🌎 Overheard at LCAW #252

Climate, capital, and carrots in London's new playbook

Tesla spurs battery innovation and corporates commit to “net-zero”

Happy Monday! This week, we spotlight battery tech featuring the latest announcements from Tesla’s recent Battery Day. The punchline is battery tech remains challenging, but manufacturing process improvements will ease the transition to mass market EVs.

We also delve into what Climate Week “net zero” corporate commitments really mean, and highlight interesting news features such as wildfire smoke limiting solar energy productivity, a climate breakdown of the debate, and renewed hope in the promise of nuclear fusion.

Thanks for reading!

Not a subscriber yet?

Climate Week 2020, usually a raucous cacophony across Manhattan involving much chanting and hand shaking, took place virtually last week amid a backdrop of wildfires, hurricanes, and the US exiting the Paris Agreement. In response to the unpopular US departure and gap in COP26 programming, corporates filled the void with ~90 new “Net-Zero” commitments.

Who has committed to net-zero?

All told, more than 1,500 companies have committed to net-zero emissions (992 companies are taking science-based climate action and 476 companies have approved science-based targets.) Together the pledgers represent 15% of the global economy, or the annual emissions equivalent of the US.

But what does net-zero mean?

It’s hard to keep track of all these pledges, let alone filter the signal from the greenwashing noise. Not all net-zero targets are equal. In fact, the definition of net-zero itself is often inconsistent.

The World Resources Institute has developed a certification for net-zero pledges through its Science Based Targets initiative (SBTi) which considers corporate commitments “science-based” if they set goals in line with a 1.5°C future. To ensure that this surge of corporate enthusiasm is channeled effectively, the SBTi compares net-zero targets across 3 criteria:

We’ve still got questions

🔋 Northvolt, a Sweden-based maker of lithium-ion batteries, raised $600m led by Baillie Gifford, Goldman Sachs and Volkswagen. Read more.

🔋 Star Charge, a China-based electric vehicle charging company, raised $125m from Schneider Electric and CICC Capital’s sub fund. Read more.

👟 Allbirds, a San Francisco, CA-based sustainable footwear maker, raised $100m in Series E funding led by Franklin Templeton. Read more.

🛥️ Pure Watercraft, a Seattle, WA-based manufacturer of electric motors for boats, raised $23m in Series A funding from L37, Amazon executives, and angel investors. TechCrunch has more here.

🦐 Shiok Meats, a Singapore-based maker of cell-based shrimp, raised $12.6m in Series A funding from Aqua-Spark, SEEDS Capital, and others. More here.

🐔 Daring, a Los Angeles, CA-based producer of plant-based chicken, raised $8m in Series A funding from Maveron, GoodFriends, Stray Dog Capital, and Kygo’s Palm Tree Crew Investments. More here.

🦜 Greenbird, an Oslo, Norway-based maker of smart meter software, raised €5m in Series B funding from EnBW New Ventures, Nysno, and ETF Partners. More here.

☀️ Easy Solar, a Sierra Leone-based Pay-as-you-Go solar company, raised $5m from Acumen among other investors. More here.

🍎 Zero Grocery, a San Francisco, CA-based zero-waste grocery delivery service, raised $3m from 1984 Ventures, Kapor Capital, and other investors. More here. (We featured Zero way back in April)

🌱 Leaf, a San Francisco, CA-based data infrastructure startup focused on the food and agriculture market, raised $2m in Seed funding from Cultivian Sandbox Ventures, SP Ventures and Radicle Growth. More here.

🏗️ Ecomedes, a San Francisco, CA-based database for sourcing sustainable building materials, raised $1.5m in Seed funding from Saint-Goblin NOVA and PivotNorth. More here.

⚛️ Radiant Nuclear, an El Segnudo, CA-based company developing the first portable, zero-emissions nuclear microreactor developed by former SpaceX engineers raised $1.2m from angel investors. More here.

💸 Spring Valley Acquisition, a Dallas-based blank check company formed by Pearl Energy Investment Management targeting the sustainability industry, plans to raise $250m. Read more.

🌾 AppHarvest, an Appalachia-based indoor farming company, will merge with a SPAC, Novus Capital Corporation, at a valuation of $1bn.

From CA Gov. Newsom’s EV announcement to the recent surge in SPACs, the new interest and funding into climate tech has made 2020 feel like the year electric vehicles have finally rolled into the mainstream. The technology driving and scaling the fleet? Batteries.

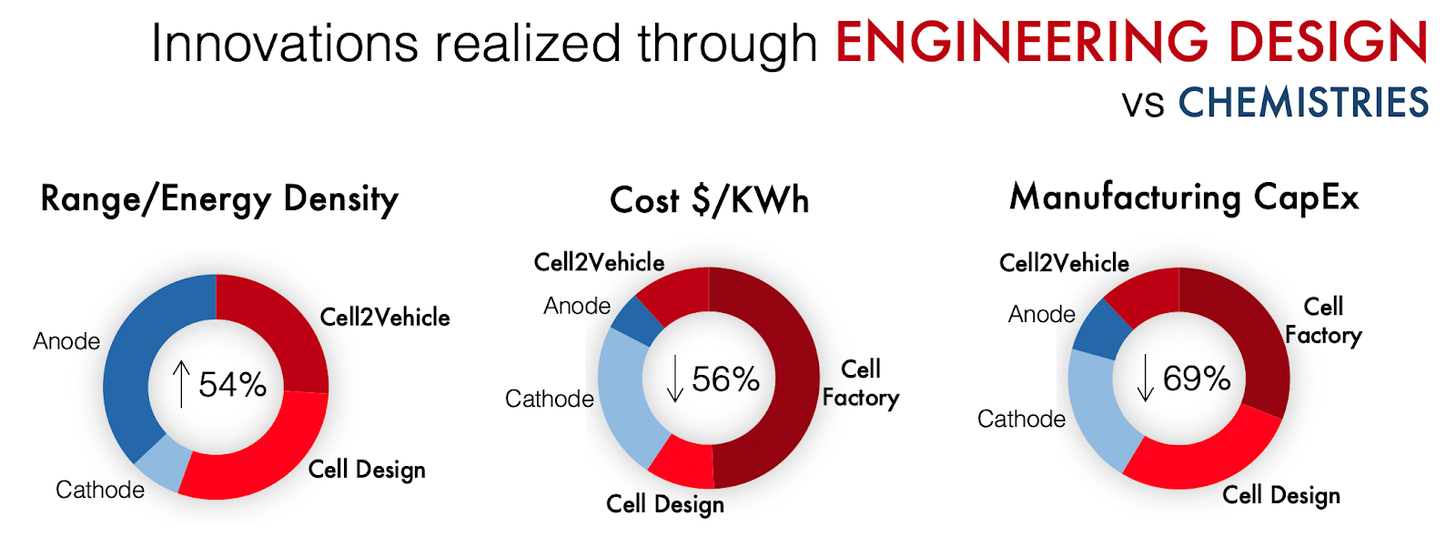

Last week, Tesla had its much-anticipated Battery Day, a bonanza for climate tech nerds rivaling Apple product drop announcements. Despite some disappointment from investors who expected a faster timeline to reach the coveted million-mile battery, Tesla’s presentation maps the route for future battery engineering, highlighting that innovation will come from manufacturing changes vs. chemistry R&D in the run up to scale.

Driving down costs at Tesla’s Battery Day

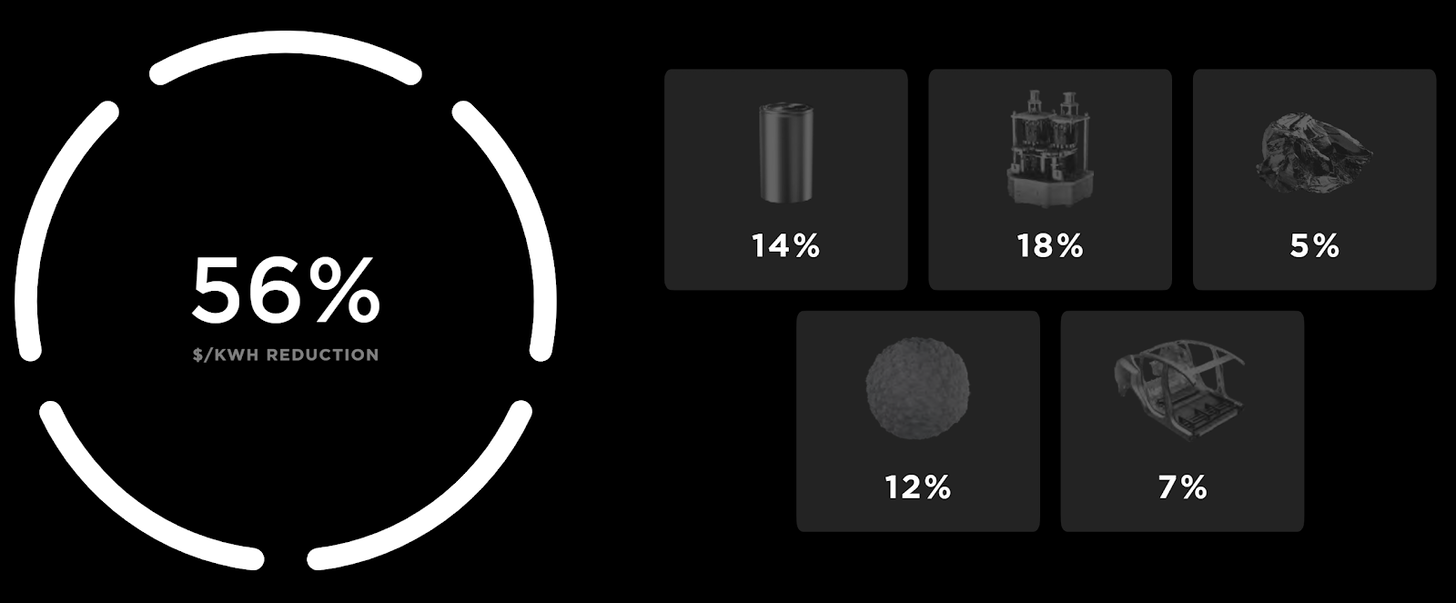

The underlying theme of Tesla’s Battery Day was price – specifically, a 56% reduction in cost / kwh of the battery pack. Musk & Co’s announcements focused on five key engineering challenges which, together, will enable Tesla to reach the coveted goal of a $25K vehicle within three years. “They’ve essentially reimagined the entire manufacturing process of the lithium-ion battery from raw materials to the finished product,” says James Frith, head of energy storage at BloombergNEF (BNEF).

Indeed, as the folks at Intercalation Station visually show in red, most of Tesla’s innovation is realized through engineering design - not chemistry R&D.

Call (and response) to industry

Tesla’s presentation ended with a call to industry to “help accelerate the transition” to battery power. We’ve outlined below the current and future market movers integral to this call to arms.

China controls ~70% of battery manufacturing capacity. The world’s largest emitter monopolized the industry by investing top-to-bottom in raw material mining and processing for lithium-ion batteries. Outside of their own borders, they crucially control much of the African rare metal supply chains as well as deepsea polymetallic deposits.

Keep your friends close. While undoubtedly the US EV goldenchild, Tesla is in a manufacturing race against a world of competitors to grab market share. If Musk’s notoriously aggressive timelines lag, fast following startups could establish competitive technologies before Battery Day announcements have time to bear fruit.

Two next-gen battery innovation pathways.

Silicon Anode: Like Musk mentioned above, replacing graphite with silicon in the anode would significantly improve energy density and lower cost. However reaching 100% silicon isn’t currently possible, and startups are experimenting with silicon doping - a variable mix of silicon and graphite. Fortunately for these startups, their materials can be dropped seamlessly into the current battery manufacturing process. Innovators: Sila Nanotechnologies, Enovix, Enevate, Amprius Technologies, Advano

Solid-state: Instead of using a liquid electrolyte, solid-state batteries are touted to be safer and have higher energy densities. However, mass adoption of these batteries aren’t expected until 2030 as building cells with a solid electrolyte requires some significant modifications to the current manufacturing process. Most startups will likely license their technology to a manufacturer, but companies like Prologium are looking to build their own facility. Innovators: Quantumscape, Solid Power, Ionic Materials, ProLogium, QingTao Energy Development

Key Takeaways:

TLDR; We’re seeing a dramatic lurch forward in demand for EVs as nations and states commit to climate action. Similar to the dynamics from the solar market, we’ll see the mass market adoption of EVs scale as incremental manufacturing improvements ratchet down the cost curve. The next decade of battery innovation will pave the way for the decarbonization of the transportation sector, but not without the concomitant struggles that any new technologies and industries dependent on raw materials have faced.

EIA: Last week, we talked about how wildfires create a climate-negative feedback loop. Taking it a step further, new data shows that wildfire smoke caused solar generation in California to decline ~30% in the first 2 weeks of September from the July average. Shayle Kann tweeted about it here.

NYT: Researchers at MIT and Commonwealth Fusion Systems are renewing hope in nuclear fusion. The company’s ambitious timeline aims for fusion energy to generate electricity beginning in the next decade.

Fast Company: A national climate bank could encourage clean energy investment and create millions of jobs. The National Climate Bank Act, which recently passed with bipartisan support in the House, could deploy $20bn in clean investments and yield three million jobs.

Science: Climate change got more attention during the most recent debate than any other in US history. Trump avoided acknowledging human-induced climate change, and Biden distanced himself from the Green New Deal.

Financial Times: Trafigura, one of the world’s largest oil traders, is making a $2bn renewables push to buy 2 GW solar, wind, and storage projects. Last week, Trafigura also proposed a $250-300 carbon tax for shipping which would gradually decline as costs of hydrogen, green methanol and ammonia fall.

Blackstone: PE firms like Blackstone are coming into the climate commitment fray by launching a program to reduce carbon emissions by 15% across new investments where they can “control energy usage”.

Morningstar: Despite Fink’s annual letter proclaiming climate risk presenting a “fundamental reshaping of finance”, Blackrock has voted against 86% of shareholder resolutions requesting to disclose climate risk this year, up from 75% last year.

Fortune has come up with a new list showcasing impact-oriented startups; 40% of the companies on the list address climate.

A big week for David Attenborough - he broke the world record for fastest time to reach 1M Instagram followers, debuted his new documentary, and is launching the Earthshot Prize with Prince William.

Amazon’s Climate Pledge Friendly packaging standards of reducing unnecessary volume and weight seem self-serving, regardless of the climate impact, given they’re pushed on to Amazon’s merchants and entirely to the distributor’s benefit.

African elephants are fighting climate change through natural carbon capture.

Impossible Foods has an Impact Calculator - check out how much land, water, and emissions you would save by eating Impossible (instead of ground beef).

Our friend, Mark Tercek, launched a newsletter called The Instigator to encourage collaboration between the environmental and business communities.

💡 Scaling-up Negative Emissions: Frontiers in Climate in collaboration with Stripe is seeking submissions on how to leverage policy, philanthropy, and investments to scale negative emissions technologies. Abstracts are due on 11/3.

💡 Activate, 2021 Cohort: Apply by October 30th to spend two years working to advance a new technology, product, or business aligned with one or more of Activate’s industry sectors.

💡 Therm smart radiator pilot: Therm builds a smart device that is able to actually control old radiators that uncomfortably heat apartments, and they’re saving energy in the process. Sign up to join their free beta this winter!

🗓️10/8 Financing the Clean Economy: Join Clean Energy For Biden for a conversation with Trenton Allen, Carolin Funk, Regine Clement, Alfred Griffin, and Nicholas Eisenberger on investment approaches to financing the clean energy transition.

ESG Research Analyst @Parnassus Investments

Associate @Generate Capital

Research Assistant @Oxford Sustainable Finance Program

Software Engineering roles @Silo

Data Scientist @ClimateTRACE

Global Restoration Lead @Conservation International

Various Roles @Overstory

Various Roles @Nori

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond

Groundbreaking results from the geothermal developer’s main project