🌎 Taxing times for CCUS #254

OBBB blows tailwinds through CCUS, but takeoff stalls

Carbon markets, climate capital stack, and investor database score as top issues to date

Happy Monday!

In this week’s issue, we gaze into our climate-inspired navel a bit to celebrate our 100th week – we’ve covered the gamut from carbon markets teardowns to lessons from Plaid and are excited to continue to bring you cool coverage as things in climate tech heat up (no extra charge for bad temperature puns).

Distributed solar systems in Asia and Africa, embedded batteries and real-time home energy intelligence top out the deals of the week as well as some light EV charging acquisitioning.

In the news, extreme springtime heat in India and Pakistan, a new hydrogen hub in Utah, and a new $2.3B DOE RFI to modernize our energy grid against climate disasters. Also, some good reads from NYT on why only 9% of plastics get recycled, as well as Google’s new climate change accelerator’s first cohort.

Thanks for reading! You make our uniquely Sunday scaries just a bit less scary.

Not a subscriber yet?

The Climate Tech VC centennial has arrived! We’re simultaneously feeling old, inspired, and grateful in celebrating our 100th week delivering cool climate coverage to your heated inbox.

To celebrate our 100th, here are the top 5 issues that caught your eyeballs and earned your comments:

With the market (and our coverage) picking up pace, we’re leveling up. We’re looking for a true “climate unicorn” - a paid, full-time Managing Editor who will drive forward Climate Tech VC’s narrative and market coverage. 📢 This is not a drill!

A good fit Managing Editor will be technically inclined, financially curious, and obsessed with unf*cking our planet. You’ll be on the front lines with leading founders and investors, help build and manage our editorial team, and make a meaningful impact influencing the narrative of climate tech. You’re epically curious and a little spicy, while being equal parts detective and orator. You’re just as fluent in ARR as you are in GHGs. Must love emojis. Apply here.

We’re excited to keep building with you (including with a new website coming soon 👀).

Here’s the TikTok version for those of you already reading on your phone.

☀️ Sun King (formerly Greenlight Planet), a Kenya-based company that provides distributed solar systems to households in Africa and Asia, raised $260m in Series D funding from BeyondNetZero, Catalyst, and Arch Emerging Markets Partners.

🔌 FreeWire Technologies, an Oakland, CA-based startup that makes chargers that include embedded batteries for energy storage, raised $125m in Series D funding from BP, Riverstone Holdings, Octave Ventures, Gly Capital Management, Blue Bear Capital, Daishin Private Equity, and others.

⚡ Sense, a Cambridge, MA-based provider of real-time home energy intelligence, raised $105m in Series C funding from Blue Earth Capital, TELUS Ventures, MCJ Collective, Schneider Electric, Energy Impact Partners, Prelude Ventures, and iRobot.

🌱 Anuvia, a Winter Garden, FL-based maker of sustainable field-ready fertilizers, raised $65.5m in Series D funding from Piva Capital, Riverstone Holdings, Morgan Stanley Investment Management, LK Advisers Limited (Mittal Family Office), Pontifax Global Food, and Agriculture Technology Fund.

💨 Brimstone, an Oakland, CA-based producer of carbon negative Portland cement, raised $55m in Series A funding from Breakthrough Energy Ventures, DCVC, Climate Pledge Fund, and Fifth Wall.

✈️ Pyka, an Oakland, CA-based electric autonomous aviation startup, raised $37m in funding from Piva Capital.

🔋 TWAICE, a Chicago, IL and Germany-based battery analytics company, raised $30m in additional Series B funding from Coatue and others.

🏠 Sealed, a New York, NY-based provider of home improvements services intended to improve energy efficiency, raised $29.5m in Series B funding from Fifth Wall, FootPrint Coalition, CityRock Venture Partners, Cyrus Capital Partners, and Keyframe.

⚡ Zeno Power, an Alexandria, VA-based developer of radioisotope power systems, raised $20m in Series A funding from Tribe Capital, DCVC, 1517 Fund, AIN Ventures, and Pallas Ventures.

🌱 Red Sea Farms, a Saudi Arabia-based agtech startup that uses salt water to grow local produce while reducing carbon emissions and water scarcity, raised $18.5m in funding from Wa’ed, The Savola Group, KAUST Innovation Fund, and OlsonUbben.

🔋 South 8 Technologies, a San Diego, CA-based developer of electrolyte formulations for lithium batteries, raised $12m in Series A funding from Anzu Partners, LG Technology Ventures, Shell Ventures, Foothill Ventures, and TNSC.

🔌 Swtch Energy, a Canada-based provider of equitable EV charging solutions, raised $10m in Series A funding from Aligned Climate Capital, Landmark Management Inc., Elemental Energy, IBI Group, Active Impact Investments, and Pacific Reach.

🌱 Verge, a Canada-based AI powered interactive software that enables efficient field operations, raised $7.5m in Series A funding from Yamaha Motor Ventures, Fall Line Capital, SP Ventures, and Artesian/GrainInnovate.

🚲 Dat Bike, a Vietnam-based maker of electric motorbikes, raised $5.3m in Series A funding from Jungle Ventures and Wavemaker Partners.

⚡ Advanced Ionics, a Milwaukee, WI-based producer of affordable green hydrogen, raised $4.2m in Seed funding from Clean Energy Ventures and SWAN Impact Network.

☀️ SolarDuck, a Netherlands-based offshore floating solar company, raised $4.2m in funding from Link Capital and Impulse.

☀️ Yotta Energy, an Austin, TX-based developer of battery tech that can integrate directly with almost any solar panel design, raised an additional $3.5m in Series A funding from APsystems.

💵 Carbon Collective, an Albany, CA-based online investment advisor focused on solving climate change, raised $2.2m in Seed funding from Powerhouse Ventures, HyperGuap, Elevation Ventures, Precursor Ventures, My Climate Journey, and Climate Capital.

🔋 BattGenie, a Seattle, WA-based battery charging startup, raised $1.5m in Seed funding from Powerhouse Ventures and VoLo Earth Ventures.

🚗 Vyro, an Australia-based online EV dealership company, raised $1m in funding from Antler Australia and Ellerston Capital.

EV charging equipment and services provider Blink Charging is acquiring EV charging provider EB Charging for $23.4m.

116F. 45C. Indians and Pakistanis are suffering through one of the hottest springs ever. The extreme heatwave threw the electric and water systems a wrench, causing power outages and water shortages throughout the two countries.

After 20+ years of investing in hydrogen R&D, the DOE issued a $500m conditional debt financing for the first US hydrogen hub planned for Utah. Why Utah? Plans to convert the Intermountain Power Project, an old coal plant, to natural gas (and eventually hydrogen) was well underway through a partnership between Mitsubishi and the plant owners.

Meanwhile, the DOE also announced an RFI on how to spend $2.3b modernizing the grid against climate disasters. This comes as FERC has started feeling the tension from stakeholders on their stance (or lack thereof) on climate resiliency on the grid.

Just how important are our forests? A report from U Maryland showed that their absence contributed to 2.5b additional tonnes of CO2 in our atmosphere, equivalent to India’s annual emissions. The report also details the challenges of reining in natural and manmade global forest destruction, including worsening wildfires that burned down more than 97,500 square miles of tree cover.

Net metering loops back to the news - this time, in favor of rooftop solar. Gov Ron Desantis (yes, woke math textbook guy) vetoed a bill that would have lowered utilities’ compensation for customer’s rooftop solar generation.

CarbonPlan issued a critique of Verra’s ton-year accounting approach – arguing it wrongly (1) does not help to reach long-term temperature goals and (2) gives projects the option to exit their carbon commitments at any time without penalty.

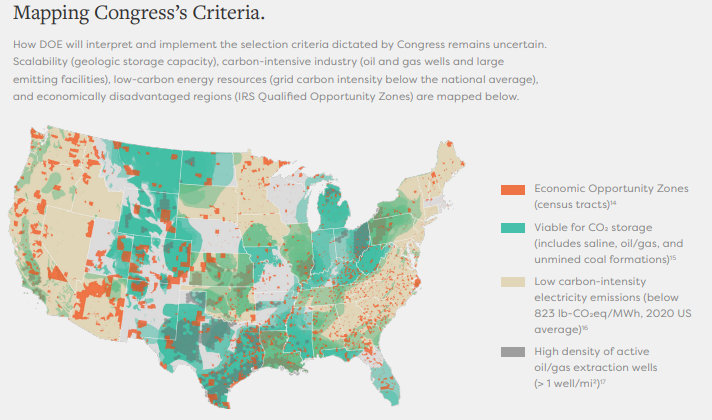

Carbon180’s new report Setting DAC on Track shows how the DOE can best execute its Regional Direct Air Capture Hubs program, with a great overlay of Economic Opportunity Zones and viable CO2 storage sites.

Can Prometheus Fuels deliver carbon-neutral fuel as cheap as gas? MIT Tech Review is (scathingly) skeptical. 🔥

The New York Times explains why only an estimated 9% of all plastics ever manufactured have been recycled.

A Japanese town of 1,500 residents is on its way to a zero-waste life.

Deep dive. S2G Ventures outlines eight key trends to ensure a vibrant blue economy.

SOSV releases its second annual Climate Tech 100 list, showcasing the firm’s wide-ranging investments in climate.

Google announces its 2022 climate change accelerator cohort, featuring ChargerHelp!, Moment Energy, and ChargeNet.

Climate change may be creating a “Pandemicene” filled with new infectious diseases.

Silicon Valley Bank’s Future of Climate Tech report highlights a record year in climate tech exit activity, with 104 climate tech exits in 2021.

To zen out, tune in to Earth.fm’s immersive, professional recordings of natural soundscapes from around the world.

💡 E2 1 Hotels Fellowship: Apply by May 9th to the year-long fellowship program identifying key policies and leading business cases addressing the most pressing environmental issues led by the collaborative efforts of NRDC’s Environmental Entrepreneurs and 1 Hotels.

💡 Energy Entrepreneurs Fund (EEF): Apply by May 11th to the ninth phase of EEF for a chance at £10m in grant funding to startups innovating across energy efficiency, power generation, heat generation, energy storage and the reduction of GHG emissions.

🗓️ Nuclear Energy Event: Tune in on May 4th to hear from Rick Griffith, a 10+ year expert in military and federal nuclear engineering, and Dinara Ermakova, a Ph.D. candidate in the U.C. Berkeley Nuclear Engineering program, as they discuss how nuclear energy will be integrated into the future’s energy profile.

**Managing Editor @Climate Tech VC

Investor, Frontier Fund @Energy Impact Partners

Senior Analyst/ Associate @Angeleno Group

Investor @Overture VC

Climate Tech VC Fellowship @World Fund

Business Development, Marketplace Partnerships @Cloverly

Business Growth Summer Associate @Persefoni

Corporate Development Manager @Amazon Climate Pledge Fund

Director of Business Development @Station A

Energy Systems Analyst @Toyota Research Institute

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

OBBB blows tailwinds through CCUS, but takeoff stalls

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook