🌎 Overheard at LCAW #252

Climate, capital, and carrots in London's new playbook

Watershed enters the 43-strong climate tech unicorn herd

Happy Monday!

The morning after the Super Bowl, we touch down with a quick draft of climate tech companies joining the unicorn team. Turns out, more (and younger) climate unicorns accelerating has been the recent trend (with many caveats across geography, SPACmania, et. al).

PS if you missed our favorite part of the Super Bowl - the ads - here’s one we liked featuring a fully electric Chevy Silverado. Stay tuned for the epilog where the Soprano mob gets into geothermal drilling driven by (very real) new therapy trends.

This week’s deals include KoBold Metals using AI to find battery metals, new unicorn Watershed in carbon accounting, and Protix in insect-based animal feed. In the news, the infrastructure bill looks towards $5b in EV charging spend, an Undersecretary of Infrastructure, and a plan for the Army to go net zero by 2050.

Thanks for reading!

Not a subscriber yet?

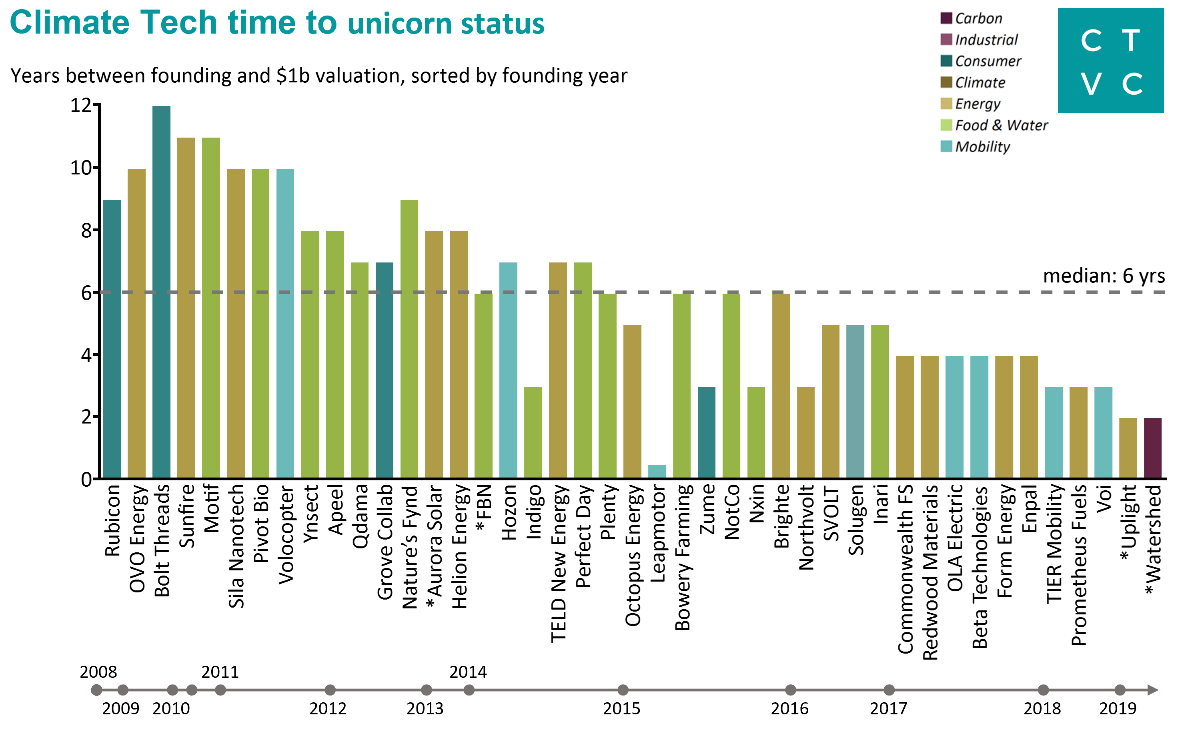

Last week, golden child climate tech co, Watershed, raised a $70m Series B round that valued the 3 year old carbon emissions measurement & management company at a billion dollars. Which got us thinking, how many other climate tech companies are on team unicorn?

[A quick history lesson: In 2013, VC investor Aileen Lee coined the term “unicorn” which has now been defined to describe privately-held companies valued at $1 billion or more.]

There are now 43 (currently) private, $1b+ climate tech companies in the unicorn club:

🦄 Climate tech is a rare but growing breed of unicorns. Of the 1,000 Unicorns today, the 43 in climate tech make up 4.3% of the overall herd (compare that to fintech’s share of ~20% or internet software’s ~18% piece of the pie). But zoom in on last year and you can see the rate of climate unicorn births have dramatically increased. 29 climate tech cos achieved unicorn status in 2021, making up 60%+ of all-time climate unicorns and ~6% of overall new unicorns that year. Big climate tech valuations were so hot in 2021 that they even outpaced the general market, with a 625% growth rate of newly minted climate tech unicorns compared to the industry benchmark growth of 287%.

⏰ Younger climate tech cos are accelerating to unicorns much faster. Not only has the number of climate tech unicorns been rapidly expanding, but the age of new unicorns is compressing. Almost 60% of the climate tech unicorns in 2021 reached the coveted $1B status in less than 7 years, the industry baseline for # yrs to reach unicorn status. Startups founded after 2017 all consistently grew into unicorns in 4 or less years, notably making up ~40% of the prominent 2021 climate tech unicorn cohort. While high valuations for climate unicorns signal a white hot market, they also bear contrast to the (under)performance of new public climate tech cos via SPAC which have mostly trended below the $10 price baseline to date. Softening public markets and a less appealing SPAC offramp will likely incentivize hot climate tech cos to stay private for longer and generate more unicorns.

💨 Watershed brings more software + carbon to the climate tech mix. Despite venture’s penchant towards software as a service, climate tech has strayed more towards hardware over the years. Watershed’s latest $70m Series B funding puts carbon B2B software on the map and potentially foreshadows other upstart carbon and software plays entering the unicorn ring. But both software and hardware will be critical to deep decarbonization, with “software to guide company strategy and capital deployment, and hardware to build the chemical and physical infrastructure needed to change today’s industries” as Nat Bullard so eloquently put.

⚡ 🇺🇸 Climate tech unicorns concentrated in the highest emitting sectors and geographies. Similar to the distribution of climate tech venture capital in 2021, more than 80% of climate unicorns fall into the three major categories of energy (35%), food & ag (33%), and mobility (16%). Climate unicorns are also homegrown in geographies which take up the largest slices of the emissions pie, with 95% of unicorns coming from the US (60%), Europe (21%), and China (14%).

⛏️ KoBold Metals, a Berkley, CA-based startup using AI to find metals used for EV batteries, raised $192.5m in Series B funding from T. Rowe Price, CPP Investments, BOND, Standard Investments, BHP Ventures, Mitsubishi Corporation, Apollo Projects, and Cleo Capital.

💨 Watershed, a San Francisco, CA-based platform helping companies track and reduce their carbon emissions, raised $70m in Series B funding from Kleiner Perkins and Sequoia.

🌱 Protix, a Netherlands-based insect-based animal feed company, raised $57.1m in funding from the European Circular Bioeconomy Fund, BNP Paribas, the Prince Albert II Foundation, The Good Investors, Aqua-Spark, Rabo Investments, and Invest-NL.

⚡ Quaise Energy, a Cambridge, MA-based supercritical geothermal drilling startup, raised $40m in Series A funding from Safar Partners, Prelude Ventures, Fine Structure Ventures, The Engine, Collaborative Fund, Nabors Energy Transition Ventures, and others.

🔋 Instagrid, a Germany-based portable battery storage startup, raised $33m in Series B funding from Energy Impact Partners, SET Ventures, Segnalita Ventures, blueworld.group, Hightech Gründerfonds, and Wille Finance AG.

✈️ Destinus, a Switzerland-based developer of liquid hydrogen-powered aircrafts, raised $29m in Seed funding from Conny & Co, Quiet Capital, One Way Ventures, Liquid2 Ventures, Cathexis Ventures, and ACE & Co.

⚡ Utilidata, a Providence, RI-based grid-edge software startup, raised $26.75m in funding from Moore Strategic Ventures, Microsoft Climate Innovation Fund, NVIDIA, Keyframe Capital, Braemar Energy Ventures, and MUUS Asset Management.

⚡ Verdagy, a Moss Landing, CA-based green hydrogen developer, raised $25m in Series A funding from TDK Ventures, Orbia Ventures, BHP Ventures, Doral Energy Tech Ventures, Khosla Ventures, Shell Ventures, and Temasek.

⚡ Rondo Energy, an Oakland, CA-based startup focused on decarbonizing industrial heat, raised $22m in Series A funding from Breakthrough Energy Ventures and Energy Impact Partners.

☔ kWh Analytics, a San Francisco, CA-based climate insurance startup tailoring insurance policies for renewable energy installations, raised $20m in a Series B funding from undisclosed investors.

💧 Elicit Plant, a France-based agtech company focused on reducing the water consumption of crops, raised $18.2m in Series A funding from Sofinnova Partners, ECBF, Bpifrance, the Aquiti Gestion-NACO fund, and Credit-Agricole Charente Perigord Expansion.

🔋 Chilye, a China-based startup developing high-voltage battery systems for EVs, raised $15.7m in Series C funding from Xiaomi, Yonghua Capital, and Oriza Holdings.

☔ FloodFlash, a London-based flood insurance technology company raised $15m in Series A funding from Buoyant Ventures, Munich Re Ventures, Sony Financial Ventures/Global Brain, MS&AD Ventures, PropTech1, Pentech, Local Globe, and Insurtech Gateway.

✈️ Odys Aviation, a California-based startup making hybrid-electric vertical takeoff and landing (VTOL) aircrafts, raised $12.4m in Seed funding from Giant Ventures, Soma Capital, 11.2 Capital, and Countdown Capital.

⚡ Allumia, a Seattle, WA-based energy efficiency startup, raised $7.5m in Series A2 funding from JW Asset Management, American Electric Power, and Duke Investments.

🌱 eAgronom, an Estonia-based farm management platform focused on carbon credits, raised $7.4m in Series A funding from Yolo Investments and ZGI Capital.

🛥️ Navier, a San Francisco, CA-based startup developing electric speedboats at relatively affordable prices raised $7.2m in Seed funding from Global Founders Capital, Treble, Next View Ventures, Liquid2 Ventures, Soma Capital, Precursor Ventures, and others.

🚗 Altigreen Propulsion Labs, an India-based EV startup, raised $6.7m in Series A funding from a subsidiary of Reliance Industries Ltd.

☔ FloodMapp, an Australia-based flood forecast startup, raised $6m in Seed funding from Union Square Ventures, Mundi Ventures, Climate X, and Jelix Ventures.

🌱 Harpe Bioherbicide Solutions, a Raleigh, NC-based sustainable weed-management solutions startup, raised over $3m in funding from Alexandria Venture Investments, iSelect Fund Management, and AgriTech Capital.

🌱 FortePhest, an Israel-based biotech startup focused on crop protection, raised an undisclosed amount in Series B funding from BASF Venture Capital and Orbia Ventures.

☀️ Sunstone Credit, a Baltimore, MD-based tech-enabled solar loan finance platform for businesses, raised an undisclosed amount in Seed funding from Forbright Bank, Cross River Digital Ventures, Grotech Ventures, Early Light Ventures, and the University System of Maryland Momentum Fund.

Bay Bridge Ventures launched an institutional ESG and Sustainability-focused fund, looking to support companies in climate tech, health innovation, and inclusive capitalism.

The US government has been keeping busy on climate since passing the Bipartisan Infrastructure Law. Here are some highlights on announcements, investment, deployment, and action this week.

⚡ With Bipartisan Infrastructure Law funds for US DOE, the department establishes an Undersecretary of Infrastructure position to figure out how to spend $62b. Responsible for commercializing American energy technology, the position wields power over departments like Jigar’s Loans Programs Office, Clean Energy Demonstrations, and Energy Security—but this power also comes with this crazy org chart…

🚗 Biden administration calls for $5 billion network of electric vehicle chargers.

🎖️ US Army releases a climate plan to reach net-zero greenhouse gas emissions by 2050. The Army plans to electrify vehicles, modernize operational power generation, beef up supply chain resilience, and even perform land management.

⛏️US coal communities receives historic $11B dispersed over 15 years to clean up abandoned mines. States and tribes will be able to apply in the coming weeks for the first tranche of $725m dedicated to cleaning up toxic abandoned coal mines (and turning them into lavender fields?).

☢️The US government revealed its multifaceted nuclear strategy—preserve, invest, and deploy nuclear. The DOE carves out $6b to support existing nuclear plants to continue operations, while Jigar’s LPO continues fuding new nukes and a federally-owned utility creates a new nuclear program. In deployment, the DOD will build a micro-reactor to power an Air Force base in Alaska.

🌾 The US Agriculture Department will invest $1 billion in pilot projects to edge closer to its net-zero greenhouse gas emissions reduction goal by 2050. Funding will go to qualified projects that reduce methane from livestock, capture and store carbon through regenerative farming, and decarbonizing food supply chains.

After the EU's new “green” label on nuclear, French Prime Minister, Emmanuel Macron, unveiled his plan to build 6 new nuclear plants, announcing a “renaissance” for the nuclear industry in France. Nuclear generates for 70% of the country’s electricity, but repairs and retirements risk continued zero-carbon electricity generation. This decision comes as European scientists say they have made a major breakthrough on their path to developing practical nuclear fusion.

More than 20 orgs, including ClimateWorks, Capricorn, Microsoft, EY, and Skoll Foundation, are leading the Carbon Call to develop an interoperable carbon emissions accounting system, making it easier for companies to benchmark, compare, and share their footprint data.

The NewEconomy Institute partnered with Carbon Market Watch and released a report detailing how 25 of the largest companies account for 5% of global GHGs in 2020. Of the 25 Corporations, 13 companies—like Amazon, Google, Apple, Vodafone, IKEA, or Maersk— have emissions reduction targets for their full value chain.

Form Energy is bringing its iron air battery to the big investor-owned utility leagues, announcing a partnership with Georgia Power to deploy a 15MW 100-hr duration battery at a price of less than $20/kWh.

Bronzeville - one of Chicago’s storied black communities - launches the country’s first neighborhood microgrid.

NYC’s East Side Coastal Resilience project raises questions on environmental justice in climate adaptation planning.

And the winner is…EVs appear front and center at Europe’s 2022 car of the year awards.

Highway to hell. More infrastructure funding could mean more highways and more emissions.

Carbon wrangler Dr. Julio Friedmann joins carbon management startup Carbon Direct.

As “dodgy” carbon offsets abound, offset disclosure becomes critical. Carbonplan offers some recommendations.

Bang for the buck. New study finds that Biden’s proposed clean energy tax credits could be one of the most cost-effective climate policies in US history.

Big air (pollution). As top skiers soar alongside smokestacks, CarbonBrief unpacks this year’s “100% green” Winter Olympics.

Green giving. Chan Zuckerberg Initiative pledges $44 million for climate tech, while philanthropists support research on Ocean Alkalinity Enhancement.

How to make climate change “un-depressing”? Check out these two rising artists.

💡 Low-Carbon Hydrogen Accelerator: Apply by Feb 16th to become a member of Greentown Labs’ first-of-its-kind cohort of founders enabling a low-carbon hydrogen economy.

💡 Ocean Visions Research Award: Apply with a research proposal by Feb 25th that assesses the conditions under which Ocean Alkalinity Enhancement (OAE) methods can can safely sequester CO2 at scale.

💡 Respond 2022: Apply by Feb 27th to a 6-month accelerator program for startups devoted to enhancing a regenerative economy and enjoy the benefits of coaching, leadership programs, and an expansive international network.

💡 Aspen Climate Cohort: Apply by Feb 28th to Aspen Institute’s 10-week, paid program that helps bring climate solutions to life through the utilization of policy and receive an $18k stipend to enable full-time participation.

🗓️ EnergyTech Collegiate Competition: Join virtually or in-person in Houston, TX on Feb 24th to watch the first round of presentations from EnergyTech University Prize’s high-potential energy technologies.

Content & Community Manager @Wireframe Ventures

Expert Network Community Manager @OnePointFive

Business Development Manager @Terra.do

Head of Growth Marketing @Patch Technologies

Account Executive @Regrow Ag

Associate, Research & Innovation @EIP

Founding Mechanical Engineer @Seabound

Mechanical R&D Engineer @Carbo Culture

Head of Electrical Engineering @Aigen

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond

Groundbreaking results from the geothermal developer’s main project