🌎 Overheard at LCAW #252

Climate, capital, and carrots in London's new playbook

Climate PE and VC funding heats up (alongside the planet)

Happy Monday!

With NYC air quality at its worst in 15 years due to forest fires in the Pacific Northwest, climate is showing up front and center to the financial capital of the world. The financial capital of the world, in turn, is showing up to invest in figuring out what to do about it.

In the last two weeks alone we track four new billion dollar funds, and over a billion dollars of venture deals into microbial fertilizers, fermented protein, and energy storage amongst a mix of other deals.

We also share Tesla considering opening up it’s charger network, Blackrock doubling its support for shareholder proposals, and a new buy-up of ESG-tech. In smaller news, we’re also featured in Energy Gang’s podcast!

Thanks for reading!

Not a subscriber yet?

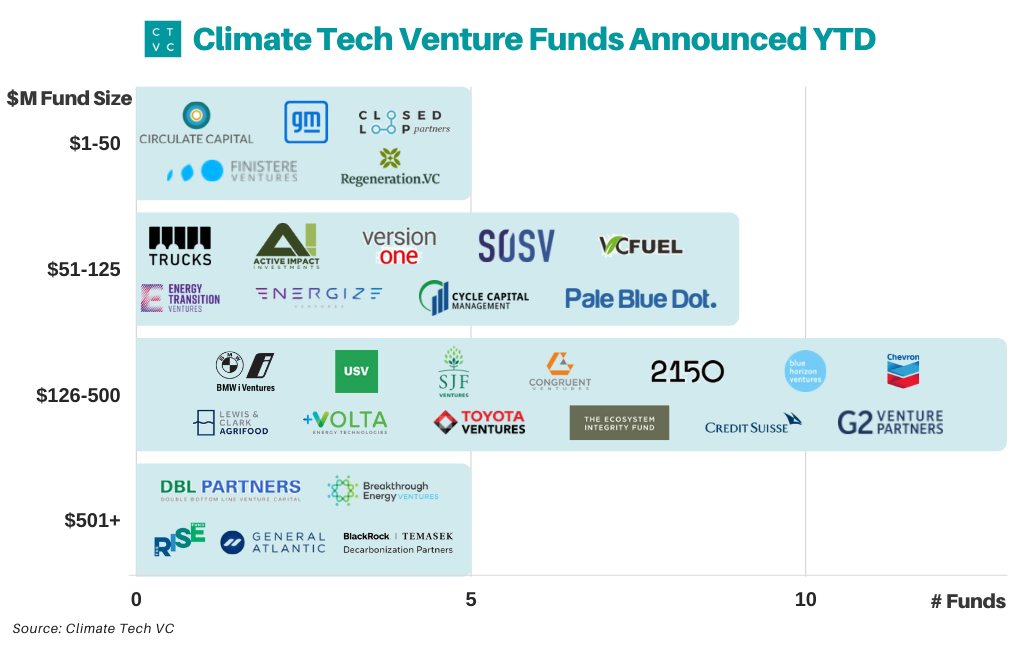

“So far in 2021, global investors have already closed as many climate-focused funds as were raised during the previous five years combined,” according to Pitchbook. In the last two weeks, we’ve seen four billion dollar new funds (with a capital B!) get announced:

While all this green capital is now gushing in, not all shades of green are the same.

Although venture capital places bets on technology inflection points pre-commercialization, PE and project finance tend to invest in infrastructure assets and projects using already mature and proven tech. Porting over their familiarity with investing in complex fossil fuel infrastructure, big PE has locked eyes with renewable energy development. Wind and solar projects have reached suitable maturity for the PE playbook and are further buoyed by the Biden American Jobs Plan’s intent to mobilize “tens of billions in private capital off the sidelines”.

As PE turns to ESG, and demand for standard-issue renewable energy projects becomes saturated, true value hounds may start to sniff out deals in other non-traditional areas of green infrastructure. Our bet is on adaptation. Green refrigeration and construction retrofits might soon be expecting big returns as resiliency of roads, bridges, and seawalls become a necessary part of the climate narrative.

But this is a venture capital newsletter. Since the start of 2021, we’ve tracked almost $10b in new dedicated climate tech venture capital across 31 funds.

Overall, the surge in the number of new funds is healthy for the climate tech ecosystem - and is far from over (we hear whispers of at least another 30+ funds this year.) But number of funds aside, the growing size of funds means that VC will be nudged by portfolio construction constraints to invest at Series B+ stages (though, what was yesterday’s B is today’s A.) While a majority of capital is bottlenecked at Series A, a majority of climate tech innovations are still pre-commercial - and many in the lab. Neither the funds nor the founders are structured to meet in the middle.

Also of note - just 8 of the 32 new funds are debut firms. It’s unsurprising that existing fund managers with ESG-eager LPs are first to market with sidecar climate tech funds. But we’re most looking forward to climate specialized fund managers to breakout, hopefully to fill that pre-Series A gap with fresh perspectives on the intricacies of climate tech.

One thing’s for sure - there’s never been a better time to be a climate tech entrepreneur!

🌱 Pivot Bio, a Berkeley, CA-based startup using microbes to replace synthetic fertilizer, raised $430m in Series D funding from DCVC, Temasek, Generation Investment Management, G2 Venture Partners, and Rockefeller Capital Management.

🌱 Nature’s Fynd, a Chicago, IL-based food company growing fermented protein, raised $350m in Series C funding from Vision Fund 2, Blackstone Strategic Partners, Balyasny Asset Management, Hillhouse Investment, EDBI, SK, and Hongkou.

⚡ Form Energy, a Somerville, MA-based startup cheaply storing large amounts of electricity to power grids, raised $200m in Series D funding from ArcelorMittal and others.

⚡ Imove, a Norway-based EV subscription service, raised $22m in Series A funding from AutoScout24, Norselab, and Idekapital.

💧 Natel Energy, a startup deploying sustainable hydropower solutions, raised $20m in Series B funding from Breakthrough Energy Ventures and Chevron Technologies.

🍅 Collectiv Food, a UK-based fresh products supply chain company, raised $16m in Series A funding from VNV Global, VisVires New Protein, Octopus Ventures, Norrsken VC, Partech, Colle Capital, and Mustard Seed.

⚡ Camus Energy, a San Francisco, CA-based advanced grid management software maker, raised $16m in Series A funding from Park West, Congruent Ventures, and Wave Capital.

🌱 Wicked Kitchen, a UK-based plant-based food company, raised $14m in Series A funding from Unovis Asset Management and NRF Nove Foods.

☔ ClimateAi, a San Francisco, CA-based climate risk modelling startup, raised $12m in Series A funding from Radical Ventures, Finistere Ventures, and FootPrint Coalition Ventures.

🌱 Rise Gardens, a Skokie, IL-based indoor, smart hydroponics startup, raised $9m in Series A funding from Telus Ventures, Listen Ventures, True Ventures, and Amazon Alexa Fund.

💨 75F, a Minneapolis, MN-based company that builds automation technologies to optimize indoor air quality and energy efficiency in commercial spaces, raised $5m in extended Series A funding from Siemens AG and Next47.

Generate Capital raised $2b in funding to back clean energy projects from QIC Ltd., AustralianSuper, Generate, Andra AP-fonden, the U.K.’s Railways Pension Scheme, Harbert Management Corp., CBRE Caledon Capital Management, and Aware Super.

Lately, the world has been feeling like The Day After Tomorrow. By our count this past week, two devastating floods (one in Germany and another in China), ~90 active wildfires across the western US with fires large enough to create their own weather systems, monsoon-induced landslides in India, and tides of dead fish washed onto the shores of Florida. Mitigation is essential, but we’re firmly in the adaptation phase.

Despite all the ambitious chatter around “building back better,” only 2% of coronavirus relief was spent on decarbonization. All while CO2 records keep breaking - and might continue to climb until 2023.

After being found partly responsible for a 30,000-acre wildfire, PG&E announced a $10b+ plan to bury power lines. The California utility committed to putting 1,000 miles a year underground — up from 70 miles planned this year.

Chevron publicly admitted that its $3b Australian CCS project has failed to meet its target to capture 80% of emissions from LNG production - so far, it’s actually capturing a measly 30%. The penalty? A fine - and continued permission to keep LNG production going...

As part of the $3.5T budget reconciliation package, Democrats are backing the Civilian Climate Corps(CCC) which would employ Americans on climate-focused public works projects like reforestation. Likewise, Democrats are proposing a “carbon border adjustment” tax, similar to the EU’s version of the carbon tax.

BlackRock doubled its support for shareholder proposals from last year, voting 35% alongside shareholders. As we saw in the Exxon coup, shareholder activism matters and can seriously shake up corporate laggards dragging their feet on decarbonization.

ESG tech is in demand. Over the last two weeks Vanguard buys Just Invest (ESG direct indexing), JPM buys OpenInvest (ESG for IFAs), Blackstone buys Sphera (ESG software), and AMG buys Parnassus (the biggest ESG firm).

United Airlines announced a purchase of 100 electric planes from Swedish startup Heart Aerospace, which just last week raised a $35m Series A.

The secret sauce to Form Energy’s long duration battery technology? Not fairy dust - iron rust! Form Energy unveiled their 100-hour duration iron-air battery technology, setting a significant milestone for the storage of excess renewable energy at around $20 per kWh that can power a 100% clean grid all year round. Interestingly iron-air batteries have been around for 50 years, but Form advanced where others left off with novel nanotechnology and catalysts.

Elon tweeted that Tesla plans to open its network of superchargers to other electric vehicles later this year. Potential motivation for that benevolence? $7.5b in EV charger spend up for grabs to companies with open standards.

This brightened our week. Gijs Schalkx hand harvests methane from a local ditch to power the Slootmotor, a methane-powered moped. The literal Dutch translation is “ditch motorcycle.” Forget about Keanu, we want to watch Gijs in the Methane-trix.

The Energy Gang features Climate Tech VC in an episode on A New Era for Climate-Focused Venture Capital.

Now that Jeff Bezos has the means to get there, his perspective from looking down on our pale blue dot from his rocketship is “to take all heavy industry, all pollution industry, and move it into space.” Pollution Prime delivery?

During the PNW heatwave, Mt. Rainier lost nearly 30% of its snowpack. Shocking before and after photos.

Saul Griffith’s hopeful climate missive is to electrify everything. In a new post, he drives this message home - literally. We need to replace 1 billion devices, and household-level decisions can get us nearly halfway there.

Nom nom. Oui oui. Ethical, lab-grown foie gras gets support from the French government. France also bans some short flights, requires more vegetarian school meals, and curbs wasteful plastic packaging.

A new nonprofit group called Subak just launched with the mission of democratizing access to climate data. How? They’ll round up a portfolio of data-driven nonprofits in an accelerator-like fashion.

Start sweating. The Tokyo summer Olympics are slated to be the hottest ever, with top temperatures reaching 90 degrees Fahrenheit. Neatly, this year’s ceremonial lighting of the fire is powered by hydrogen.

Maine signed an innovative product stewardship law to fund recycling programs by making producers pay.

🗓️ Zero, then Negative: what’s next for carbon removal as we scale: Zoom in on July 29th at 3pm ET to Carbon180’s discussion on carbon removal solutions and challenges with Senator Heinrich, Bloomberg’s Akshat Rathi, Dr Jennifer Wilcox, Stripe’s Nan Ransohoff, and more.

🗓️ Intro to CDR: Tune in on August 3rd at12pm ET to the first of OpenAir’s weekly webinar series titled “This is CDR” with Dr. Evvan Morton to explore the wide range of carbon dioxide removal solutions currently being researched, developed, and deployed.

Analyst @Draper Richards Kaplan Foundation

VC Fellow @Foundamental

VP Investments @Three Cairns Group

Supply Chain Renewable Energy Investment Lead @Google

Principal Portfolio Success Manager @Amazon Climate Pledge Fund

Carbon Markets & Regenerative Ag Principal Consultant @Anthesis Group

Demand Growth @Patch

Carbon Finance Manager @CarbonCure

Senior Project Manager @NYSERDA

VP Sales @Full Cycle

Director of Materials Manufacturing @Lilac Solutions

Plant Scientist @Fyto

Analytical Chemist @Macro Oceans

Data Science Lead @Lumen Energy

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond

Groundbreaking results from the geothermal developer’s main project