🌎 Overheard at LCAW #252

Climate, capital, and carrots in London's new playbook

Private climate commitments rally as public ones falter

Happy Monday!

As $TSLA surges past $900/share, private commitments across sectors and bold climate investing predictions take center stage away from a Halloween-edition COP26 where countries big (US, China) and small (developing nations) try to dress up the fact that promises are faltering five years from that COP21 time in Paris.

In pre-event festivities, Saudi Arabia commits to net zero by 2060 (within its borders, not export) and UK and Australia shoot for 2050. Larry Fink’s blueprint for rich countries to commit $100b to support poorer nations’ climate ambitions takes off, and 29 of the worlds’ largest pension funds and investment managers commit to a 25% cut in their portfolio’s emissions.

Thanks for reading!

Not a subscriber yet?

Source: Council on Foreign Relations

The long-awaited COP26 is right around the corner, bringing together thousands of world leaders and climate delegates (on Halloween) to hash out a global strategy to keep the planet from overheating. To make sure you’re prepped with context for the next two weeks of global climate wheeling and dealing, we’ve put together a short COP26 primer.

What is COP26? It stands for the 26th Conference of Parties (COP) to the United Nations Framework Convention on Climate Change (UNFCCC), which will take place in Glasgow from Oct 31st to Nov 12th this year.

How did it start? Countries agreed to the international UNFCCC treaty in 1992 – setting rules and expectations for global collaboration in addressing climate change. Governments meet annually at the COP to forge and improve their climate game plans in one of the only forums where the opinions of the poorest countries carry equal weight to those of the largest economies.

