🌎 Clean energy rollbacks short-circuit in court

US courts roll back Trump-era actions on offshore wind and DOE grant cancellations

Happy Monday!

After years of private capital piling into frontier energy, public markets are finally opening the door. Fervo Energy and General Fusion are stepping through it, in very different ways.

In deals, $223m for battery storage solutions provider, $97m for geothermal development, and $75m for rare earth elements recycling.

In other news, US power grids hit by winter storms, DOE says it's cutting $83bn in loans, and its energy efficiency and renewables office just got more funding from Congress.

And ICYMI - check out the results of our 2026 Prediction Markets Outlook, with all the crowd favorites and long shots across everything from climate investment, power markets, and China's rise.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

CTVC is powered by Sightline Climate, the tactical market intelligence platform for energy and investment decision-makers.

Two high-profile clean-firm power startups announced they’re going public this week, hoping to feed the markets' hunger for exits.

First, enhanced geothermal systems (EGS) startup Fervo Energy quietly filed for an IPO last week. The filing comes a month after the climate tech darling’s $462m Series E, which added to the company’s more than $1bn in private capital, as it builds the world’s largest EGS project, Cape Station in Utah.

Second, Canadian fusion company General Fusion announced plans to go public via a ~$1bn SPAC merger. It would make General Fusion the first publicly traded pure-play fusion company, with proceeds targeted at advancing commercial-scale fusion milestones.

No bell rung yet, but a clear bellwether for this market’s appetite for frontier energy tech.

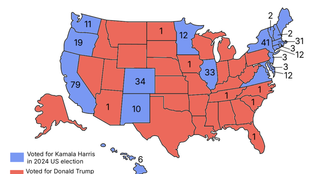

Both moves land at a moment when climate and energy investors have been openly calling for exits and liquidity. In our recent 2026 predictions survey, you said you expect more exits this year than last. Fervo topped the list of most-expected candidates, alongside fusion heavyweight Commonwealth Fusion Systems.

But while both companies are often grouped as “next-gen baseload,” they sit in very different places technologically and financially.

For Fervo, the technology itself isn’t new. EGS relies on drilling deep, fracturing hot rock, circulating water, and harvesting steady heat (sound familiar?). Fervo’s advantage has been execution. By adapting oil and gas drilling techniques, proving it could stimulate rock reliably, and signing real PPAs, the company has turned EGS into something utilities and hyperscalers could underwrite. That success also cuts both ways. Subsurface data, drilling talent, and capital matter, but there are few hard moats. If EGS works, many players can do it. Public markets appear to agree: Fervo’s filing implies a $2–3bn valuation, below what Series E investors had targeted.

General Fusion sits at the opposite end of the spectrum. The SPAC materially improves its near-term liquidity after a rough 2025, providing roughly $335m of gross proceeds to focus on technical milestones. But public markets will also magnify fusion’s core risk: Nuclear fusion remains scientifically plausible but commercially unproven, with long and uncertain timelines.

General Fusion’s magnetized target fusion approach is one of several competing pathways, alongside tokamaks, stellarators, and laser-based systems. Fusion co. TAE Technologies also announced a merger with Trump Media in December, taking it public. TAE is pursuing Field Reversed Confinement (FRC). The lack of a clear market winner preserves venture-style upside, but also raises the stakes, as going public with commercially unproven tech brings scrutiny and short pressure that private peers largely avoid.

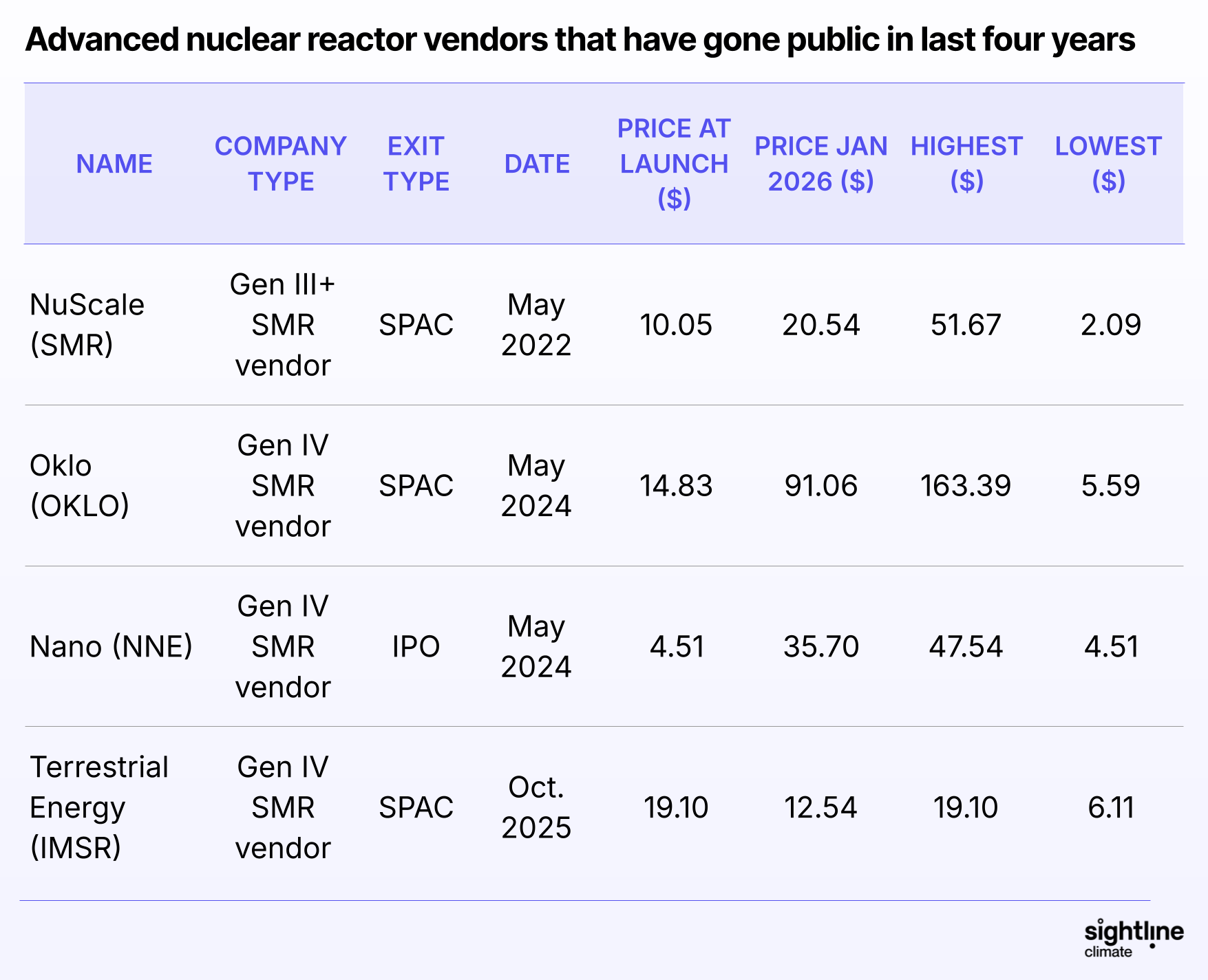

Still, the deal could serve as a signal. No fusion company is close to commercial deployment, and most will need billions more for R&D and first-of-a-kind plants. If General Fusion’s stock holds up, public markets may emerge as a viable funding layer for other fusion developers, much as they have for advanced nuclear despite broader SPAC underperformance.

🔋 terralayr, a Zug, Switzerland-based battery storage solutions provider, raised $223m in Series B funding from Eurazeo, Earlybird Venture Capital, Norrsken Launcher, Picus Capital, RIVE Private Investment, and other investors.

🚀 osapiens, a Mannheim, Germany-based enterprise sustainability management software platform, raised $100m in Series C funding from Decarbonization Partners, Goldman Sachs Alternatives, and Armira Growth.

⚡ Sage Geosystems, a Houston, TX-based geothermal developer, raised $97m in Series B funding from Carbon Direct Capital, Ormat Technologies, Abilene Partners, Arch Meredith, Climate Solutions, and other investors.

🚀 Cyclic Materials, a Toronto, Canada-based rare earth elements recycling service, raised $75m Series C from T. Rowe Price and Canada Growth Fund.

🐄 Orbem, a Munich, Germany-based AI-powered MRI developer aiming to cut food waste, raised $65m in Series B funding from Innovation Industries, 83North, General Catalyst, Possible Ventures, Supernova Invest, and other investors.

🏠 Jetson Home, a North Vancouver, Canada-based home electrification provider, raised $50m in Series A funding from Eclipse Capital, 8VC, Activate Capital Partners, Active Impact Investments, and Garage Capital.

⚡ SunLib, an Aix-en-Provence, France-based solar subscription provider, raised $29m in Seed funding from Épopée Gestion.

🏠 Cloover, a Stockholm, Sweden-based renewable energy financing platform, raised $22m in Series A funding from MMC Ventures, QED Investors, Bosch Ventures, Earthshot Ventures, Lowercarbon Capital, and other investors.

🏭 Karman Industries, a Los Angeles, CA-based industrial heat solutions developer, raised $20m in Series A funding from Riot Ventures.

🏠 Cambio, a New York City, NY-based real estate decarbonization software provider, raised $18m in Series A funding from Maverick Ventures, Adverb Ventures, Peterson Ventures, and Y Combinator.

📦 one.five, a Hamburg, Germany-based AI-powered packaging solutions developer, raised $16m in Series A funding from Green Generation Fund, KIMPA, Planet A Ventures, Revent, Speedinvest, Symbia VC and other investors.

🚗 Transvolt Mobility, a Mumbai, India-based heavy commercial vehicle provider, raised $15m in Series B funding from Finnfund.

👕 Whizzo, a Bengaluru, India-based advanced composites manufacturer, raised $15m in Series A funding from Fundamentum, BEENEXT, LB Investment, and Lightspeed Venture Partners.

⚡ Aerem, a Mumbai, India-based solar panel system and financing provider, raised $15m in Series A funding from SMBC Asia Rising Fund, Avaana Capital, Blume Ventures, British International Investment (BII), SE Ventures, and other investors.

🌾 ABZ Innovation, a Szentendrei Járás, Hungary-based agricultural drone manufacturer, raised $8m in Seed funding from Vsquared Ventures, Assembly Ventures, and Dayone Capital.

👕 Octarine Bio, a Copenhagen, Denmark-based sustainable dyes developer, raised $6m in Series A funding from Edaphon, Oskare Capital, The Footprint Firm, Unconventional Ventures, and DSM-Firmenich Venturing.

🍎 Grove, a Riyadh, Saudi Arabia-based fresh produce supply chain connector, raised $5m in Seed funding from Outlier Ventures.

⚡ Enerzolve, a Bengaluru, India-based storage and power electronics developer, raised $5m in Seed funding from Jungle Ventures, Kae Capital, and Ramakant Sharma.

📦 Dripl, a Brussels, Belgium-based workplace beverage refill station provider, raised $5m in Seed funding from Abacus Investments, Faraday Venture Partners, and Spadel.

⚡ Greenvolt, a Porto, Portugal-based renewable energy developer, raised $69m in PF Debt funding from UniCredit Bank Hungary.

🔋 ECO STOR, a Munich, Germany-based second-life EV battery storage provider, raised an undisclosed amount in PF Debt funding from Nord/LB.

💨 RESMAN Energy, a Trondheim, Norway-based wireless flow monitoring tech developer, was acquired by SLB for an undisclosed amount.

🏠 Kylmontage, a Södertälje, Sweden-based refrigeration systems installer and service provider, was acquired by Tedge Energy for an undisclosed amount.

🏠 Thermolec, a Montreal, Quebec-based electric HVAC heater manufacturer, was acquired by SPX Technologies for $1431m.

💰 Gore Street Capital, a London, UK-based renewables and energy storage private equity investment firm, announced a target of $592m for its GS EU Fund SCSp from the European Investment Fund, Ireland Strategic Investment Fund, and others, focusing on battery energy storage systems across Europe.

💰 2150, a London-based urban and industrial climate tech VC, reached final close on its $249m Fund II, continuing its mission to back technology companies that help reshape sustainable cities and decarbonise industry

This is a sample of deals available for Sightline clients. Can’t get enough deals?

US power grids from PJM to Texas are bracing for record winter electricity demand after the weekend’s major storm left over 800,000 customers without power and extreme cold is expected to linger. Grid operators are paying some large users to cut consumption and using emergency measures to prevent rolling blackouts as electricity and natural gas prices surge.

The DOE says it is restructuring, revising, or eliminating over $83bn in Biden-era loans and conditional commitments after reviewing the loan portfolio from the Office of Energy Dominance Financing (fka the LPO). It plans to cut funding for some wind and solar projects and shift investments toward natural gas and nuclear.

Meanwhile, Congress passed an appropriations bill giving DOE’s energy efficiency and renewables office $3.1bn, more than the White House’s requested $880m, and restored funding for solar and wind despite Trump’s proposed cuts. The bill is also supposed to limit the DOE’s ability to cancel or renegotiate existing federal awards, possibly setting up more court fights.

FERC approved Southwest Power Pool’s new High Impact Large Load (HILL) process, designed to speed up and strengthen reviews for big electricity users like data centers and large manufacturing. The plan creates a 90-day study-and-approval pathway tied to nearby or new generation to support faster grid connections while maintaining reliability.

Centrica and EDF are in talks with the UK government about extending the Sizewell B nuclear plant from 2035 to 2055. As the UK’s only operating pressurized water reactor, Sizewell B is well suited for a longer extension, but EDF says it would require about £800m in investment, potentially contingent on the government guaranteeing a long-term power price.

Volta Foundation just dropped its 2025 Annual Battery Report — a power-packed guide to research, policy, and business landscape.

MIT’s 10 Breakthrough Technologies of 2026 is out now, featuring the rapid rise of hyperscale AI data centers, next-generation nuclear plants, new battery technologies, and more.

Sunny forecast for solar in 2026 and 2027, supposed to deliver the largest increase in power generation, per EIA.

HydroQuébec shifted from major exporter to net importer as hydropower dries up lately.

SAF offtake takes off with new Trafigura agreement.

Execs on renewable energy at Davos.

Graphic explainer of what’s happened in US science in the past year.

Climate change has penguins in Antarctica nesting early.

📅 ClimateCAP MBA Summit: Join MIT Sloan School of Management on April 17 & 18 in Cambridge, MA to engage with MBA students, industry leaders, and experts on the financial risks and opportunities of climate change in business and investment.

📅 SOSV VC-Founder Energy Matchup: Join SOSV online March 2–6 for curated 1:1 meetings between energy tech startups (up to Series B) and investors.

📅 Climate Technology Show 2026: On March 24–25, 2026 at ExCeL London, attend a cleantech exhibition and conference that gathers global stakeholders to explore climate innovations across energy, carbon, mobility, AI, and ESG.

US Program Director @Constructive

UK Programme Manager @Constructive

Operations Manager @Constructive

Founding Account Executive @Ezra Climate

Associate @Prelude Ventures

Summer Associate @Grantham Foundation for the Protection of the Environment

Robot Software Engineer (Platform and Backend), Robot Software Engineer (HMI/UI), Electrical Engineer, Civil Engineer, Solution Engineer @Planted

Investment Associate, @Zero Infinity Partners

Summer Research Analyst – Environmental Markets, @Molecule Ventures

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

US courts roll back Trump-era actions on offshore wind and DOE grant cancellations

We asked, you answered, and experts weighed in on 2026

The real costs of the US exit from the UNFCC