🌎 Lithium-ion is the benchmark in new LDES leaderboards #281

With long duration energy procurement surging, new rankings reveal who's pulling ahead

Tax credit where it's due for storage and manufacturing in H1’2025

Happy Monday!

We’re taking stock of the tax credit market in 2025 so far in Crux’s mid-year update, which shows a market shaken up by policy but steadied by storage, manufacturing, and a new cast of emerging techs.

In deals, $250m for EV fleets, $242m for renewable energy development, and $197m for battery energy storage systems.

In other news, a new ruling on GGRF funds, gas turbine giants ramp up production, and a new nuclear power plant restart.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

2025 has been anything but steady for clean energy finance, with policy rollbacks, shifting tax liabilities, and trade fights rattling developers and investors. Yet through all this, one key pillar has (somewhat surprisingly) survived: the Inflation Reduction Act’s tax credits, still transferable and recently expanded to cover storage, manufacturing, fuels, and more.

The market is responding in real time, and today, clean energy capital markets platform Crux dropped its 2025 Mid-Year Market Intelligence Report, a deep dive into who’s buying, who’s selling, and how policy is reshaping clean energy finance. In H1’2025, a few throughlines emerge: storage is up, wind is down, and tax credit transferability is doing some heavy lifting.

The 88-page report gives a window into both supply and demand for the tax credits that enable the energy transition.

Since the passage of the Inflation Reduction Act (IRA) in 2022, tax credits have taken on a whole new role in project finance. For the first time, developers could transfer credits to third parties for cash, opening up a much broader universe of capital beyond traditional tax equity. That unlocked new liquidity, helping to catalyze a more dynamic and accessible market for clean energy finance projects.

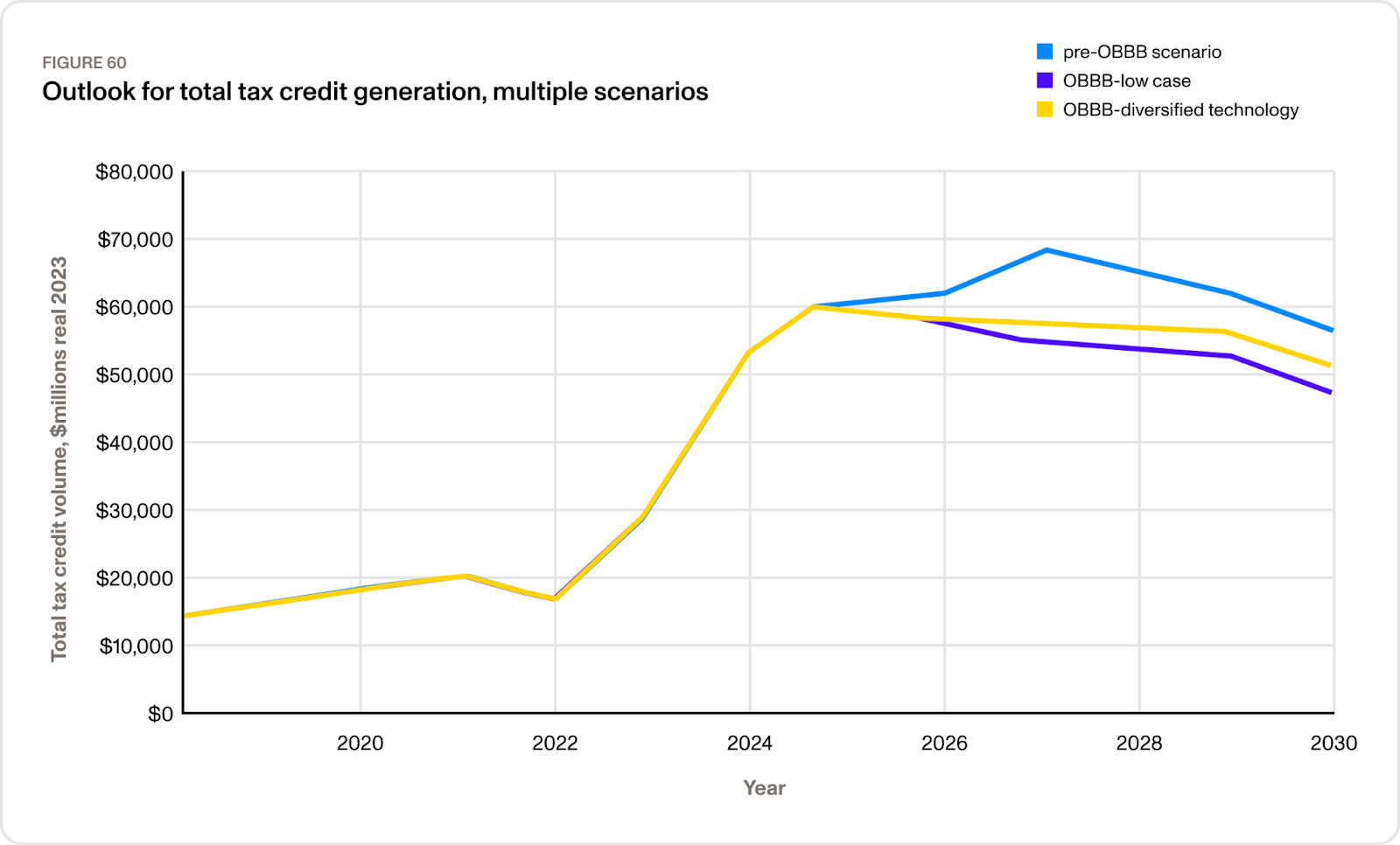

The Trump administration’s new policies, including the OBBB, introduced uncertainty through much of 2025. The law narrowed support for wind and solar but largely preserved credits for storage, fuels, and manufacturing. For now, the market is holding up — even as its makeup shifts.

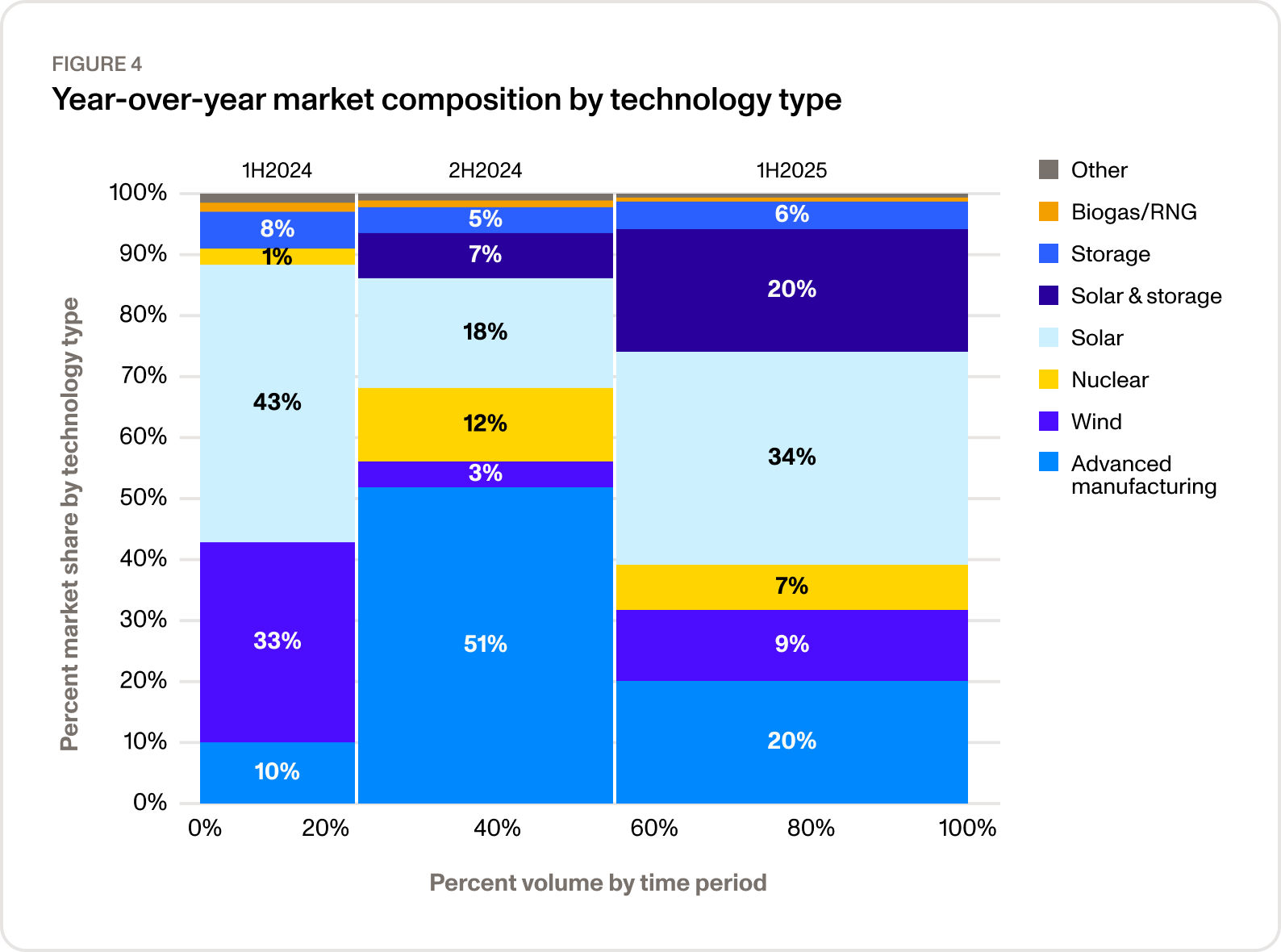

Solar and wind, the backbone of the clean energy tax credit market for decades, are showing signs of strain. Utility-scale solar is persevering thanks to investment-grade sponsors, but residential solar struggled with policy uncertainty, bankruptcies, and delivery risk. Wind saw the sharpest drop, falling from 33% of credit transactions in H1’2024 to just 9.5% in H1’2025, reflecting both investor caution and shifting policy support. Crux attributes this to buyers’ “flight to quality” in H1’2025, concentrating demand on more proven investment-grade, utility-scale solar projects with quicker timelines and lower policy risk. In a more selective market, credit rating and maturity matter more than ever, as our investment numbers reflected as well.

Meanwhile, tax credit movement indicates growth in some of the newly eligible, more emerging sectors. Storage and advanced manufacturing are standouts: standalone and solar+storage ITCs made up 26% of credit sales in H1’2025, up from 9% in H1’2024. Buyers and lenders are getting more comfortable with the economics, and policy clarity is helping solidify pricing. If momentum holds, storage could become a core pillar of the credit market.

Advanced manufacturing (45X) credits doubled YoY, rising from 10% of supply in H1’2024 to 21% in H1’2025. With $5–7bn in expected supply for H2’2025 alone, these credits could help anchor the market long after wind and solar phaseouts kick in.

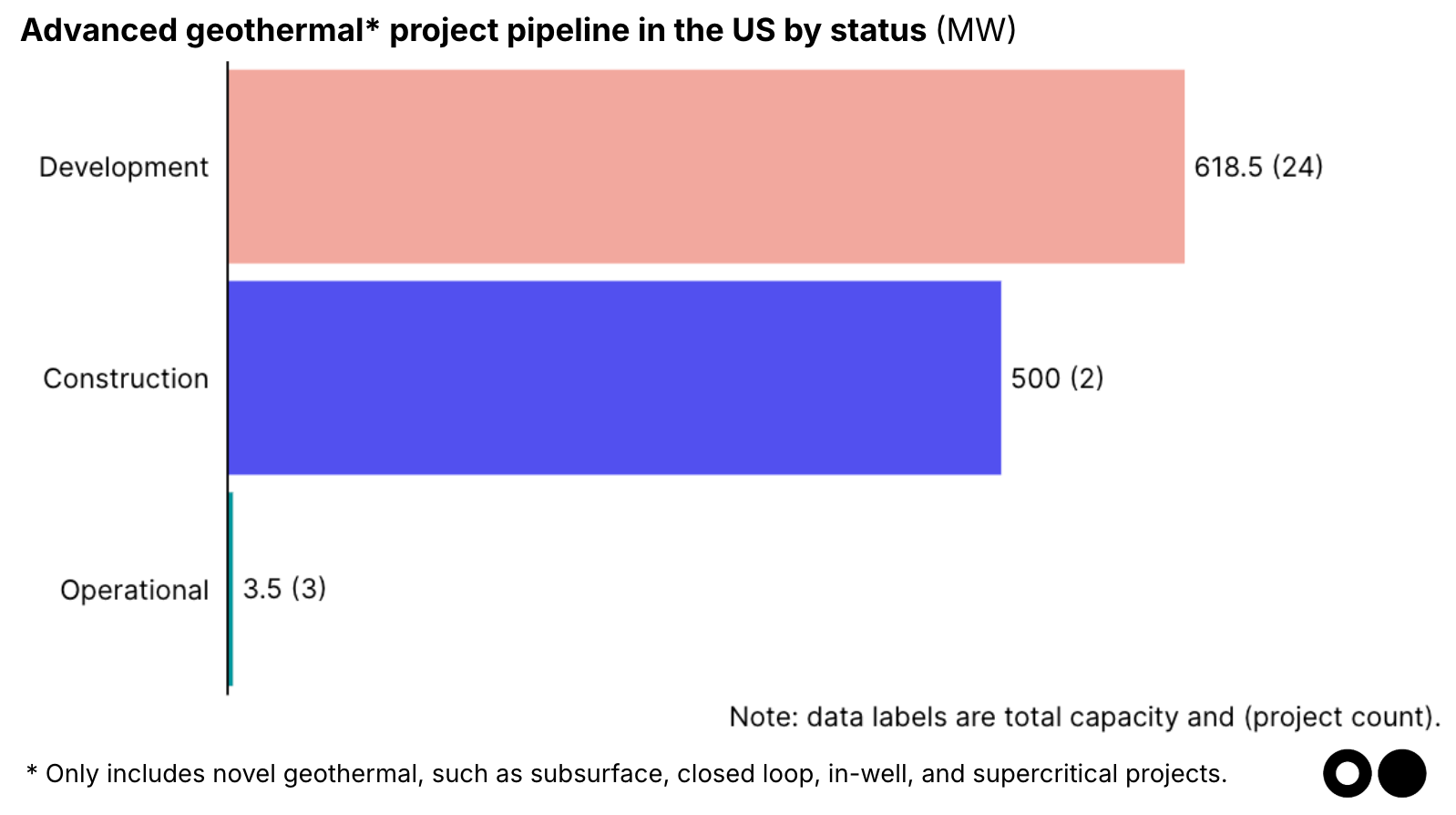

There’s growth in credits for emerging techs like geothermal and sustainable aviation fuel (SAF) as well, though they’re still early in absolute volume compared to storage and manufacturing. SAF is eligible under the IRA’s 45Z clean fuels production credit (but with a 2027 sunset), while geothermal can get ITC and PTC (either a 30% ITC on project costs or a PTC tied to electricity generation). As Sightline’s data shows, there’s 26 advanced geothermal projects with ~1.1 GW of geothermal capacity under development or construction in the US — and the credits could help unlock financing to move those projects ahead.

Underlying all this is a maturation of monetization strategies. Before the IRA, developers that couldn’t use their own credits had to partner with specialized tax equity investors — usually big banks — in deals that were complex, exclusive, and slow, often taking months of strict diligence and underwriting to close. Now, developers can transfer credits directly to any eligible buyer for cash, opening the door to a wider pool of corporate buyers and a more liquid, modular marketplace. Tax equity still plays a key role, especially for large projects with strong cash flows, but hybrid structures are becoming the norm. Most investors now offer hybrids that combine equity and transfers, with many deals involving credits sold out of equity partnerships. Transfers out of tax equity partnerships are now the fastest-growing segment of the market.

Special thanks to Alfred Johnson, CEO of Crux, for extra insights on the report — and catch him live at Sightline’s NYCW event, SightLive 2025.

⚡ VEMO, a Mexico City, Mexico-based EV fleet and services provider, raised $250m in Growth funding from Vision Ridge Partners.

♻️ ECOMMIT, a Tokyo, Japan-based circular logistics services provider, raised an undisclosed amount in Series B funding from Mercari.

🌾 Orchard Robotics, a Seattle, WA-based AI-precision crop management platform, raised $22m in Series A funding from Quiet Capital, Shine Capital, Contrary, General Catalyst, Mythos Ventures, and other investors.

🚚 FERNRIDE, a Munich, Germany-based electric autonomous trucks and operating systems developer, raised $21m in Series A funding from Helantic.

🔋 Offgrid Energy Labs, a Noida, India-based zinc-based battery developer, raised $15m in Series A funding from Archean Chemicals and Ankur Capital.

🧪 Xampla, a Cambridge, England-based natural biopolymer materials developer, raised $14m in Series A funding from Emerald Technology Ventures, Amadeus Capital Partners, Business Growth Fund (BGF), Horizons Ventures, and Matterwave Ventures.

⚡ Splight, a San Francisco, CA-based dynamic congestion grid technology developer, raised $12m in Series A from Blue Bear Capital and ZOMA Capital.

🔋 Florrent, a Boston, MA-based bio-based materials developer, raised $9m in Seed funding from MassVentures, Boston Impact Initiative, Elbezius, Maroon Venture Partners, MassMutual, and other investors.

🔋 MOPO, a Sheffield, England-based battery rental platform, raised $6m in Seed funding from Norfund.

💨 Econetix, a Vienna, Austria-based carbon removal projects developer and carbon asset management platform, raised $5m in Seed funding.

🚗 LeafyBus, a Delhi, India-based electric bus fleet operator company, raised $4m in Seed funding from Enetra EV and Impact Capital Asia Management (ICAM).

🌾 Nextage, a Meguro-ku, Japan-based indoor wasabi vertical farm, raised $1m in Series A funding from DEEPCORE.

⚡ RYE, a London, England-based corporate energy intelligence platform, raised $1m in Pre-seed funding from CapitalT, January Ventures, Earth, and Norrsken VC.

🧪 Greenitio, a Singapore-based biodegradable materials developer, raised $1m in Seed funding from SGInnovate, Better Bite Ventures, and Silverstrand Capital.

🍎 SuperGround, a Helsinki, Finland-based sustainable food processor, raised $1m in Seed funding from CHECK24 Impact and Propeller.

🔋 Green Voltis, a Stockholm, Sweden-based renewable energy asset optimization platform, raised an undisclosed amount in Seed funding from Google DeepMind.

⚡ Swift Current Energy, a Boston, MA-based renewable energy project developer, raised $242m in PF Debt funding from Canadian Imperial Bank of Commerce (CIBC), KeyBanc Capital Markets, Natixis Corporate & Investment Banking, and Truist Securities.

🔋 Akaysha Energy, a Melbourne, Australia-based battery energy storage systems developer, raised $197m in PF Debt funding from BNP Paribas, Deutsche Bank, ING Group, SMBC Nikko Securities, and Westpac.

⚡ Green Hydrogen Systems, a Kolding, Denmark-based hydrogen electrolyzer developer, completed an asset sale of $12m from Thyssenkrupp Nucera.

🥩 Finnish Food Factory, a Kouvola, Finland-based plant-based dairy manufacturer, raised $12m in PE Expansion funding from Taaleri Bioindustry.

⚡ Foremost Clean Energy, a Vancouver, Canada-based uranium exploration service provider, raised $1m in Post-IPO Equity funding from Denison Mines.

⚡ Corinex, a Vancouver, Canada-based Broadband over Power Lines (BPL) technology developer, raised an undisclosed amount in Corporate Strategic funding from Santander Alternatives Investments.

🏠 Monodraught, a High Wycombe, England-based natural ventilation systems developer, was acquired by Genuit Group for $74m.

🔋 Natron Energy, a Santa Clara, CA-based sodium-ion battery manufacturer, filed for Bankruptcy / Out of Business.

⚡ Innowatts, a Houston, TX-based energy analytics platform, was acquired by GridX for an undisclosed amount.

🌱 Greenomy, a Brussels, Belgium-based ESG reporting software provider, was acquired by Position Green for an undisclosed amount.

💰 All Aboard Coalition, a New York, NY-based climate tech investment initiative, raised $300m for a later-stage climate fund, focusing on first-of-a-kind infrastructure like power plants, manufacturing facilities, and other capital-intensive decarbonization technologies across sectors including energy, heavy industry, and transportation.

This is a sample of the deals available for Sightline Climate clients. Can’t get enough deals?

A federal appeals court ruled that the Trump administration acted lawfully in freezing $16bn in climate and clean energy grants from Biden’s 2022 climate law. The funds were blocked after the EPA chief alleged possible fraud without providing evidence. Nonprofits that had already planned programs and hired staff are now facing layoffs while they fight the decision, which could ultimately reach the Supreme Court.

Gas turbine giants Mitsubishi, GE Vernova, and Siemens Energy are expanding turbine production capacity in response to soaring demand, as lead times now stretch up to seven years. The backlog is driven by data center growth, coal plant retirements, and rising electricity demand, but experts warn the buildout won’t quickly resolve delays due to labor constraints and risk-averse capital strategies. The persistence of long turbine wait times could benefit renewables and grid-scale storage in the near term, but investment signals from OEMs suggest expectations of sustained fossil demand.

NextEra Energy plans to restart Iowa’s Duane Arnold nuclear plant by 2028, adding 600MW to meet growing demand from AI data centers. The $100m project faces supply challenges but aims for power deals with tech firms, following similar restarts at Palisades and Three Mile Island, although it’s likely the last plant in the US that could be restarted.

The UN-backed Net-Zero Banking Alliance has paused activities and proposed moving away from a membership model after major banks, including Goldman Sachs, HSBC, UBS, and Barclays, left amid political pressure. Launched in 2021 and once representing $74T, the alliance is holding a member vote on restructuring to continue guiding banks on net-zero commitments, with results expected in September.

Campaigners have launched a legal challenge against the UK government’s approval of the HyNet hydrogen scheme, citing environmental and transparency concerns. The activist group, called HyNot, argues that the government failed to properly assess the risks of CO2 storage under Liverpool Bay, the cumulative climate impact of hydrogen production, and potential habitat disruption.

85 scientists torched the DOE’s climate report as cherry-picked and politically cooked.

Gridlocked? Not anymore: See Europe’s patchwork of grid capacity maps stitched into a single open-access tool.

A Florida electric company’s rate hike was backed by dozens of testimonies – many freshly paid by its charitable arm.

Sherlock Holmes fan fiction detailing: a European thermal energy storage OEM’s agreement with a Bronx reseller.

Nova Scotia goes green underground: QIMC uncovers a natural hydrogen hotspot with record soil gas samples.

📅 Climate Social & Quiz: Join Terra.do and The Green Londoner on Wednesday, September 10, 6:00 PM - 9:00 PM in London for informal drinks, great chat, and plenty of connections with like-minded Londoners.

📅 Climate Tech Time: Join the UK’s largest monthly gathering for climate tech, bringing together VCs, angels, and investors with startups and SMEs on Wednesday, September 24, 6:00 PM - 9:00 PM in London.

📅 SightLive 2025: Back for its second year, SightLive is where sharp analysis meets real-world playbooks. On September 22, this full-day, invite-only gathering convenes top decision-makers across energy, finance, technology, and policy, combining the best of Sightline and CTVC. Through analyst deep-dives, curated discussions, and real-world case studies, the event will shape the narrative around the new age of power and the evolving global landscape for innovation. Sessions will cover clean firm power, data centers, gridtech, and more, anchored by research, data-driven insights, and community. Come for the signal. Leave with strategy. Approved registrants only. Interested in volunteering? Apply by September 15 to join and support with check-in, speaker management, and more at the event.

Community Engagement Manager @Planetary

Head of Commercial @Zulu Ecosystems

Enterprise Account Executive @Supercritical

Commercial and Contracts Manager @Tokamak Energy

Head of Operations @Tokamak Energy

GTM Strategy Director @Floodbase

Head of Distribution @Floodbase

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

With long duration energy procurement surging, new rankings reveal who's pulling ahead

A tale of two public debuts

US courts roll back Trump-era actions on offshore wind and DOE grant cancellations