🌎 IMO sets sail for net-zero #242

The International Maritime Organization's first carbon tax ships out

Happy Monday-before-Barbenheimer! Also, this 😭

Back to our original programming… Exxon bought the largest CO2 pipeline network in the US last week. While not exactly a climate tech deal, the $4.9B acquisition is the largest single carbon-management investment since the passage of the IRA and has implications for the carbon capture, utilization, and storage ecosystem.

Meanwhile, we’re already becoming numb to new heat records. Regulators miss another deadline on deep-sea mining rules, and the US is digging into the carbon removal benefits of regenerative agriculture.

In deals this week, carbon utilization for concrete gets an $80M injection. DAC also absorbs $80M and ag tech secures $77M.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter at [email protected].

💼 Find or share roles on our job board here.

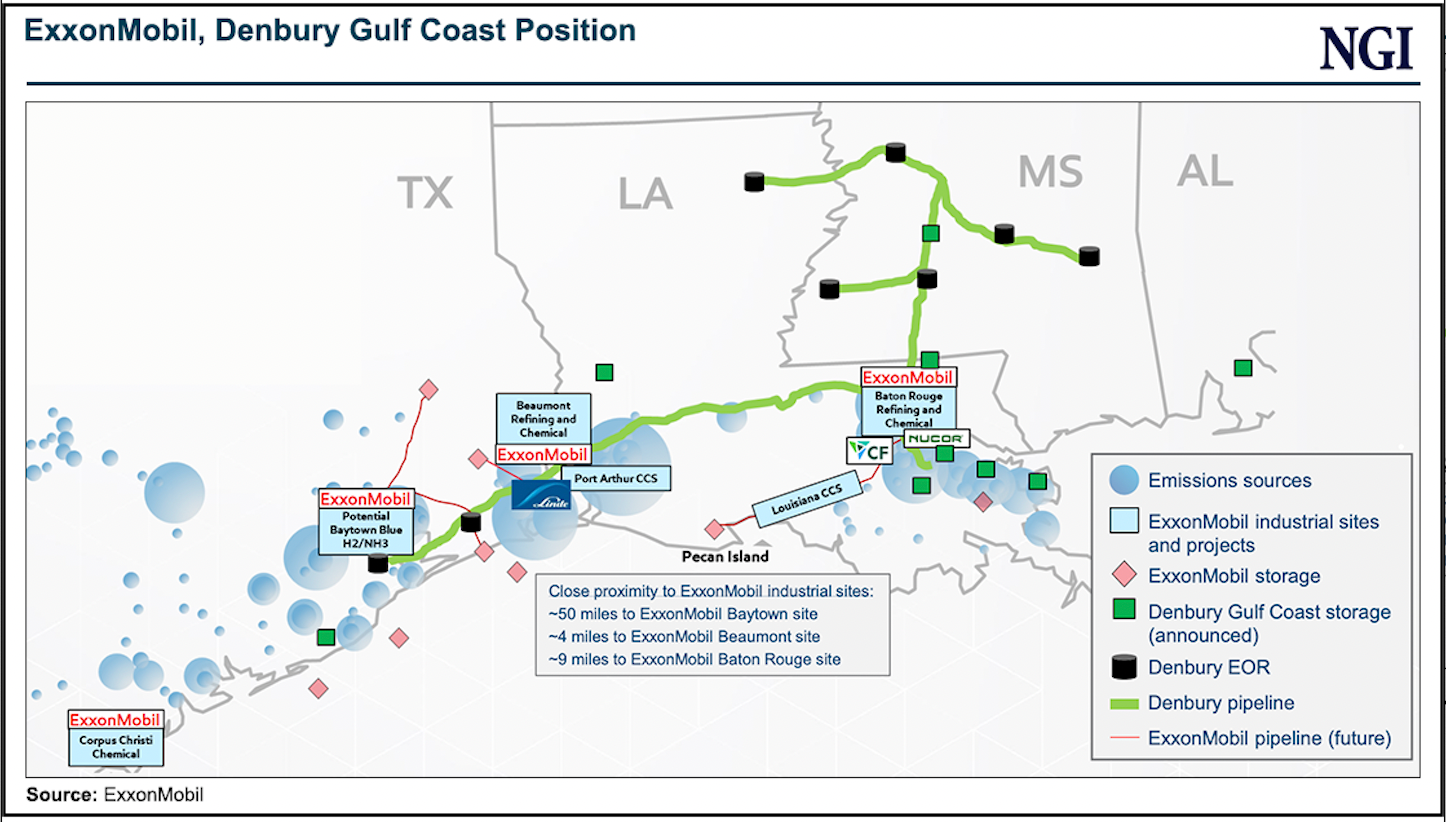

In a $4.9B deal on Thursday, ExxonMobil acquired Denbury, a Texas-based energy company focused on carbon capture and storage (CCS) and enhanced oil recovery (EOR) that controls the largest network of CO2 pipelines in the US.

It’s the largest single carbon-management investment since the Inflation Reduction Act (IRA), but not quite a true climate tech deal. The majority of Denbury’s revenue comes from EOR, which involves injecting CO2 into the ground in order to extend the life of oil fields, and ~60% of the price tag likely covered the value of Denbury’s oil production rather than the CCS infrastructure. But the deal does give us a peek inside the mind of an O&G giant angling to position itself amid the broader energy transition.

🧪 Molecules over electrons: Exxon has been vocal in its support for CCS, arguing that it “opens up the door for additional oil and gas,” allowing the industry to preserve its existing infrastructure. Its Low Carbon Solutions business plans to spend $17B on “lower-emissions” investments between 2022 and 2027, but the company is betting on clean hydrogen, ammonia, biofuels, and CCS rather than emissions-free electrons.

🤝 One-stop shop: The initial step in Exxon’s Low Carbon Solutions strategy is to become a full-service provider of CCS.

📍 Adjacent assets: Denbury’s network of CO2 infrastructure overlaps with much of Exxon’s existing footprint in the Gulf Coast, which is rich in potential CCS customers (with >1,000 major industrial emitters), viable geologic storage locations, and therefore many of Exxon’s planned lower-carbon business projects.

The IRA’s 45Q tax credit makes EOR much more attractive, providing $60 for each tonne of CO2 used for EOR. While that’s less than the $85 credit the law creates for permanently storing each tonne of CO2, it offers a company like Exxon an avenue to utilize IRA incentives.

Denbury’s physical assets combined with Exxon’s expertise and new federal policies that boost the business case make this a no-brainer, especially since the $4.9B purchase is relatively small potatoes for an O&G company that made $56B in profit (!) last year alone (that’s $6.3M each hour of 2022).

What really matters now is what happens to the CO2 captured and transported by Exxon.

The generous read: This could benefit climate tech interests in the long-term.

The cynical take: An O&G company controlling CO2 pipelines could be a detriment to scaling the carbon management tech that provides the greatest climate impact.

🧱 CarbonCure Technologies, a Dartmouth, Canada-based company injecting CO2 into concrete, raised $80M in Growth funding from Blue Earth Capital, Samsung Ventures, Breakthrough Energy Ventures, Microsoft Climate Innovation Fund, Amazon Climate Pledge Fund, Taronga Ventures, 2150, and BH3.

💨 Avnos, a Los Angeles, CA-based direct air capture startup using a CO2 adsorbent, raised $80M from ConocoPhillips, JetBlue Ventures, and Shell Ventures.

🌾 Aphea.Bio, a Gent, Belgium-based agricultural biologicals producer raised $77M in Series C funding from Innovation Industries, Korys, Bill & Melinda Gates Foundation, SFPIM, BNP Paribas, ECBF, Astanor Ventures, and AIF.

⚡ Everon, Seoul, South Korea-based EV charging infrastructure provider, raised $39M in Series B funding from Korea Development Bank, Industrial Bank of Korea, DSC Investment, L&S Venture Capital and K2 Investment Partners.

⚡ ROCSYS, a Delft, Netherlands-based autonomous EV charging solutions provider, raised $37M in Series A funding from SEB Greentech Venture Capital, Graduate Entrepreneur, European Investment Bank, and FORWARD.one.

🏭 Allonnia, a Boston, MA-based developer of microbes for environmental remediation, raised $30M in Series A funding from Bison Ventures, Viking Global Investors, BHP Ventures, Vale, Battelle, Iron Grey, and Wholestack.

🛰️ Bedrock Ocean Exploration, a Brooklyn, NY-based seafloor data exploration platform, raised $26M in Series A funding from Northzone, Primary Venture Partners, Quiet Capital, Eniac Ventures, and Valor Equity Partners.

⚡ Orennia, a Calgary, Canada-based energy transition analytics provider, raised $25M in Series B funding from Wellington Management, Quantum Innovation Fund, NGP Energy Capital Management, Veriten, and Tupper Lake Partners.

🔋 Neuron Energy, a Mumbai, India-based developer of EV batteries for micromobility vehicles, raised $24M in Seed funding from Equanimity Investments, Rajiv Dadlani Group, and others.

♻️ B:bot, a Puteaux, France-based plastic recycling robotics company, raised $22M from Eiffel Investment Group and Credit Agricole Normandie-Seine.

☔ Pano, a San Francisco, CA-based wildfire intelligence and management provider, raised $17M in Series A funding from Valor Equity Partners, T-Mobile Ventures, and Salesforce Ventures.

🔋 Peaxy, a San Jose, CA-based battery analytics platform, raised $12M in Series B funding.

🐄 Performance Livestock Analytics, an Ames, Iowa-based precision livestock platform, raised $7.5M in funding from Builders VC and Alaris Capital.

🌾 Finres, a Paris, France-based agricultural resilience software platform, raised $5M in Seed funding from Speedinvest, Illuminate Financial, AFI Ventures, Kima Ventures, Plug and Play, Raise Sherpas, Tiny VC, and Better Angle.

💨 sensand, a Melbourne, Australia-based carbon credit and MRV platform for farmers, raised $4M in Seed funding from Robert Costa.

⚡ Go Eve, a London, UK-based rapid EV charging provider, raised $4M in Seed funding from The Pearl Family Office, Carter Gem, Automotive Ventures, Kero Development Partners and Cur8 Capital.

🏠 Trebellar, a San Francisco, CA-based smart building data platform, raised $4M in Seed funding from Haystack, Altcapital, KFund and Jetstream.

🛰️ BiOceanOr, a Valbonne, France-based predictive analytics provider for water quality, raised $2M in Seed funding from The Yield Lab Europe and Grant funding from i-Nov.

🌾 NetZeroNitrogen, a Nottingham, United Kingdom-based producer of alternative synthetic nitrogen fertilizer, raised $2M in Pre-Seed funding from Revent, Zero Carbon Capital and other angel investors.

🔋 Allye, a London, UK-based mobile energy storage system, raised $1M in Seed funding from Elbow Beach Capital.

♻️ Re-Fresh Global, a Berlin, Germany-based textile upcycling company, raised $1M in Pre-seed funding from Earlybird and Serpentine Ventures.

🔋 TROES, a Markham, Canada-based modular battery energy storage systems provider, raised an undisclosed amount in Seed funding from Mobility Innovation Fund.

⚡ Power2X, a Amsterdam, Netherlands-based hydrogen project developer, raised $146M in funding from CPP Investments.

🔋 FREYR Battery, a Luxembourg-based battery manufacturing company, raised $113M in Grant funding from the European Union.

⚡ Nexus PMG, a Dallas, TX-based waste-to-value project consulting provider, raised $50M in Growth funding from Greenbacker Capital Management, Ontario Power Generation Pension Fund, and Liberty Mutual Insurance.

🛞 Wastefront, an Oslo, Norway-based tire recycling company, raised $43M from VTTI.

⚡ Yosemite Clean Energy, a Mariposa, CA-based waste gasification plants developer, raised $5M in Grant funding from the California Energy Commission.

💨 Denbury, a Plano, Texas-based CO2 pipeline and hydrocarbon provider, was acquired by ExxonMobil for $4.9B.

☢️ Oklo, a Sunnyvale, California-based developer of nuclear fission, announced a SPAC merger with AltC Acquisition Corp at a valuation of $850M.

⚡ Veritone’s Energy Business, a Denver, CO-based AI-powered DERMs platform, was acquired by GridBeyond for an undisclosed amount.

Copenhagen Infrastructure Partners, a Copenhagen, Denmark-based investment firm, held a first close of $6B out of its $13.5B fund investing in renewable energy infrastructure projects.

Spring Lane Capital, a Boston, MA-based investment firm, closed $290M for its second sustainable infrastructure fund.

Azolla Ventures, a Cambridge, MA-based investment firm, launched a $239M fund that invests in climate companies overlooked by traditional capital sources.

Coca-Cola, the soft drink manufacturer, launched a $137M fund along with eight other bottling partners and Greycroft to invest in sustainable supply chain and manufacturing.

Suffolk Technologies, a Boston, MA-based venture arm of a national construction firm, raised $110M for a fund investing in companies address sustainable and efficient construction.

AirMiners, a San Mateo, CA-based carbon removal community, launched a $250K Kiloton Fund for buying carbon credits from startups at a discount.

Share new deals and announcements with us at [email protected]

The EU narrowly passed a nature recovery law. The policy means ~20% of land and sea in the region will need to have recovery measures in place by 2030.

The UN-affiliated International Seabed Authority met this week in Jamaica to write rules for deep sea mining—a potential trillion-dollar industry as the transition to electric vehicles spurs demand for metals like cobalt and nickel, found on the bed of the ocean. Critics say the operations will threaten critical ecosystems in need of preservation.

Canada announced $450M for the UN’s Green Climate Fund, part of the nation’s $5.3B commitment to supporting climate finance in developing countries and its second replenishment for the fund.

The COP28 agenda dropped, and climate ministers are calling for action on energy and finance in order to consider the conference a success.

Complex financial structures may be routing ESG dollars to less-ESG friendly corporations, with Saudi Aramco as a leading case study.

EVs are being produced faster than they’re sold. Despite growing demand, EV inventory supply averages ~90 days sitting at the dealership vs ~50 days for ICE cars. This comes after Tesla’s price cuts have seemingly driven down prices for EVs across the board. While cost is still the main force keeping consumers from purchasing an EV, dealers' reluctance to sell EVs could also be at play here, similar to contractors dragging their feet on residential heat pumps.

The USDA wants to better quantify carbon emissions of regenerative ag. The agency will put $300M of IRA funding toward monitoring and collecting data on different farming practices.

Record-breaking weather continues to claim headlines, with an epic heat wave hitting 25% of the US, massive flooding in the Northeast, and a Gulf that may be warmer than 90°F. Across the globe, the first week of July scored the four hottest days on record.

The EPA and White House launched $20B in grant competitions to finance clean energy projects, coming from the EPAs Greenhouse Gas Reduction Fund. See more about the role of green banks from CTVC here. The administration also announced $60M to create an accelerator program aimed at climate resilience.

Connecticut became the third state to ban utilities from charging ratepayers for lobbying fees, joining Maine and Colorado. These lobbying fees are typically used in an effort to delay energy transitions and climate action, and consumers may pay for this even unknowingly.

Congestion costs, incurred when there is not enough transmission capacity to provide lowest-cost power generation, increased 56% in the US in 2022, placing a direct burden on consumers.

In a first for the industry, Brimstone received third-party approval that its carbon-negative cement is structurally the same as Portland cement—the gold standard for building requirements.

Reflective super white super paints are hot.

“Underground climate change” sinks buildings in Chicago.

Solar farms make waves.

33% by 2030, anyone? Wind and solar to produce 1/3rd of world power by 2030.

The IEA and FT sound the alarm on underinvestment in critical mineral production.

The ocean is turning green, and not in a good way.

Environmental Justice resources by state from Alabama to Wyoming.

Are the IRA and IIJA working? These 100+ slides of policy analysis say yes.

The location-adjusted cost of being cool: Air conditioning prices by state.

Oppenheimer II? Pakistan launches $3.5 billion Chinese-designed nuclear plant.

Van-oof! Competitor Cowboy rides in to rescue stranded software-enabled bikes.

🗓️ Social Impact Summer Connector: Connect and collaborate with social impact professionals and entrepreneurs at this community connector event in New York City on July 25.

🗓️ Innovation Intersection: Join Greentown Labs’ climate tech focused panel to learn more about alternative meats, energy efficient air conditioning, and metabolic assays on July 26 in Boston.

🗓️ Beacon Climate Co Art Show: This San Francisco art show curated by Baukunst x PROWL features a creative and exploratory exhibition showcasing how technology offers hope in a climate crisis on July 27.

💡 AirMiners Launchpad: Apply by Aug 11 to this six week launchpad for carbon removal startup founders aiming to advance carbon market understanding, product development, and entrepreneurial finance.

Analyst, Acquisitions (Real Estate) @Galvanize Climate Solutions

Head of Finance & Operations @Energy Innovation Policy and Technology LLC

Senior Industrial Engineer @Twelve

Senior Sustainability Consultant @Climate Partner

Head of Carbon Reductions @Carbon Direct

Investment Director, GE Lead - Core & Bio @bp

Technical Specialist, Low Carbon Fuel Standard @SCS Global Services

Technical Specialist, Responsible Biofuels @SCS Global Services

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

The International Maritime Organization's first carbon tax ships out

Trump’s coal push ignores economic reality and attractive alternatives

The tariffs' toll, explained sector-by-sector