🌎 Overheard at LCAW #252

Climate, capital, and carrots in London's new playbook

& follow-up to our list of 100+ climate tech investors

Happy Monday! Welcome to all our new subscribers!

This week we feature our chat with Tyson Woeste of Fifth Wall Ventures about climate opportunities and frameworks for investing in the built environment - which some peg as accountable for 40% of all GHGs emissions. Takeaways include that it’s not just about installing energy efficient HVAC - climate tech in the built world is also about serving the tenants, regulators, and capital markets powering the economic flywheel behind buildings.

We also feature a range of new agtech fundings, Stem’s SPAC, and a handful of political developments including Bill Gates’ call for a central clean energy office and bated breath around Biden’s remaining climate appointments.

Thanks for reading!

Not a subscriber yet?

Last week we dropped a Thanksgiving special issue, and the response was astounding! Hundreds of you messaged us comments, suggestions and feedback on our running list of climate tech investors. Thank you!

We’ve continued to update our list, and have big visions for additional categories (e.g. EU funds, project finance, etc.) while evolving our existing categorization based on your feedback.

This list is ultimately for entrepreneurs, and we’re committed to providing a quality resource for the founders who are building the next generation of climate tech ventures. Their time is precious, and their task is tremendous - this list was built to direct them towards actionable introductions to investors who “get it” and will expedite their company building.

If you know a fund that’s ready to help climate entrepreneurs build the next trillion dollar company, drop us a hint via this AirTable form.

Stay tuned for more - if you’re a founder, send us an email and we’ll share what’s behind the list.

☀️ Aurora Solar, a San Francisco, CA-based company developing tools for solar professionals to design and sell solar remotely, raised $50m in Series B funding from ICONIQ Capital, Energize Ventures, Fifth Wall, and Pear VC. More here.

🚗 Ridecell, a San Francisco, CA-based fleet management software maker, raised $45m in Series C funding from Fort Ross Ventures, Solasta Ventures. Existing investors Activate Capital, DENSO, LG Technology Ventures, and Initialized Capital. More here.

🌱 Aphea.Bio, a Belgium-based agtech company focused on fungal control and reducing fertilizer use, raised nearly $17m in Series B funding from Astanor Ventures, V-Bio Ventures, Agri Investment Fund, PMV, Vives Fund, VIB, Qbic II and Gemma Frisius Fund. More here.

🏢 Infogrid, a London, UK-based startup optimizing building management and efficiency, raised $15.5m in Series A funding from Northzone, JLL Spark, Concrete VC, The Venture Collective and Jigsaw VC. TechCrunch has more here.

⚡ GreenCom Networks, a Munich, Germany-based energy information brokerage platform, raised $14.5m in Series C funding from Shell Ventures and Japan’s Energy & Environment Investment. More here.

🍎 Phood, a New York City, NY-based platform harnessing AI to reduce food waste, raised $2m in Seed funding from New Stack Ventures and Story Ventures. More here.

🌱 KisanHub, a UK-based provider of agri-food supply chain solutions, raised $1.5m in Seed funding from Low Carbon Innovation Fund 2, Future Fund, IQ Capital, Notion Capital, and Sistema VC. More here.

The Lion Electric, a Canadian electric truck and bus maker, will go public via a reverse merger with Northern Genesis Acquisition at a $1.9b valuation. TechCrunch has more here.

Stem, a San Francisco, CA-based AI-driven energy storage company, will go public via a reverse merger Star Peak Energy Transition Corp at a valuation of $1.4b.More here.

Seven Oaks Acquisition, an ESG-focused SPAC led by Gary Matthews (ex-CEO of IES Holdings) and Andrew Pearson (ex-Soundview Advisors, General Atlantic), filed for a $200m IPO. More here.

Vestas, a global wind turbine manufacturer, launched a venture arm focused on long-duration storage and grid flexibility, carbon-neutral fuels, wind energy technologies, and sustainability and advanced materials. More here.

This week we chatted with Tyson Woeste of Fifth Wall about the VC firm’s approach to climate investing in the built world. Infrastructure and buildings are an enormous - and often under-cited - driver of emissions, and few traditional climate investors bridge the divide. Fifth Wall is a global venture capital firm focused specifically on the real estate industry and property technology. Over the past few months, Fifth Wall has published their perspective on the intersection of climate and the built environment and invested in companies including Aurora Solar, Blueprint Power, among others. [We’re edited the newsletter version lightly for length; visit our website for the full feature].

What is Fifth Wall and your approach to venture investing?

Fifth Wall specializes in startups and technology for the global real estate business. We think about real estate broadly – as the entire built world. This includes hotels, homes, apartments, shopping centers, data centers, warehouses, and any other kind of building. We have over 60 LPs from 14 countries made up of real estate corporates. With this global and corporate footprint, we probably have an LP associated with any sort of building anywhere in the world.

Fifth Wall was started because of the size, reach, and outdatedness of the real estate industry. Real estate is one of the largest business sectors by asset class on the planet. Interestingly, before Fifth Wall was founded four years ago in 2016, real estate had not been transformed by technology – like just about every other sector of the economy had. Software is eating the world but hadn’t eaten the built world yet.

How does climate change and decarbonization fit into your firm’s strategy in real estate?

It started in earnest two years ago. But we first started to really notice this shift about 12 to 18 months ago, when we began to see an increasing volume of inbound questions from our LPs and other groups who were increasingly focused on climate tech. They were looking at AI systems to manage their HVAC systems better or new IoT sensors that could help with submetering, or on-site solar, to name just a few. Three forces were driving LPs to ask these questions: regulatory pressures - ie. carbon taxes, investor pressures, and tenant demands.

What’s your framework for thinking about climate?

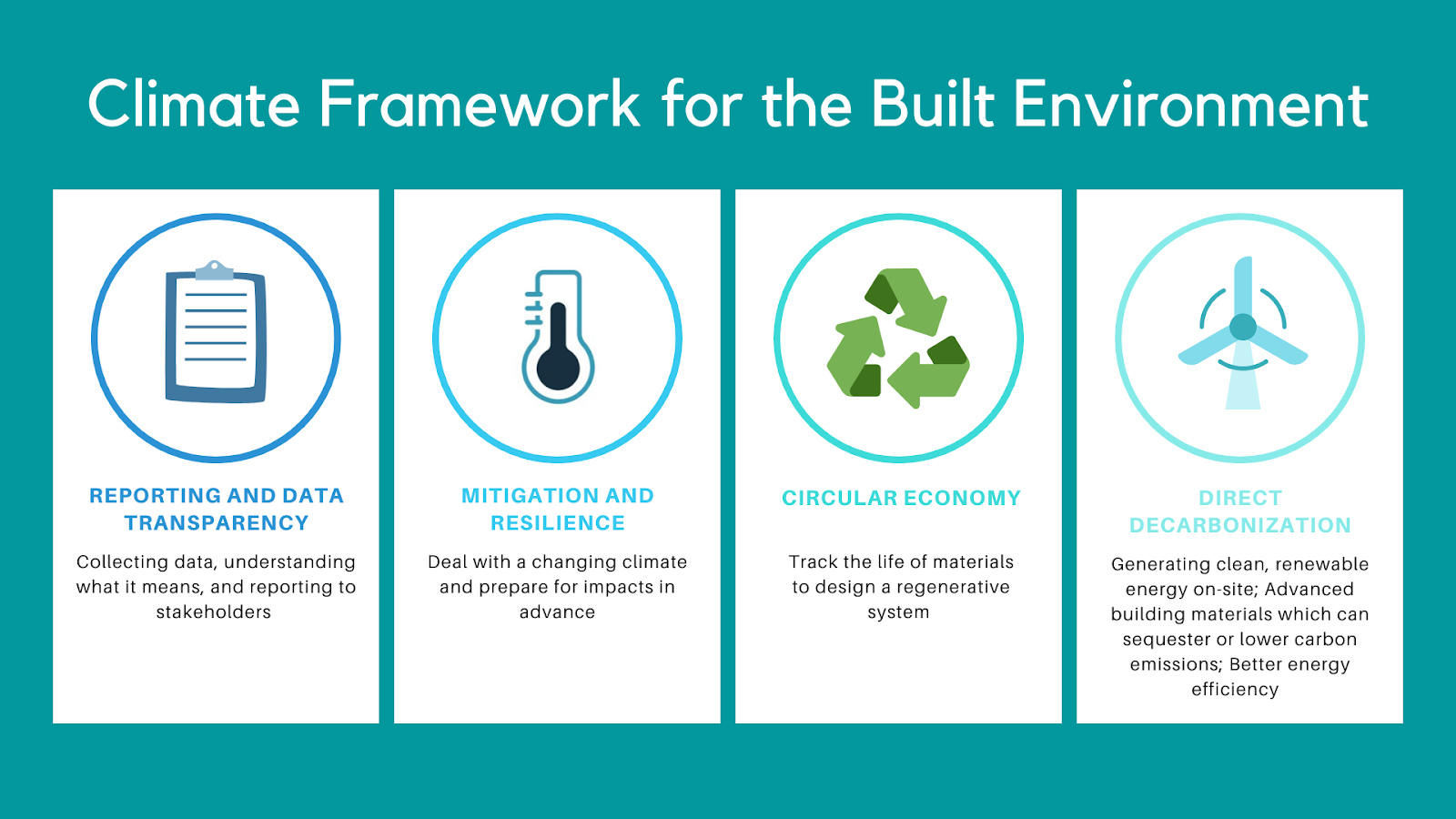

Buildings are the biggest end user of energy and therefore the biggest polluters in the economy. 40% of all GHGs emitted can be attributed to buildings. When we think about climate tech, we think about carbon as our North Star. We ask ourselves, “Does this technology we're looking at have the potential to meaningfully decarbonize the built world?” We think about the investment landscape for the built environment and climate tech in four categories:

📈 Reporting and data transparency is the first. To manage anything, you need to measure and report it. There is a whole category of startups focused on collecting data, understanding what it means, and then reporting those takeaways to stakeholders. When an owner or operator of an asset or a portfolio of assets wants to decarbonize, this is usually the first step.

🚧 Mitigation and resilience technologies help our LPs deal with a changing climate and prepare for impacts in advance. If you’re a real estate owner in Florida dealing with flooding or in Los Angeles dealing with wildfires, you have big decisions to make today related to climate risk. As one example, software products (e.g., insurtech) have popped up to help these folks decide whether to buy or sell certain properties based on their climate risk exposure by modeling these threats.

♻️ Circular economy tends to be more of a European concept than an American concept. Here, we include technologies like IoT sensors and ML that track the life of materials to measure the carbon impact of creating and operating a building. Water, for example, might not seem like a decarbonization problem but it is. In California, some estimates put 20% of the power in the state being used to pump water around, treat it, heat it up, and dispose of it.

💨 Direct decarbonization is the last category, which has a few subcategories:

⚡️ First, on-site power. As one example, we have an LP who is a large logistics and warehouse provider with a ton of rooftop space. One of their customers is Amazon, who wants to charge its electric trucks at this LP’s facilities when they are loading. All of a sudden our LP has become a utility company. This presents many many opportunities for various technologies to manage and deliver this service, from roof to outlet.

🏗 Another subcategory is advanced building materials and carbon sequestering building materials. Most folks talk about how concrete or cement account for ~10% of the carbon load for buildings, but there are a lot of other pieces that go into that. There are some interesting opportunities in retrofitting as well.

🚴 Lastly, there’s efficiency, including better ways to run HVAC systems informed by sensors and ML algorithms. One unexpected example that illustrates the breadth of opportunities in efficiency are electric motors. Like we switched out incandescents for LED light bulbs ten years ago, there’s a new generation of electric motors coming up now that are 30-60% more efficient than current ones.

You’ve mentioned there’s been a tipping point in your industry. Why do you think the conversation around climate change has changed?

What we think is unique about the real estate business is that it has an economic problem around their GHG footprint that a lot of other sectors don't. I think it's going to be really hard in other sectors. There are echoes of the cleantech 1.0 or greentech 1.0 bust 10-15 years ago. People were not willing and had no economic incentive to adopt a lot of these things. I think that's still true with climate tech in many sectors of the economy today – despite all the rhetoric. Real estate, though, is different. The reason for that statement is we basically think there are three things driving actual economic incentives in real estate:

⚖Number one is regulation – like Local Law 97 in New York. When you look at a map of the US, there are these blue dots. Those blue dots tend to be cities, and cities are where the majority of the buildings are. So when mayors and city councils get elected in these cities, they are generally left learning and want to demonstrate strong climate action. Real estate tends to be a natural target for these regulators. Buildings like the Empire State Building can’t threaten to leave New York City, so, if you’re going to put a carbon tax on anything, you put a carbon tax on buildings.

👬Another force is the tenants of buildings. The people who've shown leadership here are corporates like Facebook, Google, Amazon, and Walmart. Fortune 500 companies taking decarbonization pledges, like Amazon, means they're going to lean on all of their suppliers to decarbonize and provide low carbon versions of their current goods and services. One of the biggest suppliers to Amazon globally is real estate – for logistics, warehouses, distribution centers, data centers, office buildings, and even hotels for business travel. If you're a landlord for an office building in New York City and Amazon is your primary tenant, you're going to get taxed for your carbon emissions by city officials and pushed by Amazon to decarbonize more quickly.

💸The third force that we see is not unique to the real estate business; it's capital markets. You're starting to see big institutional global investors like BlackRock, pension funds, endowments, and sovereign wealth funds show explicit preferences to deploy capital into lower- and no-carbon assets. With real estate being the world's largest asset class, it feels that pressure the strongest. We talk to our real estate CEOs who come off earnings calls and say that analysts are talking all about sustainability.

These three forces come together in a way that is unique to the real estate business. This is not a five year problem. People are going to pay the price in the very short term – creating an economic incentive for climate tech and real estate.

While Biden has announced John Kerry as the international climate envoy, we’re still waiting to find out who will fill other important climate positions in the EPA, DoE, and domestic policy.

Plug Power, the largest user of hydrogen to fuel forklifts and other vehicles, is expanding its green hydrogen power production by building the first US-wide network of facilities and a gigafactory producing fuel cells and electrolyzers.

Enel, Europe’s biggest utility announced its plans to spend $83B on expanding renewables in the next decade, following Iberdrola’s recently announced $89 plan to invest in renewables by 2025.

In light of Nasdaq’s proposal to mandate board diversity, BNEF has issued a report highlighting that a corporate board made up of 30% or more women has a positive correlation to better climate governance and innovation in the energy and mining sectors.

BlackRock released the much anticipated Aladdin Climate– a tool to enable investors to model climate science onto their asset-specific projections to predict the climate risk of their portfolios.

The next home mortgage disaster could be sparked by climate change. As climate risk data becomes more accessible and buyers refuse to pay for natural disaster prone homes, the more than trillion-dollar portfolio of Fannie Mae and Freddie Mac “could take an enormous hit.”

New climate commitments from China and other countries as well as the promises of President-elect Biden could limit emissions to 2.1ºC and put the UN Paris goals “within reach,” according to the Climate Action Tracker.

Nikola and GM have significantly scaled down their partnership; GM will still supply hydrogen fuel cells to Nikola but no longer partner in manufacturing an electric truck or take an 11% stake.

Third Derivative released its inaugural startup Cohort 417 (named after this year’s peak atmospheric CO2 concentration) of 50 some climate tech startups from 600+ applicants from 60+ countries, including some familiar friendly faces at Kanin Energy, Banyan Infrastructure, Myst AI, and Frost Methane.

Bill Gates proposes creating a central office responsible for clean energy innovation modeled after the National Institute of Health (similar to the Energizing America report we featured).

Andy Lubershane, Director of Research at Energy Impact Partners, lays outs the three acts of the energy transition: Iteration, Innovation (where we’re at right now), and “Coopetition”.

MIT Technology Review sets the scene for the Cleantech 2.0 or “climate tech” boom.

Not new, but super helpful. Credit to the folks at American University’s Institute for Carbon Removal Law and Policy for open sourcing this carbon removal corporate action tracker.

Watch this Ted Talk between John Doeer and Hal Harvey of Energy Innovation.

The thoughtful Andrew Chang and Marilyn Waite launched a new podcast on Chinese cleantech.

🗓️ Watt it Takes: Sign up for Powerhouse’s live podcast featuring Stephen Lacey, the man behind the mic of The Energy Gang and The Interchange, on December 16th.

🗓️ C3E Women in Clean Energy Symposium: Join on December 8th & 9th for some excellently climate-nerdy poster sessions and the awards ceremony (open to the public for the first time, because, 2020).

💡 Work on Climate is chairing the Predictive Analytics World 2020 Climate sub-conference. Startups and established companies can submit proposals by December 15th to speak.

💡 Cleantech Open: Applications for Cleantech Open 2021 will open on January 14th.

💡 On Deck Climate Tech Fellowship: Apply by January 30th to On Deck’s 10-week fellowship to bring entrepreneurs and experts together to start climate tech companies.

💡 Carbon to Value Initiative: Startups tackling carbon capture, utilization and sequestration challenges can apply by January 27th to be considered.

Agricultural Economist @Boost Biomes

Program Coordinator @Third Derivative

Program Marketing Lead @Third Derivative

Director of Marketing @FluroSat

Director of Development @Clean Energy Trust

Chief of Product @microTERRA

Hydro Commercial Associate @Natel Energy

Electrical Engineer @Windborne Systems

ARPA-E Fellow @Ken Caldeira

Director of Carbon Finance @Carbon Cure

Investment Associate @Activate Capital

Associate @Spring Lane Capital

Senior Analyst @Radicle Impact

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond

Groundbreaking results from the geothermal developer’s main project