🌎 Overheard at LCAW #252

Climate, capital, and carrots in London's new playbook

Happy Monday!

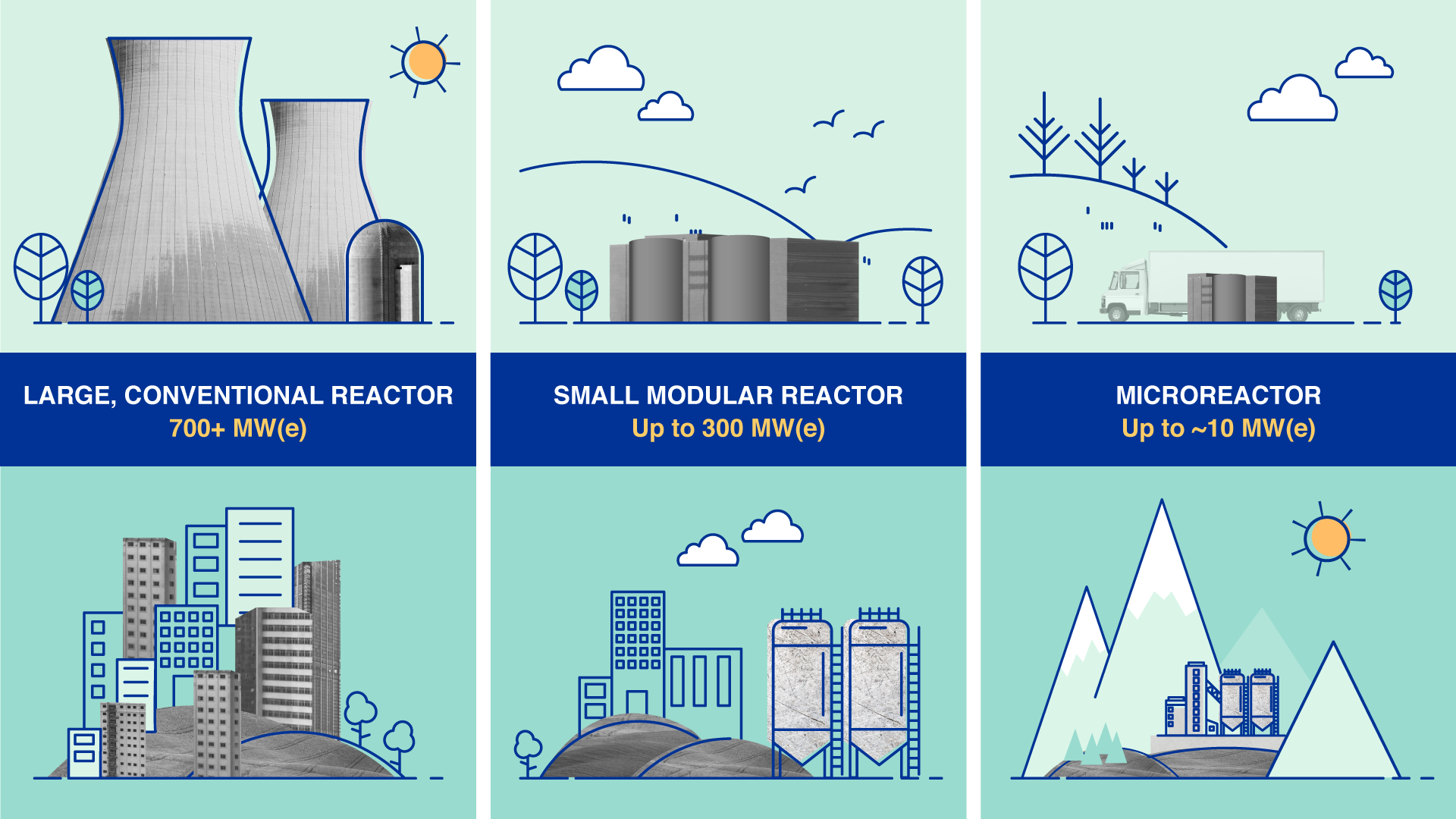

Big Tech is going nuclear, with big news in small modular reactors. We’re diving into Amazon’s new deal with X-energy, where it’s paying prime for next decade delivery.

In other news, the courts say that the EPA can regulate power plant emissions (for now), global EV sales drive ahead, and Brazil introduces new regulation for CCS as the sector grows.

In deals, $500m for small nuclear reactors, $84m for battery storage solutions, and $69m for heat pump installation.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

Last week, four announcements in nuclear fission signaled major propulsion for the sector — splitting the potential among different advanced technologies.

What happened?

Why it matters

We’ve said it before, and we’ll say it again: electricity demand, in part driven by data centers and AI, is on the rise, calling for greater amounts of clean firm power than are currently available. While questions remain over just how big this demand is going to be, it's no coincidence that the three largest cloud service providers, which collectively account for two-thirds of the world's cloud compute, have all in the last month announced massive nuclear deals: Last month, Microsoft signed a massive 20-year 800MW PPA to restart a reactor at the Three Mile Island nuclear power plant, in addition to the aforementioned Google and Amazon news.

Amazon’s paying prime for next decade delivery particularly stands out. In the past, Big Tech players have signaled their willingness to pay for clean firm power, but generally steered clear of taking on development risk themselves, in favor signing PPAs that vendors can use to unlock funding. Now, Amazon is engaging in project development directly, working with utilities to advance specific projects, and also making a significant investment in X-Energy. It shows a much greater level of commitment, both in terms of financial risk and looking longer-term. While Three Mile Island is due back online in 2028, X-Energy is unlikely to be supplying power until the 2030s. But many aspects of the deal show Amazon’s focus on speed:

Key takeaways

⚡ X-energy, a Rockville, MD-based nuclear reactor & fuel design engineering service provider, raised $500m in Series C funding from Amazon Climate Pledge Fund, Ares Management, NGP, and the University of Michigan.

🔋 Terralayr, a San Francisco, CA-based battery storage solutions company, raised $84m in Equity and Debt funding from Creandum, Earlybird Venture Capital, Norrsken VC, Picus Capital, and RIVE Private Investment.

🏠 Aira, a Stockholm, Sweden-based heat pump installation platform, raised $69m in Series B funding from Altor, Kinnevik, Statkraft Ventures, and Temasek Foundation.

⚡ Koloma, a Denver, CO-based geologic hydrogen developer, raised $50m in additional Series B funding from Mitsubishi Heavy Industries and Osaka Gas.

🔋 Equilibrium Energy, a San Francisco, CA-based renewable energy optimization platform, raised $39m in Series B funding from DCVC, Breakthrough, and Valo Ventures.

🌊 CorPower Ocean, a Stockholm, Sweden-based wave energy conversion technology developer, raised $35m in Series B funding from NordicNinja, Cisco Investments, EIT InnoEnergy, Iberis Capital, SEB Greentech Venture Capital, and other investors.

⚡ REsurety, a Boston, MA-based renewable energy project risk and analytics platform, raised $32m in Series C funding from Citi and S2G Ventures.

🛰 OroraTech, a Munich, Germany-based wildfire detection and monitoring platform, raised $27m in Series B funding from Korys, Bayern Kapital, and European Circular Bioeconomy Fund (ECBF).

⚡ Sistema.bio, a Mexico City, Mexico-based biogas technology and systems developer, raised $15m in Growth funding from Electrifi Ventures, AXA Investment Managers, Blink CV, Chroma Impact Investment, EcoEnterprises Fund, and other investors.

🔋 Forge Nano, a Louisville, CO-based nano-coating technology for lithium-ion batteries platform, raised $10m in Series C funding from GM Ventures.

🧪 Econic Technologies, a London, England-based CO2 to polymers service, raised an undisclosed amount in Growth funding from Taranis Carbon Ventures, CM Venture Capital, Capricorn Partners, GC Ventures, and ING Corporate Investments.

⚡Treehouse, a San Francisco, CA-based residential EV charging installation platform, raised $17m in Series A funding from Flourish Ventures, Acrew Capital, CarMax, Eaton Electrical, Holman and other investors.

🏠 RIFT, an Eindhoven, Netherlands-based iron fuel technology developer, raised $12m in Series A funding from Brabant Development, Energy Transition Fund Rotterdam, Invest-NL, OostNL, PGGM, and other investors.

☀️ King Energy, a Durango, CO-based multi-tenant solar program management company, raised $10m from ArcTern Ventures, Active Impact Investments, Blackhorn Ventures, and NEXT Frontier Capital.

🔋 Green Gravity, a North Wollongong, Australia-based gravity-based energy storage developer, raised $6m in Series A funding from BlueScopeX, HMC Capital, Pacific Channel, and Sumisho Coal Australia Holdings (SCAPH).

⚡ Aerleum, a Strasbourg, France-based DAC to Methanol producer, raised $6m in Seed funding from 360 Capital, High-Tech Gründerfonds (HTGF), Bpifrance, Marble, and Norrsken VC.

💨 Octavia Carbon, a Nairobi, Kenya-based direct air carbon capture platform, raised $5m in Seed funding from E4E Africa, Lateral Frontiers, Catalyst Fund, Fondation Botnar, Renew Capital and other investors.

🧱 Concretene, a Manchester, UK-based reinforced concrete production, raised $4m in Seed funding from Molten Ventures and LocalGlobe.

✈️ Eve Air Mobility, a São Paulo, Brazil-based eVTOL developer, raised $88m in Debt funding from the Brazilian Development Bank (BNDES).

🔋 Liminal, an Emeryville, CA-based intelligence battery manufacturer, raised $10m in Corporate funding from LG Technology Ventures, ArcTern Ventures, Chailease Holdings, Chrysalix Venture Capital, Ecosystem Integrity Fund, and other investors.

💨 ION Clean Energy, a Boulder, CO-based CO2 capture technology developer, raised an undisclosed amount in Corporate Strategic funding from Williams.

🌾 Advancing Eco Agriculture, a Middlefield, OH-based regenerative agriculture platform, raised an undisclosed amount in Corporate Strategic funding from Topraq.

Conservation Resources, an Exeter, NH-based investment firm, held a first close of its $80m inaugural farmland fund.

Can’t get enough deals? See full listings and deal analytics on Sightline Climate.

The Supreme Court allowed the Environmental Protection Agency to (temporarily) move ahead with its plans to limit carbon emissions by power plants starting next year. The plans are part of the Biden administration’s push to curb pollution from coal- and gas-fired power plants, requiring them to capture up to 90 percent of their emissions by 2032. More than a dozen states have challenged this, and the case is still moving through the lower courts, setting up another legal showdown.

Global EV sales rose by 30.5% in September on the heels of a record number of sales in China, although US market gains have been slower. These overall numbers, while nuanced by geographic markets, indicate that the fears of an EV downturn might be overblown.

Brazil has passed new legislation with its first legal framework for Carbon Capture and Storage (CCS), focusing on regulating and inspecting activities involving the capture, transportation, and geological storage of CO2. Under the new framework, the National Agency of Petroleum, Gas and Biofuels will oversee CCS operations, issuing regulatory standards and granting authorizations, a signal that the sector is growing in Brazil.

To address the impact of severe drought conditions, Algeria is planning to spend $5.4 billion to boost its desalination facilities, targeting acquiring 60% of the country’s drinking water from desalination. This project reflects the dire effects of climate change on water scarcity and the move for countries to invest in desalination and adaptation technology, which have been becoming increasingly more energy efficient. In tandem, Zambia approved the construction of a third coal-fired power plant as it battles a power crisis caused by drought, which has severely impacted its hydro-electricity generation.

The Department of Energy announced its first two conditional commitment loan agreements for sustainable aviation fuel through a $1.5bn loan to Gevo Net-Zero and a $1.4bn loan to Montana Renewables. These loans will aid in both expanding the existing capacity of production and research and development of SAFs with a projected expansion of up to 60 million gallons of SAFs under Gevo and 315 million gallons of biofuels per year under Montana Renewables. This milestone signals an increase in attention by the DOE in SAFs, which may stimulate greater market awareness and investments in the sustainable aviation fuel space.

Germany has introduced a $54bn initiative, ‘Carbon Contracts for Difference’, to help bridge the investment gap between clean tech and polluting technologies in industrial production. Companies applying for the CCfD scheme must submit a fictional carbon price that would allow them to develop clean production while remaining competitive against rival companies running on fossil fuels. This new policy mechanism could bring in state subsidies to cover the investment gap, and help meet EU decarbonization goals.

Highview Power is pushing forward a 2.5GWh liquid air energy storage project in Hunterston, Scotland following the UK’s announcement of a new cap-and-floor scheme for long duration energy storage projects. The project, 8x larger than Highview’s first, demonstrates an increased confidence in financing energy storage due to increased demand and policy support, despite the high costs for development. Three more 2.5GWh projects are in the early planning stages, but their future will hinge on this newest project’s performance and ability to cut costs as investors watch closely.

Carbon copy: The DOE’s newly published Carbon Management Strategy instructs the rollout of carbon capture, removal, and utilization technologies.

Love is Blind star Taylor Krause helps hydrogen projects find a perfect match with 45V credits.

(Green) power surge: Global emissions are set to peak in 2024, thanks to a surge in EVs and clean energy.

Bill Gates’ Breakthrough Energy has a new report on the state of climate tech as they enter a new “deployment era”.

Extreme weather-proof: A climate resistant community in Florida was built to weather hurricanes – and did!

The new 2024 Global Status of CCS report is out — and global CO2 capture capacity on track to double to over 100 million tons per year.

Cascade Climate's newly released “Foundations” document is an all-you-need-to-know guide to Enhanced Rock Weathering deployment.

Crux estimates that north of $7bn worth of tax credit deals closed in Q3’24, with mature clean energy technologies continuing to claim a majority of credits, but advanced manufacturing and nuclear are quickly climbing the ranks.

📅 Climate Tech Summit: Register to join the annual Greentown Labs Climate Tech Summit on October 22nd in Houston and October 24th in Boston for networking opportunities with over 200 startups in the incubator.

💡 Activate Fellowship: Apply to the Activate Fellowship by October 23rd for a chance to bring your technology research to market as part of the 2025 cohort and receive benefits such as a yearly stipend of $100,000 and at least $75,000 in additional flexible capital.

📅 Powerhouse Climate Party: RSVP to attend the Powerhouse Climate Party on October 24th to join hundreds of entrepreneurs, corporate leaders, and investors for a climate tech party with no agenda.

📅 NSF Geothermal Intern Program: Apply to the DOE’s NSF Geothermal Intern Program for an opportunity to receive funding for your graduate student internship in the geothermal industry.

📅 Cost of Capital for Climate Tech: RSVP to attend the Cost of Capital for Climate Tech webinar on November 20th to discuss questions around fundraising, capital strategy, and corporate finance, and hear from Planeteer Capital’s own Hannah Friedman!

💡 Scale For ClimateTech: Apply for the opportunity to join the 6th cohort of Scale for Climate Tech by November 30th and receive support ranging from manufacturing assistance to access to a vetted supplier network and help in commercializing your hardware product.

Product Manager, Research Analyst, Enterprise Customer Success Manager @Sightline Climate

Technical Lead - Functional Coatings @Earthodic

Building Decarbonization and Ops Technical Lead @Lawrence Berkeley National Laboratory

Reaction Engineer (Senior and above) @Ammobia

Analyst @Volta Circle

Startup Portfolio Associate @ClimateHaven

Decarbonization Project Manager (Public Sector) @ICF

2025 Sustainable Investing Fellowship Program @Morgan Stanley

Associate, Technology @Energy Impact Partners

Sustainability Services - Non Financial Reporting Assurance & Advisory Senior @EY Parthenon

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond

Groundbreaking results from the geothermal developer’s main project