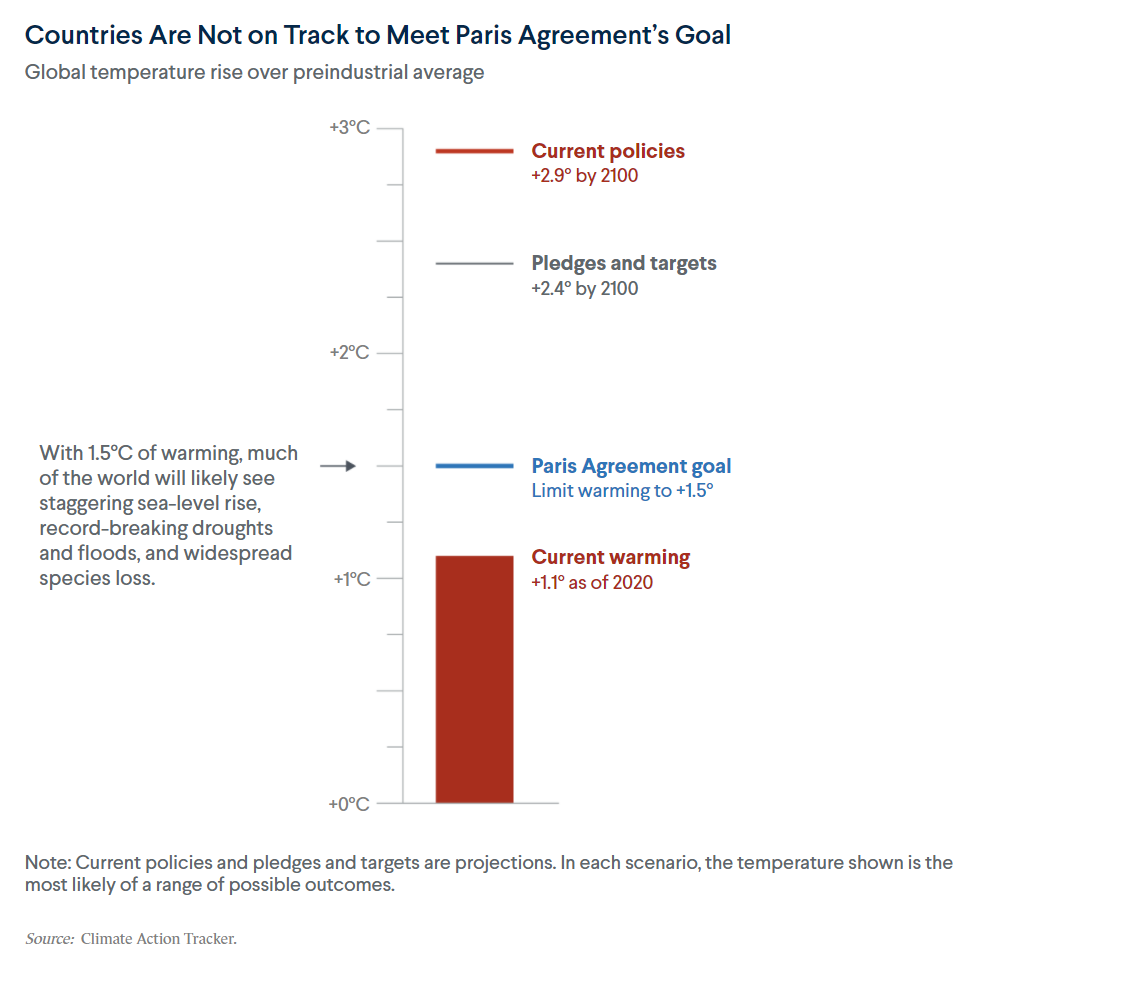

How does COP26 relate to the Paris Agreement? The Paris Agreement was reached at COP21 in 2015. Under the landmark agreement, nearly every nation committed to limiting global warming to <2ºC (and preferably <1.5ºC) above pre-industrial levels. While the agreement is legally binding, countries’ commitments to limiting emissions (known as National Determined Contributions or “NDCs”) are not. Five years after COP21 (this year!), countries must return to COP26 with more ambitious revisions to their initial emissions commitments. But even before the talks kick off, major emitters are already hinting that they’re unwilling to step up their climate efforts and will likely fall short on cutting emission 45% by 2030.

What to watch out for at this COP? The brokering behind closed doors will conclude in a unanimously agreed-upon text. We expect the following hot topics to garner many headlines:

💰 Climate aid. Twelve years ago in Copenhagen, rich countries promised to gift $100b / yr by 2020 to less developed countries to support their climate mitigation and adaptation journeys. Rich nations have broken that promise. Oxfam sorted through the woeful data tracking and estimates public climate finance realistically sits at ~$20b, despite the EU and US’s public efforts to fill the $80b hole.

🏭 Coal use. Ratcheting down coal use is one of decarbonization’s quickest wins. But rapidly industrializing countries like China and India have resisted any threat to phasing down their abundant national energy source. The closest commitment on coal so far has been China’s pledge to end building coal plants abroad.

🥊 China-US leadership. Most of all, the eyes are on the world’s two largest economies (and heavy hitter emitters) to lead the charge at Glasgow. With a combined ~40% share of global emissions, China and the US gatekeep global climate ambition and set the agenda with other countries following suit. President Biden had hoped to arrive in Glasgow with a neat climate bill in hand, but instead the centerpiece of his agenda was dashed a week before the summit. Now President Xi Jinping looks unlikely to attend, and is shoring up China’s oil and coal supply for the energy crunch.

As countries lay out their opening chess moves, a flurry of corporate commitments brighten the innovation atmosphere (hint: read the news section below). But private investment dollars won’t bridge the gap to reach climate action at scale. Likewise, Big Tech remains stuck in “inactivism” focusing too much on company operations and not enough systemic public policies - often while their trade associations lobby to kill important legislation.

As we saw in the Paris Agreement, this COP has the potential to be a turning point for global climate collaboration - and we’ll be watching to see if developed nations are ready to step up to the charge.

Other resources. This primary summary of COP is not comprehensive. Curious for more? Check out the helpful resources below:

CNN’s COP26 preview (sunlight zone)

Bloomberg’s roadmap to COP26 (twilight zone)

British Ecological Society’s guide to COP26 (midnight zone)

New York Times’ Climate Hub (the trenches)

☀️ Enpal, a Germany-based “solar as a service” startup, raised $174m in Series C funding from Softbank Vision Fund II.

☀️ Sunfire, a Germany-based industrial electrolyzer producer, raised $125m in Series D funding from Lightrock, Planet First Partners, Carbon Direct, HydrogenOne Capital, and existing shareholders.

⛵ Saildrone, an Alameda, CA-based startup using autonomous vessels to gather ocean data, raised $100m in Series C funding from BOND, XN, Standard Investments, Emerson Collective, and Crowley Maritime Corporation.

⚡ Autogrid, a Redwood City, CA-based virtual power plant software provider, raised $85m in Series D funding from SE Ventures, Moore Strategic Ventures, SolarEdge Technologies, Microsoft Climate Innovation Fund, GS Futures, National Grid Partners, Shell Ventures, and Total Carbon Neutrality Ventures.

🌱 Via Separations, a Watertown, MA-based developer of a membrane filtration system facilitating the industrial separation processes, raised $38m in Series B funding from NGP ETP, 2040 Foundation, The Engine, Safar Partners, Prime Impact Fund, Embark Ventures, and Massachusetts Clean Energy Center.

💨 Carbon Capture, a Pasadena, CA-based carbon removal startup, raised $35m in Series A funding from Prime Movers Lab, Rio Tinto, Idealab Studio, Idealab X, Marc Benioff’s TIME Ventures.

✈️ H3 Dynamics, a Singapore-based aerial decarbonization company, raised $26m in Series B funding from Japan’s Mirai Creation Fund, SPARX Asset Management, Sumitomo Mitsui Banking, and others.

🚗 Our Next Energy, a Novi, Michigan-based EV battery startup, raised $25m in Series A funding from Breakthrough Energy Ventures, Assembly Ventures, BMW i Ventures, Flex, and Volta Energy Technologies.

🍼 BIOMILQ, a Durham, NC-based lab-grown breast milk startup, raised $21m in Series A funding from Novo Holdings, Breakthrough Energy Ventures, Blue Horizon Ventures, Spero Ventures, Digitalis Ventures, Green Generation Fund, Alexandria, and Gaingels.

🌱 pulsESG, a San Francisco, CA-based ESG software as a service platform, raised $8.5m in Seed funding from FINTOP Capital, Aligned Climate Capital, SOMPO Holdings, Builders VC, eLab Ventures, and individual investors.

⚡ Beem Energy, a France-based maker of home energy efficiency and energy management systems such as solar kits, raised $8.2m in Series A funding from 360 Capital, Bpifrance, BNP Paribas Développement, and Alter Equity.

💸 Ando, a San Diego, CA-based sustainable banking startup, raised $6m in Seed funding from TTV Capital, HOF Capital, Kinetic Ventures, and NNS Group.

🔋 STABL Energy, a Germany-based battery storage startup, raised $5.2m in Seed funding from Smart Energy Innovation Fund of Energie 360°, Initiative for Industrial Innovators, and others.

💨 Pledge, a London-based carbon measurement and removal API company, raised $4.5m in Seed funding from Visionaries Club, Lowercarbon Capital and Zinal Growth.

🦐 Vertical Oceans, a Singapore-based startup growing sustainable shrimp in aqua towers, raised $3.5m in Seed funding from Khosla Ventures and SOSV.

⛏️ Novalith, an Australia-based provider of sustainable direct lithium extraction technology, raised $2.5m in Seed funding from Clean Energy Finance Corporation.

♻️ Sensoneo, a Slovakia-based smart waste management company, raised $2.3m in Seed funding from EIC Fund and Venture to Future Fund.

⚡ EnergyBank, a New Zealand-based energy storage startup, raised $1.9m in Seed funding from Icehouse Ventures, Blackbird, Promus Ventures, Version One, and Nuance Connected Capital.

💨 Carbon RE, a UK-based AI platform reducing industrial emissions, raised $1.4m in Seed funding from Clean Growth Fund, UCL Technology Fund, Portico Ventures, University of Cambridge Enterprise Fund, and Blue Impact Ventures.

One of the world’s largest oil producers, Saudi Arabia, has committed to reaching net zero emissions by 2060, following the same timescale set by China and Russia. Most notably, the pledge focuses within the country’s own borders with no indication of slowing outgoing O&G supply abroad. (Skeptics take to Twitter.)

The National Party of Australia agreed to a plan to cut to net zero by 2050, but the real decision-making on emissions will come down to state governments.

Always one step ahead on climate, the UK unveiled a roadmap to meet net zero for 2050 - highlights include accelerating EV adoption, SAFs for aviation, industrial carbon capture and storage, forest carbon sinks, and nuclear power investments.

The EPA announced a roadmap to regulate PFAS, forever chemicals which can last for hundreds of years without breaking down.

The Financial Stability Oversight Council, responsible for identifying threats to the US financial system, issued a report definitively stating climate change as an emerging financial threat. The report specifically calls out risks in the form of climate-related disasters and sudden drops in stock prices from the move away from fossil fuels.

Heeding Larry Fink’s advice from his op-ed, richer nations drew up a blueprint to contribute $100b per year in climate investments to poorer nations.

Over in shareholder world, an alliance of 29 of the world’s biggest pension funds and investment firms with a combined $9.3T in AUM, including Allianz and Calpers, intend to cut the emissions of their portfolio holdings by at least 25%. The target covers public equities, corporate bonds, and real estate portfolios.

The Ford Foundation, one of the largest private foundations with $16b under management, announced divestment from fossil fuels. Relatedly, the McKnight Foundation, a $3b endowment, said it would achieve net zero emissions by 2050.

Rio Tinto, the Anglo-Australian miner which focuses primarily on iron ore and aluminium, announced a $7.5b plan to reduce carbon emissions by 50% by 2030, 3X greater than its previous target.

Toyota and Stellantis will pour $3.4b to build US EV battery factories, signaling its defeat in lobbying efforts to slow the transition towards EVs. Other than Stellantis, every other major global battery player made moves to the US - CATL with Tesla, SK with Ford, LG with GM, and the list goes on.

By 2023, China will have the capacity to deploy solar power nationwide at the same price as coal, and currently has that ability in three-quarters of the country.

United Airlines flies its first 100% SAF commercial flight from Houston using trash-derived fuels. Not to be outdone, the US Air Force is also soaring into fossil-free aviation fuels partnering with Twelve to produce the first fossil-free batch of E-Jet fuel from CO2 electrolysis.

Amazon, IKEA, Michelin, and Unilever announced their commitment to progressively switch all of their ocean freight to vessels powered by zero-carbon fuels by 2040. Currently, few, if any, viable sustainable shipping exist, with only Maersk planning to launch a carbon neutral ship by 2023.

$44b up for grabs. “As long as it saves greenhouse gas emissions, we can fund that.” says Jigar Shah and the US DoE Loans Office.

Let this giant oyster farm wash your problems, pollution, and energy woes away.

We took the stage last week at SOSV’s Climate Tech Summit. Kim chatted about investing in deep decarbonization at EIP, and Sophie interviewed Karsten Temme from Pivot Bio about sustainable fertilizers.

The Israel Innovation Authority finds that 10% of the past year’s new Israeli startups are climate tech, but are there enough dedicated climate funds in Israel to support them?

Follow the money. Bill Gates compares climate tech today to “the early days of software and computing,” projecting 8 to 10 Amazon/Google/Microsoft-sized winners for investors.

Pique Action launches their new micro-doc climate solutions media company - and it’s the opposite of doomscrolling.

“If you are responsible, you must act.” Follow the rallying cry of an iron ore tycoon as he attempts to pivot his empire towards the clean steel revolution.

Beyond Meat and Impossible get scolded by activists for incomplete sustainability reporting. Similarly, BCG finds that 9 in 10 firms aren’t measuring emissions correctly.

The IEA is raising the bar on their energy outlook scenarios. No more “business-as-usual.”

🗓️ VERGE 21: Tune in on Oct 25-28th to the conference for people advancing systemic solutions to address the climate crisis. Startups can access 40% off All-Access Passes here. Sophie presents on Wednesday.

💡 gener8tor Sustainability: Apply by Dec 19th for gener8tor’s flagship sustainability 12-week accelerator for $100k in funding and access to mentoring and corporate partners.

Account Executive @NCX

Director of Business Development @COI Energy

Marketing Associate @Spoiler Alert

Climate Strategy Manager @Watershed

Fullstack Engineer @Euclid Power

Fullstack Engineer @YourStake

Investment Operations Associate / Manager @Prime Impact Fund

CFO @Greentown Labs

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond

Groundbreaking results from the geothermal developer’s main project