🌎 The SMR shake-up #284

Small reactors, big power rankings

Happy Monday!

This week, we’re diving into the IEA’s newly released 2025 Outlook, which adds a previously retired scenario back into the mix, widening the range of possible futures and complicating an already uncertain transition.

In deals, $490m for utilities, $331m for renewable development, and $196m for CCS.

In other news, COP updates, US states’ energy affordability meet climate pushes, and Australia’s aluminum decarbonization plans.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

Last week, the International Energy Agency (IEA) released its 2025 World Energy Outlook, the agency’s flagship annual assessment of the global energy system. This year’s edition describes today’s emerging “Age of Electricity,” with rising demand from transport, heating/cooling, industry, data centers, and more.

In particular, it brings back the Current Policies Scenario (CPS), widening the spread of outcomes the report explores. The result is a policy-driven choose-your-own-adventure approach to emissions.

The IEA, founded in 1974 after the oil crisis, has published the World Energy Outlook for nearly five decades as its annual readout on global energy data, technologies, markets and policy direction. This year’s 500-plus-page edition lands at a tense moment amid rising electricity demand, trade friction, and uneven policy momentum, and reflects an “energy addition” rather than energy transition narrative.

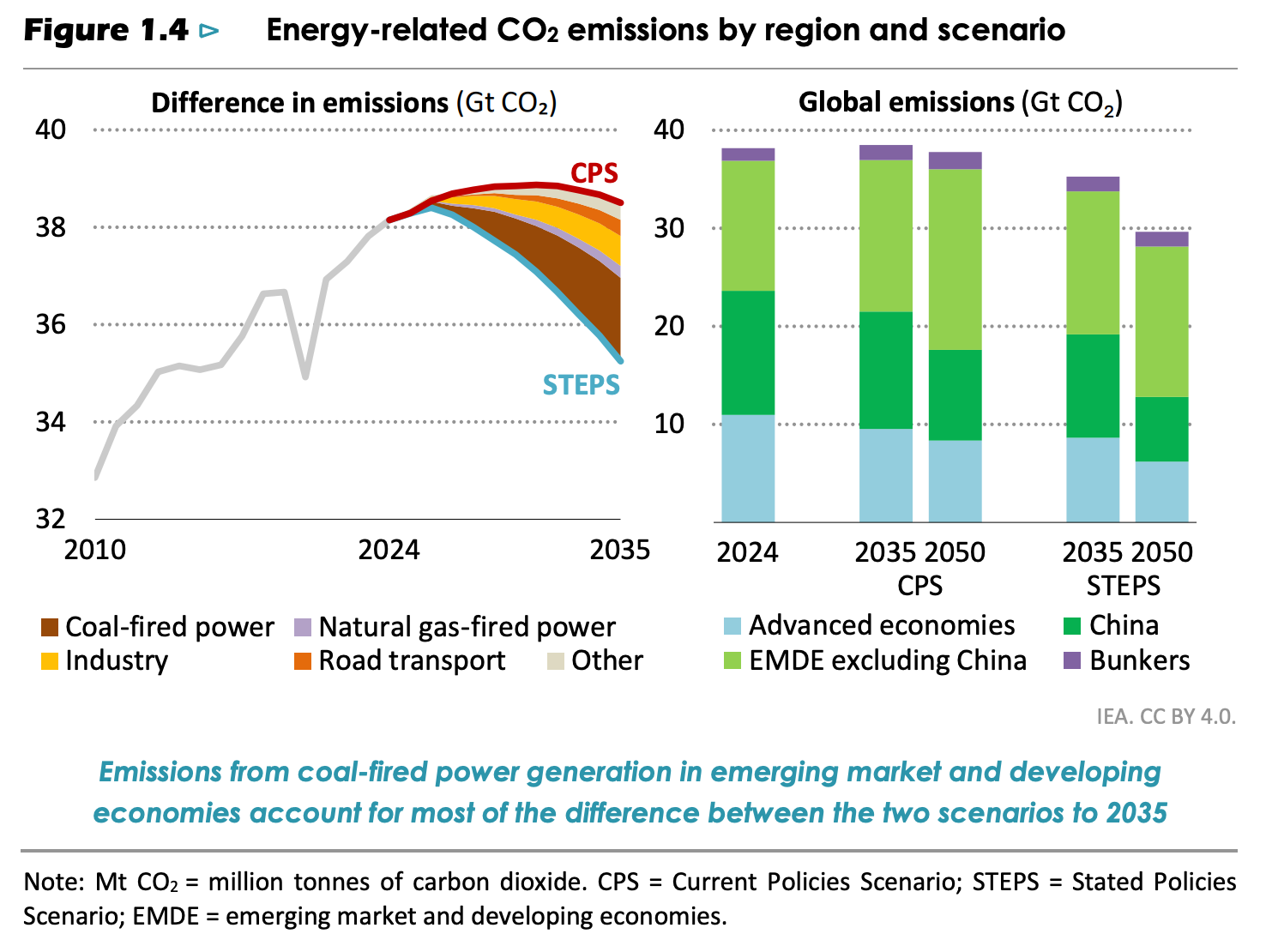

The biggest headline is the return of the Current Policies Scenario (CPS), which the IEA dropped after 2020 and replaced with alternatives like the Announced Pledges Scenario (APS). CPS models a world where governments introduce no new policies beyond those already in place. That typically means slower clean energy adoption, higher fossil fuel use, and higher long-term emissions. Its reintroduction widens the gap between potential emissions trajectories and shows how far current actions diverge from stated ambitions.

It also reflects political pressures: the Trump administration pushed for CPS to return because it paints a more conservative picture of the transition, one in which oil and gas demand stay strong for decades. While controversial, it’s more explicit about how different policy choices shape different energy futures.

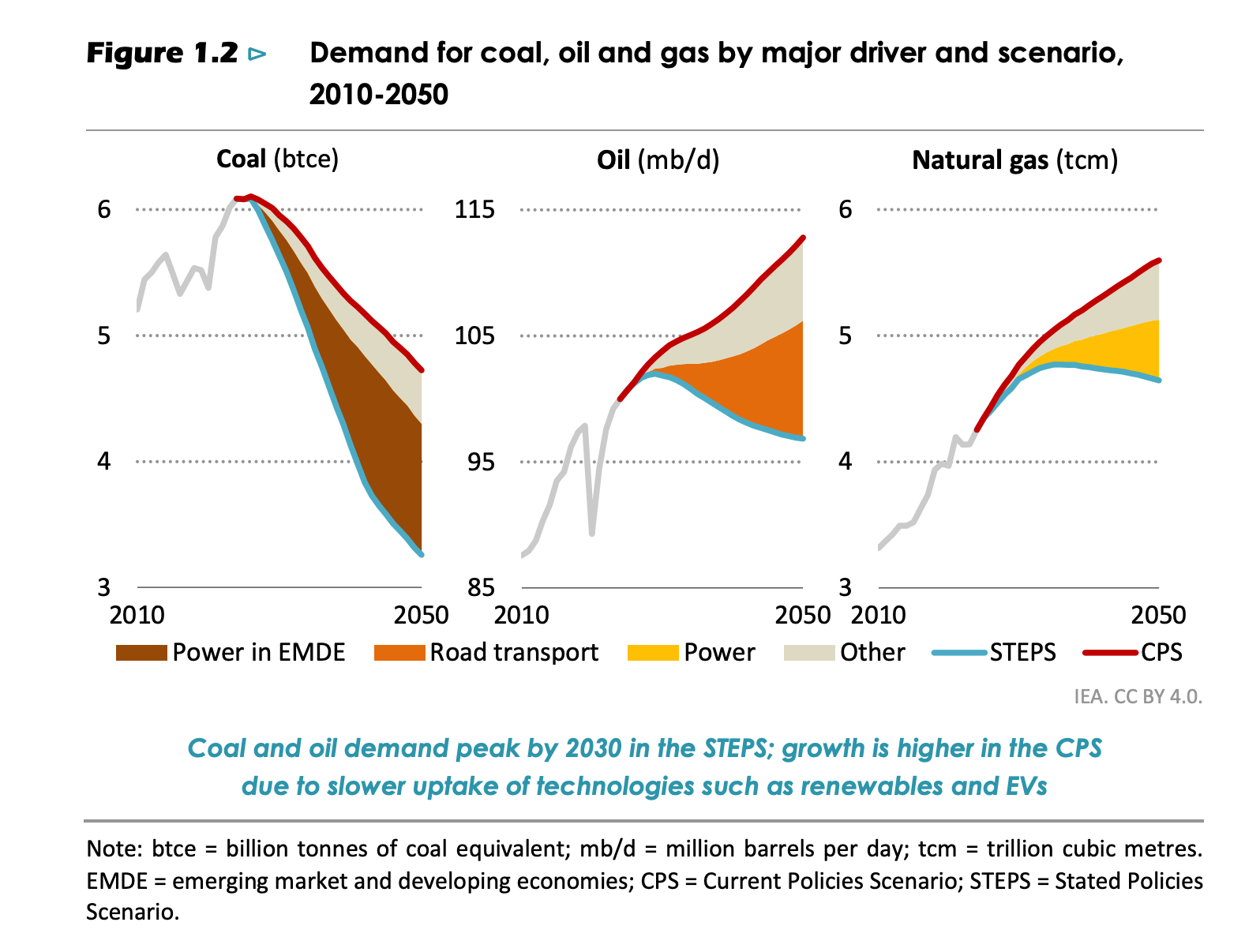

The Outlook uses three scenarios to show how different policy paths shape radically different energy and emissions futures.

The reintroduction of the CPS resets the “peak” debate. CPS shows demand for oil and natural gas continuing to grow to 2050, although coal starts to fall back before the end of the current decade. In STEPS, the pressure on fossil demand builds, and coal and oil demand peak by 2030. Gas demand now continues growing into the 2030s. In all scenarios, renewable energy is expected to at least double over the next five years. But overall, the spread between scenarios is wider now, not narrower, as uncertainty grows.

The report explores the factors driving these trends, from governments’ increasing focus on energy security to affordability pressures to the concentration of critical minerals’ supply chains in one country (China). Other key findings for energy decision-makers to know:

🚚 Harbinger, a Gardena, CA-based medium-duty EV trucks manufacturer, raised $160m in Series C funding from FedEx, Capricorn Technology Impact Fund, THOR Industries, and other investors.

🧪 Hive Energy, a Hampshire, England-based global renewable energy developer, raised $79m in Growth funding from HSBC.

☀️ Infinity Power, an Amsterdam, Netherlands-based renewable energy project developer, raised $40m in Growth funding from the European Bank for Reconstruction and Development.

⚡ Valar Atomics, an El Segundo, CA-based nuclear-based synthetic fuel developer, raised $130m in Series A funding from Day One Ventures, Dream Ventures, Snowpoint Ventures, Anduril Industries, and Shyam Sankar.

🏭 Voya Energy, a Hayward, CA-based carbon-free metal-fuel power systems developer, raised $13m in Seed funding from Energy Impact Partners, Founders Fund, In-Q-Tel, and other investors.

🌾 SAIA Agrobotics, a Wageningen, Netherlands-based autonomous indoor farming system, raised $12m in Series A funding from CHECK24 Impact, European Innovation Council, Navus Ventures, and OostNL.

🔋 Quino Energy, a San Leandro, CA-based redox flow battery manufacturer, raised $10m in Series A funding from Atri Energy Transition.

🔋 Flux XII, a Madison, WI-based aqueous flow battery energy storage developer, raised $4m in Seed funding from Grantham Foundation, WARF, Desai Ventures, and gener8tor.

⚡ AGL Energy, a Sydney, Australia-based utility service provider, raised $490m in Secondary funding from Future Fund and Queensland Investment Corporation.

⚡ ReNew Power, a Gurgaon, India-based renewable energy producer, raised $331m in PF debt from Asian Development Bank.

⚡ DESFA, an Athens, Greece-based national gas infrastructure operator, raised $196m in Grant funding from the EU Innovation Fund.

🔋 Highview Power, a London, England-based liquid air energy storage developer, raised $171m in PF equity from Centrica, Goldman Sachs, KIRKBI, Mosaic Capital Partners, and Scottish National Investment Bank.

💨 Varaha, a Gurgaon, India-based carbon credits platform, raised $30m in PF equity from Mirova.

⚒️ Lifezone Metals, a Douglas, Isle of Man-based critical minerals mining service, raised $15m in Post-IPO equity.

⚡ Kuppa, a London, England-based smart home-energy software, was acquired by Octopus Energy for an undisclosed amount.

📦 Tilli, a Paris, France-based care & repair services platform, was acquired by Reekom for an undisclosed amount.

⚡ Pearce Services, a Paso Robles, CA-based outsourced infrastructure services, was acquired by CBRE Group for $1.2b.

💨 Pachama, a San Francisco, CA-based forest carbon project marketplace, was acquired by Carbon Direct for an undisclosed amount.

⚡ Pine Gate Renewables, an Asheville, NC-based renewable energy developer, filed for Bankruptcy / Out of Business.

💰 Audacia, a Paris, France‑based growth equity firm, raised $174 m for its “Calderion” fund dedicated to next‑generation fuels.

💰 VOX Capital, a São Paulo, Brazil‑based impact investment manager, raised $50m for its “Catalytic Capital for the Agricultural Transition (CCAT)” fund targeting sustainable agriculture in Brazil.

This is a sample of the deals available for Sightline clients. Can’t get enough deals?

Since COP30 opened last Monday in Brazil, key discussions have centered on accelerating the global energy transition, with a proposal already backed by 17 nations urging countries to phase out coal, oil, and gas. Activists highlighted ongoing fossil fuel extraction by the US, Australia, Norway, and Canada as continuing to drive inequality. Amidst concerns over the weakening of EU climate policies and targets, Germany and Spain committed $100m to the ARISE program to help poorer countries build climate resilience and merge resilience with economic development.

In the US, governors are trading climate commitments for energy affordability, with New York Governor Kathy Hochul approving a $1bn underwater natural gas pipeline to meet rising energy demand, despite repeated environmental objections and concerns that the project conflicts with the state’s 2019 climate law, arguing that the pipeline will help stabilize energy costs and reliability for residents. In Pennsylvania, Governor Josh Shapiro oversaw the state’s withdrawal from the Regional Greenhouse Gas Initiative, prioritizing affordability and economic competitiveness over participation in the regional carbon market.

In addition to offering its citizens free solar power, Australia is moving to decarbonize its aluminum industry by introducing the $1.3bn Green Aluminium Production Credit, which will cover 30–40% of the extra costs of clean power and provide credits for up to 10 years for the country’s four major smelters. These smelters consume roughly 10% of national electricity and contribute about 4% of emissions but have faced challenges in transitioning due to variable renewable availability and aging grid infrastructure.

Singapore is implementing a green fuel levy on air travellers to fund the centralized purchase of SAF. The levy, which ranges from $1 to $32, will be applied to tickets sold from April 1 for departures from October 1, while cargo flights will face a per-kilogram duty. The funds will support SAF procurement from Singapore’s largest refinery, which is primarily geared toward exports, enabling the country to reach its target SAF adoption rate of 3–5% by 2030.

A wave of large load tariffs is reshaping how US utilities connect energy-intensive facilities like data centers and manufacturing plants to the grid, as regulators aim to prevent costs from being shifted to existing customers. In Kansas and Michigan, regulators approved large load rate plans requiring customers over 75 MW and 100 MW, respectively, to pay for transmission upgrades, commit to long-term contracts of 12–15 years, and cover a minimum of 80% of their expected monthly demand. Delaware is considering similar legislation for loads above 30 MW.

The UK government has greenlit Rolls-Royce to build small modular reactors (SMRs) at Wylfa in Wales, signaling a major push to capitalize on the country’s nuclear momentum, though exact timelines remain uncertain. These SMRs are larger than initially envisioned, ranging from 300–500 MW, suggesting that smaller reactors may not be economic. Meanwhile, EDF in France is also advancing its SMR program, aiming to finalize a similarly midsize design next year and deploy up to 30 units by 2050.

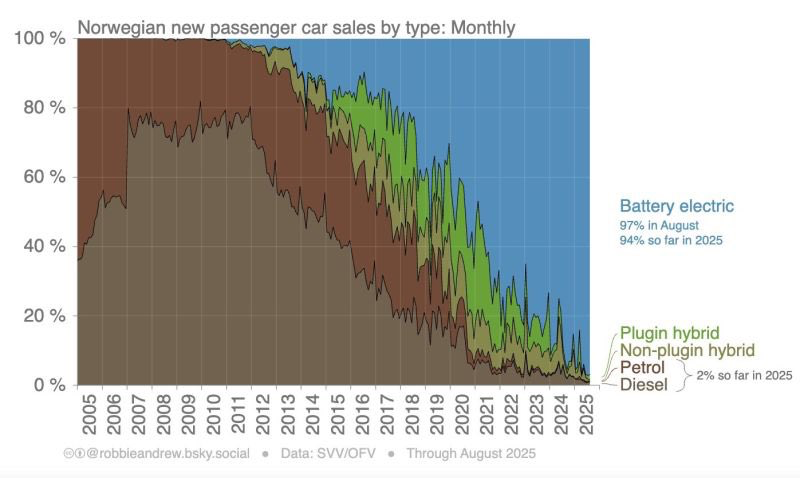

0 to 60? Try 0 to 100 percent EV car sales in just 13 years.

Fossil carbon emissions creep up 1.1% head for another record in 2025, but land use emissions down.

Solar and wind generating capacity still dominate despite federal fossil fuel push.

From grid upgrades to nuclear delays, power remains the ultimate bottleneck for the $5T data center buildout.

New paper on the full environmental impact of AI, and how to fix it - and another on who foots the bill.

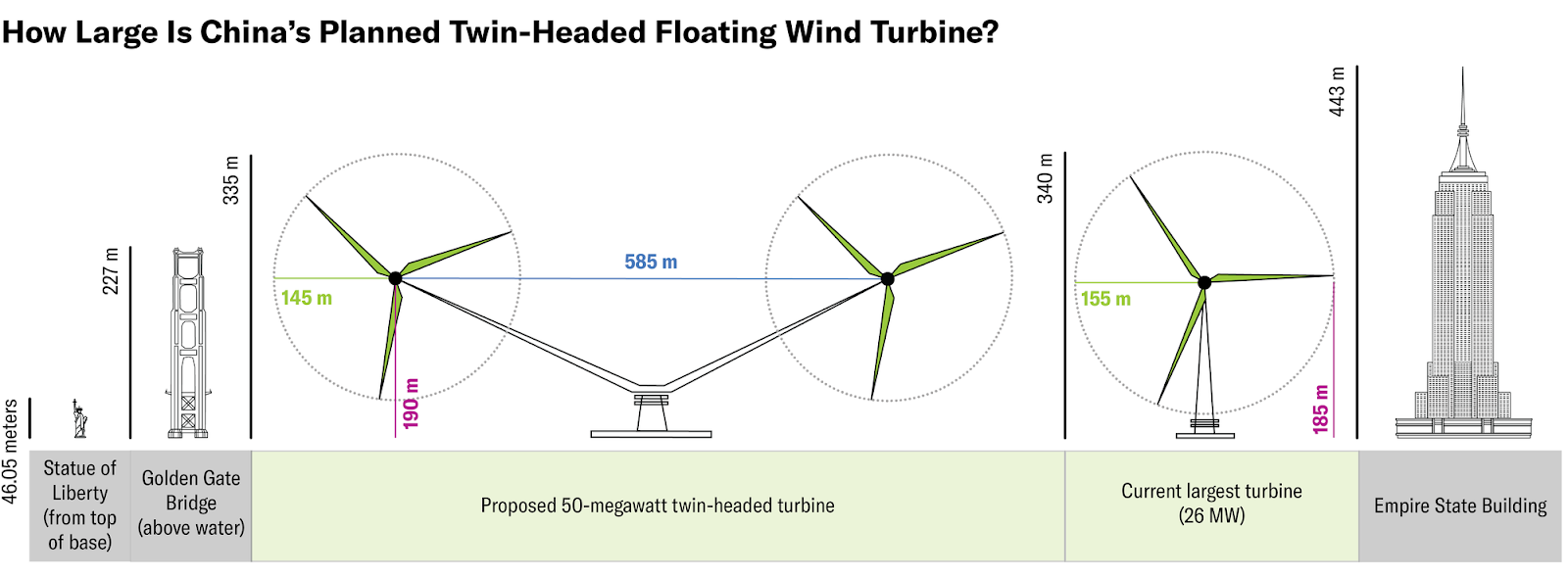

Twice the turbine equals twice the power: China’s new turbine will have two heads.

Pinch me, am I dreaming? A 40MW solar project constructed in 38 days with no crop damage.

500 vapes recycled into … 3 days of power?

Underwater linguists rejoice: whales speak our language, or at least our vowels.

Farewell, Lincoln! The penny’s time is up.

📅 Scaling Positive Investment: Join other experts and leaders in sustainable finance in London on Wednesday, November 19th from 5:00-8:00PM to discuss the progress of sustainable finance from Paris to COP30, while assessing policy, integration, transparency, and international cooperation.

📅 Lecture in Climate Data Science: Columbia Business School’s “Learning the Earth with AI & Physics” center in NYC is opening a seminar this Thursday, November 20th from 2:30-4:00PM on climate data science taught by Sam Silva to the public.

📅 MaRS Climate Impact: Join climate innovators, investors, business leaders, and policymakers in Toronto (or online) on December 2-3 to discover the latest technologies, hear from leading experts, and engage with entrepreneurs in the energy and climate space.

💡 ClimAccelerator Startup Call: ClimAccelerator is a global program for clean-tech start-ups to scale the potential of their climate solutions. Startups can apply to kickstart and scale their climate solution with our professional resources, knowledge and network. Rolling deadlines.

💡 Sage Impact Entrepreneurship 2026: Village Capital, in partnership with Sage Foundation, is now accepting applications for their equity-free investment-readiness program supporting early-stage startups based in the US, Europe, and UK. Selected ventures will receive expert mentorship, tailored business support, and grant funding between $10K - $50K. Applications are open until January 5th.

2026 Climate Corps Fellow @Environmental Defense Fund

2026 Summer Law Clerk @Environmental Integrity Project

Reporting Manager, Analytics @Greenlight America

Data Engineer @Greenlight America

Growth Marketing Manager @Adventure Scientists

Financial Advisor @Energy Solution

Senior Software Product Owner @Energy Solution

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

Small reactors, big power rankings

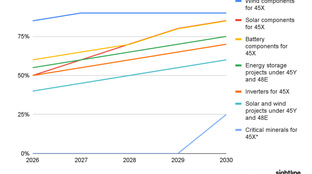

Stricter foreign sourcing rules reshape clean energy tax credit eligibility

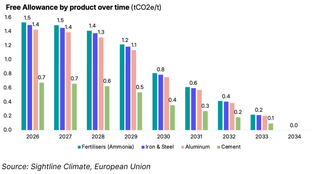

We did the EU carbon math