🌎 Overheard at LCAW #252

Climate, capital, and carrots in London's new playbook

For the first time, the US could put strict limits on PFAS levels in drinking water

Happy Monday!

Last week, the EPA drew a new line in the sand for the acceptable levels of PFAS in drinking water. The proposed regulations would mean utilities have to bring concentrations of these forever chemicals to near zero. The question now is which type of tech can break down these enduring chemicals at a price point that governments, utilities, and consumers can handle.

In other news, the SVB fallout continues, the Biden administration approves a big oil project in Alaska, and BlackRock CEO Larry Fink’s annual letter drops without three familiar letters.

This week in deals, $50M for electric bikes. Solar and battery recyclers raise $30M and $21M, respectively. Microbes for soil carbon sequestration land $30M and algae biofuel pulls in $25M.

Plus, we’re hiring! Like data? We want your number. CTVC is looking for a London-based data engineer to help us level up our data operation. If you’re passionate about decarbonization and database design, drop us a line.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals, announcements, events & opportunities, or general curiosities for the newsletter here.

💼 Find or share roles on our job board here.

The Environmental Protection Agency will require utilities to remove PFAS chemicals from drinking water for the first time. It’s a change the industry saw coming, but the announcement last week arrived more quickly than expected.

These perfluoroalkyl and polyfluoroalkyl substances, also known as forever chemicals, are found in materials from disposable food packaging to cosmetics to rain jackets and have already contaminated drinking water for as many as 200 million Americans.

Restricting PFAS levels would be the biggest upgrade to water regs in decades and remove a lot of other chemicals in the process.

WTF is PFAS?: A class of ~4,700 man-made chemicals, PFAS have been used widely in water- and stain-resistant consumer products since the 1940s.

The EPA’s proposed changes would drastically reduce the concentration of PFAS chemicals allowed in drinking water, dropping its advisory on safe exposure levels from 70 parts per trillion to 0.02 parts per trillion of perfluorooctanesulfonic acid and 0.004 parts per trillion of perfluorooctanoic acid—basically if they can be detected at all, they’ll have to be removed.

This comes after the EPA found last year that PFAS can cause harm at much lower levels than previously understood.

The US is actually ahead of the curve on these regulations. A handful of states have been exploring restrictions on PFAS in drinking water over the last few years, though none as stringent as what the EPA has proposed. The EU began considering a ban on PFAS last month.

EPA wants to see the rule finalized by the end of the year, but experts say that’s ambitious. In the past, the Dept. of Defense has stalled this type of law—military bases and airports are major sources of PFAS.

Saying farewell to forever: Methods of isolating PFAS are well-established but the tools to actually destroy them are still relatively nascent.

There are some ways to filter water at the point of use—meaning tech that attaches to your sink, for example—but safely breaking down PFAS chemicals makes more economic sense at a higher volume, Ferguson said.

This creates a significant disruption in the waste chain. PFAS chemicals accumulate in landfills, which had previously been sending PFAS-filled leachate to water treatment facilities but are now looking to treat it on-site. The technologies typically used by water treatment plants don’t touch PFAS chemicals.

Removal Solutions

Destruction solutions

The cost of upgrades to remove PFAS will ultimately be passed onto consumers paying their water bills. The Biden administration is trying to classify these chemicals as hazardous under the superfund law, which would provide more funding from the polluters to address their removal. However, that decision is far from final and it would potentially take years to recoup the money.

The EPA estimated that water utilities will need to spend between ~$770M and $1B annually to comply with the new rule, but the industry expects a heftier price tag. PFAS contamination has been a “global land poisoning event” and the idea that the US could fix it for $1B per year is “wishful thinking,” Ferguson said, noting that the EPA’s estimate is probably an order of magnitude off the real cost of compliance.

For context, outfitting just one water utility to remove PFAS, the Cape Fear Public Utility Authority in North Carolina, will cost an estimated $43M. Some money from the $9B that the EPA received for water programs through the infrastructure bill will go toward helping states with these expenses, EPA Administrator Michael Regan said.

While there isn’t a lot of willingness from households or governments to pay more for water, the good news is that these technologies are dropping down the cost curve. PFAS removal needs to reach a unit cost of ~$0.20 per gallon for the economics to work for the industry and Ferguson thinks that isn’t too far away.

But even if it’s $20B, this is human health, Ferguson said. “We’ve poisoned the well and we’ve got to unpoison it.”

🛵 Kabira Mobility, a Verna, India-based electric bike startup, raised $50M in Series A funding from Al Abdulla Group.

♻️ Solarcycle, an Oakland, CA-based solar recycling company, raised $30M in Series A funding from Fifth Wall, HG Ventures, Urban Innovation Fund, Prologis Ventures, and Closed Loop Partners.

🌾 Andes, an Emeryville, CA-based startup developing microbes for soil carbon sequestration, raised $30M in Series A funding from Leaps by Bayer, KdT Ventures, Cavallo Ventures, Yamaha Motor Ventures & Laboratory Silicon Valley, Germin8 Ventures, Accelr8, Voyager Ventures, and Venturance Alternative Assets.

⚡ Viridos, a La Jolla, CA-based company developing sustainable algae biofuel, raised $25M in Series A funding from Breakthrough Energy Ventures, Chevron, and United Airlines Ventures.

♻️ Green Li-ion, a Singapore-based provider of battery recycling technology, raised $21M in Series B funding from SOSV, Entrepreneur First, Equinor Ventures, TRIREC, Envisioning Partners, Ervington Investments, GS Holdings, EDP Renewables, TES, DPI Energy Ventures, Decarbonisation Consortium, and other investors.

🏭 intelligent fluids, a Leipzig, Germany-based manufacturer of non-toxic and biodegradable cleaning fluids, raised $11M in Series B funding from High-Tech Grunderfonds, IBG Beteiligungsgesellschaft Sachsen-Anhalt, and WAVE Equity Partners.

☀️ Sunhero, a Barcelona, Spain-based residential solar installation platform, raised $11M in Series A funding from Planet A Ventures, Vorwek Ventures, Redstone, SpeedInvest, and All Iron Ventures.

🥩 Chromologics, a Søborg, Denmark-based company developing natural food colorants from fungal fermentation, raised $8M in Seed funding from Blue Horizon Corporation, Döhler Ventures, Giampaolo Cagnin, Nordic Foodtech VC, Novo Holdings, Thia Ventures, and Vaekstfonden.

⚡ Aerem, a Mumbai, India-based solar panel financing platform, raised $5M in Seed funding from Avaana Capital and Blume Ventures.

🌱 The Climate Choice, a Berlin, Germany-based supply chain decarbonization software platform, raised $2M in Pre-Seed funding from Gutter Capital, Possibilian Ventures, and WestTech Ventures.

⚡ Tallarium, a London, UK-based price discovery analytics platform for OTC energy markets, raised $2M in Seed funding from Reciprocal Ventures and XTX Ventures.

💨 CollectiveCrunch, an Espoo, Finland-based analytics platform for sustainable forests, raised $1M in Seed funding from Nidoco.

🥩 Barvecue, a Cornelius, NC-based maker of wood-smoked plant-based meats, raised $1M in Seed funding from Alwyn Capital, Clear Current Capital, Dismatrix Group / Planthesis Fund, Siddhi Capital, Stray Dog Capital, Vegan Capital, and VegInvest.

☀️ Amarenco, a Cork, Ireland-based solar IPP and energy storage provider, raised $321M in equity financing from Arjun Infrastructure Partners.

🚗 Arrival, a publicly traded London, UK-based maker of electric vans and buses, raised $300M in equity financing from Westwood Capital.

Green Generation Fund, a Berlin, Germany-based venture fund raised $106M to invest in food, climate, and green tech startups.

Swen Capital Partners, a Paris, France-based private equity firm raised $180M to invest in ocean sustainability companies.

Mirova, a Paris, France-based investment firm, raised $171M for a blended finance debt fund to accelerate the clean energy transition in emerging markets.

Elemental Excelerator, a Honolulu, HI-based climate tech accelerator, will increase its funding to $43M into climate tech startups through its accelerator and newly launched catalytic project funding. The Next 150, a Mexico City, Mexico-based venture operator, raised $2M to scale green project development in emerging markets.

The Biden Administration approved ConocoPhillips’ controversial $8B Willow Project in Alaska—an oil development hotly contested by activists for its likely impact on Indigenous communities and wildlife—after the Alaska House of Representatives voted unanimously to support the project. Producing up to 180,000 barrels per day, the Willow Project could generate up to 278 million metric tonnes of CO2e over its lifetime.

The SVB collapse looked a bit more systemic this week, extending beyond a VC-led bank run as some other mid-size financial institutions struggled and UBS acquired rival Credit Suisse.

With 1,500+ climate tech companies connected to SVB in some manner, the bank's failure continues to ripple through the ecosystem. More than 60% of community solar was financed by SVB in some capacity, but after years of de-risking, these projects are less reliant on the bank for growth. Fledgling companies turned to climate tech incubators for support and now startup accelerators are contemplating new services, as riskier early-stage, non-dilutive funding becomes more scarce.

Likely an attempt to assuage ‘woke war’ investors, BlackRock CEO Larry Fink steered away from “ESG,” which has been used regularly in past letters to CEOs and shareholders, and instead leaned into the “energy transition.”

The Department of Housing and Urban Development (HUD) is revamping and refocusing its disaster recovery program with more than $3.3B in grants to improve service to, and resilience-building in, communities directly impacted by climate change.

Google developed a new approach to clean energy power purchasing agreements, accelerating grid decarbonization by balancing risk between buyers and sellers as well as increasing transparency on terms and pricing.

Clean energy tax credits continue to boggle the minds of investors. As of March 1, ~4,000 comments submitted to the U.S. Treasury Department requested clarification on how investors can ensure qualification for the IRA’s new and extended tax credits, grants, and programs.

Algae is back— in a macro way! Scientists trigger engineered duckweed to produce extra oil without slowing growth and Microsoft turns to Running Tide’s kelp-growing buoys.

X number of variations in the magnetic field marks the spot. The U.S government launched a first-of-its-kind plan to map the entire U.S. for critical minerals, starting with 800 locations.

Can hydrogen clean up diesel-powered mining equipment? Inside the partnership between BP and a mining company to build a massive green hydrogen production facility in the Australian outback here.

Young and impressive. Forbes 30 under 30 Social Impact Entrepreneurs repped climate-related issues from overfishing, DAC on ships, and fission for industrial manufacturing.

The hydrogen-powered train that could! Canadian company Alstrom launches North America’s first hydrogen-powered train this summer with a route from Quebec to coastal Baie-Saint-Paul. The company says hydrogen is a good alternative for hard-to-electrify routes.

Deep Green’s tiny data centers are heating up public swimming pools in the U.K. The company is cutting energy bills for rec centers and swimming in a cash pool of their own—avoiding the cost of expensive cooling systems.

The ab-nox-ious greenhouse gas you don’t know about yet: nitrous oxide.

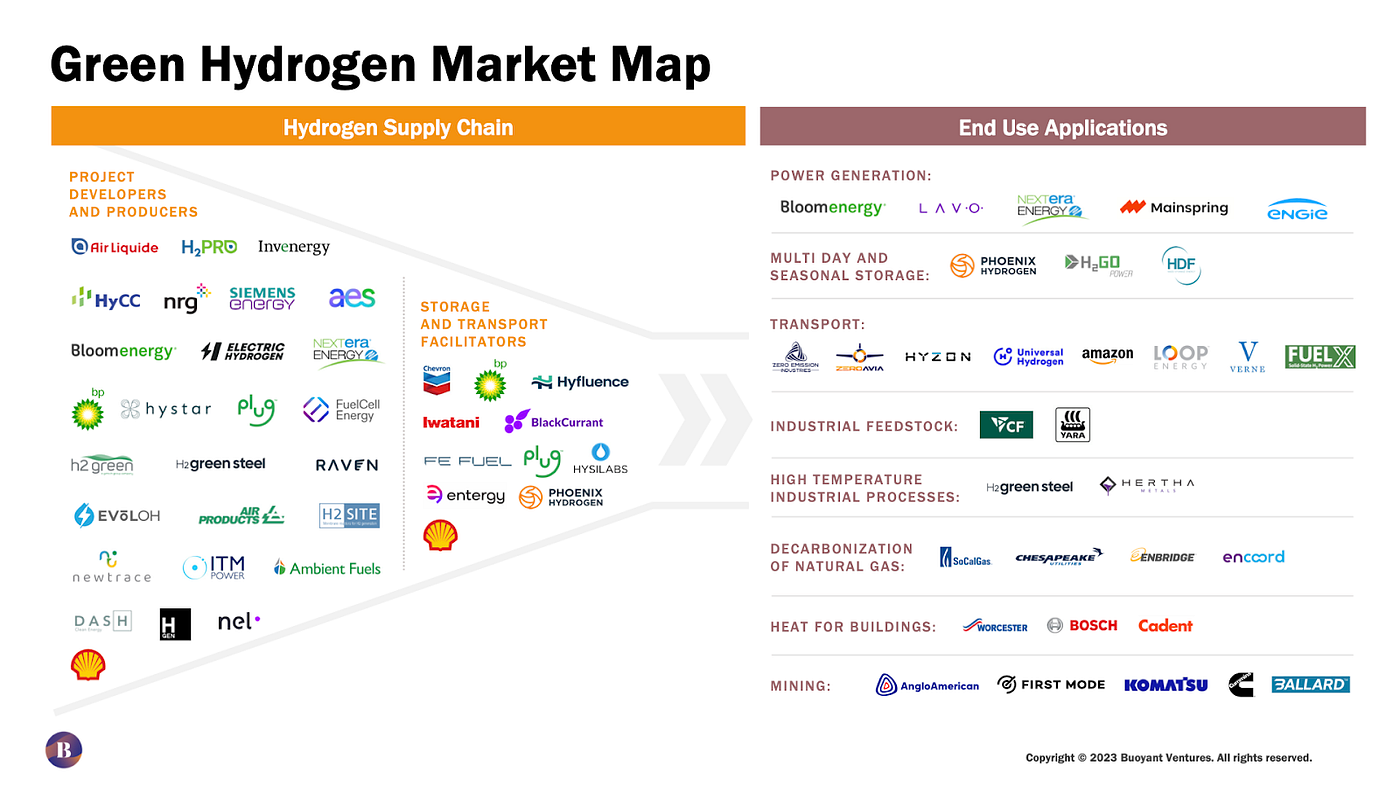

Bouyant’s take on the Hydrogen Market.

🗓️ Berkeley Haas SAIF Conference: Attend the Berkeley Haas Sustainable and Impact Finance Initiative conference on Mar 22nd and explore private capital solutions and public policy developments that mitigate climate change.

🗓️ YPE Meet & Greet: Join Young Professionals in Energy’s New Member Meet & Greet on Mar 23rd to meet like minded climate enthusiasts interested in joining YPE!

🗓️ Our Fusion Future: Register to hear from Lawrence Livermore’s director, Kim Budil, about the development and future of fusion energy on Mar 27th.

🗓️ APAC Climate Tech Showcase: Virtually attend the APAC Climate Tech Showcase hosted by Brinc & GIFT on Mar 28th to hear from leaders in the APAC climate investing and carbon removal space.

🗓️ MCJ Climate Startup Series: Register to attend MCJ Toronto’s Climate Startup Series on Mar 29th, and hear from various founders on their experience in social and climate entrepreneurship.

💡 Elemental Excelerator: Apply to receive up to $1m in funding and in-depth support for your climate tech startup from Elemental Excelerator, investors looking to scale climate solutions. Priority applications are due Apr 14th.

🗓️ Piva Capital Networking: Join Piva Capital’s networking breakfast on Apr 19th to mingle and network within the Climate VC ecosystem.

🗓️ SF Climate Week: Register to attend SF Climate week from Apr 17th-23rd, and join in on various events hosting individuals and firms developing innovative climate solutions.

Data Engineer @CTVC

Product Designer (UI/UX) @QuitCarbon

Software Engineer @QuitCarbon

Director, Technical Diligence (Solar & Storage) @Euclid Power

Climate Solutions @Cloverly

Backend Developer @Octopus Energy

Business Development @Rubi Laboratories

Chief of Staff @DEXMAT

Internal Operations Catalyst @DEXMAT

Co-founder with energy markets background @PowerStealthEnergy

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond

Groundbreaking results from the geothermal developer’s main project