🌎 Bright spots and sunsets in the OBBB #253

One Big Beautiful Bill ushers in new (and old) energy agenda

The IPCC unequivocally determines that climate change is here and human-caused

Happy Monday!

In honor of our exceedingly alarming weather, the NYT started an extreme weather column and they’re likely to be busy. The IPCC assessment report “unequivocally” points fingers at humans as the cause of ~1.1°C of global warming, coincidentally colliding with the passage of the $1T infrastructure bill. We also highlight three underappreciated areas of climate tech from the IPCC report with big potential impacts (methane, carbon removal, and climate adaptation).

We also feature funding for fertilizer from lightning, small nuclear reactors, and liquid metal battery tech. Plus news of the SEC’s pending ESG regulating, registration to join our roundtable with Techstars, and celebration of Lowercarbon’s new $800m fund!

Thanks for reading!

Not a subscriber yet?

It’s been a hot summer for climate. Literally so much so that the NYT started an extreme weather column to exclusively cover record breaking (in all of the worst ways) heat waves, wildfires, and floods. And, of course, last week’s big IPCC sixth assessment report highlighted the physical science extremes of our climate emergency. Tl;dr it’s “unequivocal” that we’ll continue to experience more intensive impacts of climate change in the absence of rapid emissions mitigation. NYT extreme weather reporters, prime your pens.

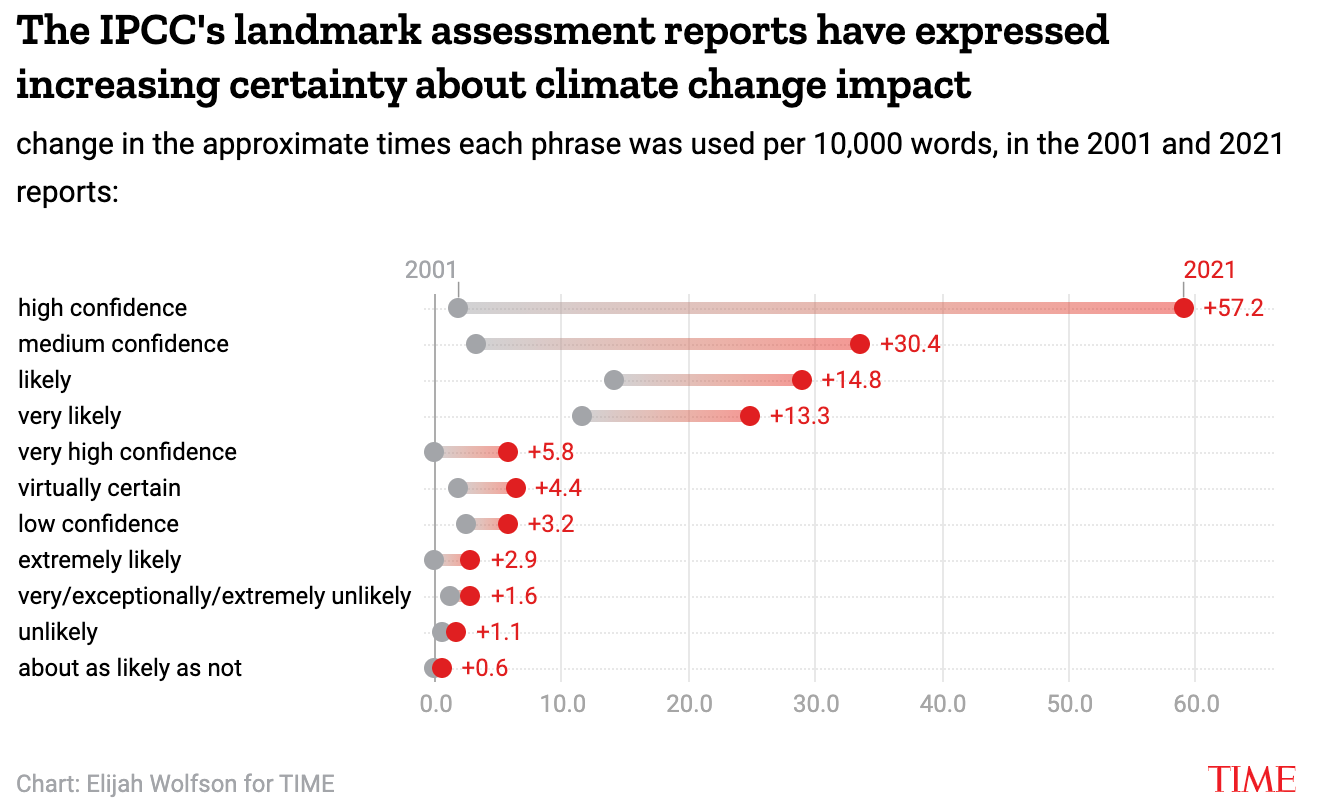

Of particular interest is the evolution in the language and rhetoric used over the past two decades of IPCC reports.

Unequivocally caused by humans. The IPCC’s group of top international scientists historically veer on the edge of scientific conservatism, but this year’s report is the equivalent of climate scientists “screaming at the top of their lungs.” The authors declare that “it is unequivocal that human influence has warmed the atmosphere, ocean and land.” It’s the strongest description the IPCC has ever used to attribute climate change to human activities.

Beyond mitigation to adaptation. Human activities have already caused ~1.1°C of global warming past pre-industrial levels. Even in the most stringent mitigation scenario, predictive climate models still exceed 1.5°C of warming, blowing past the global threshold established in the Paris Accords.

Coincidentally this same week, the US Senate passed the $1T bipartisan infrastructure bill including $550b in new spending – part of which aims to address climate change. The IPCC report’s “unequivocal” determination that climate change is here and human-caused, complements the US infrastructure bill’s resiliency relief deployment. Echoing the IPCC’s call for adaptation alongside mitigation, the bill earmarks spending for two underserved areas of climate - CCS for mitigation and resilience infrastructure for adaptation. The funding is reflective of a world in which climate change is already at our front door, where federal disaster policy must transition from disaster reaction to disaster prevention.

Carbon removal: $8.5b

Infrastructure resilience: $47b

Methane. For the first time, the IPCC report singled out methane emissions - “Strong, rapid and sustained reductions in CH4 emissions would also limit the warming effect resulting from declining aerosol pollution and would improve air quality.”

Innovators: Project Canary, MethaneSat, Bluefield, GHGSat, Andium (See more innovators in Bloomberg Green)

Carbon removal. To reach net zero global emission by 2050 and our only hope of sticking to 1.5ºC, emissions will have to be offset by carbon removal (e.g., planting trees or building machines). Optimistic IPCC scenarios call for ~5b tons of carbon dioxide removal per year by midcentury and 17b by 2100.

Innovators: Carbon Engineering, Climeworks, Global Thermostat, Heirloom, Holy Grail, Mission Zero, Verdox, Svante, Carbon Clean, Pachama, NCX (See more detail from our prior feature on CCS technologies)

Climate adaptation. Climate change is already here - 1.1°C worth of global warming to be specific. We’re living through “observed changes in extremes such as heatwaves, heavy precipitation, droughts, and tropical cyclones.” In addition to mitigation, we need a lot more innovation (e.g. fire resistant materials) and deployment (e.g. building seawalls) of adaptive physical infrastructure.

Innovators: Rain.aero (drones for wildfires), Harbor (disaster preparedness), Green Stream (flood sensors)

🌱 80 Acres Farms, a Hamilton, OH-based vertical farming company focused on pesticide-free produce, raised $160m in Series B funding from General Atlantic, Siemens Financial Services, Blue Earth, Barclays, and Taurus. More here.

☢️ NuScale Power, a Portland, OR-based developer of small modular reactor nuclear, raised $152m closing out its Series A-5 round from GS Energy, Doosan, IHI Corporation, Samsung C&T, Sargent & Lundy and Sarens.

🔋 Ambri, a Marlborough, MA-based developer of liquid metal battery technology, raised $144m in funding from Reliance Industries, Paulson & Co., Fortistar, Goehring & Rozencwajg Associates, Japan Energy Fund, and Bill Gates.

🔋 Nanotech Energy, a Los Angeles, CA-based manufacturer of graphene-based batteries, raised $64m in Series D funding from Fubon Financial Holding.

🌱 V2Food, an Australia-based alternative protein company, raised $63m in Series B extension funding from Astanor Ventures, Huaxing Growth Capital Fund, Main Sequence, and ABC World Asia.

⚡ Wirelane, a Germany-based EV charging startup, raised $21.2m in Series B funding from Abacon Capital.

🏢 Enerbrain, an Italy-based startup using IoT energy retrofit solutions to increasing the efficiency of existing buildings, raised $6.1m in Series B funding from EDF Pulse Croissance, IREN, EQUITER Rif-T and AZIMUT Libera Impresa SGR’s Digitech Fund, and GELLIFY.

🚚 Remora, a Detroit, MI-based modular CCS startup for decarbonizing heavy trucking, raised $5.5m in Seed funding from Union Square Ventures, Lowercarbon Capital, Y Combinator, First Round Capital, Neo Ventures, and MCJ Collective. [See our interview from Friday’s feature with Remora’s CEO!]

💨 44.01, an Oman-based carbon removal startup, raised $5m in Seed funding from Apollo Projects, the early-stage investment fund from Max and Sam Altman, Breakthrough Energy Ventures, and unnamed families in Oman and environmental organizations in Europe.

🌱 Nitricity, a Stanford, CA-based agtech startup producing renewable nitrogen fertilizer, raised $5m in Seed funding from Energy Impact Partners, Fine Structure Ventures, Lowercarbon Capital, and MCJ Collective.

🍄 Fable Food, an Australia-based startup making mushroom-based meat alternatives, raised $4.8m in Seed funding from Blackbird Ventures, AgFunder, Aera VC, Better Bite Ventures, Ban Choon Marketing, and former Sequoia Capital partner Warren Hogarth.

⚡ Branch Energy, a Houston, TX-based startup that helps consumers lower their energy usage, raised $4.5m in Seed funding from Comcast Ventures, Global Founders Capital, and Inovia Capital.

🔋 Librec, a Switzerland-based li-ion battery recycling company, raised $3.3m in Seed funding from the Swiss Federal Office of Environment.

☔ Supercritical, a UK-based maker of climate impact measuring software, raised $2.3m in pre-Seed funding from LocalGlobe and a number of angel investors.

💨 Cemvita Factory, a Houston, TX-based biotech startup using synthetic biology to decarbonize heavy industry, raised an undisclosed amount in Series A funding from 8090 Partners, Oxy Low Carbon Ventures, Seldor Capital, Climate Capital, and others.

Lowercarbon Capital raised $800m to continue investing in companies working to address climate change.

Energy Capital Ventures, a Chicago, IL-based venture fund aiming to drive the transformation of the natural gas distribution industry, raised $45m in capital commitments from five publicly traded natural gas utility and multi-line utility companies.

ChargePoint acquired ViriCiti, a Netherlands-based electric fleet management platform, for €75m ($88m) in cash.

Aurora Solar acquired Folsom Labs, a developer of software solutions for the commercial solar sector.

Senate Democrats approved a $3.5T budget resolution including a “Clean Electricity Payment Program”, the clean electricity standard repackaged to fit the strict rules governing reconciliation [the Interchange has more on how this version of the CES might work].

Breakthrough Energy Ventures announced it will commit $1.5b to joint projects with the US government if Congress passes a program aimed at developing technologies that lower carbon emissions. The Bipartisan Infrastructure Bill allocates $25b for demonstration projects with the Energy Department but is waiting on approval from the House to become law.

The California Energy Commission voted to require solar power and battery storage in new commercial and residential buildings, with revisions in the building code coming in December. The standards will encourage electric alternatives to gas appliances, expand solar and battery standards, set up more EV charging, and strengthen ventilation standards.

Yet another EV coalition, the National EV Charging Initiative combines an unlikely array of electrical worker unions, utilities, environmental groups, and automaker trade organizations to lobby governments for faster EV infrastructure buildout.

New mortality data showed that 600 more people than had been estimated died in Oregon and Washington during the June heat wave.

An academic study from Cornell and Stanford casts doubt on blue hydrogen (hydrogen produced from natural gas with CCS) having a role in the energy transition citing the “large amounts of natural gas needed to fuel the process itself and the escape of “fugitive methane” from wells”.

The SEC may be deciding who’s ESG naughty or nice before this Christmas, as the commission grapples with bringing standardization to ESG reporting and climate disclosures.

Consider us thoroughly impressed by this year’s Pritzker Emerging Environmental Genius Award candidates.

Didn’t get through last week’s full report? Watch Space Capital chat with Bloomberg about space tech’s role in combating climate change.

You say tomato, I say tomato. The debate over the benefit of organic vs conventional farming practices rages on, with some new evidence countering that organics’ greater land requirements make it less sustainable.

RMI heavy weights drop a must-read report on how to (profitably) decarbonize harder-to-abate sectors like heavy transport and industrial heat. Bringing data to life, check out our Friday feature on mobile CCS for trucking.

Emperor penguins will soon be listed as a threatened species under climate change.

Does this feel like old news? A 1912 newspaper article aptly predicted coal-fueled climate change. But climate science dates back even further.

Ladies and gents, this is called a win-win-win: oyster reefs defend against sea level rise and water pollution (while being delicious).

Mesa, a plug-and-play energy saver for office spaces from Sidewalk Labs, is donating free energy kits to nonprofits and community centers to help them on their path to sustainability.

Sommelier scaries! Climate change is coming for your wine cellar.

🗓️ Techstars Sustainability Roundtable: Join us on this Wednesday, August 18th for a conversation with our good friend Cody Simms at Techstars about the dynamic state of climate tech and venture capital. It’s a great peak behind the curtain at the inner dynamics of Climate Tech VC!

💡 Imagine H2O Asia: Apply by September 1st to join Cohort 3 of this Singapore-based accelerator open to international water tech startups scaling in South and Southeast Asia.

💡 European FinTech Hackcelerator 2021: Open call for European Green Finance startups interested in entering the Southeast Asia market via the Singapore FinTech Festival ecosystem. Applications close on August 31st.

10 days after the CTVC Job Board went live, over 100 companies have posted ~150 top open climate tech roles - which have been viewed over 100,000 times! Be sure to bookmark and subscribe to the Pallet directly for updates, but for your immediate viewing pleasure, here’s a smattering of some of the most popular and Featured roles:

Head of Project Finance & Expansion @Carbo Culture

Product Design Lead @Sustain.Life

Embedded Systems Application Engineer @Vence

Director, Project Development @Form Energy

Head of Product @Nitricity

Associate, Energy & Environment @Emerson Collective

Feel free to 📩 send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond