🌎 Overheard at LCAW #252

Climate, capital, and carrots in London's new playbook

Reflections and aspirations for a new dawn of climate investing

Happy Monday!

In this week’s issue, we walk through some salient differences from Cleantech to Climate Tech and what we’re looking forward to. Tl;dr - a more connected, practical, and future forward transformation measured in tangible impact (not just SPACs).

We also break down the SCALE act, cover a bevy of deals in batteries, scooters, and waste management, and seven new ‘proofs’ from Albert Wenger of USV on climate and crypto.

Thanks for reading!

Not a subscriber yet?

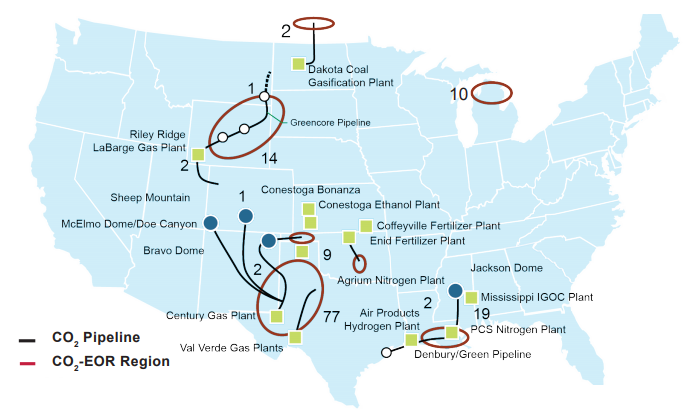

A bipartisan group introduced the US’ first comprehensive CO2 infrastructure bill – the Storing CO2 And Lowering Emissions (SCALE) Act. While CO2 capture has long been hailed as the gateway to decarbonization, the CO2 midstream and downstream has long been overlooked. Just like the fossil fuels it seeks to offset, carbon capture will rely on a buildout of pipeline and storage infrastructure that provides the critical missing link for CO2 sequestration and utilization in end-use markets. The US currently has around 50 CO2 pipelines (primarily for enhanced oil recovery), but the existing network is vastly insufficient to transport the volume necessary for CCS at scale to achieve net zero.

Fortunately, investing in CCS seems to be one thing everyone can agree on. Supporters of the bill have cited recent analysis from Rhodium Group that shows that, over the next 15 years, carbon capture could create 100K+ jobs per year and offer a $200B+ investment opportunity. To develop CCS infrastructure while creating regional economic opportunities and jobs, the landmark bill would:

💨Establish the CO2 Infrastructure Finance and Innovation Act (CIFIA) program to (1) provide flexible, low-interest loans and grants for CO2 transport infrastructure projects and (2) facilitate private sector investment in infrastructure for reaching net-zero emissions

🔨Build upon the existing Department of Energy (DOE) CarbonSAFE program to provide cost sharing for deployment of commercial-scale saline geologic CO2 storage projects

🖊Authorize increased funding to EPA for permitting Class VI CO2 storage wells to ensure rigorous and efficient CO2 geologic storage site permitting

💰Provide grants to state and local governments for procuring CO2 utilization products to create demand for materials, fuels, and other products made from captured carbon

♻️ Allonnia, a Boston, MA-based waste performance company, raised $20m in Series A extension funding from Evok Innovations.

⚡ Charge Amps, Sweden-based green-tech company and maker of EV charging solutions, raised $15m in funding from Swedbank Robur, Microcap and others.

🛴 Unagi Scooters, an Oakland, CA-based-based electric scooter manufacturer, raised $10.5m in Series A funding from The Ecosystem Integrity Fund, Menlo Ventures, Broadway Angels, and Gaingels.

☀️ Zolar, a Berlin-based residential solar startup, raised $12m in additional Series B funding from Energy Impact Partners.

☀️ Ubiquitous Energy, a Redwood City, CA-based maker of transparent solar energy technology, raised $8m from ENEOS Holdings.

🌎 Pixxel, an India-based earth-imaging technology startup, raised $7m in Seed funding from Omnivore VC, Techstars, Lightspeed Ventures, Blume, and others.

💧 ZwitterCo, a fouling-resistant membrane technologies provider, raised $6m in Seed funding from Mann+Hummel Corporate Ventures, R-Cubed Capital Partners, Burnt Island Ventures and others.

🏢 75F, a Minneapolis, MN-based building management system, raised an additional $5m in Series A funding from WIND Ventures.

⚡ Noon Energy, a Palo Alto, CA-based creator of a low cost, long-duration, energy-dense battery, raised $3m in Seed funding from Prime Impact Fund, At One Ventures, Collaborative Fund, and Xplorer Capital.

🌱 Nordetect, a Denmark-based agritech provider of portable water and soil testing solutions, raised $1.5m in Seed funding from Luminate NY, Rockstart, SOSV, PreSeed Ventures, and Vækstfonden.

Generate Capital launched a credit arm to capitalize on increased clean energy firm demand for loans.

DBL Partners, a San Francisco-based venture firm focused on cleantech, sustainable products and services, and healthcare has raised $600m for its fourth fund.

In the early 2000s, concern around rising energy prices tied with rising emissions led to a wave of venture investors piling into cleantech almost overnight. The VC crusaders who rode the internet wave applied the same investment formula to what they saw as a disruptive market opportunity in clean energy. They poured billions into nascent clean technologies like thin-film solar, batteries, and biofuels, and waited for the sky-high returns that had been promised of the industry. Then unforeseen forces, such as advances in fracking and China’s manufacturing prowess, drove energy and solar PV prices way down, causing high-flying cleantech startups to topple one by one. The cleantech bubble burst, leaving venture capitalists with massive write-downs and scar tissue that hasn’t quite seemed to heal until now.

But if cleantech 1.0 was about energy and efficiencies, climate tech is about everything and evolution. The new dawn of climate tech is about acknowledging our planet’s hurtling trajectory towards an unlivable future, and rewiring the way we do things to get to any reasonable place. Amongst the euphoria of climate technology investment and the chase for the next Tesla, reality holds true that the dividends of innovation are measured in decades not SPACs. Here, we offer some reflections on how climate tech has evolved, where we are today, and some ways we may guide the future while heeding past missteps:

What has always been true?

So, what’s different this time? How is Climate Tech different from Cleantech 1.0?

What are we excited about? What’s unique and positive about Climate Tech investing today?

What are we worried about? What gives us pause?

Volkswagen threw a Power Day celebration of the car maker’s pathway towards EVs batteries, unveiling an ambitious plan to build six gigafactories (240 GWh production capacity/ year) in Europe by 2030. VW’s emphasis on two-way charging stood out, particularly as Elon downplayed it at Tesla’s own Battery Day bash.

Deb Haaland officially became the first Native American to serve in any US cabinet position. Her department oversees the country’s 500m acres of federal lands, coastlines, and wellbeing of 1.9m Native people - alongside land use for energy infrastructure, giving her the ability to stifle or boost transmission, renewables, and fossil fuel policies.

Microsoft is digging a 550-foot deep hole as tall as the Washington Monument below their new building. The goal? Harness enough thermal energy from the ground-source pumps to heat and cool the entire building.

Bottom trawling produces 1 gigatonne of carbon per year, meaning that if trawling for fish were a country it’d be the world’s 6th most polluting economy.

How does natural gas fit into a lower carbon future? Scientific-American discusses strategies to decarbonize the natural gas system: (1) replace gas with biomethane, (2) replace gas with hydrogen, (3) transport hydrogen in other chemical forms, and (4) extract carbon at consumer locations.

USV’s Albert Wenger drops seven “proofs” on supporting both climate and crypto.

Northwestern University and ClimateWorks released a 100+ page report on several pathways to decarbonize concrete.

If you’re looking to buy an e-bike for the impending warm weather (and back to office commute), you might want to hold out for the $1,500 e-bike tax credit bill just submitted.

One man’s harrowing journey to electrify his home in NY shows that getting our buildings off fossil fuels still has a long way to go.

Apes together strong. In just a week, WallStreetBets frequenters have taken $383K of their hard-earned profits to the Dian Fossey Gorilla Fund.

Need an activity for your next virtual happy hour? Check out X’s new game, “Moon Shot” (of course). Choose your cards and be challenged to think about problems in novel ways.

🗓️ Techstars Sustainability Summit: Entrepreneurs, investors, and industry leaders in climate and sustainability, join Techstars on April 15th for a global summit on entrepreneurial solutions to the climate challenge.

🗓️ 2021 MIT Sustainability Summit: Join the Summit on April 16th as the "For Good Measure" theme explores questions and needs for measuring impact on both people and the planet.

💡 Google For Startups Accelerator: Apply by April 1st to join this 10-week program that brings the best of Google to startups using AI and ML to combat climate change.

💡 OPEN 2021: Concept papers due April 6th for funding from the DOE for “ideas that involve technology which is so high-risk that it can’t get support, but so potentially high-impact that it should.”

💡 New York Climate Progress: Cleantech startups with a presence in New York should apply by April 14th for an investment up to $500k from NYSERDA.

💡 Elemental Excelerator: Elemental is launching applications for its 10th cohort looking for passionate, diverse teams committed to solving climate change. Apply by April 16th.

💡 2021 Cleantech Open: Apply by April 18th to the world’s largest cleantech accelerator spanning over 10 years.

Senior Policy Advisor @Carbon180

Analyst @Precursor Ventures

Growth Equity Associate @Emerson Collective

Growth and Operations @Ambrook

Portfolio Impact Principal @Primary Venture Partners

Finance Ops Intern @Google X

Head of Data Science @Equilibrium Energy

Impact Measurement Intern @Planet Labs

Director of Powertrain Development; Hydrogen Systems @Universal Hydrogen

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond

Groundbreaking results from the geothermal developer’s main project