🌎 H1 2025 Climate Tech Investment: Capital stacking up for energy security & resilience

Get Sightline’s signature H1’25 investment trends report inside

Climate tech venture capital exists to foster climate innovation; innovation requires an ecosystem, and few institutions shape the ecosystem more than the Department of Energy.

As the Inflation Reduction Act, Defense Production Act, and CHIPS (hopefully, thankfully) scale the government's impact on accelerating climate tech, founders should be asking themselves: what’s my opportunity to engage with the Department of Energy? How do I get that $, that commercialization support, or that distribution engine?

As with all layers of the Climate Capital Stack, public funding has its caveats. The lessons of the DOE’s involvement in Clean Tech 1.0 (indelibly Solyndra, but also Tesla and BrightSource) were particularly hard to learn and have been even harder to forget. Yet, the DOE—like venture itself—has restructured to suit the new climate moment by focusing on deployment (vs. R&D). This pivot requires more robust partnership with private industry by necessity, and we’re excited to partner with the DOE to bring a practical guide to navigating their governmental intricacies.

Disclosure: we’re discussing additional ways to partner with the DOE to share data and resources to better fulfill their mission (and ours) of accelerating climate innovation. This piece is published without cost, with thanks to folks in the DOE (cited) who helped us with background and reporting.

As the characterization of “energy” has shifted over the decades, so has the focus of the DOE since the Department’s official founding in the late ‘70s. Amidst the 1970s Energy Crisis, the DOE brought energy R&D, regulation, and security under one umbrella. In the half century since, the DOE’s focus has evolved alongside energy’s complex role within our economy, international relations, and environment - from shoring up oil prices, to tapping natural gas and shale resources, funding nuclear R&D and clean-up, to now spearheading the US’s role to deliver our clean energy future in a changing climate.

While the DOE’s roots are in research and innovation, pure innovation doesn’t get us to net zero. As Secretary Jennifer Granholm chants, we must “deploy, deploy, deploy.”

Accordingly, there’s been a deployment tidal shift underway at the DOE in a bid to better work with private industry. This past February, the DOE announced an organizational restructuring to achieve clean deployment goals by establishing two Under Secretaries: one focused on fundamental science & clean energy innovation and the other on deploying clean infrastructure. The newly launched $20B Office of Clean Energy Demonstrations and $390B Loan Programs Office conveniently sit within the latter to scale demonstration and deployment climate tech projects.

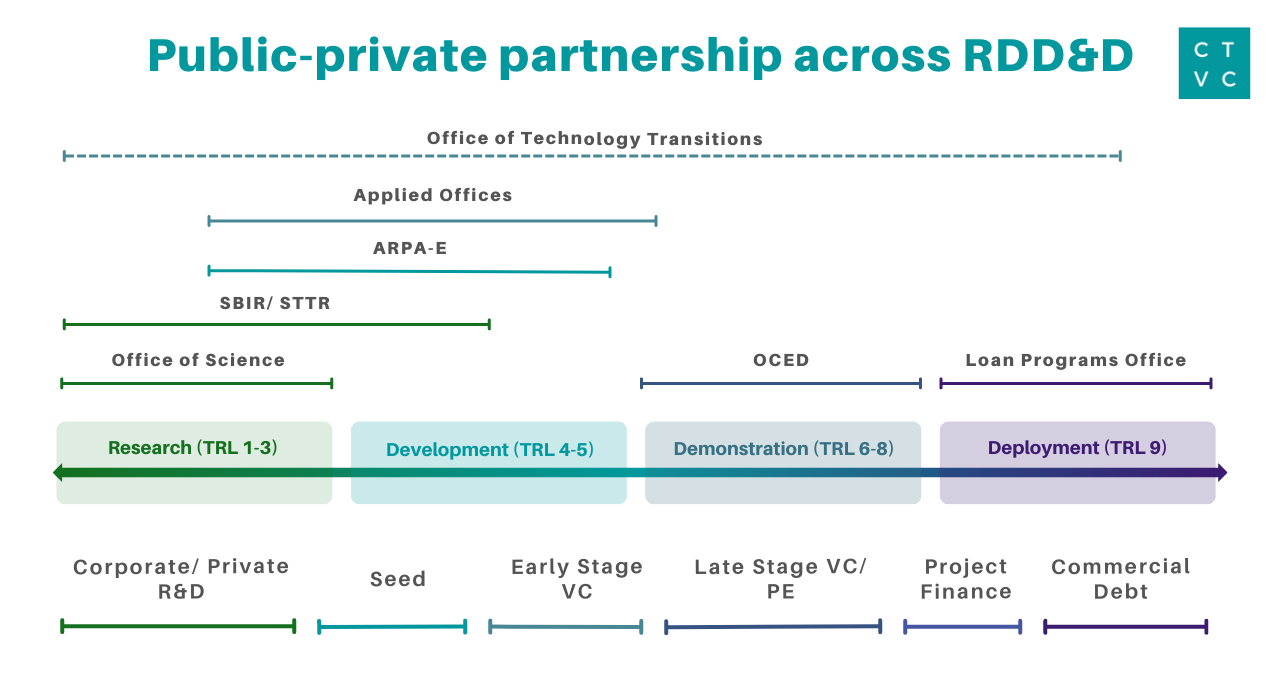

With the DOE expanding downstream of R&D, the department’s funding and support is designed to traverse climate tech’s multiple Valleys of Death from Research & Development, Demonstration, and Deployment (aka RDD&D - now say that ten times fast).

[TRL: ~1-5, Pre-Seed/Seed]

Many climate tech cos can trace their roots back to the DOE’s sprawling network of national labs, universities, and research programs. R&D innovation continues to be the engine driving the DOE’s many shots-on-goal to get to net zero, with ~$15B in funding for the Undersecretary for Science & Innovation making up 30% of the 2023 DOE budget request to support fundamental science and innovation for industry, clean vehicles and fuels, and buildings.

It all starts with the science, and DOE has the braintrust of 17 National Labs to prove it. The US National Labs are responsible for breakthrough climate technologies like lithium-ion batteries, LED lightbulbs, biofuels from microbes, and advanced fusion. The National Labs are also home to DOE’s Lab-Embedded Entrepreneurship Program (LEEP), located at Argonne National Laboratory, Lawrence Berkeley National Laboratory, Oak Ridge National Laboratory, and the National Renewable Energy Laboratory. Funded through DOE’s Advanced Manufacturing Office, 120 past and present startups have raised $918 million in follow-on funding and created nearly 1,000 jobs. Not to mention, it’s also home to the renowned Activate Fellows program, churning out 140+ founders across 100+ startups. The network of labs are ripe with IP, facilities, and leading scientific talent moving the ball forward on climate.

There's an alphabet soup of DOE programs and offices out there ready to fund climate tech at the earliest stages—from basic science to improving climate tech solutions in renewables, energy efficiency, transportation, climate resilience, and buildings, etc. We’ve previewed a select few grant and awards options for early-TRL R&D activity below.

Office of Science: The largest federal supporter of basic research, where the theoretical physicists and nuclear scientists live. Office of Science houses everything from nuclear physics and fusion, to advanced scientific computing, to basic energy sciences down to the atomic and molecular levels, as well as environmental research mapping complex natural systems at scales that extend from the genome of microbes to the entirety of planet Earth.

Office of Energy Efficiency and Renewable Energy: Chances are many of the DOE funding announcements we’ve made in CTVC have come from this mighty office, which is tasked with equitably transitioning the US to net zero by 2050 while ensuring good paying jobs and equal benefit to all Americans. EERE applied programs span the full RDD&D continuum to scale R&D out of the national lab network and into the real world. The programs center around five key decarbonization priority areas: 1) electricity 2) transportation 3) energy-intensive industries 4) buildings 5) agriculture.

Applied Programs Offices:

Fossil Energy and Carbon Management: For the hardest-to-abate stuff, FECM then comes in to support climate technologies reducing emissions from fossil fuel production, removing atmospheric and legacy CO2 emissions, and durably converting/storing CO2. The key priority areas center around 1) point-source carbon capture 2) carbon transport and storage 3) CO2 conversion 4) hydrogen with carbon management 5) methane emissions reduction 6) critical mineral production and 7) carbon dioxide removal.

ARPA-E: The Advanced Research Projects Agency-Energy is modeled after its Defense equivalent as an innovation-focused offshoot giving its Program Directors broad reign to ideate and catalyze climate moonshots (fascinating rabbit hole here into why the DARPA model works). ARPA-E Program Directors serve a 3-4 year term during which they’re given a broad mandate to build programs that financially and technically support high-risk, high-potential R&D and demonstration projects across the DOE’s wide aperture on energy and climate.

Rather than being bound to a roadmap, ARPA-E seeks to accelerate and de-risk early TRL “game-changing energy technologies” to drive follow-on private sector investment. Since 2009, the program has provided $3B+ in R&D funding for more than 1,326 projects—190 of which received more than $10.3B in private sector follow-on funding and 25 of which successfully exited to the tune of $21.6B(!)

SBIR/STTR: The SBIR (Small Business Innovation Research) and STTR (Small Business Technology Transfer) programs provide grants sponsored by a federal agency to expand R&D and innovation. Unfortunately, SBIR/STTR grants are one-way affairs, meaning entrepreneurs seeking funding can only apply to existing solicitations from federal agencies.

After funding and scaling lab-scale experiments, the next step is transferring IP and know-how into commercial application and adoption to meet planetary-scale climate challenges.

The Office of Technology Transitions stewards DOE-developed technologies through the RDD&D continuum, connecting the work of offices within the R&D and D&D-focused Under Secretaries and collaborating with the private sector to ensure technology and market de-risking occur hand-in-hand before bridging solutions into the real world. Dr. Vanessa Chan, the Director of the Office of Technology Transitions and DOE’s Chief Commercialization Officer, explains “At the Office of Technology Transitions, we actively engage with the private sector throughout this process through our programs supporting entrepreneurs, accelerators, and regional innovation clusters, and by funding the commercialization of critical national lab IP.”

