🌎 Taxing times for CCUS #254

OBBB blows tailwinds through CCUS, but takeoff stalls

Public markets for climate and tech correct pricing

Happy Monday!

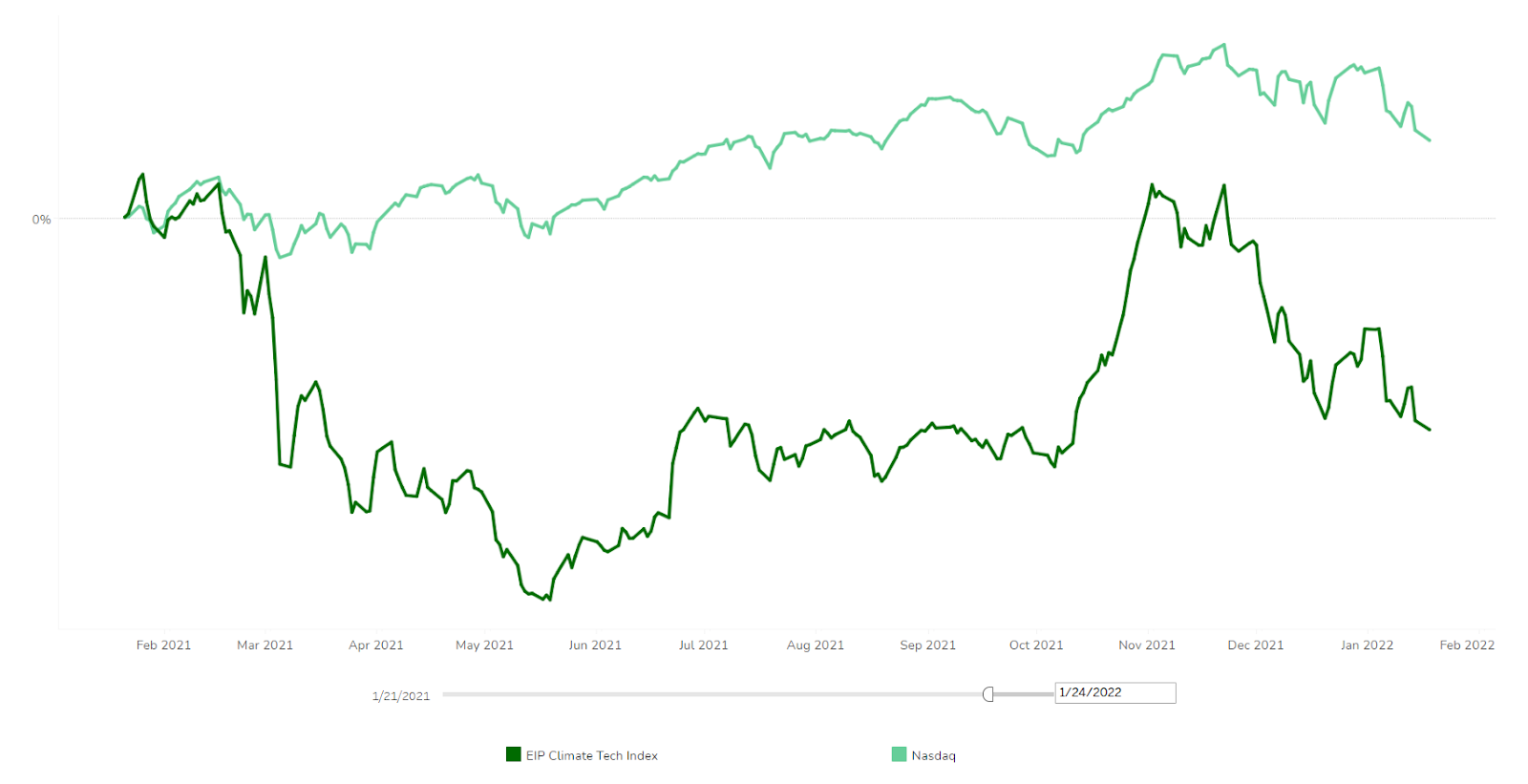

In this week’s issue, we dive into climate stocks’ dive – EIP’s Climate Tech index is down ~13% since the start of the year and ~30% since market peak last year.

While we’re optimistic that this price discipline will steel investors for the long term, the sectors’ prior infamy precedes any rational appraisal in the moment (e.g. from EVs will save us to EVs will fail us! in roughly quarterly intervals).

We also share some new battery, e-scooters, and electric rail transport fundings as well as a German home energy SPAC and two renewables IPO filings. In the news this week, the Boston Globe launches a climate desk and Europe’s securities regulator takes aim at proof-of-work crypto mining.

Plus a bevy of climate venture jobs, and stay tuned for the 2021 annual deals review later this week!

Not a subscriber yet?

As more money than ever before flows into climate tech venture (hint, hint - keep your 👀 on your Friday inbox for our 2021 annual venture review!), investor enthusiasm for the earliest stages of climate company formation has begun to diverge from a recent downturn in prices in the public clean tech market. Or, as Bloomberg put it, “clean energy stocks have been getting absolutely clobbered.”

The Energy Impact Partners’ Climate Tech Index niftily tracks the performance of public companies “primarily involved in providing technology that supports global decarbonization.” The portfolio of 37 companies is down ~13% since the start of the year and ~30% since market peak last year. The S&P Global Clean Energy index tells the same story; it’s down 8% since the start of the year and 39% since market peak. This trough marks clean energy stocks’ lowest level in 16 months.

What’s driving the dip? Everything, and all at once, as always. In particular, obstruction of Biden’s Build Back Better agenda, surging global gas prices, speculation about lower solar subsidies in California, anticipation of higher US interest rates, continued supply chain woes and semiconductor shortages, and ripple effects from investors shifting out of pandemic (tech) winners.

The result? Clean energy ETFs have hemorrhaged capital. The Goliath $5b iShares Global Clean Energy ETF shed $195m of outflows in the past month. Meanwhile $417m got pulled from Invesco Ltd.’s $2.4 billion Solar ETF in December, for the dishonorable title of the worst month in the fund’s nearly 14-year history.

Before everyone gets excessively twitterpated, this is a public markets pricing correction, not a bursting sectoral bubble. We’ve written liberally before about floods of fresh ESG capital pouring into embryonic climate sub-markets with obvious impact, but non-obvious size (see: EVs). Those excessive valuations are recorrecting.

As we watch stocks shake, it’s a good time to reflect on the interconnectedness of the public and private markets and some ways how the public clean energy market downturn could affect climate tech venture investing:

📈 Exit outlook. Startup valuations are priced in part on comparisons to similar public companies. Poor clean tech prices today could influence how much private markets are willing to pay for equity. But the public clean tech vs early-stage climate cohorts have long been apples to oranges. There are few relevant public co benchmarks for the current cohort of climate tech cos which skew more interdisciplinary and towards software.

🧘 Investor patience. The public market downturn and poor reception to recent clean tech SPACs could incentivize companies to hold out and stay private longer. Private investors would need to remain patient, which is easier to do for funds structured for climate-aligned longer return horizons (e.g. 15 years vs traditional 10 years)

⚠️ Fairweather fleeing. The newest holdings are often the first to go. In a flight to shore up risks, climate tech might be abandoned. This sector does not reward fairweather tourists, the value will accrue to those who hold through the full market transformation.

🔋 Factorial Energy, a Woburn, MA-based producer of solid-state batteries, raised $200m in Series D funding from Mercedes and Stellantis.

🛴 Ather Energy, an India-based maker of electric scooters, raised $57m in funding from Hero MotoCorp.

🚆 Parallel Systems, a Culver City, CA-based autonomous battery-electric rail vehicle startup, raised $50m in Series A funding from Anthos Capital, Congruent Ventures, Riot Ventures, Embark Ventures, and others.

🚗 Fermata Energy, a Charlottesville, VA-based vehicle-to-everything technology services provider, raised $40m in funding from Carlyle Strategic Investors, Verizon Ventures, Skyview Ventures, I Squared Capital, and ClearSky.

☀️ Colossus, a Boston, MA-based solar software and marketplace model startup, raised $36m in Series A funding from BuildGroup, Capital Creek, RTP Global, CEAS, and Poplar Ventures.

🔥 Exergyn, an Ireland-based provider of solid-state technology for thermal management, raised $34m in Series A funding from Mercuria, Lacerta Partners, and McWin.

🧊 Submer, a Spain-based provider of data center cooling solutions, raised $34m in funding from Planet First Partners, Norrsken VC, Alma Mundi Ventures, and others.

🌱 Vertical Future, a UK-based vertical farming startup, raised $28.5m in Series A funding from Pula Investments, Gregory Nasmyth, Nickleby Capital, Dyfan Investment, and SFC Capital.

⚡ Ineratec GmbH, a Germany-based producer of sustainable e-kerosene made from carbon dioxide and green hydrogen, raised $23m in a Series A funding from High-Tech Gruenderfonds, Extantia Capital, FO Holding, Planet A, Engie SA, Safran SA, and MPC.

💨 Seurat Technologies, a Wilmington, MA-based 3D metal printing startup focused on decarbonizing manufacturing, raised $21m in Series B funding from Xerox Ventures, SIP Global Partners, Capricorn’s Technology Impact Fund, True Ventures, Porsche, and Maniv Mobility.

💸 Doconomy, a Sweden-based climate impact-focused credit card startup, raised $19m in funding from CommerzVentures, Ingka Group, Citi Ventures, Mastercard, and Ålandsbanken.

⚡ Monta, a Denmark-based EV charging startup, raised $17m in Series A funding from Creandum and Headline.

⚡ Ionomr Innovations, a Canada-based developer of ion-exchange membranes, raised $15m in Series A funding from Shell Ventures, Finindus, Chevron Technology Ventures, NGIF Cleantech Ventures, and Pallasite Ventures.

🥩 IntegriCulture, a Japan-based cell-based meat startup, raised $7.4m in Series A funding from AgFunder, Beyond Next Ventures, Hiroshima Venture Capital, NH Foods, Real Tech Fund, VU Venture Partners, and others.

🔥 Heaten, a Norway-based developer of a high-temperature heat pump for industrial use, raised $6.8m in funding from Azolla Ventures, Nysnø, and Shell Ventures.

⚡ Ostrom, a Germany-based renewable energy service platform, raised $5m in Seed funding from 468 Capital, J12 Ventures, Global Founders Capital, Übermorgen Ventures, and angel investors.

🌱 Aigen, a Kirkland, WA-based solar-powered robotics platform for soil regeneration, raised $4m in Seed funding from NEA, AgFunder, Global Founders Capital and ReGen Ventures.

⚡ Supercritical Solutions, a UK-based electrolyzer developer for producing low-cost hydrogen, raised $3.6m in Seed funding from Jericho Energy Ventures, Lowercarbon Capital, and New Energy Technology.

🚗 Selex Motors, a Vietnam-based manufacturer of smart electric motorcycles, raised $2.1m in Seed funding from Touchstone Partners, ADB Ventures, and Nextrans.

⚡ SoHHytec, a Switzerland-based green hydrogen production startup, raised $2m in Seed funding from the Fund for Sustainability and Energy.

🌱 Rebundle, a St. Louis, MI-based creator of plant-based hair extensions, raised $1.4m in a pre-Seed funding round from Evergreen Climate Innovations, RareBreed Ventures, M25, Closed Loop Ventures, Sku’d Ventures, Arch Grants, Chicago Early, Big Delta Capital, Precursor Ventures, and Innocreative Capital.

☔ Komunidad, a Philippines-based environmental risk platform, raised $1m in Seed funding from Wavemaker Partners and ADB Ventures.

✈️ Electra.aero, a Falls Church, VA-based hybrid-electric plane startup whose vehicles require very short takeoff and landing distances, raised an undisclosed amount of Series A funding from Lockheed Martin Ventures.

Energy Impact Partners announced the launch of its Deep Decarbonization Frontier Fund targeting $350m for early-stage, revolutionary technologies that accelerate the transition to net-zero greenhouse gas emissions. We spoke with Shayle Kann about the new fund’s 5-part investment thesis in Friday’s feature.

German smart home energy company Tado is going public via merger with SPAC GFJ ESG Acquisition at an implied $514m valuation.

New York-based owner and operator of energy storage and renewables generation assets REV Renewables filed for an IPO.

New York-based renewable energy producer DESRI filed for an IPO.

The vice-chair of the European Securities and Markets Authority called for a ban on proof of work crypto mining, arguing that bitcoin has redirected renewable energy away from critical carbon-intensive sectors. Meanwhile in the US, the House Energy & Commerce Committee held an oversight hearing on the energy impacts of cryptocurrency. Bitcoin mining, which accounts for 0.6% of the world’s energy consumption, has already been banned in China.

In addition to California’s Governor Newsom announcing billions to support increasingly common wildfires, the US Government plans to allocate $50b to tackle forest management—focusing on lives saved rather than acres saved. This focus could jeopardize carbon offset projects, specifically if the federal government can invoke eminent domain to reclaim fire-prone land.

After facing investor pressure last May to strengthen its energy transition strategy, ExxonMobil committed to achieve net-zero emissions by 2050. However, this commitment excludes Exxon’s non-operated assets and Scope 3 emissions, which account for 80% of the company’s footprint. Shell, bp, Equinor, and a number of other oil majors have set Scope 3 targets.

Citi released 2030 financed emissions benchmarks for the energy and power sectors, targeting absolute emissions reduction for its energy loans. Like BlackRock CEO Larry Fink, Citi acknowledged the climate risks associated with oil and gas divestment. Citi is now the fourth US bank - following JPMorgan, Morgan Stanley, and Goldman Sachs - to set 2030 targets, though more work can be done to drive net zero banking.

Even the world’s largest battery maker struggles to meet the ever-growing market demand. While CATL produced a record-breaking 120GWh of battery capacity, the battery manufacturer seeks to raise even more capital from Chinese investors to scale operations. Reports estimate that RMB¥89b ($14b) will close CATL’s whopping 430GWh battery demand gap by 2025.

“Now, RJ, where are our vans?!” Amazon’s demand for electric delivery vehicles outpaces supply.

Canary Media will host one of the nerdiest—and contentious—energy policy debates on rooftop solar policy in California, NEM 3.0.

Norco, a new point-and-click digital adventure, puts gamers on the frontlines of climate change.

Join this twitter thread and give heat pumps a sexier name.

Fire up the presses. The Boston Globe has launched a full-time climate desk and page.

TED Talks Daily and How to Save a Planet highlight how indigenous land management practices support carbon removal.

RIP Tree 103. After almost 350 years, New York’s tallest known tree has fallen.

Volta Foundation releases its 2021 Battery Report, offering a comprehensive summary of battery technology, policy, and market trends.

Watch how US renewables and batteries exploded in the last 20 years.

Norway leads the charge, with EVs accounting for 2/3 of new cars sold in 2021.

Why the price of lumber may be a “climate price.”

EV startup Rivian and Under Canvas - an upscale camping company - deploy open access charging at outdoor resorts in Utah.

Waste not want not. Israeli artist Beverly Barkat uses plastic pollution to create a 13-ft wide globe for the lobby of the World Trade Center.

On the road to net zero, car companies pour millions into EV advertising.

Cattle-izing deforestation. How the beef industry has decimated the Amazon rainforest.

🗓️ Paving the Way for Climate Entrepreneurship: Join Climate-KIC on Jan 27th as they celebrate their entrepreneurship programs by sharing information, insights, best practices and future prospects for 2022.

🗓️ Plugging In To Federal Clean Energy Innovation Programs: Join virtually on Feb 14th to hear about the ways that American clean energy businesses are plugging in to federal programs to support the development and commercialization of new technologies.

💡 Delta Clime VT: Apply by Jan 31st to be part of a diverse cohort of startups that reduce emissions by enabling the acceleration of electrification and be eligible for a $25k prize for being the top venture.

💡 Keeling Curve Prize: Apply by Feb 10th for a chance to win $25k alongside 10 other projects with a proven track record of reducing, avoiding, or eliminating greenhouse gasses.

Investment Associate @Azolla Ventures

Finance & Operations Associate / Manager @Azolla Ventures

Associate @Purpose Venture Group

Associate, Natural Climate Solutions @Just Climate

Editorial Assistant @Important, Not Important

Biz Dev Director, Green Finance @ClimateView

Investor in Residence @Elemental Excelerator

Manager @Urban Future Labs

Founding Engineer / Senior Front End Engineer @Greenwork

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

OBBB blows tailwinds through CCUS, but takeoff stalls

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook