🌎 Overheard at LCAW #252

Climate, capital, and carrots in London's new playbook

Digging into Microsoft’s carbon removal portfolio and soil carbon sequestration

Happy Monday!

As the weather outside grows frightful, we go back to the (frozen) soil in search of its potential for carbon sequestration. A motley crew from scientists to startups, farmers to financiers are seeding the ground with renewed vigor for soil-based carbon offsets.

We also control-click into Microsoft’s (impressive!) carbon initiative update, Larry Fink’s take on investment risk as climate risk and more - including two new climate tech bubble proclamations.

Just for fun and given all of the recent invitations to tender, New Concept Energy which “employs some five people and negligible amounts of oil… from some wells in Appalachia” recently got the Reddit treatment as its shares soared to a market cap of $128m off Y19 revenue of $590k. Did someone say bubbly?

Thanks for reading!

Not a subscriber yet?

Last week, Microsoft checked in on it’s 2020 resolution to become “carbon negative” by 2030. Over the past 12 months, the company cut its carbon emissions by 6% and paid for the removal of 1.3m metric tons of carbon – the largest annual corporate removal purchase ever. Through 26 projects around the world, Microsoft is leveraging a variety of approaches, including bioenergy with carbon capture and storage (BECCS), direct air capture (DAC), bio-oil, blue carbon, as well as forestry and soil offsets to reach its carbon goals.

💨 Negative emissions: 99.5% of the drawdown 1.3m mtCO2 came from temporary nature-based solutions like forest and soil offsets. With permanent solutions like DAC comprising <0.1% of its carbon removal portfolio, Microsoft has taken a clear side in the ongoing debate over permanent (expensive, new tech) vs temporary (cheaper, good old photosynthesis) negative emissions. Perhaps permanent sequestration tech is a better fit for Microsoft’s $1B Climate Innovation Fund. The truth is, that we need both.

⚖ Climate risk: Microsoft’s sustainability report called for “a widely adopted and comprehensive risk framework.” After demonstrating leadership in impact reporting, Microsoft seems likely to help guide processes for identifying, assessing, and managing climate risks. (Which sounds like a great topic for a CTVC feature next week - stay tuned!)

🔮 Transparency: The information that Microsoft shares about its climate efforts – ranging from reports to interactive graphics – demonstrate market-leading transparency. This transparency and willingness to learn in public tangibly speeds up the learning curve for fast followers seeking net-zero.

💸 Loanpal, a San Francisco, CA-point-of-sale payment platform for home efficiency solutions, raised $800m in funding from NEA, WestCap, Brookfield Asset Management and Riverstone Holdings. More here.

🔋 Sila Nano, an Alameda, CA-based battery materials company, raised $590m in Series F funding from Coatue, T. Rowe Price, 8VC, Bessemer Venture Partners, and Sutter Hill Ventures. More here.

⚡ FreeWire Technologies, a San Leandro, CA-based EV charging company, raised $50m in Series C funding from Riverstone Holdings, BP, Energy Innovation Capital, and others. More here.

🌱 Sitetracker, a Palo Alto, CA-based infrastructure tech company, raised $42m in additional funding from H.I.G. Growth Partners, Energize Ventures, NEA, National Grid Partners, Wells Fargo, and Salesforce Ventures. More here.

⚡ Span, a San Francisco, CA-based maker of smart electrical panels, raised $20m in funding from the Alexa Fund and Munich Re Ventures. More here.

🚜 Bear Flag Robotics, a Newark, CA-based producer of autonomous tractors, raised $7.9m in a Seed extension round from True Ventures, Graphene Ventures, AgFunder, and others. More here.

❄️ Axiom Cloud, an East Bay, CA-based developer of software solutions to grocery store refrigerators, raised $1.1m in Seed funding from Ulu Ventures, Powerhouse Ventures, and Correlation Ventures. More here.

Royal Dutch Shell agreed to buy Ubitricity, owner of the U.K.’s largest public electric vehicle charging network. More here.

Sunlight Financial, a residential solar financing platform, will go public via merger with SPAC Spartan Acquisition Corp. II, valuing it at $1.3b. More here.

Faraday Future, an electric car maker, will go public via merger with SPAC Property Solutions Acquisition Corp., valuing it at $3.4b. More here.

Sometimes it’s the simplest solutions that can be the most challenging. Last week we wrote about technologies to engineer new pathways for capturing carbon. This week we dig into one of the oldest (and complex) carbon removal pathways in the book - soil. [We’ve edited the newsletter version lightly for length; visit our website for the full feature]

Just last week, Microsoft announced the purchase of just under 200,000 mtCO2 from two soil projects (Truterra/Land O’Lakes and Regen Network) and Biden’s climate executive orders encouraged “agricultural practices that produce verifiable carbon reductions and sequestrations.” The potential prize is big: scientists estimate nearly 500 gigatons of CO2 equivalents have been eroded from soils.

The existing voluntary offset market is increasingly offering soil carbon as a new flavor of offset product. While forestry-based carbon offsets are relatively plentiful, regenerative ag and forestry make up just 2% of the market. Australia boasts the most robust soil carbon market with an established government-backed marketplace and a regulated, empirical measurement methodology.

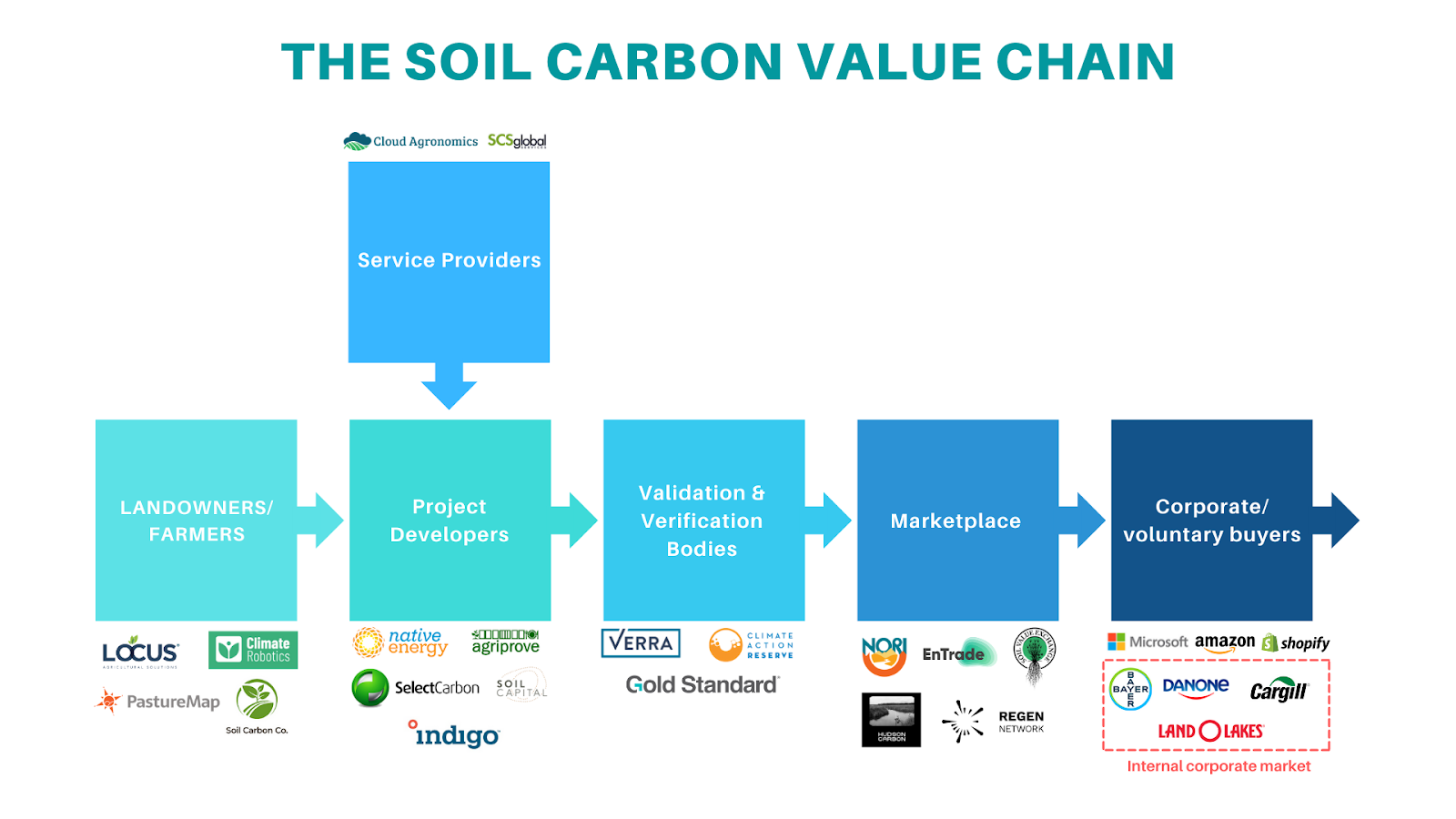

Nature-based climate solutions are accelerating as a critical strategy to reach net-zero (as Mark Tercek well articulates). On top of their sequestration benefits, healthy soils mutually benefit farm productivity. Despite the increasing enthusiasm, a number of questions remain about the viability of soil carbon sequestration: What tools can farmers use? How accurately can we monitor and quantify? What is the right market or policy structure to reward farmers? A number of entrepreneurs (including those in IndigoAg’s Carbon Challenge last week) are hard at work developing solutions. We spoke to some of these founders, scientists, and investors to unearth this complex value chain.

It takes growers’ boots on the ground to adopt effective carbon-sequestering regenerative management practices like no-till, planting cover and mixed species forage crops, rotational livestock grazing, conversion of cropland to pasture, and reduced chemical use. Startups like Climate Robotics and Soil Carbon offer a further carbon retention boost with their respective biochar and microbial products. From a farmers’ P&L perspective, carbon-rich healthy soils mean good business not only from diversified carbon credit income, but also from reduced soil erosion, lower chemical inputs, and improved biodiversity.

Project Developers: Quarterback and broker the end-to-end project plan

In response to early criticism, carbon credit methodologies have increased in rigor. While significant discussion remains, all carbon projects must now prove realness, completeness, consistency, transparency, additionality etc. Project developers (e.g., Native Energy, AgriProve, Soil Capital) handle this complexity and are on the hook with auditors. Matthew Warnken, Managing Director of AgriProve, explains “we provide a one-stop shop to agricultural landholders in managing the administrative, monitoring, reporting, and compliance requirements of soil carbon projects, freeing the landholders to focus on the land management practice change for soil carbon.” By closely adhering to a third party registry’s (e.g. Verra, CAR) methodology, project developers design projects and then act as the middle broker by supporting and partnering with farmers.

Measurement, Reporting, and Verification (MRV): Calculate and prove soil carbon levels

Undertaking sequestering practices is no longer enough to claim credible carbon credits. Rigorous measurement, reporting, and verification are crucial to scale demand for soil carbon credits. Currently, one needs to extract physical soil cores which are then mailed to a lab and incinerated to determine carbon content. Emerging technology companies using in-situ spectrometry (Yard Stick, currently in stealth) and AI-enabled remote sensing (Cloud Agronomics) are bringing down the cost and time curves in order to scale MRV. By combining attributes of the soil, AI, satellite imagery and ground truth soil sampling, Cloud Agronomics is able to detect carbon levels up to 30cm underground. CEO Mark Tracy explains, “If you use traditional soil sampling, you can’t capture in-field variability well. We are providing the same quantifiable information, but we can aggregate thousands of points within a field to come to an accurate value for that entire field, not just single points.”

Marketplaces: Sell the carbon credit to buyers

Project developers can sell the carbon credits they produced to a variety of players:

Scaling up soil carbon measurements poses significant scientific challenges. Agricultural soils are a living, breathing system. The biggest challenge confounding scientists is how to handle the heterogeneity of data associated with soils. The amount of clay, historical practices, weather, location, and endless other attributes all impact soils’ carbon content.

Soil carbon sequestration provides multiple benefits. “It’s a really amazing win-win opportunity where carbon payments can help improve the quality and sustainability of our food systems in addition to climate benefits,” says Paul Gambill, CEO of Nori.

Sequestration technologies face a tough sell into farmers. Given just 40 chances to improve their yield, farmers are inherently skeptical buyers of new technologies. Look out for clever financing and insurance mechanisms that align farmers’ and startups’ and credit purchasers’ incentives to bring more soil sequestering technologies to market.

Permanence is very much up for debate. Even if MRV reaches certain accuracy, if a farmer then plows, does all of the carbon stay in the soil? In comparison to other carbon dioxide removal approaches (see: last week’s feature) permanence is soil’s relative weak spot. Read any criticism of soil, and questions around permanence are front and center (rightly so).

Investing in this space still requires reliance on voluntary credit purchases. Enough said. Though “voluntary” purchases are getting stickier by the day particularly as corporates announce their offset commitments publicly.

It remains to be seen how heavy of a hand the US government will lend. Australia shows that the government can successfully play a market convening role, and the Biden administration had previously floated the idea of soil carbon banks for farmers. Similarly, Rory Jacobson from Carbon Direct points to the Growing Climate Solutions Act as one way the federal government might get involved by setting enforceable standards for soil carbon offsets.

*Special thanks to Stella Liu for helping us unearth the dirt on soil carbon sequestration.

Larry Fink didn’t beat around the bush in his annual letter: climate risk is investment risk. The $8.6T asset fund manager will internalize its own advice alongside a 363% YoY increase in SASB disclosures and more than 1,700 organizations rallying behind a TCFD global disclosure standard.

The White House has been so busy with recent climate executive orders that they made us a fact sheet of Biden’s recent actions, including one that plans to replace the 645,000 federal vehicle fleet with electric vehicles.

The Fed tapped Kevin Stiroh, who previously supervised banks at the New York Fed, to lead a new team focused on climate risks to financial markets dubbed the “Supervision Climate Committee.” Marvel, take note.

Drop it like it’s (literally) hot. New York City’s largest pension funds announce ~$4B of divestment from fossil fuels.

36 of America’s corporate bigwigs from Amazon to Walmart to Disney signed on to federal decarbonization policy priorities beyond net-zero jargon that include expanding wholesale energy markets, clean energy procurement and standards, and energy R&D commercialization.

Fairweather GM is back again with plans to be carbon neutral by 2040 and to end the sales of internal combustion vehicles by 2035. But don’t forget their 2018 proclamation of the zero-emissions future, followed by support for the Trump administration’s emissions regulation rollback just last year.

Robert Downey Jr. is playing Iron Man in real life raising VC funds focused on sustainability startups.

With backing from Jeff Bezos’ Earth Fund and Breakthrough Energy, Mission Possible Partnership has launched to help decarbonize seven hard-to-abate industries.

Amy Harder from Axios Generate is starting Breakthrough Energy's journalist team.

First the fridge, now the pantry, and then to infinity and Beyond? Beyond Meats partners with PepsiCo to bring plant-based snacks to the PLANeT.

The bubble battle rages on: Andrew Beebe believes we’re entering a climate decade - a perfect storm of tech breakthroughs and consumer/ employee behavior shifts will prevent the same fate as Cleantech 1.0. Our friend Rob Day says that the second cleantech bubble has arrived. He argues it’s less important when it pops but how institutional investors will react.

🗓️ ClimateTech & Energy Prize@MIT: Apply by February 5th for the 14th CEP MIT competition grand prize of $100k and the priceless glory of winning the longest running student led energy competition.

🗓️ Climate Hacks: Society of Women Coders is hosting their first ever virtual hackathon on March 5-7 for young women interested in climate STEM challenges. The team at SOW is also looking for event sponsors.

Climate Impact Fund Fellowship @VertueLab

Junior Research Analyst @Climatescape

Senior Project Engineer @Kanin Energy

Chemical Engineer, Hardware Test Engineer @Charm Industrial

Java Backend Developer (contract) @CarbonChain

Chief of Staff @Obvious Ventures

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond

Groundbreaking results from the geothermal developer’s main project