🌎 Taxing times for CCUS #254

OBBB blows tailwinds through CCUS, but takeoff stalls

BNEF reports $900B for climate tech deployment, McKinsey says we have another $8.1T to go

Happy Monday!

In lockstep with our CTVC 2021 recap, BloombergNEF reports $900b invested last year across PE, project finance and a few additional climate segments. So while pouring $40b into climate venture last year felt like a whirlwind, VC is but a tiny slice of the pie.

To hit net zero by 2050, McK’s initial projections expect $9T annually as the minimum so we’ve still got some ways to go to help avoid planetary collapse (even though it’s exciting to see the rate of investment tick up).

In the news this week, the California senate passed a law requiring companies to report GHG emissions and Arizona’s utility blocks a clean energy transition after 5 years of ongoing debate.

In fundings, Plenty raises $400m for vertical farming and Kula Bio (sustainable fertilizer) and Sylvera (carbon offset ratings) raise $50m and $33m respectively.

Thanks for reading!

Not a subscriber yet?

The transition to net zero isn’t going to come cheap. Fortunately, the climate tech investment pie is rapidly growing to smooth out our path to full decarbonization.

Last Friday, we reported that venture capital investment in climate tech injected $40bn into more than 600 deals in 2021 (by diligently tracking >900 deals and 1,700 unique investors). But before we pat ourselves on the back, we recognize that venture makes up only a small slice of the investment pie. To avoid a climate catastrophe, we need to look outside of venture towards the full stack of climate tech financing options.

Several reports have come out in the past weeks, including our own, framing the fast-paced climate investing market.

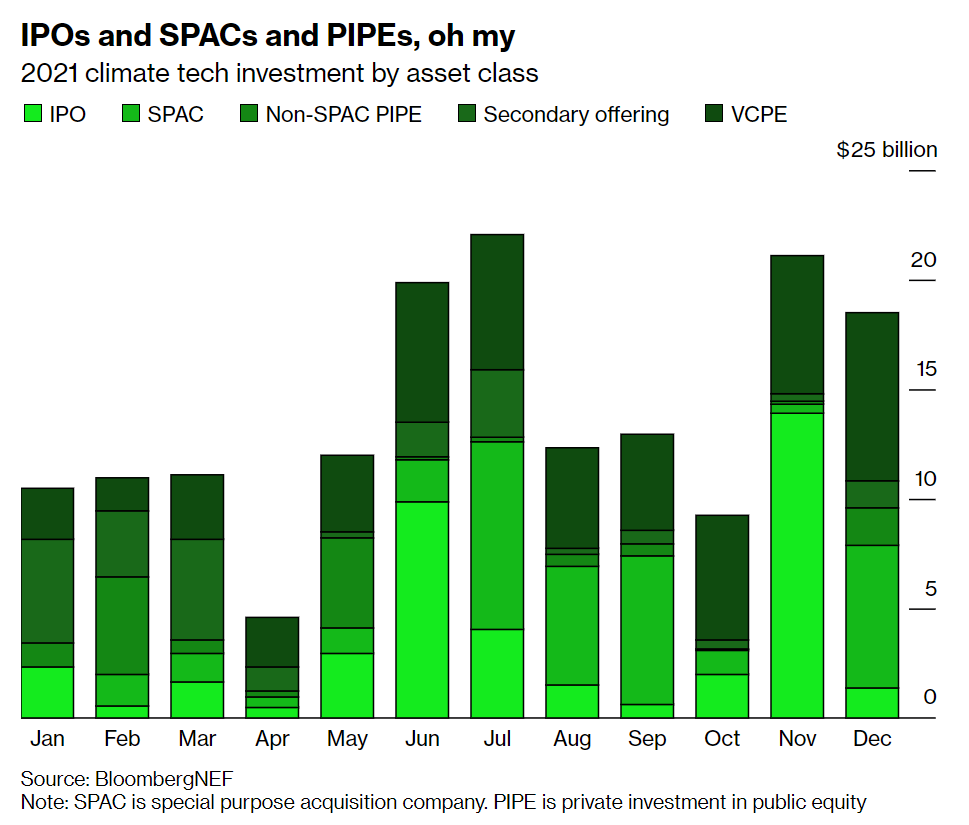

BloombergNEF reported that in 2021 a whopping $900 billion of deployment capital was put to work constructing the energy transition and climate tech technologies like renewable energy, energy storage, EVs, hydrogen, nuclear, and carbon capture. Not too far behind, climate innovation funding reached $165B to develop the next wave of climate tech unicorns, with $54B coming from VC/ PE (where our $40B of venture capital fits nicely into).

PwC’s State of Climate Tech 2021 tracked climate tech investment across VC/ PE amounting to $60bn to 600 in H1 2021 – with the vast majority of investment dollars funneling into “mobility and transport,” “food, agriculture, and land use,” and “industry, manufacturing and resource management.” PwC’s report captures a wider view of the innovation investment pie including late-stage capital levers like private equity and government funds.

McKinsey’s latest estimate puts the road to net zero at $9T per year between 2021 and 2050 (10x where we are today!). So while last year’s reported values may vary slightly, the message is clear: we need an all the above option - and even though the pie is bigger we need to grow it even more.

🌱 Plenty, a San Francisco, CA-based indoor vertical farming technology company, raised $400m in Series E funding from One Madison Group, JS Capital, Walmart, and SoftBank.

🚲 Cowboy, a Belgium-based e-bike manufacturer, raised $80m in Series C funding from Exor, HCVC, Siam Capital, Tiger Global, Index Ventures, Eothen, Isomer Opportunities Fund, Future Positive Capital, and Triple Point Capital.

⚡ H2Pro, an Israel-based hydrogen production technology, raised $75m in funding from Breakthrough Energy Ventures, ArcelorMittal, Temasek, Horizons Ventures, and Yara.

🦠 Kula Bio, a Boston, MA-based company focused on sustainable nitrogen fertilizers, raised $50m in Series A funding from Lowercarbon Capital, Collaborative Fund, Grantham Environmental Trust’s Neglected Climate Opportunities Fund, iSelect Fund, Pillar VC, Embark Ventures, and BOPU. [Disclaimer: Sophie helped to found Kula Bio]

⚡ Skeleton Technologies, an Estonia-based manufacturer of high energy and power density ultracapacitors, raised $42m in Series D funding from Wise’s Taavet Hinrikus, Nidoco AB, EIT InnoEnergy, and others.

💨 Sylvera, a UK-based carbon offset ratings provider, raised $32.6m in Series A funding from Index Ventures, Insight Partners, Salesforce Ventures, and LocalGlobe.

🔋 Addionics, a CUK-based EV battery technology company, raised $27m in Series A funding from Deep Insight, Insight Partners, Catalyst Fund, Delek Motors, Dr. Boaz Schwartz, Novelis, Magna International, JX Nippon Mining & Metals, and Union Tech Ventures.

💧 Orbital Systems, a Sweden-based developer of water recycling technology for domestic appliances, raised $23m in funding from K2A, M2 Asset Management, Stena, Polar Growth, Vatio, and others.

🐝 Beewise, an Israel-based AI-run beehive management solutions startup, raised $10m in Series A funding from Fortissimo, lool Ventures, Atooro Fund, Arc Impact, and others.

🛍️ Archive, a San Francisco, CA-based startup helping integrate resale marketplace brands, raised $8m in funding from Lightspeed Venture Partners, Bain Capital Ventures, Firstmark and a number of angel investors.

💨 ClimateTrade, a Spain-based blockchain-enabled marketplace financing certified carbon offsetting and climate-regenerative projects, raised $7.8m in pre-Series A funding from Conexo Ventures, ClearSky, Borderless Capital, SIX FinTech Ventures, SIX Group, Wayra, Omron Ventures, Amasia, and Zubi Capital.

🥩 Black Sheep Foods, a San Francisco, CA-based maker of plant-based lamb alternatives, raised $5.25m in Seed funding from AgFunder, Bessemer Venture Partners, New Crop Capital, Siddhi Capital, and others.

♻️ Green Li-ion, a Singapore-based battery recycling tech company, raised $5.2m in Series A funding from Energy Revolution Ventures.

☀️ Bodhi, an Austin, TX-based solar-focused software technology company, raised $4m in funding from Clean Energy Ventures.

🚌 BasiGo, a Kenya-based maker of electric buses, raised $1m in pre-Seed funding from Climate Capital and Third Derivative.

🚗 Oben Electric, an India-based EV startup, raised $1m in funding from angel investors.

⚡ GPS Renewables, an India-based waste to energy tech company, raised an undisclosed amount in funding from Neev II Fund.

EV battery maker LG Energy Solution went public, becoming South Korea’s second most valuable firm in IPO with a valuation of $59b.

Blackstone announced the launch of Blackstone Credit’s Sustainable Resources Platform, which will focus on investing in and lending to renewable energy companies and those supporting the energy transition.

California state senators passed a law requiring companies to disclose annual greenhouse gas emissions. Once the governor and assembly approves the Climate Corporate Accountability Act, companies generating over $1b in revenue will report GHG emissions in all three scopes: direct, emissions through purchasing and electric supply, and downstream indirect emissions. Meanwhile, the Chinese Government jailed 47 steel executives for faking emissions data.

Arizona’s electric utility regulators blocked a 100% clean energy proposal after previously agreeing to it and nearly 5 years of debate. The regulators voted 3-2 against the rules package that included a timeline for 100% carbon-free generation and expansion of utility energy efficiency programs. The three commissioners against the package believed the utilities are “sincere in their commitments to clean energy” and used a common Republican trope—citing how clean energy would “drive up costs”.

Natural gas markets almost triggered flashbacks to the Texas freeze a year ago when US natural gas futures spiked last week due to tight gas trading and heating demand increase ahead of the cold snap in eastern and central US. Gas traders noted that this was a classic commodity short squeeze but noted that there was no reason for the 72% increased price spike with gas storages only 1% below normal.

One of the last large automakers, Renault Nissan Mitsubishi Alliance, announced a $25.7b investment over 5 years to design and build 35 EVs by 2030, playing catch up on the rest of the auto industry.

After visiting dilapidated schools affected by pollution in Mississippi, EPA administrator, Micahel Regan, pledged to step up efforts to “do better” to help disadvantaged communities struggling with polluted air and water. The EPA announced increases in random visits to polluting industries, visits that halted during the Trump administration citing pandemic related challenges.

A federal judge invalidated 80 million acres of oil drilling leases issued by the Biden administration—stating that the administration acted “arbitrarily and capriciously”. Instead of updating an environmental study, performed during the Trump administration, the Biden administration simply repurposed the study without any changes.

Hell’s kitchen. Americans’ gas stoves are warming the planet and worsening public health.

Low-income consumers buy cheaper, inefficient light bulbs and get higher lifetime costs.

“The next 1,000 unicorns [will] be…startups that help the world decarbonize and make the energy transition affordable,” wrote BlackRock CEO Larry Fink in his annual letter.

Uncut gem. Check out Robert Höglund’s list of carbon removal buyers, including Microsoft and Stripe.

BloombergNEF releases its 2022 Energy Transition Investment Trends report.

Dividends may not help carbon taxes cross the political finish line.

Phyconomy’s State of the Seaweed Industry report highlights growing investor interest in the climate benefits of seaweed.

ChargerHelp! and BlocPower team up to train workers in electric vehicle charging.

Are avocados… toast? How climate change is impacting avocado, coffee, and cashew farmers.

This interactive guide explains how we might think about the costs of scaling carbon removal.

These steps could help climate-vulnerable countries scale investment in disaster-risk management tech.

Bill Nye and the importance of climate change communications.

No Timothée, no problem. Can tech save the UAE from encroaching dunes?

🗓️ Both Sides of the Coin: Join Greentown Labs on Feb 3rd in their Investor Speakers Series which will feature two climate tech founders and their investors as they discuss the journey thus far and plans for the future.

🗓️ Carbon13 Climate Entrepreneurship: Join Carbon13’s webinar on Feb 7th to listen alongside other climate tech entrepreneurs who are eager to learn about developing and scaling their innovations.

🗓️ Browning the Green Space: Partake virtually on Feb 17th in critical conversations addressing the racial disparity which exists for POC-owned businesses and the lack of contracts received and discuss supplier diversity and energy efficiency for communities of color.

💡 The Diamond List: Apply by Feb 6th to become a nominator of climate tech companies to Diamond List’s 2022 round of “hidden gem” startups.

💡 EDICT Internship: Students from traditionally excluded background should apply by Feb 6th to Elemental Excelerator’s 10-week internship program if passionate and interested in gaining work experience in climate.

💡 Keeling Curve Prize: Apply by Feb 10th to win $25k towards your carbon drawdown or emissions reduction initiative to bend the GHG curve back down.

There's never been a better time to... apply for a climate tech investor job! 🌍📈👩💼

— Sophie Purdom (@SophiePurdom) January 24, 2022

🧵 of open VC roles on the @climatetech_vc jobs board right now 👇

Founding Engineer / Senior Front End Engineer @Greenwork

Investor @G2 Venture Partners

Senior Associate Dean & Chief Operating Officer @Stanford Climate School

Product Manager, Technology & Tools @Third Derivative

Economics Associate @Nature's Fynd

Biz Dev Manager @Terra.do

Biz Dev Director @ClimateView

Finance & Operations Associate / Manager @Azolla Ventures

Investment Associate @Azolla Ventures

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

OBBB blows tailwinds through CCUS, but takeoff stalls

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook