Climate Pledge Fund, Saltwater, Lowercarbon Capital, MCJ Collective, OATV, and other investors.

⚡ Gridtential Energy, a Santa Clara, CA- based lead battery developer, raised $12m in funding from 1955 Capital, SVB, Crown Battery, and others.

🐄 Vence, a San Diego, CA-based startup enabling rotational grazing with virtual electric fences, raised $12m in Series A funding from Tyche Partners, Grantham Environmental Trust, Eniac Ventures, Trailhead Capital, and Rabobank’s Food & Ag Innovation Fund.

🛰️ Albedo, a Denver, CO-based operator of satellites that capture visible and thermal imagery, raised $10m in Seed funding from Initialized Capital, Liquid 2 Ventures, Soma Capital, Jetstream, and Rebel Fund.

🛍️ Package Free, a New York, NY-based zero-waste ecommerce shop, raised $8m from Vanterra Accelerator Fund and Naadam.

☀️ SunRoof, a Sweden-based solar power-based roof tile maker, raised $5.5m in extended Seed funding from Inovo Venture Partners, SMOK Ventures, and LT Capital.

♻️ TripleW, an Israel-based startup producing biodegradable plastic from food waste, raised $5m in Series B funding from Millennium Food-Tech R&D Partnership.

🍎 RipeLocker, a Seattle, WA-based provider of containers extending the post-harvest life of food perishables, raised $5m in Series B funding from angel investors.

💨 Sweep, a France-based startup tracking carbon emissions across supply chains, raised $5m in funding from New Wave, 2050, and La Famiglia.

The White House backed up its 50% by 2030 ambitions with a proposed Clean Energy Standard requiring 80% of retail power sales to come from zero-carbon sources by 2030, and then 100% by 2035.

“There is simply no reason why the blades for wind turbines can’t be built in Pittsburgh instead of Beijing.” During his 100 days address, Biden boosted his green jobs rhetoric, though much felt like deja vu from stale green jobs promises afore. ~7% of his speech was devoted to energy, climate, or clean water.

Not to be outmatched by new national climate commitments, California’s Governor Newsom proposed ending new permits for frackingby January 2024.

Last Saturday, for a fleeting 4 seconds, California hit an all time high record of 95% renewable energyon its main power grid due to renewables optimal conditions of abundant sunshine and cool weather.

California’s carbon credit program not only fails to achieve real carbon benefits but in fact incentives more pollution. The scorching new report from CarbonPlan finds systemic over-crediting of California forestry offsets and quantifies that 33% to 71% of the credits don’t represent real carbon reductions.

New York’s largest zero-emitting electric resource generated its last MW this past Friday. The closure of the state’s last nuclear facility has divided clean energy advocates. Indian Point generated more clean power in 2020 than the state’s solar and wind combined. Now filling its empty shoes? Natural gas.

A raft of representatives from across the aisle and more than 250 groups banded together in support of a National Climate Bank Act including a $100b ‘green bank’ to mobilize private investment. (Committee chair Edward Markey, D of MA, first introduced the idea in 2009.)

Golden boy Warren Buffett opposes shareholder proposals on climate and diversity, potentially risking tarnishing Berkshire’s reputation.

The ongoing battle between Exxon Mobil and activist shareholder Engine No. 1 over XOM’s climate transition strategy (or lack thereof) gained steam as the three largest US pension funds, including CA and NY’s retirement funds, hitched their cabooses to the hedge fund.

More than 10m electric cars traveled the roads globally last year, according to the IEA’s annual Global EV Outlook. An excellent chart from Axios shows just how quickly China and Europe’s EV adoption are leaving the US and rest of the world in the dust.

Forget Blockchain! Lumber trading prices skyrocketed from $381 to $1,104 in the past year. Climate change, wildfires, hungry beetles, and bored millennial DIYers are to blame.

It’s not Nio, it’s life. In China, buying a Nio EV isn’t just a car purchase - it’s a ‘joyful lifestyle’ complete with branded mahjong sets and wine.

The “Exxon of green tech” that you’ve never heard of. A NYT longform profile of Iberdrola, the once-ordinary Spanish electric utility that took a big bet that’s now paying off.

The family dynasty that’s tiled more solar roofs than Elon Musk, and has a skyscraping story to match. Meanwhile, Musk bemoans that Tesla has made ‘significant mistakes’ with their solar roof tile project.

A helpful AirTable of climate tech software startups by Pietro Invernizzi aka @pinverrr.

Stirring the acronym soup, JOG Capital, a leading O&G PE firm, rebranded as Carbon Infrastructure Partners (CIP) – signaling its new focus on carbon capture, utilization, and storage (CCUS) and carbon markets.

Airbnb and Arcadia have teamed up to make home stays more sustainable. Airbnb hosts (in NY, ME, IL, MD) can sign up for renewable energy and a $150 utility bill credit - we did!

Venture For ClimateTech crowned their 11 inaugural cohort companies and, in the same weekspan, the C2V Initiative also announced their 10 carbontech accelerator companies. Mars Materials doubles up for a cameo on both lists!

Heirloom came out of stealth with a low-cost carbonate mineralization approach to carbon removal.

A new species of adorable but deadly pumpkin toad was discovered in Brazil. You can look, but definitely don’t touch.

🗓️ Carbon to Value Kickoff: Tune in to the C2V Initiative with Urban Future Lab, Greentown Labs, and Fraunhofer on May 6th as they announce their first cohort of carbontech startups.

🗓️ The Future of Carbon Removal: Join Clean Energy Trust on May 12th for a conversation on the latest carbon removal technologies featuring Lanzatech and the Clean Air Task Force.

💡 Techstars Sustainability Accelerator: Techstars and The Nature Conservancy have teamed up for this unique accelerator’s third Fall class. Apply by May 12th for up to $120k in funding.

💡 AirMiners Launchpad: XPRIZE, AirMiners, and Creative Destruction Lab have partnered on this six-week intensive program for (very) early teams interested in pursuing the Elon Musk-funded $100m Carbon Removal XPRIZE competition. Apply by May 25th to be considered for Batch #1.

💡 Creative Destruction Lab: Calling all founders with massive ideas to apply to CDL's Climate stream by July 30th for the 10th annual cohort, which will start in October 2021.

VC Summer Associate @Fifth Wall Climate Tech

Associate ESG & Impact @Energy Impact Partners

Sustainable Investment Strategist @Wells Fargo

Impact and & Fundraising Operations Intern @rePlant Capital

Energy Analyst @Environmental Defense Fund

Senior Business Analyst @Arrive Outdoors

Data Scientist; Product Manager @EcoCart

Software Engineer @Felt

Hardware Engineer @Heirloom

Building Energy Analyst; Data Lead @Blocpower

Business Development @Karbone

Entrepreneur in Residence (open to BIPOC candidates) @Prime Coalition

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond

Groundbreaking results from the geothermal developer’s main project