Tech Transfer case in point: Mars Materials, which sequesters CO2 for use in wastewater tech and carbon fiber, uses nitrilation technology developed at the National Renewable Energy Laboratory (NREL). CEO Aaron Fitzgerald says, “We were connected with NREL through LabStart, a program designed to connect entrepreneurs with national lab researchers and technology transfer personnel. As a fast-moving startup, working with a national lab can be challenging as there’s no shortage of red tape. The best approach we’ve found to cut through it all is to build strong relationships with the technology’s lead Principal Investigator (PI) and your Technology Licensing Officer (TLO).”

[~TRL: 6-8, Series B/C]

Office of Clean Energy Demonstrations: Once the technology has been de-risked, companies enter the next “Demonstration” Valley of Death to prove out market and commercial validation.

DOE’s new Office of Clean Energy Demonstrations sports a fresh $20B to support demonstration projects across clean hydrogen, carbon capture, advanced nuclear reactors, grid-scale energy storage, and grid updates. “OCED has a clear role in commercializing clean energy technologies and filling a critical innovation gap on the path to achieving our nation’s climate goals. We will validate these technologies in real-world conditions and provide confidence that the technology works as intended,” explains Kelly Cummins, OCED’s Acting Director. The office will look to develop clean energy demonstration projects with organizations— including tech developers, EPC firms, utilities, and local governments—to accelerate market adoption and unlock private sector follow-on funding.

Since its establishment at the start of the year, OCED has already been busy ramping up demonstration programs—and our eyes are peeled for more announcements to come:

[~TRL: 9, Series C/Growth+]

Loan Programs Office: After navigating past and proving demonstration-scale, it’s time to scale fully to commercial-level deployment. Often at this stage, operators face the chicken and egg dilemma where no financiers are willing to fund the first commercial-scale project—experienced firsthand by Rob Hanson from Monolith in our previous interview, “raising $40-50m for a pilot with a lot of promise is relatively easy. Raising $100-300m for a commercial unit, which doesn’t have great economics on its own, is much harder.” Big banks and lenders demand “bankability,” which only comes with proving project scalability and replicability.

The DOE’s Loan Programs Office is open for business and ready with $390B to back large-scale energy projects. LPO Director Jigar Shah says, “There are many areas that are mature from a technology standpoint but not mature from an access to capital standpoint—that’s a nexus where there’s a clear mandate for LPO to participate.”

The LPO has a unique suite of capital within the broader ecosystem, with a mandate to issue debt vs grants (read: LPO expects repayment). LPO’s loans and loan guarantees are designed to fill the gap in funding commercial deployment, serving as a bridge to bankability for innovative climate technologies before private lenders are willing to step in. Startups that make it through the LPO’s intensive diligence often come out the other side with a stamp of approval to accelerate raising follow-on private sector funding. Currently, LPO’s authority consists of billions across five programs: Innovative Clean Energy (Title 17), Advanced Technology Vehicles Manufacturing, Carbon Dioxide Transportation Infrastructure (CIFIA), Energy Infrastructure Reinvestment (EIR), and Tribal Energy.

LPO’s target universe:

Climate technologies that stand to benefit: hydrogen, long-duration storage, carbon capture, advanced nuclear power, biofuels, transmission lines, offshore wind projects, energy efficiency, virtual power plants, and EV and battery manufacturing

Announced projects so far:

A healthy warning that public DOE and private VC funding are not created equal. (More in our Climate Capital Stack guide). Where venture funding specifically seeks an outsized, time-bound return, public funding is purposefully catalytic in addressing funding gaps for climate solutions. Naturally, government funding is typically non-dilutive with different flavors and caveats that come with it.

RFI Examples: Advanced Energy Manufacturing and Recycling Grants, Low-income Community Solar Subscription, Clean Energy Demonstration Program on Current and Former Mine Land

NOI Examples: Regional Clean Hydrogen Hubs in Sept/Oct 2022, Regional DAC Hubs in Q4 2022, CCS Demonstration Projects in Q4 2022

FOA/Prize Examples: EERE Funding Opportunities, American-Made Solar Prize, Energy Program for Innovation Clusters Prize

Announcement pages for relevant offices or programs: See updated RFIs, NOIs, or FOAs on individual office/program websites

EERE, ARPA-E, Loan Programs Office, Office of Science, Office of Electricity, Office of Nuclear Energy, NETL, Bipartisan Infrastructure Law Programs

Exchange sites/Fedconnect: Find Funding Opportunity Announcements and application processes

EERE, ARPA-E, OCED,

DAC NOI

Grants.gov: Filter and search for energy related grant opportunities

Huge thanks to Lucia Tian from OTT for her herculean help “departmentalizing” the DOE! As well as the engagement of Secretary Granholm, Dr. Vanessa Chan, Kelly Cummins, Jigar Shah, and their teams. As the DOE doubles down on engagement with the private sector, here’s a hat tip to founders, operators, and investors to keep a 👀 lookout for unique partnership opportunities in the coming months.

Get Sightline’s signature H1’25 investment trends report inside

Survey results: what’s working, what’s stalled, and what’s missing

A sneak preview from Sightline’s exclusive client-only webinar