🌎 FEOC in focus #283

Stricter foreign sourcing rules reshape clean energy tax credit eligibility

Groundbreaking results from the geothermal developer’s main project

Happy Monday!

We’re tapping into Fervo’s groundbreaking new findings to show just how hot next-gen geothermal is getting.

In deals, $750m for efficient data center development, $206m for enhanced geothermal, and $149m for fusion.

In other news, dismantling US power plant pollution rules, the UK’s nuclear bets, and storage and solar bankruptcies.

And ICYMI, on Friday, CTVC and Elemental Impact put out a 2025 investor pulse check, mapping the space’s sentiment on everything from funding to FOAK to philanthropy. Check out Elemental’s blog post full of insights, and read our newsletter with all the data.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

Fervo’s at it again — pushing the limits of enhanced geothermal and what’s possible in clean, firm power. Last week, the company announced that its latest well is its hottest and deepest yet, unlocking the potential for even more power per well. Paired with a fresh $206m in project funding, Fervo’s rapid rise is showing no signs of cooling off.

Fervo released new data from drilling its Sugarloaf appraisal well in southwest Utah, part of its flagship 500MW Cape Station Phase 1 project and now its most advanced geothermal well to date. It shows major technical leaps:

The Sugarloaf well is part of Cape Station Phase 1, Fervo’s first full-scale commercial development. In parallel, last week, a consultancy released new findings that the site’s reserves can support over 5GW of resource potential at depths up to 13,000 feet — a 2.5x increase of the previous estimate of 2GW.

The following day, Fervo announced an additional $206m of project finance for Cape Station: $100m in project preferred equity from Breakthrough Energy Catalyst, $60m from Mercuria (adding to its existing $120m loan), and $46m from X-Caliber Rural Capital in bridge debt financing.

And it wasn’t the only big news out of the sector this week: Meta and XGS Energy also announced an agreement to offtake 150MW of power from XGS’s closed-loop advanced geothermal projects to power Meta’s data centers in New Mexico.

Separately and together, these announcements mark a major acceleration for Fervo — and for the broader case for its EGS technology.

In geothermal, it all comes down to heat. These systems don’t extract oil or gas; they circulate fluid through fractures in hot rock deep underground. That fluid heats up, comes back to the surface, and drives a turbine to produce electricity. The hotter the rock, the more energy the fluid can carry — meaning more power per well, and more revenue when that power is sold.

At the same time, faster drilling means lower capex. Drilling costs, like rig time and labor, rise depending on how long it takes to complete a well. Fervo’s Sugarloaf well was not only the hottest, but also its fastest to drill. That combo — hotter wells in less time — means Fervo's EGS could be competitive in more locations.

A larger-than-expected resource at Cape Station is another unlock. Developing a geothermal project isn’t just about one good well — it requires years of exploration, modeling, permitting, and seismicity testing. Cape's bigger-than-expected size means Fervo can bring more megawatts online, sooner, and at lower cost per unit.

Sightline clients can dive into profiles of Fervo's technology and more on the platform here.

And all of this is now backed by cheaper capital. Fervo funded early drilling at Cape with venture dollars, but is now moving into project finance — raising $206m from big players like Breakthrough Energy Catalyst, Mercuria, and X-Caliber. The shift from VC to loans reflects growing investor confidence in Fervo’s EGS as a bankable technology — and unlocks faster scaling.

Plus, Fervo already has customers lined up. It’s signed a pair of 15-year PPAs with Southern California Edison totaling 320MW, along with a 48MW deal with Clean Power Alliance, 20MW with California Community Power, and 31MW with Shell. Google has also signed an offtake agreement, part of its broader strategy to secure 24/7 clean energy.

As power demand from AI and data centers surges, geothermal is becoming a favorite for clean, firm load. The Meta-XGS Energy deal is big news too, although XGS uses a different “closed-loop” geothermal approach. But with Sugarloaf’s results on the board, the bar just got higher. Any competitor will now need to do exceptionally well to beat Fervo in the race.

🌾 Beewise, a San Ramon, CA-based automated beekeeping systems developer, raised $50m in Series D funding from APG Asset Management, Austin Hearst, Badiya Capital, Fortissimo Capital, Insight Partners, and others.

🛰 Muon Space, a Mountain View, CA-based satellite systems developer, raised $44m in Series B funding from Congruent Ventures, ACME Capital, Activate Capital Partners, ArcTern Ventures, Costanoa Ventures, and Radical Ventures.

⚡ Kazam, a Bangalore, India-based EV charging management platform, raised $6m in Series B funding from Vertex Ventures, Avaana Capital, and Chakra Growth Capital.

♻️ Impact Recycling, a Falkirk, Scotland-based plastic recycler, raised $4.5m in Growth funding from IW Capital.

🏠 Runwise, a New York City, NY-based building energy efficiency platform, raised $30m in Series B funding from Menlo Ventures, Alumni Ventures, Cooley, Fifth Wall, Helium-3 Ventures, MassMutual Ventures, Munich Re Ventures, Nuveen, and Soma Capital.

⚡ Proxima Fusion, a Munich, Germany-based stellarator-based fusion energy developer, raised $149m in Series A funding from Balderton Capital, Cherry Ventures, Bayern Kapital, Club degli Investitori, DeepTech & Climate Fonds (DCTF), and others.

🛰 Bedrock Ocean Exploration, a Brooklyn, NY-based ocean exploration vehicle developer and data platform, raised $25m in Series A funding from Northzone, Primary Venture Partners, Autopilot, Costanoa Ventures, Harmony Partners, Katapult, and Mana Ventures.

🔋 Vecmocon Technologies, a New Delhi, India-based light EV tech stack platform, raised $18m in Series A funding from Ecosystem Integrity Fund, Aavishkaar Capital, Blume Ventures, and British International Investment (BII).

🛰 Sorcerer, a San Francisco, CA-based high-altitude weather data provider, raised $3.9m in Seed funding from FundersClub, Collaborative Fund, First Order Fund, New Legacy, Pioneer Fund, Transpose Platform, and Y Combinator.

⚡ Engrate, a Stockholm, Sweden-based energy data integration platform, raised $2.9m in Seed funding from Maniv Mobility, Course Corrected VC, and Eviny Ventures.

🚢 ENVGO, a Waterloo, Canada-based electric hydrofoil boats developer, raised $2m in Seed funding from Two Small Fish, Garage Capital, and Waterloo Venture Group (WVG).

🏠 Crusoe, a Denver, CO-based developer of AI-optimized efficient data centers, raised $750m in Debt funding from Brookfield Asset Management.

⚡ Fervo Energy, a Houston, TX-based geothermal project developer company, raised $106m in Debt funding from Mercuria and X-Caliber Rural Capital, and raised $100m in PF Equity funding from Breakthrough Energy Catalyst.

⚡ Enagas, a Madrid, Spain-based natural gas liquefaction and gasification to hydrogen specialist, raised $38m in Grant funding from the European Union.

⚡ Soluna, a New York City, NY-based renewable-powered data center developer, raised $20m in PF Debt funding from Spring Lane Capital.

⚡ Hydrogenera, a Sofia, Bulgaria-based renewable hydrogen technology developer, announced IPO funding.

✈️ XCF Global Capital, a San Francisco, CA-based SAF producer, announced a SPAC merger with Focus Impact BH3 Acquisition at an implied valuation of $1.8bn.

Ecosystem Integrity Fund, a San Francisco, CA-based climate-focused venture firm, announced the close of its fifth fund, EIF Fund V, with $225m to back early-stage innovations in sustainability, including nature-based carbon, flood resilience, EV fleet optimization, and sustainable agriculture.

Swen Capital Partners, a Paris, France-based sustainable investment firm, announced the first close of its Swen Blue Ocean 2 Fund with €160 million ($182 million) to back startups focused on regenerating ocean biodiversity through Series A investments across Europe.

Can’t get enough deals? See full listings and deal analytics on Sightline Climate.

Trump repealed a Biden-era restriction on power plant emissions, advancing plans for 19GW of natural gas fueled power by 2028 and prolonging the life of coal plants previously being phased out. The repeal comes as utilities scramble to meet new data center demand driven by AI. The restrictions would not have barred construction of plants, but would have compelled utilities to capture nearly all of their CO2 emissions.

The UK placed a multi-billion pound bet on nuclear with new funding for fission and fusion, including £11.5bn ($15.6bn) to nuclear plant Sizewell C, £2.5bn ($3.4bn) to support three Rolls-Royce SMRs, and £2.5bn ($3.4bn) for fusion development, marking one of the largest national investments in next-gen nuclear. The funding signals a renewed UK nuclear strategy, making the UK the first country to back both SMRs and fusion with substantial capital, amid a global race for leadership.

Bankruptcies are rippling through clean energy, with Powin, Sunnova, and Mosaic filing for Chapter 11 in the past two weeks. Battery integrator Powin blamed tariff and margin pressures, while residential solar firms Sunnova and Mosaic were hit by high rates, weak net metering, and failed debt exits. The wave exposes mounting financial stress across storage and solar finance as policy and macro headwinds tighten.

Shell and EDF canceled their 1.5 GW Atlantic Shores 1 project in New Jersey, citing permit loss, inflation, and supply chain pressures. The move underscores persistent financial and regulatory fragility in US offshore wind despite recent progress like Empire Wind. The sector faces heightened policy uncertainty just as it begins to scale.

Dynamic line rating (DLR) is shifting to scale this week, with LineVision launching a five-circuit, 170-mile commercial project with National Grid UK after piloting since 2022. Meanwhile, GridRaven was picked by Finland’s FinGrid for a five-line sensor-based demo with grid-wide potential by year-end. Heimdall Power also crossed 100 sensors deployed, likely marking the largest sensor-based DLR project to date — underscoring European TSOs' leadership in validating sensor-first DLR approaches.

Elemental Impact’s new blog post on how philanthropy can catalyze FOAK funding.

New report from F4E Fusion Observatory on private sector investment shows the US is heating up.

ESG isn’t dead yet — the world’s biggest sovereign wealth fund remains committed.

Capital stacking it up: Mark1’s new whitepaper on FOAK financing.

The Big Beautiful Bill’s latest climate catch: a tax targeting foreign investors that could prevent European energy giants from investing in US O&G.

From battery bust to bot bets: Northvolt CEO joins new AI startup.

Sam Altman’s latest blog finally has some ChatGPT power usage numbers.

Greener skies ahead: The first fully electric airplane touched down in the Big Apple.

Wayve and Uber are revving up for a self-driving rollout in the UK.

Methane-munching microbes cut cow farm emissions.

This deep-sea squid inks its first video debut in Antarctic waters.

A geoengineering lay of the land (and sea).

Nepal mourns the melting Yala Glacier with a funeral.

A million new species and counting — Basecamp builds new gen AI species biological database.

💡Decarbon8-US 2025: Apply by June 20 to E8 Angels’ annual philanthropic impact fund, for innovative, capital-light software solutions that meaningfully advance decarbonization. Apply here.

📅 Europe’s Energy Moment: Registration approval required. Join Sightline Climate on Thursday, June 26 at an exclusive London Climate Action Week event to explore how Europe can reclaim leadership in the global energy transition amid geopolitical shocks and decarbonization pressures.

📅 Female Founders and Funders: Request to join. For the first time, FFF is coming to London Climate Action Week, hosted by Planeteer and Earthshot Ventures; sponsored by Breakthrough Energy, Elemental Impact, ImpactAssets, and SE Ventures. We're gathering 100+ women in London on June 24 who are building and investing in climate. Hear flash pitches from actively fundraising CEOs, connect with old friends and new, and get inspired.

📅 Climate Leadership Salon: Invite only. Join Elemental, Earthshot Ventures, EIF, Brookfield, Novo Holdings, and Sightline Climate for an evening salon during London Climate Action Week on June 24 as we bring together fellow leaders from across the climate investment ecosystem. We are gathering venture and growth investors, philanthropic leaders, founders building first-of-a-kind projects, and others who are at the forefront of building what's next.

💡 Watershed and Powertrust's Clean Power RFP: Apply now to participate in a transformative clean energy initiative sourcing 150MW across 100+ projects in emerging markets like India, Malaysia, and Nigeria. This RFP offers long-term, fixed-price contracts for distributed renewable energy projects with strong additionality and community impact.

Chief of Staff @Glacier

Controller @Heirloom

Senior Office Coordinator @Sublime Systems

Business Development Representative @Spare-it

Graduate Strategy, Operations, and Finance Intern @De-Ice

Control Room Operator @Equinor

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

Stricter foreign sourcing rules reshape clean energy tax credit eligibility

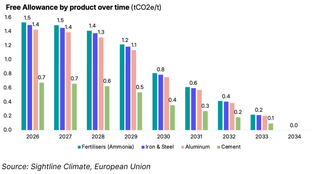

We did the EU carbon math

With long duration energy procurement surging, new rankings reveal who's pulling ahead