🌎 Overheard at LCAW #252

Climate, capital, and carrots in London's new playbook

Activist hedge fund takes a different track on climate ETF construction

Happy Monday!

Welcome to the 565 of you who’ve joined since last week’s newsletter! We’re happy the carbon markets are as exciting for you as they are for us (and our future)

Engine No. 1 takes a different tack on climate ETF construction, buttressing legacy buyers to load up on future-forward climate tech.

In this week’s $100m+ fundings, AI programming for scooters and a corporate insurance company for climate risks. Plus $37m for Zero Acre’s low carbon vegetable oil and $80m for Verdox’s electric carbon capture.

In the news, China makes (literal) snow mountains for the Winter Olympics and Carlyle commits to net zero financing by 2050. Also, gas leaf blowers emit the equivalent of driving 1,100 miles and penguins are the new leading indicators of climate change.

Thanks for reading!

Not a subscriber yet?

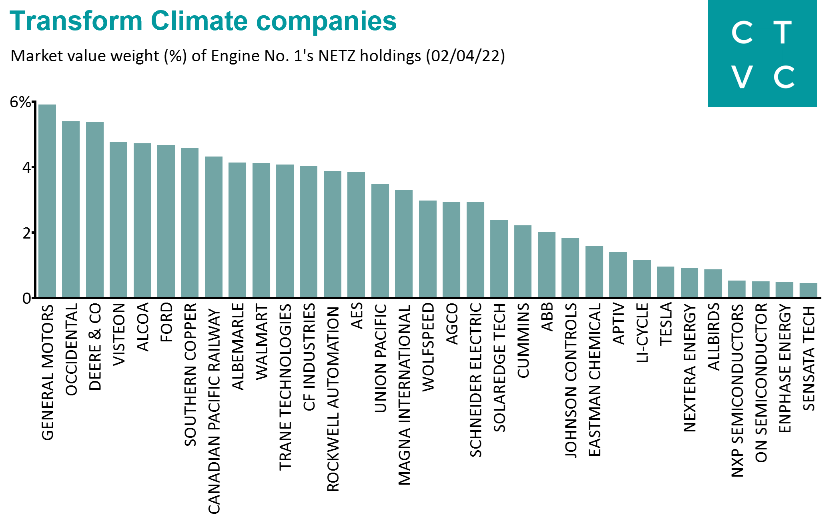

Best known as the upstart activist hedge fund that claimed three Exxon board seats for climate-forward directors, Engine No. 1 is back on track with a public market play to drive decarbonization: Transform Climate. The new exchange-traded fund (ETF) trades under a nifty ticker (NETZ) and invests in legacy companies profiting from the energy transition.

NETZ’s portfolio includes 33 companies from some of the heaviest emitting industries (energy, agriculture, transportation) with significant potential and demonstrated commitment to decarbonize.

Transform Climate takes a markedly different approach to climate ETF portfolio construction versus the heavy emphasis on young, renewable clean energy stocks that most existing climate ETFs take. NETZ sees upside in the transformative hefty balance sheets and developed supply chains of companies like GM, Occidental, and Deere, and isn’t afraid to get their hands dirty with active engagement and proxy voting to promote climate progress.

Why spill ink on a public ETF in a newsletter literally titled Climate Tech VC? Legacy companies’ transitions open the door for new, innovative startups. The 33 corporates in NETZ’s portfolio will need new climate technologies to reach their emissions reduction goals - and are already some of the most acquisitive (Schneider, Deere, Trane) and biggest R&D big spenders. More public equity investor pressure on legacy companies helps create more potential buyers for innovative climate tech down the road.

🛴 Superpedestrian, a Cambridge, MA-based startup using AI programming to power ultra-safe scooters, raised $125m in Series C funding from Antara Capital, the Sony Innovation Fund, FM Capital, Spark Capital, General Catalyst, and the Citi Impact Fund.

☔ Descartes Underwriting, a Paris-based corporate insurance technology company that addresses climate and emerging risks, raised $120m in Series B funding from Highland Europe, Eurazeo, Serena, Cathay Innovation, Blackfin Capital Partners, Seaya Ventures, and Mundi Ventures.

💨 Verdox, a Woburn, MA-based electric carbon capture and removal company, raised $80m in funding from Breakthrough Energy Ventures, Prelude Ventures, and Lowercarbon Capital.

🚲 Dott, a Netherlands-based electric bike and scooter startup, raised $70m in Series B extension funding from Abrdn, Sofina, EQT Ventures, and Prosus Ventures.

⚡ Ekona Power, a Canada-based developer of hydrogen technology, raised $61.9m in funding from Baker Hughes, Mitsui, Severstal, ConocoPhillips, TransAlta, Continental Resources, NGIF Cleantech Ventures, and BDC Capital.

⚡ Marvel Fusion, a Germany-based nuclear fusion startup, raised $40m in Series A funding from Earlybird, PRIMEPULSE, Thistledown Capital, Nicolas Berggruen Charitable Trust, Heinz Dürr Invest, Possible Ventures, and others.

🌱 Novi Connect, a Larkspur, CA-based B2B marketplace for sustainable ingredients and packaging, raised $40m in funding from Tiger Global, Defy.vc, and Greylock.

🌱 Zero Acre Farms, a San Francisco, CA-based vegetable oil alternative startup, raised $37m in Series A funding from Lowercarbon Capital, Fifty Years, S2G Ventures, Virgin Group, Collaborative Fund, and FootPrint Coalition.

⚡ Modern Electron, a Bothell, WA-based hydrogen-based home heating startup, raised $30m in Series B funding from At One Ventures, Extantia, Starlight Ventures, Valo Ventures, Irongrey, Wieland Group, and others.

🌱 Agritask, an Israel-based agronomic intelligence startup, raised $26m in Series B funding from Liechtenstein Group, Bridges Israel, Smart Agro Fund, and InsuResilience Investment Fund.

🌊 Regent, a Boston, MA-based manufacturer of electric seagliders, raised $18m in Seed funding from Thiel Capital, JAM Fund, Mesa Air Group, and others.

🍎 Zero, a Sanger, CA-based plastic-free grocery delivery startup, raised $12m in Seed funding from Sway Ventures.

🔋 Soelect, a Greensboro, NC-based solid-state battery component developer, raised $11m in Series A funding from Lotte Ventures, GM Ventures, and KTB Network.

☀️ mPower Technology, an Albuquerque, NM-based solar panel startup, raised $10m in Series B funding from Cottonwood Technology Fund, Hemisphere Ventures, and others.

💨 Moss.earth, a Brazil-based carbon credit marketplace focused on preserving the Amazon, raised $10m in Series A funding from SP Ventures, Acre Venture Partners, Jive, Arrington Capital, and others.

⚡ Resonant Link, a Shelburne, VT-based, provider of wireless EV charging technology, raised $9.3m in Seed funding from The Engine, Volta Energy Technologies, Emerson Collective, Urban Us, Scout Ventures, and FreshTracks Capital.

🧻 Cloud Paper, a Seattle, WA-based bamboo-based toilet paper startup, raised $5m in funding from Bezos Expeditions, TIME Ventures, Presight Capital, SOUNDWaves, and others.

🚗 Ferry, an Austin, TX-based EV subscription startup, raised $4m in Seed funding from AMYP Ventures, Venn Ventures, and others.

⚡ Leap24, a Netherlands-based startup facilitating a charging network for electric vans and trucks, raised $4.9m in Seed funding from undisclosed investors.

🚢 FleetZero, a New Orleans, LA-based manufacturer of battery-electric cargo ships, raised an undisclosed amount in funding from Y Combinator, MCJ Collective, and others.

☔ Entelligent, a Boulder, CO-based climate risk assessment platform, raised an undisclosed amount in Series A funding from Societe Generale, North Base Media, and the Oak Creek Group.

🧱 ZERUND, a India-based manufacturer of lightweight waste-based bricks, raised an undisclosed amount in pre-Series A funding from NEDFi Venture Capital Ltd.

TPG Rise Climate will invest $500m to sponsor the carve-out of solar tracker maker Nextracker from its parent company Flex.

Lightsmith Group announced the final closing of its Lightsmith Climate Resilience Partners, having raised $186m.

China is striving to run a green Olympics – from natural CO2 refrigeration at ice rinks to 100% renewables-powered venues. Additionally, pollution in China has declined by ~40%, and by ~50% in Beijing, thanks to the country’s “war against pollution” since 2013. But a climate-friendly winter Olympics is challenging with no snow. The Beijing Winter Games was the first to take place on 100% artificial snow, diverting key water reservoirs to make snow - and worse in a region in extreme drought.

India’s FY23 Budget directs an additional $2.6b to the country’s solar module production incentive scheme and signals intent to launch a blended finance / co-investment facility for agri-tech. It further classified grid-scale storage as infrastructure (critical for access to credit) and signals the roll-out of a national battery-swapping policy.

To curb methane leakages from abandoned wells, the White House announced a $1.2b investment to plug 130,000 documented orphaned wells across US oil fields. Despite the largest chunk of investment going to Texas, the Lone Star state regulators often turn a blind eye to letting oil majors off the hook of cleaning up after their own messes.

Meanwhile, what started with ExxonMobil union workers fighting for better wages and pensions has turned into an attempt to cripple Exxon’s efforts to build a $100b carbon capture hub in Houston. Exxon’s decarbonization strategy relies heavily on carbon capture (and greenwashing), but unions argue the company can’t be trusted with the jobs that come along with the CCS hub if it can’t even bother negotiating with disgruntled union workers.

The Carlyle Group committed to net zero financed emissions by 2050, pledging to establish climate plans at all majority-owned power and energy companies within two years of ownership. Despite investing over $1 trillion in fossil fuel assets since 2010, private equity was conspicuously absent from last year’s launch of the Glasgow Financial Alliance for Net Zero. Carlyle’s announcement could trigger similar pledges from its competitors, as high-emitting assets continue to flow to private markets.

The IEA rolled out their 2021 review of the EV market —showing global EV sales doubling their market share in this past year. However, cheaper ICE cars still dominate 98% of new sales in growing economies like India, Brazil, and Indonesia.

Overwhelmed by the sheer volume of applications and shortage of labor, the US’ largest grid operator, PJM, stopped accepting any new power plant proposals for the next two years, most of them solar, storage, and wind.

After experiencing the catastrophic drought that triggered first-ever water cuts on the Colorado River system, Mayor of Los Angeles, Eric Garcetti, wants the City of Angels to be the west coast’s hydration station. The $4.3b investment in storm water reclamation and water treatment plants will ensure LA will not go without water.

Using a gas leaf blower for an hour is equivalent to driving 1,100 miles. City and state governments have had enough.

Looking for a new car? Research shows that the total cost of many electric SUVs is less than their ICE counterparts. But watch out for the weight…

What do you call geothermal on Mars? Wrong answers only

Pumped up creeks. Can climate entrepreneurs foster a pumped hydro comeback?

Coral reefs could disappear if we exceed 1.5C, adding to growing concerns about biodiversity.

These Dark Materials: the energy transition needs better accounting of the costs of mining.

Data from the EO satellite start-up Kayrros showcases the climate impact of methane ultra-emitters.

A full carbon 180. How Boris Johnson went from climate skeptic to climate diplomat.

According to a new survey from Credit Suisse, Gen Z consumers in emerging economies care more about sustainability than young shoppers in developed countries.

Penguins are the canary in the coal mine when it comes to tracking climate change.

Seeing the forest for the trees. Carbonplan issues a report on ton-year accounting for carbon storage, with pushback from forest carbon startup NCX.

Why a disorderly transition to net zero could cause prices to skyrocket.

💡 Innovate2030: Apply by Feb 13th to Innovate2030-SDG11’s program to receive funding and mentoring for any innovation that will help transitions cities globally to be more sustainable and climate-smart.

💡 Climate13 Climate Entrepreneurship: Join Carbon13’s webinar series on Feb 15-16th to listen alongside other climate tech entrepreneurs interested in applying to an impactful 7-month accelerator program.

💡 Net Zero Lab: Apply to Upward Labs’ cohort of real estate decarbonization startups by Feb 28th to connect with critical partners and resources in a 3-month accelerator program.

🗓️ Transition on Tap: Join virtually on Feb 17th to hear Houston energy experts discuss their experience with the 2021 Texas freeze and how climate tech innovations can help to develop more resilient and reliable energy grids.

Partner @AiiM Partners

VP/ Head of Business Development @Sublime Systems

Account Executive @Regrow Ag

Software Engineering Manager @Regrow Ag

Head of Financial Planning & Analysis @The Future Forest Company

Head of Growth Marketing @Patch Technologies

Content & Community Manager @Wireframe Ventures

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond

Groundbreaking results from the geothermal developer’s main project