🌎 Taxing times for CCUS #254

OBBB blows tailwinds through CCUS, but takeoff stalls

Happy Monday! In this week’s issue, we click into the shift in big donations towards new climate research centers across private universities - while promising, public support for climate education still lags.

In deals this week, small-modular nuclear reactors raise $315m, followed by $168m for electrolyzer technology for hydrogen and $160m for (more) nuclear fusion. Also, five new funds hot on the heels of our dry powder analysis - including a whopping $15b for Brookfield’s Global Transition Fund. In the news, Biden considers a federal gas tax holiday to offset pain at the pump, PG&E pays Tesla Powerwall owners to send electricity back to the grid, and Amazon’s Rivian vans hit the streets.

Thanks for reading!

Not a subscriber yet?

For the climate-first generation who have always been conscious of the responsibilities that come with inheriting a warm planet, climate and environmental sciences are surging in popularity as top ranking proposed majors for new undergrads. Universities are racing to catch up with students’ class preferences, formalizing what has long been an interdisciplinary field of study (add a pinch of chemistry, sociology, geology, and policy… and voila!) into a comprehensive Bachelor education.

This week, Harvard joined its peers with a $200m gift to establish the Salata Institute for Climate and Sustainability, following on the back of the Doerrs’ $1.1B gift to create the Stanford Doerr School of Sustainability in May. Meanwhile, Yale, Columbia, UMich, Cornell, Duke, Brown, UC Berkeley, and others have long been at their climate schools – though funded by research funding and donations, during times when large single philanthropic checks went to flashier topics du jour.

Undergrad climate study has been somewhat neglected - seen before as a theme, not a field - while academic funding flowed through more advanced R&D channels funding clean energy or nutrient cycling research. Now, the rush of climate tech and opportunity is making its way down to all students, from funneling individual research grants to formalizing climate into official Schools.

It’s not the first time big dollars have funded new undergrad programs in the spirit of innovation. The dot-com boom spurred a flurry of computer science programs with Bill Gates donating $20m to build MIT’s Laboratory for Computer Science and another cool $25m to boost Harvard's CS programs. Even adjusted for inflation, the recent climate school donations outpace that of CS - signaling a new era of climate pioneers.

Climate is the shiny new computer lab, for only those privileged enough to get a key card. Private philanthropic dollars are a start, but there’s still a gap of public funding (likely made worse by shifting political parties). We need to ensure that a comprehensive climate education isn’t just for the ivory tower, because all of our talents are key to this fight.

🔋 Newcleo, a London-based developer of small-modular nuclear reactors raised $315m in funding from Exor NV, Azimut Holding, and others.

⚡Electric Hydrogen, a Natick, MA-based startup developing electrolyzer technology to enable low-cost, clean hydrogen, raised $198m in Series B funding from Fifth Wall, S2G, Silicon Valley Bank, Trinity Capital, Amazon’s Climate Pledge Fund, Cosan, Equinor Ventures, Honeywell, Mitsubishi Heavy Industries, Rio Tinto, and existing investors.

⚡Zap Energy, a Seattle, WA-based nuclear fusion startup, raised $160m in Series C funding from Lowercarbon Capital, Breakthrough Energy Ventures, Shell Ventures, DCVC and Valor Equity Partners.

🚛 Amogy, a Brooklyn, NY-based startup that develops ammonia-based fuels for trucks and ships, raised $46m in bridge financing led by SK Innovation, that included Saudi Aramco Energy Ventures, Newlab, AP Ventures, and Amazon.

🥩 HappyVore, a France-based plant-based meat company, raised $37m in Series A funding from Invus, family-group Artal, Adrien de Schompré, BPI France, and Philippe Cantet.

📗 ESG Book (fka Arabesque S-Ray), a Germany-based ESG data platform, raised $35m in Series B funding, from Energy Impact Partners, Meridiam, and Allianz X.

⚡ Statiq, an India-based EV charging network, raised $26m in Series A funding from Shell Ventures.

☀️ Enviria, a Germany-based B2B solar-as-a-service company, raised $24m in Series A funding from Redalpine, Galileo Green Energy, BNP Paribas Developpement, and Alter Equity.

🌲Vibrant Planet, an Incline Village, NV-based operating system for forest restoration, raised $17m in a Seed funding led by Ecosystem Integrity Fund, and the Jeremy and Hannelore Grantham Environmental Trust.

⚡ Evergen, an Australia-based software platform enabling distributed energy assets, raised $10.4m in Series B funding from Fotowatio Renewable Ventures.

🔋Connected Energy, a UK-based provider of energy storage systems using retired EV batteries, raised $15.8m from Volvo Group, Caterpillar, Hinduja Group, Mercuria and OurCrowd.

🏡 Dvele, a La Jolla, CA-based housing technology company that offers all-electric modular homes, raised $14m from Crescent Real Estate.

☀️ Lemon Energy, a Brazil-based digital clean energy provider, raised $11.4 in Series A funding from Kaszek, Lowercarbon Capital, Sergio Furio, and Kevin Efrusy.

⛏️ Impossible Mining, a San Jose, CA-based company developing technology for seabed mining and refining, raised an additional $10.1m in Seed funding from Justin Hamilton and others.

🚗 Synop, a New York, NY-based operating system for commercial EV fleets, raised $10m in Seed funding from Obvious Ventures, Wireframe Ventures, Congruent, and Better Ventures.

🏗️ Banyan, a San Francisco, CA-based project finance platform for sustainable infrastructure, raised $8.2m in Series A funding from VoLo Earth Ventures, Ulu Ventures, Vista Verde Capital, Nomadic Venture Partners and Industrious Ventures.

🌱 Symbrosia, a Hawaii-based startup that develops seaweed feed additives which reduces livestock methane emissions, raised $7m in Series A funding, from Danone Manifesto Ventures, Pacific6, and Hatch Blue. [We ruminated on enteric emissions in last week’s feature here].

🧪 Epoch Biodesign (fka Mellizyme), a London-based startup developing a bio recycling technology to transform plastic waste into chemicals, raised $11m in Seed funding from Lowercarbon Capital, BoxGroup, Amadeus Capital Partners, MCJ Collective, Zero Carbon Capital, Voyagers Climate-Tech Fund and the Venture.

♻️ Posh, a Hayward, CA-based startup automating EV battery recycling, raised $3.8m in Seed funding from Helium-3 Ventures, Y Combinator, Metaplanet, Outbound Capital, Starling Ventures, Uphonest Capital, Global Founders Capital, and others.

💨 Travertine, a Boulder, CO-based carbon removal startup converting carbon dioxide into carbonate minerals, raised $3m in Seed funding from Grantham Environmental Trust and Clean Energy Ventures.

⚡ e-Mission Control, a Sacramento, CA-based provider of low-carbon fuel programs for electric fleets, raised $3m in Series A funding from Skyview Ventures.

🎧 Post Script Media, a Boston, MA-based climate-focused podcasting company, raised $2m in Seed funding from Prelude Ventures.

Canada’s Brookfield Asset Management raised $15b for their Inaugural Global Transition Fund, the largest private fund created to support the transition to a net-zero economy. The fund targets investments that reduce greenhouse gas emissions, and has already deployed $2.5 billion in capital. [We wrote more on dry powder in the climate tech markets here]

IP Group has launched Kiko Ventures, a $450m climate tech investment platform, and plans to invest roughly $211m over the next five years in cleantech companies.

Yamaha Motor established a $100m Yamaha Motor Sustainability Fund.

MUUS Climate Partners raised $25m for its first round closing of their second convergence fund focused on leveraging advanced technologies that accelerate decarbonization.

Schneider Electric, a French company that specializes in digital automation and energy management, has acquired EV Connect, an El Segundo, California-based EV charging provider.

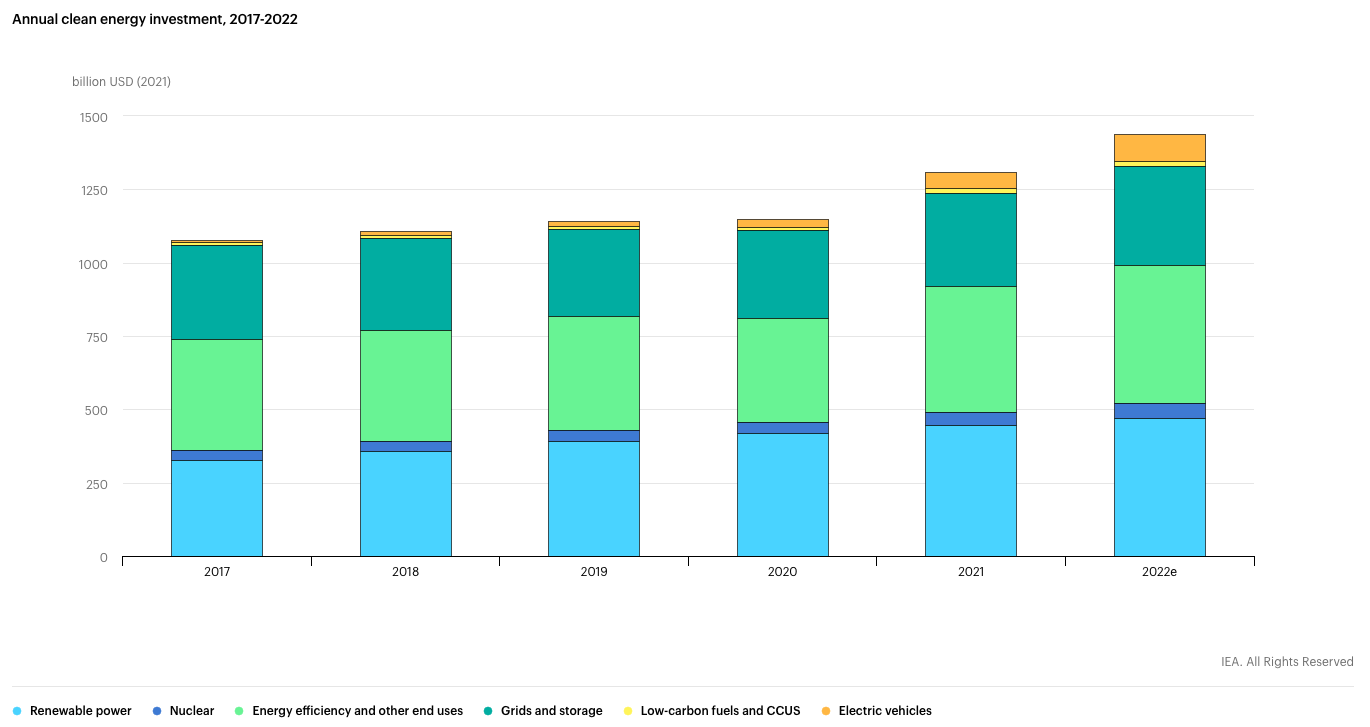

Clean energy investment topped $1.4T in 2022 and is rising 8% YoY — but not fast enough — according to the IEA’s most recent report. In order to stay within the Paris Agreement’s 1.5C threshold, the investment rate through 2030 must double. Meanwhile, prices of everything are surging from raw materials to finished solar panels, wind turbines to batteries – eating away at climate tech investment profit.

President Biden called for a three month suspension to the federal gas tax, encouraging oil and gas companies to increase production as the national average gas price hits $5 per gallon for the first time.

Empowered solar developers and investors at the US Solar Buyer Consortium are teaming up to purchase over $6b of domestically produced panels, following the admin’s signal via the Defense Production Act.

Pacific Gas & Electric began paying customers to send extra electricity back to the grid, flipping the switch on the world’s largest virtual power plant - courtesy of a distributed network of Tesla Powerwalls.

FedEx receives their first major delivery of electric vans from GM subsidiary BrightDrop, while Amazon’s Rivian vans get spotted in the wild.

“What’s worse: climate denial or climate hypocrisy,” asks David Wallace-Wells in a must read, sobering op-ed.

Energize Ventures offers a 124-page framework for electrifying everything.

Tear it down or clean it up? Tackling the property industry’s huge carbon footprint.

To unlock biomass carbon removal and storage, we need to increase the availability of sustainable biomass.

Climate media surges with a new raise from Post Script Media, the launch of a climate streaming show and podcast from Bloomberg, and a new climate action podcast from IDEO.

Adam Marblestone and Neil Hacker’s Climate Technology Primer overviews the scale of climate change, carbon removal, and geoengineering.

Meet Sparky, the world’ first full-size, ship-handling electric tug boat.

Climate Central’s “Climate Shift Index” shows how climate change is affecting local weather across the U.S.

East African countries consider a “Great Blue Wall” of interconnected seascapes to protect marine life, support fishing communities, and combat sea level rise.

💡 AirMiners Launchpad: Apply by June 30 to the AirMiners Launchpad 6-week program to get your early stage carbon removal startup in flight

💡 Ocean Alkalinity Enhancement Engineering Award: Calling all mechanical, industrial, and chemical engineers and innovators to apply to Additional Ventures’ newest award. Prototypes for safe, cost-efficient, and scalable OAE have a chance to win $750k to $1.5M — assuming they don't sail past the July 15 deadline.

🗓️ Federal Energy Funding 101: Join Clean Energy Business Network on June 28 to learn about recurring federal funding opportunities from a panel of expert speakers.

🗓️ Nature-Based Solutions Conference: Join for 13 two-hour sessions over three days starting July 5 to learn and share from a set of case studies from the global north and south, urban and rural to clarify what’s most needed from these communities.

Senior Associate, Growth Equity @Closed Loop Partners

Carbon Removal Marketing Manager @Bioecro

Climate Investment Director @Biorecro

Product Marketer @Macro-Eyes

Chief Engineer @Brilliant Planet

Associate Product Manager @Generate Capital

Carbon Removal Systems Scientist @Carbon Direct

Head of Communications @Commonwealth Fusion

Strategic Intelligence Associate @Patch

Senior Associate @Deciens

Managing Director @Purpose Venture Group

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

OBBB blows tailwinds through CCUS, but takeoff stalls

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook