🌎 Bright spots and sunsets in the OBBB #253

One Big Beautiful Bill ushers in new (and old) energy agenda

Trade associations from pro-climate businesses obstruct BBB agenda

Happy Monday!

We’re off next week in recognition of Thanksgiving and will be back stuffed with a fresh baked climate feature on Dec 3rd.

In this week’s issue, we jump out the post-COP lull with a take on climate misinformation and obstruction. Nature reports that climate science denial spending has shifted towards climate tech solutions denigration (e.g. renewables caused the TX blackouts!). While lobbying policy can sometimes be boring, it’s noteworthy how many otherwise ‘pro-climate’ orgs finance against explicitly climate objectives.

We also cover a few deals, jobs, and some big news namely the House passing BBB, alternative energy markets valued at $1.2T (rivaling oil and gas), and Ford dumping Rivian but gaining a good few billion - and a new corporate rival.

Thanks for reading!

Not a subscriber yet?

This week seemed slow for climate news, coming off the deluge of major COP26 announcements and pledges. In this quiet, though, we were reminded of the (anti-climate) action so often shrouded in silence. Climate misinformation and obstruction are always at work shaping the news of climate tech and policy - though prefer not to make headlines.

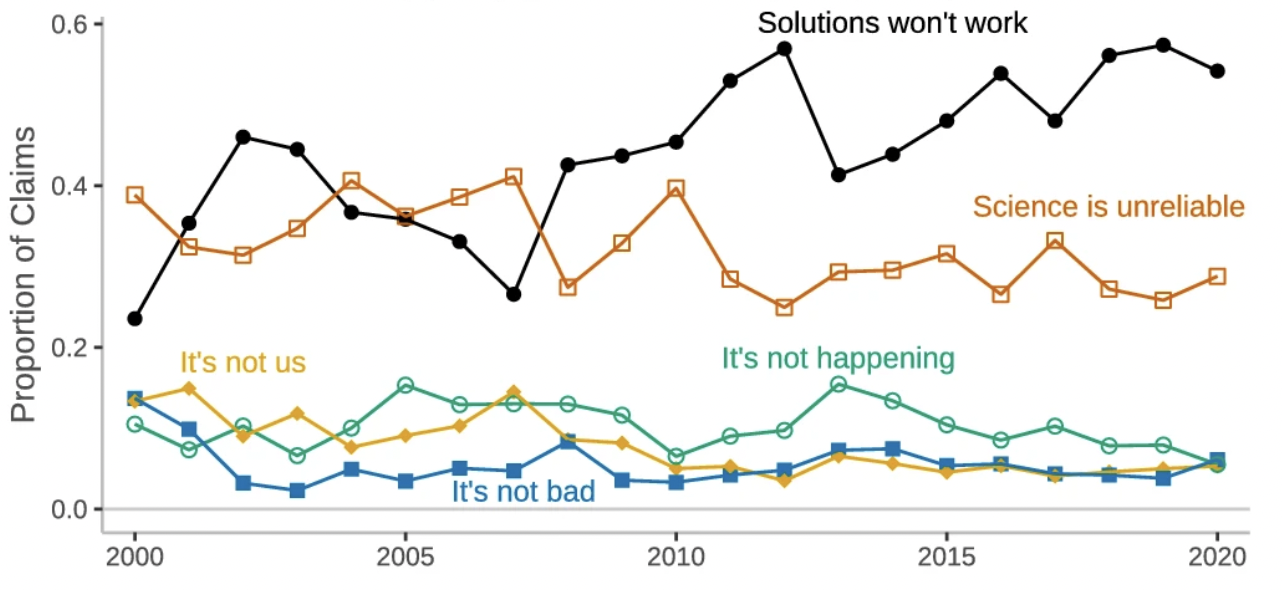

🤥 Misinformation. For decades, an invisible network of lobbyists, philanthropists, and advertisers have peddled highly coordinated narratives of climate denial and misinformation to customers and voters. Like the playbook of Exxon - which knew about the repercussions of climate science 40 years ago and spent lavishly to blow smoke - the past two decades of climate misinformation centered around a story of “the science is unreliable.” The narrative partly worked, yet today, more Americans believe in climate change than ever before as the science of climate change is (sadly) undeniable (see: August IPCC report).

So misinformists have started to sell a different story, one that targets the dubiousness of climate solutions, not science. Two recent examples of climate solutions scapegoating: the February Texas cold weather event and last month’s global energy crunch. In both situations, blame for outages was stuck on renewables, while fragile fossil fuel supply chains and infrastructure were the true primary culprits.

A recent paper in Nature identifies five buckets of climate misinformation: (1) climate science or scientists are unreliable; (2) climate solutions won’t work; (3) global warming is not happening; (4) human-produced GHGs are not causing global warming; (5) climate impacts are not bad.

🤫 Obstruction. Sometimes the strongest form of obstruction is doing nothing at all. Inertia maintains the status quo and inhibits decisive climate action - and rarely makes public headlines. Some of these silent obstructionists are the same companies that released lofty pledges during COP or operate high-flying climate venture funds.

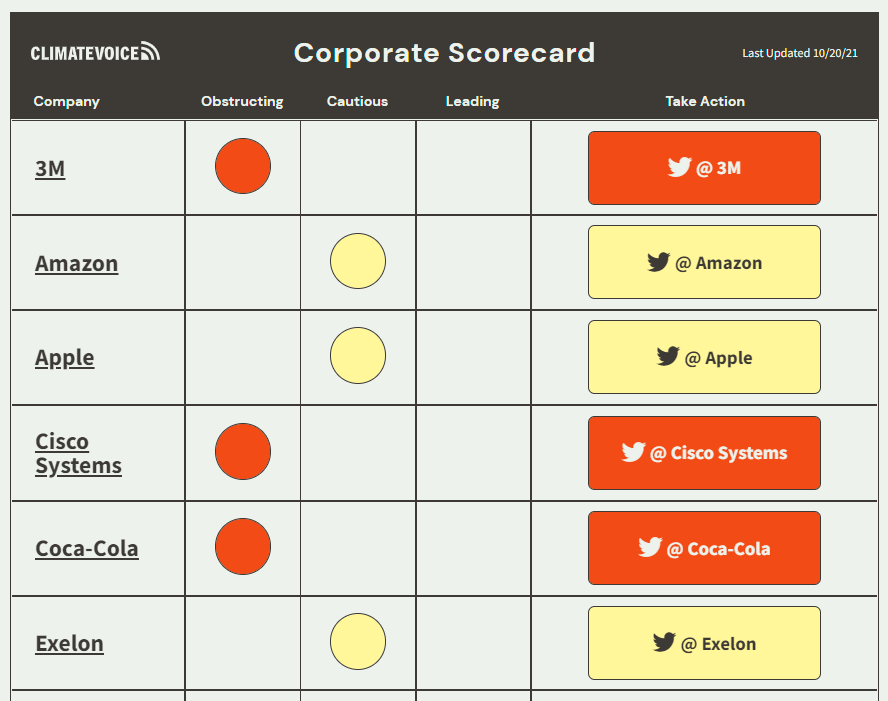

During the 2020 election cycle, Bloomberg Green analyzed the political donations of the S&P 100 and found that even climate-forward corporates spent $1.84 supporting Congress climate-obstructionists for every $1 that went towards their pro-climate peers. Even climate tech sweethearts Amazon, Alphabet, and Microsoft made the list.

Playing out in the Senate in real time, a majority of pro-climate companies remain tightlipped or actively antagonistic against the historic Build Back Better climate legislation. Eager to openly promote the greenest benefits of the bill, companies unleash their conservative trade associations to oppose revenue provisions from the legislation quietly. Climate Voice scored 20 pro-climate companies (like Tesla, Nike, HP) regarding their positions on BBB – 10 companies are obstructing, 10 are offering cautious support, and zero are fully endorsing the climate bill.

Conclusion. Dollars devoted to climate progress (e.g., invested in climate tech innovation) are diluted and dwarfed by misinformation and obstruction efforts. Let’s not forget the silent headline.

💨 FirstElement Fuel, a Newport Beach, CA-based hydrogen refueling network, raised $105m in Series D funding from Air Water, MUFG Bank, Nikkiso, and Japan Infrastructure Initiate.

💧 Gradiant, a Boston, MA-based cleantech water treatment company, raised $100m in Series C funding from Warburg Pincus and Schlumberger New Energy.

🚜 Monarch, a San Francisco, CA-based autonomous tractor company, raised $61m in Series B funding from Astanor Ventures, CNH Industrial, At One Ventures, and Trimble Ventures.

🚲 Zoomo, an Australia -based e-bike subscription service, raised $60m in Series B funding from Grok Ventures, Skip Capital, ArcTern Ventures, AirTree Ventures, Clean Energy Finance Corporation, Contrarian Ventures, and Maniv Mobility.

🔥 Kettle, a Kensington, CA-based climate change impact insurer, raised $25m in Series A funding from Acrew Capital, Homebrew, True Ventures, Anthemis, Valor, DCVC, and Lowercarbon Capital.

🔋 Mitra Chem, a Houston, TX-based li-ion battery producer, raised $20m in Series A funding from Chamath Palihapitiya’s Social Capital Holdings Inc and Earthshot Ventures.

💧 Klir, a Reno, NV-based water utilities management platform, raised $16m in Series A funding from Insight Partners, Bowery Capital, Spider Capital, and SaaS Ventures.

🔋 Sepion, an Emeryville, CA-based li-metal battery company, raised $16m in funding from Solvay Ventures and Fine Structure Ventures.

🛰️ Hydrosat, a Washington, DC-based geospatial data startup, raised $10m in Seed funding from OTB Ventures, Freeflow Ventures, Cultivation Capital, Santa Barbara Venture Partners, and Expon Capital.

⛏️ Mangrove Lithium, a Canada-based lithium refining company, raised $10m in Series A funding from Breakthrough Energy Ventures and BDC Capital.

📦 Noissue, a New Zealand-based sustainable packaging company, raised $10m in Series A funding from Felix Capital.

🚿 Hai, a Los Angeles, CA-based maker of smart showerheads, raised $6m in Seed funding from Trousdale Venture, Dreamers VC, A-Rod Corp, The Najafi Companies, Amity Supply, Animal Capital, and others.

🏭 Brimstone Energy, an Oakland, CA-based carbon-neutral cement producer, raised $5.1m in Seed funding from DCVC and Breakthrough Energy Ventures.

💨 DiviGas, a Singapore-based startup developing membranes for hydrogen separation, raised $3.6m in funding from Mann + Hummel.

🌿 AKUA, a New York City, NY-based maker of kelp-based burgers, raised $3.2m in seed funding from Vibrant Ventures, Pegasus Sustainable Finance, Halogen Ventures, Fifth Down Capital, SOA’s Seabird Ventures, and Alumni Ventures Group.

🔋 Moment Energy, a Canada-based startup repurposing retired EV batteries, raised $2.8m in Seed funding from Version One, Fika Ventures, Garage Capital, and MCJ Collective.

Sofinnova Partners raised $170m for its third fund dedicated to environmental impact projects.

Spring Lane Capital announced a $151m first close of its second fund focused on sustainable infrastructure.

The House voted to pass Biden’s $2.2B Build Back Better Act (otherwise known as the reconciliation bill), complete with a record setting 8 hour filibuster from Republican Kevin McCarthy. For a reminder on what’s in the $500B+ marked for climate, read our breakdown here or pore through Princeton REPEAT’s handy dandy spreadsheet. The BBB bill is onto the Senate next for their vote.

Biden submitted the Kigali Amendment, an international treaty amendment to the Montreal Protocol to curb the usage of HFCs, to the Senate. The EPA had already committed to slash HFCs by 85% over the next 15 years in line with the amendment in September.

Are oil drilling rigs climate tech now? An Australian lithium mining company proves it might be. Controlled Thermal Resources planted a $500m oil drilling rig—named Hell’s Kitchen—in a California dried up salty lake to extract lithium for batteries while also tapping into geothermal energy for power.

Mechanical and energy engineers nerded out at NET Power’s new Allam Cycle gas plant, new technology that captures and stores 100% of its CO2 emissions as it generates electricity. While a scientific achievement, Allam cycle plants still burn natural gas and would need CO2 storage, raising eyebrows at whether this would benefit the climate.

Ford is ditching Rivian, despite investing $500m in the then-start-up back in 2019. Instead Ford CEO Jim Farley wants to give their own designers a chance and plan to scale their EV production to 600,00 cars per year by 2023.

Despite all their recent climate fanfare, O&G companies Shell, BP, Chevron, and Exxon spent $192m in drilling rights on oil and gas reserves in the Gulf of Mexico during a federal auction. The tiny silver lining? Exxon snapped up $15m worth of offshore acreage for potential carbon capture projects.

When it comes to reducing carbon, Royal Dutch Shell isn’t going Dutch. To shirk their federal mandated emissions reduction target, Shell moved their headquarters to the UK.

How big will the clean energy technology market be if we meet net-zero emissions by 2050? According to the new IEA report, just as big as the $1.2T oil and gas market today.

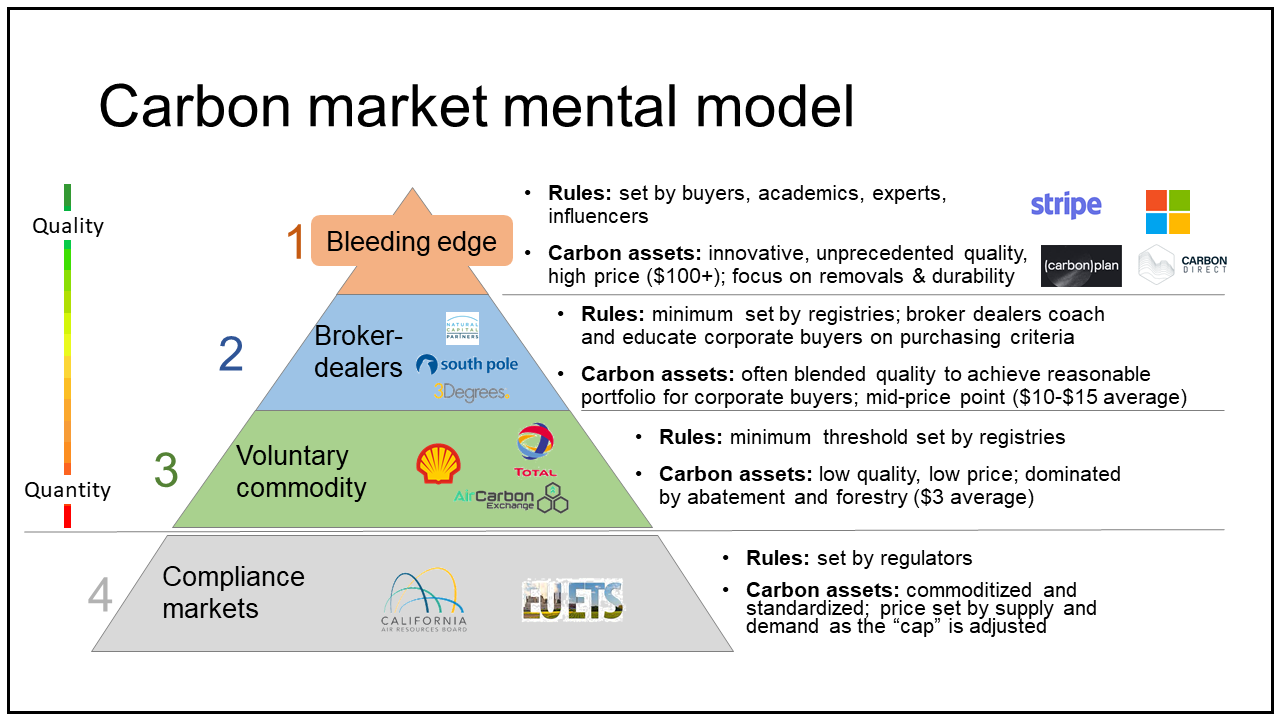

Carbonware unpacks a mental model for the booming carbon credit markets.

Economists reimagine Adam Smith’s “Wealth of Nations” to reflect a warming planet.

Are we in a $22T subprime carbon bubble? Al Gore thinks so.

1 country, 150 citizens, and a goal for 2030. Dive into Macron’s policy experiment gathering 150 randomly selected citizens to write France’s climate policy goals.

Move over COP. The US Conference of Mayors outlines how their cities are staying on the frontier edge of implementing climate x urban tech.

Check out where your state lands on achieving the UN’s Sustainable Development Goals on this ranking and map. (Spoiler: small but mighty Vermont takes 1st prize).

SPF for your 401K. Sphere and Reflection Asset Management partner up to launch the Sphere 500 Fossil-Free Index Fund (SPFFX), focused on giving 401Ks a climate option.

ESG is hitting global coffers. Sovereign wealth funds incorporating ESG jumped from 24% to 70% this year.

What’s a climate investor’s favorite wine? One that captures carbon of course! Familia Torres has pioneered a new circular method to capture and reuse CO2 from grape fermentation with massive balloons.

The author of MOVE - a book about human mobility and migration - makes the case for adaptation.

In Climate X Crypto milestones, Klima DAO has accumulated over 9M tonnes of carbon offsets worth $100M.

What if climate change was a comet? Don’t Look Up features Leonardo DiCaprio and Jennifer Lawrence debating a certain upcoming disaster. Coming to theatres Dec. 10, if you still do that kind of thing.

The new business leaders are embracing ESG - and so are the MBA programs.

💡 Activate Fellowship: Apply by Nov 30th for the paid, two-year fellowship (see our CTVC feature with Activate!) for science entrepreneurs developing climate- and carbon-tech—now available in New York, too!

💡Sustainable Accelerator Fund: Want to help fight climate change? Invest in a dedicated Climate Tech fund based in the UK with as little as £100.

🗓️ The Greenhouse Demo Day: Join Dec 1st (in-person in London) for an opportunity for early-stage investors to meet 15 exciting climate startups.

Founding Analyst @Deep Science Ventures

VP Operations & Strategy @ZZ Driggs

Strategy and Business Operations Mgr @ESS

Chief of Staff @Noon Energy

Head of Product @Gaiascope

Climate Solutions Lead @Pledge

Director of Marketing @Cloud To Street

Development Associate @Project Vesta

Test Engineer @Electric Hydrogen

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond