🌎 Bright spots and sunsets in the OBBB #253

One Big Beautiful Bill ushers in new (and old) energy agenda

Evaluating climate SPAC performance and the blockchain hype cycle

Happy Monday! In this issue, we review climate tech SPACs’ outperformance across 2020 and dive deeper into a range of use cases for blockchain and climate. Tl;dr - there’s probably good uses for it, but only if the problems come before the solutions (and not sure Wozniak is on to the next big apple).

In the news this week, Canada raises its carbon taxes, power plants go virtual, and Bridgewater and the Pope get into the sustainable investment game.

As a reminder; please submit additions to our climate tech list of VCs here - we’re now including accelerators !

Thanks for reading!

Not a subscriber yet?

This year has witnessed a wild west of public market activity, with a surprising concentration of growth coming from renewable energy, EV, and fuel cell companies. It’s still not clear what fueled this climate tech market frenzy, but our bet is on some combination of Tesla’s rocketship performance, the army of Robinhood retail traders, Biden’s clean energy push, the flood of ESG institutional capital, and the growing recognition of the climate crisis.

🏆 A few of this year’s climate tech stock winners include: Blink Charging, FuelCell Energy (up ~12x yoy), and Plug Power, Tesla (up ~9x yoy). And of course we’d be remiss to leave out the SPAC Attack. 27 (!) climate tech companies have announced (so far) this year that they’re going public through a SPAC.

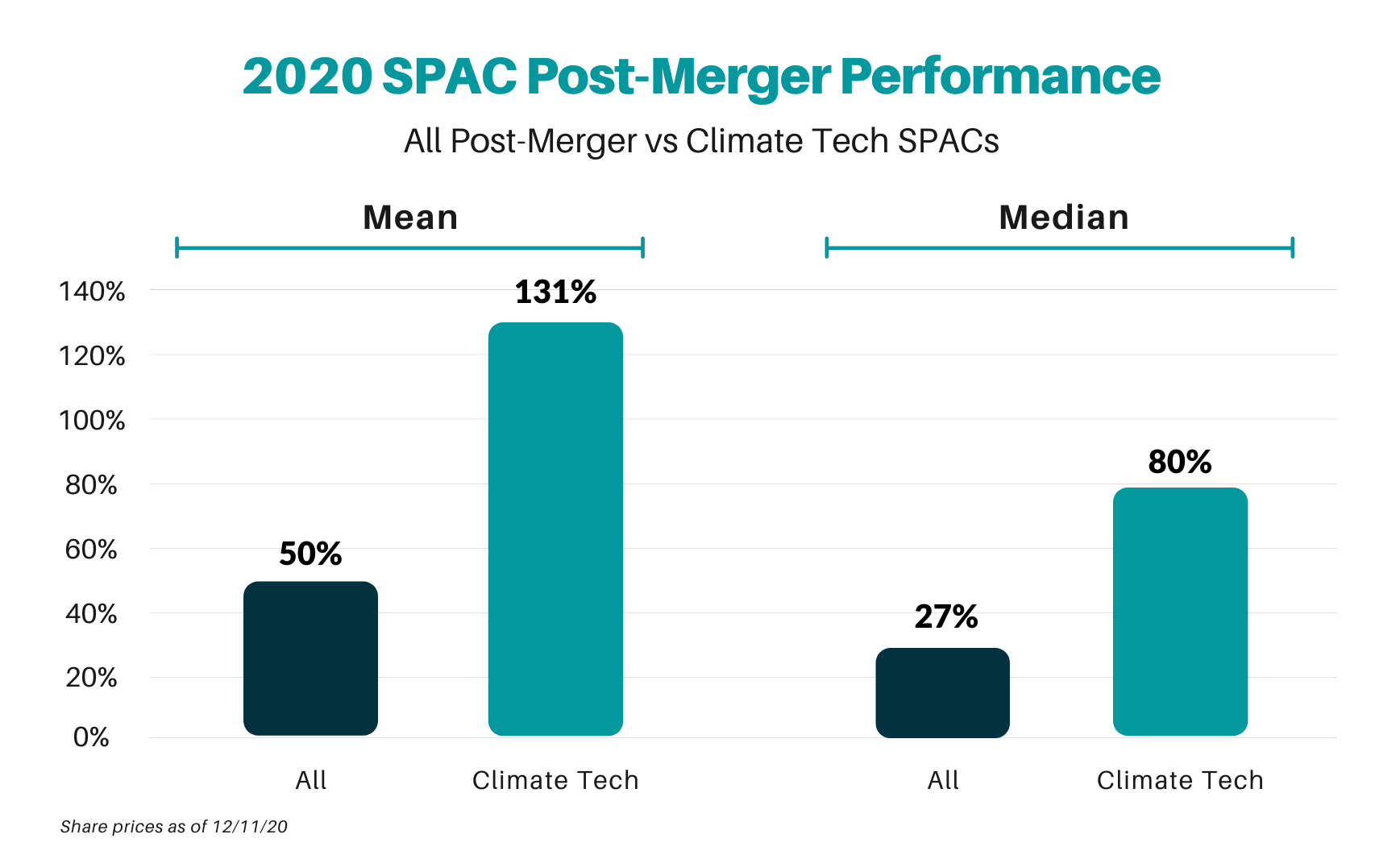

📈 The 10 climate tech companies that have completed mergers and are now officially publicly traded are also significantly overperforming the total SPAC post-merger market; on average, climate tech SPACs have posted a 131% return vs the 50% return of the total SPAC market (assuming a $10 offer price).

2020 has no doubt brought many unpleasant surprises, but this clean energy bull run is one of the small silver (green?) linings. However, only time will tell how truly sustainable this sustainability market boom really is.

⚡ Swell Energy, a Los Angeles, CA-based provider of residential renewable energy, is raising $450m to finance four virtual power plants from Ares Management and Aligned Climate Capital. More here.

⚡ OhmConnect, a San Francisco, CA-based demand response startup, raised a total of $100m Sidewalk Infrastructure Partners, with $80m allocated towards building a virtual power plant. More here.

🌱 Gotham Greens, a New York, NY-based operator of tech-enabled greenhouses, raised $87m in Series D funding from Manna Tree and The Silverman Group. More here.

🌲 SeeTree, a Fresno, CA-based AI-powered tree intelligence company, raised $30m in Series B funding from the IFC, Citrosuco, Oribia Ventures, and Hanaco Ventures. More here.

🌱 Sunday, a Boulder, CO-based eco-friendly lawn care startup, raised $19m in Series B funding from Sequoia Capital, Tusk Ventures, and Forerunner Ventures. More here.

🔋 Recurrent, a Seattle, WA-based used EV platform, raised $3.5m in Seed funding from Wireframe Ventures, PSL Ventures, Vulcan Capital, Prelude Ventures, Powerhouse Ventures, and Ascend VC. More here.

🌱 Avant, a Hong Kong-based plant-based protein producer, raised $3.1m in Seed funding from China Venture Capital, Lever VC, among others. More here.

🍿 Planet FWD, a San Francisco, CA-based maker of moonshot snacks from regenerative materials, raised $2.5m in Seed funding from Emerson Collective. More here.

🥢 ChopValue, a Vancouver, Canada-based company recycling chopsticks into durable materials, raised $1.7m in Seed funding from Active Impact Investments.

Lightning eMotors, a startup electrifying commercial vehicle fleets, will go public via a reverse merger with GigCapital3 at a $651m valuation. More here.

EvBox, a provider of EV charging solutions, will go public via a reverse merger with TPG Pace Beneficial Finance at a $969m valuation. More here.

Electric Last Mile, an EV startup focused on commercial delivery networks, will go public via a reverse merger with Forum Merger III at a $1.2b valuation. More here.

[The newsletter version has been edited lightly for length, so check out our website for the full feature].

Last week, the acclaimed co-founder of Apple, Steve Wozniak, unveiled his second company, Efforce, with a slick website and much media fanfare. Efforce claims to disrupt the energy efficiency market by using blockchain and ‘WOZX’ tokens to finance energy efficiency projects.

The platform encourages the public to directly invest in energy efficiency projects - and receive tokens in exchange for energy saved. Think of a blockchain version of the PACE loan model which allows debtholders to pre-fund efficiency projects. What we (and the market experts) are left puzzling is why the WOZX token? Efforce’s emphasis on crypto is reminiscent of 2017-18 ICOs where this token model failed to be adopted (or understood) at necessary scale.

In the rollercoaster of the pandemic and hype of SPACs, the heady rush of ICOs back in 2017-18 seems long forgotten. What exactly happened to all the blockchain hype? Taking a few years’ step back, blockchain first emerged on the scene in 2008 with Satoshi Nakomoto’s seminal whitepaper on creating the first blockchain-based cryptocurrency, Bitcoin. (It’s important to remember that Bitcoin and blockchain are not synonymous; if blockchain is the flour, Bitcoin is a croissant pastry). At its core, blockchain is simply a distributed record-keeping system that uses cryptography to prevent the falsification of records, therefore ensuring trust without the need for a centralized verifying authority. The excitement around blockchain technology’s potential “led a number of startups down the path of a solution in search of a problem,” notes Matt Brown, VP of Corporate Development at LO3 Energy. Needless to say, the market corrected itself and blockchain applications in climate tech suffered the same fate.

So in light of Wozniak temporarily forcing the blockchain spotlight back on climate tech, we dug into the evolution of the climate blockchain landscape with new and surviving ventures from the 2018 crypto crash and evaluate opportunities for meaningful applications in energy and the carbon market & accounting.

The accelerating deployment of DERs (Distributed Energy Resources) in our electricity grid jives naturally with the decentralized features of blockchain. Through solar panels, smart devices, and storage systems like EVs, customers are increasingly controlling their energy grid participation. During the 2017 crypto boom, startups making broad claims about using blockchain to manage complex electric power systems raised over $300m (75% through ICOs). However, the majority of these startups fizzled out under the power sector’s conservative and heavily regulated thumb which left no space for blockchain innovation.

In 2016, LO3 Energy ran blockchain-based marketplace pilots for homeowners to trade electricity. Since then, LO3 has pivoted its business model to a B2B2C enterprise offering for utilities and electricity retailers. The company has been able to outlast many of its energy blockchain startup peers by “focusing on commercial and regulatory realities and working with incumbent suppliers where the economics for community-level DER markets make sense” Matt Brown explains. In these local energy marketplaces, blockchain enables prosumers who own DERs or community assets to provide services to other retail customers. As more DERs come online and participate in programs at multiple levels of energy markets, blockchain ledgers could be useful for securely processing and recording these distributed transactions.

It’s hard to think of a messier market that’s more ripe for blockchain’s unique capabilities than the carbon market. Legacy carbon markets are fundamentally plagued with a double-counting problem. If a buyer in France purchases a carbon credit from a Brazilian developer, both France and Brazil will count the same emissions reduction as their own. In voluntary carbon trading too, brokers can trade credits many times before the carbon is retired, resulting in an inaccurate and inflated market size. There’s limited liquidity nor fair market price, despite carbon inherently being a commodity.

Enter the potential for blockchain to eliminate double counting, and enable fair operational carbon markets and accounting. Blockchain can replace paper-based settlements, audits, and reconciliations with immutable, timestamped records of ownership. As the market for large carbon neutral corporate offtakers expands, so will the demand on accurate and efficient reporting of carbon offsets and footprints. ClearTrace does this by connecting to smart metering devices and loading energy data into a blockchain ledger to create an auditable trail across the energy supply chain. “ClearTrace is like Carta, but for carbon systems of record. We’re more than a digital climate accounting system. We’re the tool that enables critical infrastructure like electricity, steam, and natural gas to transition from the physical to the digital world,” says Founder and Chief Strategy Officer, Evan Caron. Combining such traceability and auditability with a tokenized marketplace, Nori seeks to create a carbon removal economy - starting with agricultural soil carbon. CEO Paul Gambill explains, “The solution is two-fold: 1) put all records of transactions on a public ledger, and 2) separate the removal from the trading, so that carbon is ‘retired’ immediately and the token (which represents 1 future tonne of CO2 removed) can be bid on as a commodity.”

🧰 Blockchain is a tool in the toolkit, not a silver bullet solution. Fundamentally blockchain enables tracking and auditing of complex systems without bias, and - as with most enablers - is most powerful when not seen or heard. Businesses starting with blockchain as the solution (most cryptocurrencies) will continue to go the way of the Dodo. Meanwhile, businesses designed to solve a problem (tracking, verifying, auditing) by thoughtfully wielding blockchain in pursuit of a clear business case will survive.

✔️ Data providers will fill in for blockchain’s missing verification layer. Blockchain does as it’s told. To verify information, one needs a middle layer of validation between the raw data and blockchain ledger. This source of truthing comes from a separate suite of data providers ferrying information from the physical to digital worlds. IoT data providers can certify the quality of data sensors and meters, and AI companies can validate based on predictive models.

🤧 On burnt ground from the 2018 boom and bust, blockchain applications face serious hurdles to adoption. Whether right or not, corporates, investors, and much of the public have an allergy to the word “blockchain”. Blockchain is perceived as a clunky solution that introduces new complexities like cybersecurity, regulatory, and compliance risks. There’s also the need for establishing some common protocol for end applications to work, much like how the Internet Protocol facilitated the scaling of the internet. And of course, the benefits of the distributed ledger technology manifest only with a multiplayer network.

✊ Never doubt that a small group of highly collaborative, innovative, and mission-driven blockchain fanatics can change the world. Blockchain (not crypto…) attracts just the type of systems thinkers needed to solve the climate crisis. Time will tell if they can change the world.

Curious to learn more about blockchain climate solutions? Check out Yale’s OpenLab with Martin Wainstein (who graciously shared his expert perspective), Climate Chain Coalition, InterWork Alliance, the World Bank’s Climate Warehouse, the Open Climate Collabathon, Hyperledger Climate Action & Accounting SIG, Climate Ledger Initiative, and the Energy Web Foundation.

Curious to work on building blockchain climate solutions? LO3 is hiring a Full Stack Developer, ClearTrace is hiring a Director of Sales, and Nori is hiring a Senior Software Engineer and Head of Product.

Canada will hike its carbon price to CAD$170 and invest CAD$15B by 2030 in its new commitment to cut emissions ~40% below 2005 levels.

EU leaders have agreed to cut net carbon emissions by 55% in the next decade (2030!), expediting the global stage for near-term carbon cuts before most countries’ 2050 net zero commitments.

Everything in 2020 has gone virtual, including power plants! Sidewalk Infrastructure Partners and OhmConnect are partnering to create a 550 MW “Resi-Station” using smart devices to power energy reductions during peak demand while Swell Energy is building four virtual power plants.

Square is partnering with Watershed (we featured here) to be net zero by 2030, in addition to starting an initiative to support greener bitcoin mining.

Amazon is backing 26 renewables projects equal to 3.4 GW(!) of electricity, apt for the world’s largest retailer.

United Airlines switches up its 2050 net zero commitment by investing in direct air capture instead of only purchasing carbon offsets.

A consortium of global energy companies including Denmark’s Orsted and China’s Envision are aiming to drive the cost of green hydrogen below $2/ kg (currently at $3.5 -8/kg) by boosting output to 25 GW by 2026.

Adding to 2020 O&G industry woes, Exxon and Shell are under fire over the companies’ poor financial performance and snail-paced clean energy transition. With shares down 35-40% YTD, institutional and activist Investors are demanding cost cutting-measures and launching a shareholder effort for new directors. Shell’s key energy transition leaders are also resigning over slow green technology adoption.

What do the Vatican and the world’s largest hedge fund have in common? The Pope and Ray Dalio from Bridgewater are both getting on the ESG train. The Vatican leader has helped form the Council for Inclusive Capitalism and Bridgewater is starting a sustainability strategy.

New York state’s $226B pension fund has pledged to reach net-zero GHG emissions by 2040.

E8 aggregated a climate-friendly carbon negative gift catalog just in time for Christmas. And if you’re in need of more inspiration Amazon has 10,000+ ideas for you.

After our November feature on climate accounting, HBR released an article on the Future of ESG is… accounting?

If a tree never falls in the forest … if companies are paying to protect trees that weren’t ever going to be cut, are they really offsetting carbon?

💡 FrequencyGRAD: Calling all graduate students and faculty members interested in launching a startup. Apply by December 18th for a free, 1-week program by Pillar VC and Petri designed to help you answer questions about whether and how to start building.

💡 The Greentown Labs KAITEKI Challenge: Apply by February 10th to participate in a 6 month program, which will foster collaboration between Mitsubishi Chemical Holdings Corporation and startups innovating in proteins, plastics, and packaging.

Investment Analyst @Energy Impact Partners

Principal Software Architect @CleanRobotics

R&D Intern @Boston Meats

Senior Product Manager @Aclima

Head of Sales & Biz Dev @Aclima

Commercial Director @Polynatural

Director of Product Management, Battery Storage @Sunrun

Marketing & Communication Intern @Beyond Black VC

Emerging Equities Manager (aka get a seeded fund) @Social Capital *apply by 12/15

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond