🌎 Taxing times for CCUS #254

OBBB blows tailwinds through CCUS, but takeoff stalls

House passes IRA and China-US climate relations take a plunge

Happy Monday!

In big news this week, the IRA passed the House and is headed to Biden’s desk — heralding the largest shift in US pro-climate policy to date, and bringing us closer to the Paris targets decided nearly a decade ago. In 2015 the Paris Climate Accords signified a breakthrough in diplomacy and signed us up for a multi-year, multi-region policy scramble to figure out how to 1) grow clean emerging economies and 2) transition developed economies towards climate-neutrality.

At the dawn of US policy (finally) kicks in, now diplomacy falters; namely in a breakdown of US-China relations. The IRA positions issues of climate security as economic and national security, and the push towards catching-up on clean manufacturing is a recognition that China has not sacrificed regular ol’ carbon-emitting growth for clean growth. Forfeiting diplomacy and failing to recognize we’re playing different games than China (e.g. growth that is both and versus only clean transition) and to a lesser extent EU/Russia will inhibit our ability to recognize our unique climate competitive advantages and the potential that the IRA now brings in reorienting industry towards them.

Deals this week are led by $115m for AI that prevents food waste, $63m for wireless EV charging, and $35m for EV industrial trucks. In the news, IRA’s job creation estimate of 1.5m gigs bodes well, India commits to 50% renewable energy by 2030 and a (low) carbon tax, and lots of electric flying taxis.

We’re off for the rest of the week to recharge on feature content, and will be back in your inbox next Monday. Thanks for reading!

Not a subscriber yet?

In the same week as the major IRA climate policy win, China suspended climate talks with the US after Nancy Pelosi’s visit to Taiwan. As COP27 in Egypt ticks closer, global climate action feels as if it’s suddenly made a 180 pivot from gradual policy cooperation to intense diplomatic competition.

But the US and China have long been playing different games. The CCP promises economic growth above all else, ambivalent about carbon intensity. While clean energy manufacturing and export are a key part of the CCP’s engine, its alongside and additional to fossil-powered economic accelerants. Meanwhile, the US has been playing a transition game, backed by the promise of climate tech innovation displacing carbon-fueled growth.

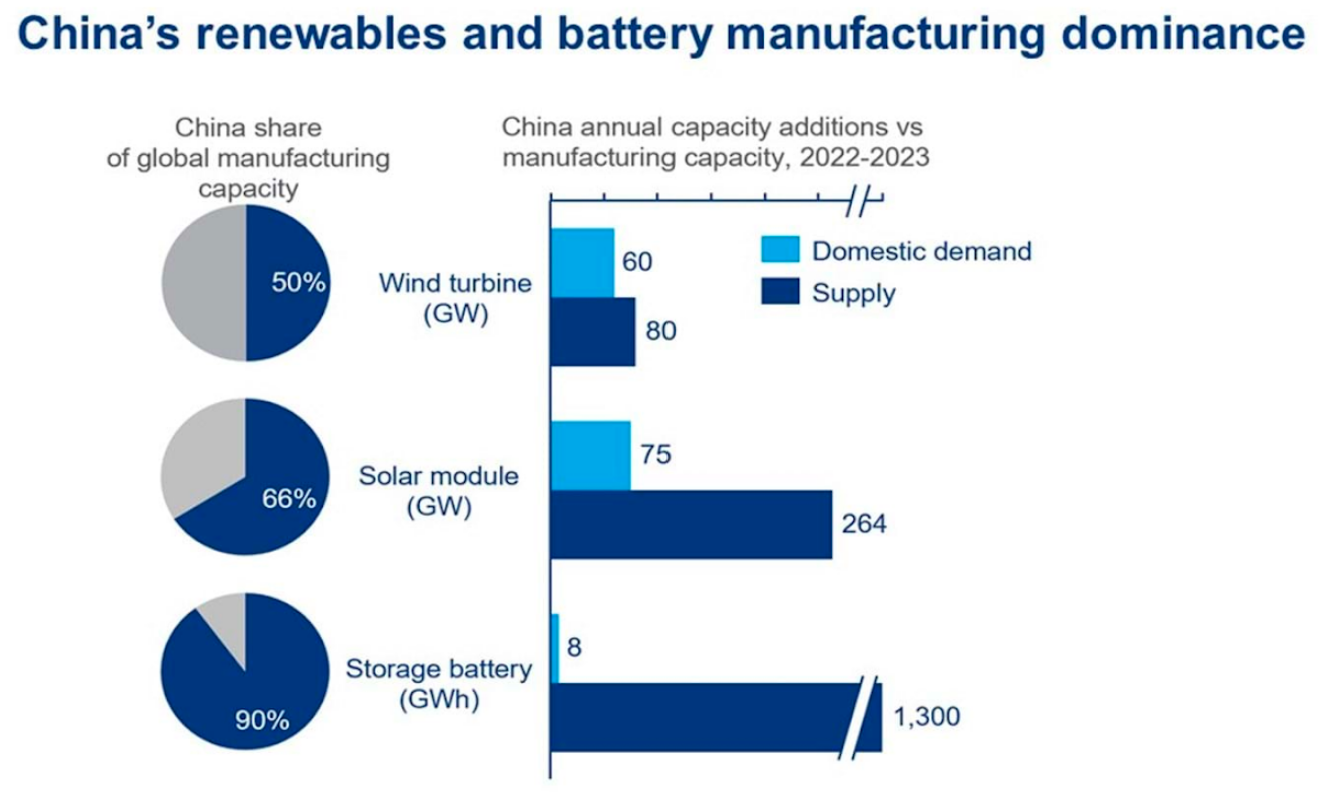

The IRA now positions issues of climate security as economic and national security, and pours $370b into the tank so the US can play catch-up on clean manufacturing - where China’s miles ahead. China owns 79% of the global lithium ion battery capacity versus the US’s <6% of battery manufacturing capacity.

The IRA’s Made In America push most obviously manifests in the form of the new EV tax credits - which require vehicles to be built with North American critical minerals. By 2024, EV makers must source >40% of their battery materials from the US or trade-aligned countries in order to access half of the credit, ramping up to 80% sourcing in 2026. Vehicles with minerals from a “foreign entity of concern” (read: China) sacrifice qualification for any of the tax credit.

Building a battery plant looks like a walk in the park compared to standing up an entire self-sufficient battery value chain from mine to vehicle. “Considering it takes seven years to build a mine and refining plant but only 24 months to build a battery plant, the best part of this decade is needed to establish an entirely new industry in the United States,” Simon Moores, chief executive of Benchmark Minerals notes. CTVC has noticed the start of an uptick in private investment into US-based companies early in the battery value chain, though we anticipate that the IRA will now open the funding floodgates given tax credits’ acceleration of profitability.

The US must not lose perspective on what game we’re playing. While economically necessary and a diplomatic prerogative, manufacturing is the US’s defense and should not distract from our unique innovation offensive strategy.

Planet Earth is the real scorekeeper of the US vs China competitive climate game. Global decarbonization is set for a showstopping new half to the match. Competition between two global superpowers with opposing deployment and innovation offensive strategies should lead to one certain winner: rapid global decarbonization.

🍎 Afresh, a San Francisco, CA-based AI company developing food technology that prevents food waste, raised $115m in funding from Spark Capital, VMG Partners, Maersk Growth, Ischyros New York, Insight Partners, Innovation Endeavors, HighSage Ventures, and Bright Pixel.

🚗 WiTricity Corporation, a Watertown, MA-based wireless EV charging startup, raised $63m from Siemens AG, Japan Energy Fund, Mirae Asset Capital, Stage One, Airwaves Wireless Electricity, and Delta Electronics.

🚚 Orange EV, a Riverside, MO-based EV manufacturer specializing in industrial trucks, raised $35m in funding from S2G Ventures and CC Industries.

⚡ Utility Global, a Houston, TX-based sustainable hydrogen startup, raised $25m in Series B funding from Saudi Aramco, Samsung Ventures, Saint-Gobain NOVA, and Ara Partners.

☀️ Project Solar, a Lehi, UT-based company automating solar panel installation processes, raised $23m in Series A funding from Left Lane Capital.

🌿 xFarm Technologies, a Switzerland-based digital farming startup developing SaaS solutions for sustainable agriculture, raised $17.5m in Series B funding from United Ventures, Swisscom Ventures, NovaCapital, Neva SGR, Grey Silo Ventures, and Emerald Technology Ventures.

💨 Econic Technologies, a UK-based company developing catalysts for polymer manufacturing from carbon dioxide, raised $12.6m in Series D funding from ING Sustainable Investments, GC Ventures, and CM Venture Capital.

♻️ Genecis, a Canada-based startup developing compostable plastic from waste, raised $7m in Series A funding From Khosla Ventures, BDC Capital Cleantech Practice, IT-Farm, Heinz, Gullspand Refood, and AME Cloud Ventures.

♻️ Bluestem Biosciences, a Omaha, NB-based renewable chemicals company utilizing synthetic biology, raised $5m in Pre-Seed funding from Zero Infinity Partners.

⚡ Vespene Energy, a Berkeley, CA-based methane mitigation company converting methane waste into electricity, raised $4.3M in Seed funding from Polychain Capital.

🌾 Muddy Machines, a UK-based robotics company automating crop harvesting, raised $1.5m in Seed funding from Regenerate Ventures, Ponderosa Ventures, and SVG Ventures.

It’s (almost) official! 🎉 The House voted 220 to 207 to pass the IRA, sending the bill to Biden’s desk. With $369b for clean energy and energy security, this is the US’s largest federal climate investment in history. Lots and lots of takes on IRA impacts and graphical teardowns.

Clean energy research firm Energy Innovation estimates that the IRA could spur the creation of up to 1.5 million jobs by 2030.

India approved a massive energy conservation bill with two key provisions. 1) 50% renewable energy by 2030 and 2) a price on carbon for industrial polluters. The catch? Asia has a precedent for setting carbon prices too low to incentivize decarbonization.

Not to be outdone, and fresh off their election, Australia's House of Representatives voted in favor of cutting the country's emissions 43% below 2005 levels by 2030.

Heatflation has already arrived. Miami launches first-ever mobile climate resilience pods and coal and diesel shipping dried up (heh) on the too-shallow Rhine and Danube key river routes - further threatening European energy supply chains.

Some relief: Spain turned on Europe’s largest solar power plant. With 1.5m solar panels, Iberdrola’s newest plant will produce enough electricity to supply more than 334,000 homes.

Ford and DTE Energy announced the largest renewable energy purchase in US history, adding 650 MWof solar energy capacity for Ford by 2025.

Electric aviation takes flight with Archer Aviation’s $10m "pre-delivery payment" for 200 flying taxis from United Airlines. Another California eVTOL startup, Joby Aviation, expanded its contract with the US Air Force.

Punchy, poetic ode on our debt to pay up to the bees - surprisingly, but excellently, in the FT.

Now that the IRA can levy hefty fees on methane, creative oil majors accountants are already spinning up loopholes to avoid $1,500/ton penalties.

In a league of their own. On the sleeves of its home kit, English football club Reading FC will feature 150 red and blue warming stripes to raise awareness about the climate crisis.

NY Climate Week can feel hectic. Here’s your guide to CDR events happening Sept 19th-24th.

Kim and Sophie break down the IRA’s climate tech impact in Protocol.

On the path to net zero, can thermal storage bring the heat?

According to McKinsey, companies should focus on ESG to earn their ‘social license’ and ‘approach externalities as a core strategic challenge.’

Raising the steaks. BCG concludes that cultivated meat can indeed significantly reduce protein’s emissions, from lower energy and land use. Click in for some wild consulting graphics.

A herculean study in Nature synthesizes all climate hazards (heatwaves, droughts, floods, storms) and all infectious pathogens in one paper and concludes that climate change makes hundreds of diseases worse.

Heirs from the Getty and Rockefeller oil family lineages funded climate activist groups trying to block fossil fuel projects. “It’s time to put the genie back in the bottle… I feel a moral obligation to do my part.”

Profile on ARIA’s two new heads of Britain's new climate research agency, Ilan Gur of Activate and Matt Clifford of Entrepreneur First.

🗓️ Climate Week NYC: RSVP for Climate Week NYC events, taking place from September 19-24. Hosts include the NRDC, the World Climate Foundation, and the C2V Initiative.

🗓️ Co_Invest Climate: RSVP for Evergreen’s climate tech startup showcase, taking place in Chicago on September 7 with speakers including Carbon Direct’s Dr. Julio Friedman and CTVC’s very own, Sophie Purdom.

🗓️ Cleantech Open Northeast: Register for the Regional Finals when industry professionals, entrepreneurs, and innovators get together to celebrate top finalists’ pitch to a live audience at Greentown Labs on September 29.

Founder, Natural Capital Markets @Deep Science Ventures

Clean Energy Strategy Analyst @8 Rivers

Business and Market Analyst @Nitricity

Director of Sales/Revenue Ops @QuantAQ

Fellow (Fall 2022) @ARPA-E

Development Test Engineer @Form Energy

Mobile/Web Software Engineer @Artyc

Lab Technician @Tula Foundation

Engineering Lead @ Rheaply

VP of Technology @Climate X

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

OBBB blows tailwinds through CCUS, but takeoff stalls

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook