🌎 The SMR shake-up #284

Small reactors, big power rankings

Happy Monday!

The EPA’s latest biofuel rule and the Senate’s proposed tax bill mark a sharp turn toward homegrown fuels — giving corn ethanol and domestic biodiesel a boost while shucking imported alternatives.

In deals, $1.1bn for nuclear across two deals, $80m for urban robot delivery, and $72m for renewable energy development.

In other news, inside the firing at the Nuclear Regulatory Commission, the climate angle on Nippon Steel, and national adaptation plans and investment.

Plus, we turned our latest investor sentiment pulse check into a full report! Download it here, now with even more insights on what’s driving climate tech in 2025. For Sightline clients, you can access it in the platform here, as well as our other recent reports, like Data Center Powering Models.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

Last week, the EPA quietly proposed new rules for the Renewable Fuel Standard (RFS), the federal program that requires transportation fuel sold in the US to include a minimum volume of renewable fuels like ethanol, biodiesel, and renewable natural gas. The proposed rule goes all gas, no brakes on domestic production — arriving just as Congress hashes out the next federal budget.

Since its launch in 2005, the RFS has become a cornerstone of US ag and energy policy, with strong backing from corn and soybean producers (and a dash of energy independence rhetoric).

Now, this new proposal ups the ante.

The EPA’s proposed RFS rule arrives amid a broader push in Washington to realign US biofuel policy with domestic priorities. In the past week alone, Senate Republicans introduced a bill to extend the 45Z clean fuel production credit through 2031 — but slash its value by 20% for fuels made from foreign feedstocks. That follows the House bill proposed in May, which takes an even harder line by excluding most foreign inputs entirely. They still need to be reconciled, but both bills also revise emissions accounting to exclude indirect land use change, a controversial move that makes it easier for corn ethanol to qualify.

That’s a major shift for markets that still lean heavily on imports. In 2024, nearly 45% of biofuels were imported or made from imported feedstocks, with feedstocks like used cooking oil (UCO) from China and finished fuel from Neste’s Singapore refinery making up a big share. Under the EPA’s proposal, starting in 2026, fuels made with foreign feedstocks would only generate half as many RINs. Combine that with the expected 45Z haircut or disqualification, and producers relying on Brazilian sugarcane ethanol or Asian UCO — especially in the SAF and renewable diesel sectors — are facing a one-two punch.

Meanwhile, US producers are getting the green light. The RFS rule boosting renewable volume obligations by ~10% from 2025 to 2027 offers added certainty to domestic biofuel makers after years of policy whiplash. That’s particularly welcome for corn ethanol producers, who face long-term structural decline as EVs eat into gasoline demand. With 85-90% of US ethanol currently blended into gasoline, policies like the EPA’s and Trump’s earlier E15 order aim to rev up the industry.

The domestic biodiesel market also stands to benefit. Imports have undercut US soybean oil in recent years, especially in California, where the LCFS gives equal credit to all low-carbon fuels regardless of origin. So this federal rule could make domestic feedstocks more competitive and spur new capacity.

🏠 TerraPower, a Bellevue, WA-based nuclear reactor and storage developer, raised $650m in Growth funding from Bill Gates, HD Hyundai, and NVentures.

📦 Coco Robotics, a Santa Monica, CA-based urban robot delivery platform, raised $80m in Series B funding from Deepwater Asset Management, Offline Ventures, Outlander Fund I Archimedes, Pelion Venture Partners, and SNR.

☔ Pano, a San Francisco, CA-based wildfire intelligence and management software, raised $44m in Series B funding from Giant Ventures, Congruent Ventures, Initialized Capital, Liberty Mutual Strategic Ventures, Salesforce Ventures, and other investors.

🥩 Rival Foods, an Amersfoort, Netherlands-based plant-based protein developer, raised $12m in Series B funding from APG Asset Management, PYMWYMIC, PeakBridge, and ROM Utrecht Region.

⚡ HYMETH, a Gladsaxe Municipality, Denmark-based green hydrogen electrolyzer developer, raised $4m in Seed funding from FAM AB and Antler.

⚡ Light Bridge, a Hwaseong-si, South Korea-based hydrogen electrolysis systems manufacturer, raised $3m in Series A funding from Anda Asia Ventures, Magna Investment, and Ubiquoss Investment.

💧 captoplastic, a Vicálvaro, Spain-based microplastics capture technology developer, raised $2m in Series A funding from BeAble Capital.

💧 Xatoms, a Toronto, Canada-based AI-driven water purification materials developer, raised $2m in Pre-seed funding from Quantacet, BDC Capital, BoxOne Ventures, Genesis Ventures, and League of Innovators.

⚡ Oklo, a Sunnyvale, CA-based small modular reactors developer, raised $460m in Post-IPO Equity funding.

⚡ AMEA Power, a Dubai, United Arab Emirates-based renewable energy developer, raised $72m in Project Finance Debt funding from International Finance Corporation (IFC).

⚡ Intelligent Energy, a Jerichow, Germany-based PEM fuel cell manufacturer, raised $23m in Grant funding from Aerospace Technology Institute (ATI), Department for Business and Trade(DBT), and Innovate UK.

🚗 Polestar, a Göteborg, Sweden-based EV manufacturer, raised $200m in Post-IPO Equity funding from PSD Investment.

🌊 Minesto, a Kriebitzsch, Germany-based tidal and ocean current energy technology developer, raised $2m in Post-IPO Debt funding from Fenja Capital.

💨 Equitable Earth, a Stockport, England-based carbon market platform, was acquired by The Ecosystem Restoration Standard (ERS) for an undisclosed amount.

Climate Tech Partners, a Sydney, Australia-based investment firm, announced a $50m first close of its Fund I, targeting early-stage climate technologies with a focus on grid innovation, low-carbon fuels, and climate adaptation, backed by investors including CEFC and Australian Ethical.

Can’t get enough deals? See full listings and deal analytics on Sightline Climate.

The Trump administration recently fired a top Nuclear Regulatory Commission official, sparking concerns over political interference in nuclear oversight. This move follows a similar attempted removal at the Office of Special Counsel that a judge ruled illegal. The firings coincide with executive orders pushing for faster nuclear project approvals, suggesting political pressure may be used to influence regulatory decisions and undermine the NRC’s independence.

Nippon Steel’s $14.9bn takeover of US Steel was finalized this week. While it gives the president a “golden share” with veto power over key corporate decisions, it also brings Nippon’s more efficient blast furnaces and a decarbonization plan better aligned to US Steel’s current assets, including potential carbon capture, to the US.

The UK committed £7.9bn over ten years to flood defenses, including barriers, tidal gates, drainage upgrades, and wetland restoration to boost climate resilience. Meanwhile, US climate adaptation spending nears $1T annually — exceeding 3% of US GDP — to address growing damage from floods, fires, and storms. These investments underscore the critical need for upgraded infrastructure to tackle escalating climate risks.

The massive blackout that left over 1.2m people in Spain and Portugal without power was caused by a botched dispatch by Spain’s grid operator, according to a new report. Contrary to early speculation, renewables weren’t the culprit: most generators went offline due to overvoltage, not low frequency, highlighting gaps in voltage management rather than clean energy reliability. As Spain investigates grid dispatch protocols and considers upgrades, the EU and European Investment Bank committed €1.6bn ($1.8bn) to a long-delayed France-Spain transmission link, aiming to improve resilience and double interconnection capacity.

Google and CTC Global launched an initiative to boost US grid capacity using advanced conductors that support transmission without needing new rights-of-way. Utilities are invited to submit upgrade projects, with Google co-funding and providing technical support. This reflects Big Tech’s expanding role in addressing grid constraints amid rising AI and data center power demand.

US funding cuts have led BP to indefinitely pause its blue hydrogen project at a Texas refinery, citing economic challenges and uncertainties around carbon capture infrastructure. The suspension reflects broader financial risks for blue hydrogen, which relies heavily on CCS infrastructure to reduce emissions, but faces costly hurdles amid limited government support.

Sand batteries go against the grain to store solar and wind.

A study explores the conditional effects of air conditioning.

On climate, Gen Z’s firing up while Boomers keep cooling down.

An FAS report reveals how to de-risk clean energy and unlock trillions in green investment.

Pangaea Ventures’ Hard Tech Report says the future is in materials, bio, and digital.

Greenhushing: US green bond sales have fallen as companies seek to avoid unwanted attention from the Trump administration.

Is one chatbot greener than the next?

📅 Sightline Client Session: Staying Current with Gridtech: Sightline clients can join us on June 27, 2025, at 4:00 PM BST for a 30-minute exclusive session with Sightline’s Lukas Karapin-Springorum. Get the latest on DLRs, VPPs, and transformers, hear our thoughts on trends in grid performance, policy, and business models, and ask us anything in a live Q&A.

📅 BlueTech Happy Hour: Join us on June 26 at South Beach Cafe in San Francisco from 5–7:30pm. Connect with ocean innovation leaders, featuring talks from Bedrock Ocean Exploration and Plastic Odyssey. Tickets are $15.

💡Environmental Tech Lab: Apply to the 2025 challenge competition by August 8. Companies that can help the NYC Department of Environmental Protection (DEP) around operations and emergency response are in the running for this year’s competition.

📅 LA Resilient Rebuilding Cup: Join us for an innovation competition for resilient rebuilding and climate action to welcome the world in 2028. Registrations are now open to watch the live pitches and see the judging panel announce the results.

SAF & Sustainability Program Manager @Alaska Airlines

Vice President @Goldman Sachs

Senior Accounting Manager @Environmental Defense Fund

Transmission Planning Engineer @Nira Energy

Senior FP&A Analyst @Afresh

Head of Plant Design @Heirloom

Marketing Intern @ClimateCamp

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

Small reactors, big power rankings

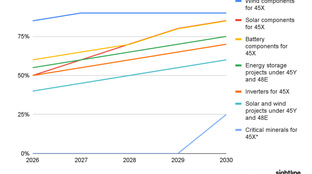

Stricter foreign sourcing rules reshape clean energy tax credit eligibility

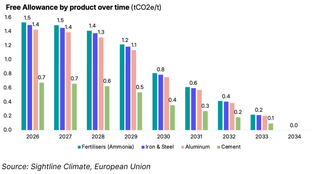

We did the EU carbon math