🌎 Bright spots and sunsets in the OBBB #253

One Big Beautiful Bill ushers in new (and old) energy agenda

EV SPACs trading down, but Proterra rings the Nasdaq bell

Happy Monday!

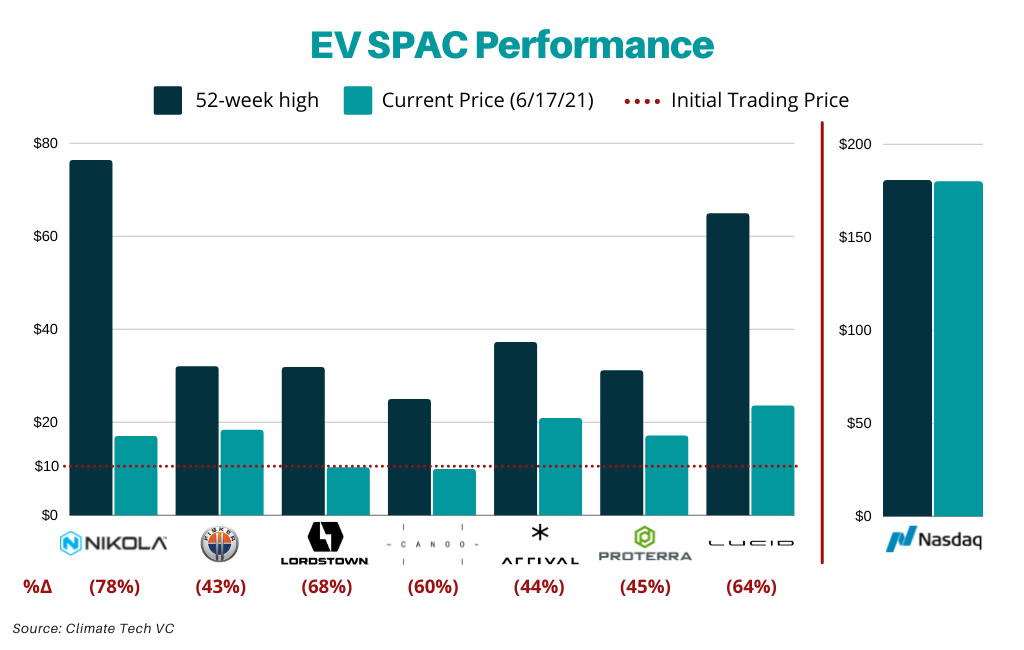

In this week’s issue we observe some financial gravity as the air gets let out of EV SPACs’ tires. Cumulatively EV SPACs are down ~60% across the board. We dig into some of the drivers - and lack thereof.

We also feature some crazy fundings including Heligoen’s sunlight refineries and Ecologi the “Spotify of sustainability.” Meanwhile Chamath finally announces the winners of his climate change ideas competition to a collective yawn, the Heat Dome sweats out the Southwest, and many a technical climate job abounds.

Thanks for reading!

Not a subscriber yet?

It’s been a bumpy road for EV startups – particularly for electric truck company Lordstown Motors. In the past month, its CEO and CFO resigned, costs and production targets were missed, and preorders were overstated. These problems confirm some of the accusations made by short-seller Hindenburg Research in March.

Hitched to these issues, Lordstown’s promise has long been a less costly version of the gas-powered Ford F-150. Then a few weeks back, Ford announced their electric F-150 priced >20% lower than Lordstown’s truck. Lordstown is just one example of an EV startup blowing through all the red lights and overselling its potential prior to commercial production. There’s been a broader shakeout in the EV SPAC market with EV OEM upstarts losing on average ~60% in value versus their 52-week high.

It’s important to note that the downward trend is not indicative of the broader market. In fact, both the Nasdaq and S&P 500 have both been trading around their all-time highs. So what exactly has deflated the EV SPAC tires?

🚀 General overhype. Since the beginning, many have said that electric vehicles are going to be the best thing since sliced bread. General overhype from people and publications contributed to financiers and consumers thinking the transportation future was here now. According to a Pew Research Center study published two weeks ago, only 7% of US adults said they currently have an EV or hybrid and 39% said they were very or somewhat likely to buy an EV for their next vehicle. The grade to full EV adoption is steep.

🚗 Auto OEM incumbents. Legacy auto OEMs are ramping up their EV investments, and the total capital from the OEMs relative to the SPACs valuations is significant. These incumbents (e.g., Ford and GM) have the infrastructure, sales channels, scalability, and experience in place to knock out the young competition. Ford is already scaling up manufacturing while many EV startups are still in the design phase.

🦹♂️ Bad actors. Lordstown is not alone in its management madness. Nikola CEO Trevor Milton also got blown up by Hindenburg Research for years of deception and false statements on its technological capabilities. Fisker CEO Henrik Fisker entered hot water for promising solid-state batteries earlier than the new target year of 2022. EV SPACs’ poor performance and overhype partially stems from c-suite short-sightedness.

However, just like we’ve predicted in our past SPACommentary, investors have started to peek under the hood. The road median between low quality businesses with fictitious orders and unbelievable revenue projections, and businesses ready for public markets, are now being reflected in their relative share price performance. For example, Proterra, which rang the Nasdaq closing bell last week, hasn’t fallen as steeply on stock price compared to the other OEMs given its the largest commercial EV provider in North America with almost $200m revenue in 2020 to show for it.

It’s also important (and interesting) to note that the EV SPAC market hasn’t completely fallen out yet. Most shares are still trading up relative to their initial trading price of $10, despite significant speed bumps in their businesses. In the meantime, we’re buckling our seat belts and keeping our eyes on the road ahead.

[Disclaimer: Kim is an investor at Energy Impact Partners which participated in Proterra's PIPE]

🌱 Motif FoodWorks, a Boston, MA-based plant-based food company, raised $226m in Series B funding from Ontario Teachers’ Pension Plan Board, BlackRock, AiiM Partners, Wittington Ventures, Rethink Food, Rage Capital, Breakthrough Energy Ventures, CPT Capital, General Atlantic, Louis Dreyfus Company, and Viking Global Investors.

☀️ Heliogen, a Pasadena, CA-based renewable energy tech company, raised $108m in two funding rounds from ArcelorMittal, Edison International, Prime Movers Lab, Ocgrow Ventures, and A.T. Gekko.

⚡ Caban Systems, a Burlingame, CA-based startup that designs and makes software-enabled energy storage and management systems for the telecommunications industry, raised $35m in funding from Ember Infrastructure.

⚡ Origami Energy, a UK-based energy trading startup, raised $24m in Series C funding from Barclays, Octopus Ventures, Cambridge Innovation Capital, and Aggreko.

🌱 EcoRobotix, a Switzerland-based provider of precision farming solutions, raised $15m in Series C funding from Swisscom Ventures, Verve Ventures, CapAgro, 4GO Ventures, and BASF.

🚲 Vässla, a Sweden-based maker of e-bikes and e-mopeds, raised $11m in Series B funding from Skabholmen Invest, Magnus Wiberg, and Patrik Hedelin.

🌱 InnerPlant, a San Francisco, CA-based maker of plant sensors to aid with crop risk management, raised $5.7m in Seed and pre-Seed funding from MS&AD Ventures, Bee Partners, UpWest, and TAU Ventures.

💨 Ecologi, a UK-based carbon-offset startup looking to be the “Spotify of sustainability”, raised $5.7m in funding from General Catalyst.

🌡️ Hydrosat, a Washington DC-based satellite startup measuring ground temperature data, raised $5m in Seed funding from Geospatial Technologies Fund, Freeflow Ventures, the Yield Lab, Expon Capital, Techstars, Industrious Ventures, and Synovia Capital.

♻️ Resourcify, a Germany-based provider of a waste and recycling management platform, raised $3.6m in funding from Speedinvest.

💨 Minimum, a UK-based startup that makes apps to calculate personal carbon emissions, raised $2.6m in Seed funding from Octopus Ventures, Clocktower Ventures, Dutch Founders Fund, Plug & Play Ventures, and AGO Partners.

Vertical Aerospace, a UK-based eVTOL developer, will go public via merger with blank-check company Broadstone Acquisition Corp., valuing the business at $2.2b.

Solid Power, a Louisville, CO-based maker of EV batteries, will go public via merger with SPAC Decarbonization Plus Acquisition Corporation III, valuing the business at $1.2b.

G2 Venture Partners, a Menlo Park, CA-based venture firm, raised $500m to support entrepreneurs that aim to make existing industries more efficient, environmentally friendly and socially responsible. [Check out our Friday feature interview with G2!]

SOSV, a Princeton, NJ-based venture firm, raised $100m for the SOSV Select Fund.

VC Fuel, a Houston, TX-based energy transition-focused investment firm, is raising $100m for its debut VC fund and $500m for an infrastructure fund.

Electriphi, a San Francisco, CA-based EV fleet monitoring software startup, was acquired by Ford.

Chamath (finally) announced the 8 winners of his much hyped climate change ideas competition. The general sentiment? 🥱 and 😕 as to why the winners “will receive a $25k award” verses the previously promised opportunity to invest a significant pool of Chamath’s cash into climate solutions.

China cracks down on crypto mining by ordering government-owned power companies to immediately stop supplying power to coin miners. Turning off just Sichuan’s power to miners decreased power load by 8 gigawatts- aka 40% of all power consumed in NY, the four largest solar parks’ combined generation, or 18 Apollo rockets’ worth of fuel.

EU lawmakers proposed a groundbreaking carbon border tax to set limits on carbon content in imported goods, jolting already stressed supply chains and sending shivers down the spines of EU trading partners. If passed, manufacturers that rely on heavy carbon-emitting electricity or industrial production would have to drastically change their practices or face a large carbon bill as products cross the EU border.

BlackRock is buying the climate-modelling technology of consultancy Baringa Partners for Aladdin, its risk management system.

California, Arizona, and Nevada are trapped in a “Heat Dome” that’s sending temperatures soaring into the triple digits. Climate change will only exacerbate these conditions and the accompanying wildfires and water shortage.

Check out this nifty data visualization (in Tableau 🤷♀️) of the federal budget for energy innovation.

While you’re nerding out, click on over to the Climate Change AI Wiki that summarizes various topics related to machine learning applications for tackling climate change.

Sam Altman and the OpenAI team want to invest in early-stage climate tech startups where AI tools can empower consumers to have transformational effects. Watch their video and fill out a form to get in on $100m.

Once and for all, what is the true climate impact of streaming? Netflix partnered with researchers at University of Bristol and The Carbon Trust to find out.

Reuters dropped a Hot List (touché) of 1,000 climate academics.

Just 0.2% of the Fortune 100’s board members have relevant ESG and climate experience.

Will America return to its RDD&D glory days?

Porsche is now making battery cells.

Tires, restaurant ratings, and now inflatable sails?

Elemental Excelerator and the Clean Energy Leadership Institute (CELI) partnered to launch EDICT (Empowering Diversity in Clean Tech) to bring more much needed diversity to clean energy. Their 30 interns just kicked off a paid 10-week program at 25 leading startups.

🗓️ The International Symposium on Sustainable Systems & Technology (ISSST): Register for this conference on sustainability technology, policy, and behavior from June 21-25.

🗓️ Startup Basecamp: Apply by June 23rd to the Future of ClimateTech Online Pitch Competition for pre-seed and seed startups.

🗓️ Urban Us reverse hiring fair: Join on June 23rd when startup founders pitch candidates to help them solve the biggest climate and urbantech challenges.

🗓️ Sustainable Ocean Alliance: Tune in to Demo Day on July 8th to meet the accelerator’s 4th Wave Cohort!

Geospatial & Agricultural Analytics Data Scientist @McKinsey

Machine Learning Engineer @Cloud to Street

Senior Data Science Engineer @Sust Global

Account Manager; Carbon Data Analyst @Watershed

Director of Sales, Broker Channel @David Energy

Carbon Removal Program Manager @Microsoft

Head of Philanthropic Partnerships @Elemental Excelerator

Investor Program Manager @Greentown Labs

Investment Director @SWEN Blue Oceans

Climate Tech Fellowship Program Associate @On Deck

Program Associate @Sequoia Climate Fund

Associate @500 Startups

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond