🌎 Bright spots and sunsets in the OBBB #253

One Big Beautiful Bill ushers in new (and old) energy agenda

Aether makes diamonds out of thin air, SPACs make EVs vroom out of thin margins

Happy Tuesday! What do Pablo Escobar’s hippos, carbon negative diamonds, and EV SPACs have in common? You wouldn’t expect them all to reproduce at the rate that they do.

In this issue, we explore fine jewelry's air of change with Aether Diamonds which compresses captured carbon into bling. We also go deep on Chamath’s Proterra push, contrasting other EVs’ valuation ambitions, technologies, and potential to be turned into investment meme-o’s.

In this week’s fundings, we see an agricultural data company in NY and a solar company in Nigeria. In news, we cover ESG’s 2021 resolutions and two new initiatives for women founders & operators in climate. And if you’re searching for a job in climate, we’ve got you covered.

Thanks for reading!

Not a subscriber yet?

The EV SPAC boom hasn’t tapped the brakes in 2021. Last week, Proterra, the vaunted electric bus OEM, which had flirted with the idea of going public, announced a reverse merger with the SPAC ArcLight Clean Transition. The transaction values Proterra at $1.6bn and includes a bevy of investors including Daimler and Chamath Palihapitiya in the $415m PIPE. (Reference Chamath’s meme-o for further detail.) On the very same day, it was reported that Lucid Motors and Faraday Future were also in talks about going public via SPACs.

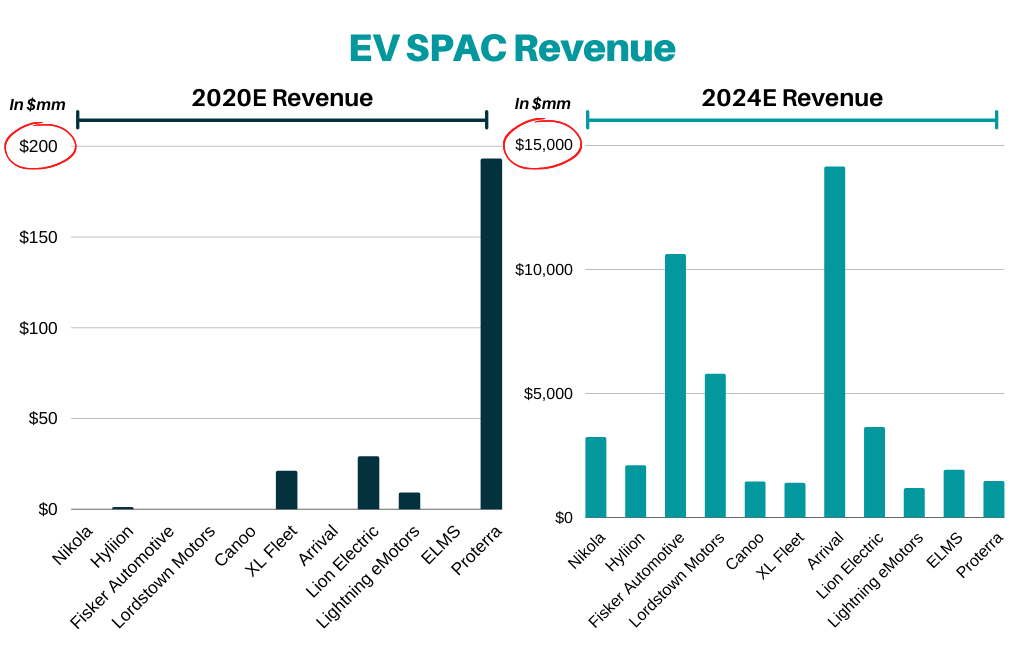

In this SPAC market frenzy, Tesla fomo has investors praying that the 11 new EV SPACs all transform into the next rocketship EV manufacturer. The SPAC vehicle has given companies the risky license to market and base valuations off of their own internal future projections. With the exception of Proterra - each of the 10 other new EV OEMs have used that green light to project multi-billion dollar sales in 2024, despite showing little to no revenue in 2020 (👀Fisker, Lordstown, and Arrival). Keep in mind that it took Tesla 9 years to reach more than $10bn in revenue.

We’ve tried to visualize just how wildly different these projections are from today’s reality. The chart above compares 2020 estimated revenues with 2024 projections. We had to use two charts because we literally couldn’t fit the 2024E axis such that any 2020E revenue was visible - just four years out, and projected revenues for these SPAC EV OEMs are literally off the scale.

[Disclaimer: Kim is an investor at Energy Impact Partners which participated in Proterra's latest round]

🌱 Gro Intelligence, a New York, NY-based agricultural data platform, raised $85m in Series B funding from Intel Capital, Africa Internet Ventures, Ronald Lauder and Eric Zinterhofer. More here.

☀️ Daystar Power, a Nigeria-based solar energy company, raised $38m in Series B from Denmark's Investment Fund for Developing Countries, STOA, Proparco, the French DFI, and Morgan Stanley. More here.

♻️ Xampla, a U.K.-based startup providing an alternative to single use plastic, raised $8m in Seed funding from Horizon Ventures, Amadeus Capital Partners, Cambridge Enterprise, and Sky Ocean Ventures. More here.

🌱 Topl, a Houston, TX-based blockchain platform helping companies prove ethical and sustainable supply chains, raised $3m in Seed funding from Mercury Fund, Blue Collective, RevTech Ventures, Social Impact Capital and others. More here.

☀️ Solstice, a Cambridge, MA-based shared solar power company, raised $3m in Seed funding from Total Carbon Neutrality Ventures, MA Clean Energy Center, Schneider Electric Ventures, Powerhouse Ventures, and others. More here.

🐠 Coral Vita, a Freeport, Bahamas-based startup focused on coral restoration techniques, raised $2m in Seed funding from Builders Collective, Apollo Projects, among others. More here.

💨 Blue Planet, a San Jose, CA-based developer of carbon capture technology, raised an undisclosed amount in Series C funding from Chevron Technology Venture. More here.

Proterra, a Burlingame, CA-based electric bus-maker, has agreed to go public via a reverse merger with ArcLight Clean Transition. More here.

This week we sat down with co-founders Ryan Shearman and Daniel Wojno and CMO Robert (“Bob”) Hagemann of Aether Diamonds to learn more about how they make “diamonds from thin air.” Described by Forbes as the “Tesla of diamonds,” Aether produces the world’s first carbon-negative carats using sequestered CO2. Just a week into their public launch, with an already vastly oversubscribed waitlist, we explore Aether’s influence as a brand for climate impact. [We’ve edited the newsletter version lightly for length; visit our website for the full feature].

What is the supply chain of alchemy, step by step from air to diamond?

The product requires three independent technologies in order to be made: direct air capture on the front end, diamond synthesis at the back end, and an entirely new technology to bridge the gap between them. At a super high level, we take mid-grade CO2 from the air, purify it, and then convert it into hydrocarbon gas that is perfect for growing diamonds using chemical vapor deposition (CVD) reactors.

Growing diamonds in a lab is not new, but doing it well is still quite challenging. Diamond crystals are extremely sensitive to imperfections when they are forming. They simply will not grow, or will crack or turn a very undesirable yellow/brown color in the presence of certain contaminants. A key part of our process is the purity and mixture of our proprietary hydrocarbon gas.

Within the CVD diamond reactor - which is about the size of a refrigerator on its side - is a little grow plate where you put your diamond seeds (a really thin wafer of a diamond). We close the machine up, inject our hydrocarbon and a blend of other gases, and blast it with a microwave. This excites the hydrogen into a plasma state and the carbon breaks off and precipitates down onto the seeds like snowflakes. The free carbon atoms bond with the diamond seeds and begin to grow vertically, like snow accumulating on the ground. Four weeks later, the pieces of rough diamond are large enough to be cut and polished into gemstones.

Beyond sourcing DAC carbon, what else is Aether doing to decarbonize?

We approach decarbonization in a couple of different ways. Our process uses a fair bit of energy, so the first thing we do is source renewable or low-emission power to cover our production needs. The next phase of growth for the business comes from vertical integration, in which we’ll generate our own clean power on site. We aim to generate an excess amount of clean power that we can send to the grid by 2023.

We also allocate a portion of the profit from every transaction to funding promising decarbonization initiatives all over the world. Simply offsetting our own operational footprint isn’t enough for us - we want to ensure a net negative carbon footprint for every carat of diamond sold. Beyond energy use, our packaging and jewelry boxes are made from post-consumer recycled materials including sustainably produced wool andultrasuede– a combination of plant-based biomaterial and recycled plastic. Every single element of Aether is sustainably-minded.

It’s very exciting to see the economic engine we envisioned coming to life. As we continue making diamonds, we’ll put more and more money into carbon sequestration. We hope to remove our first million tonnes of carbon from the air within the next 18-24 months.

How do you compare and price lab-grown diamonds to mined diamonds?

Digging a diamond out of the ground is expensive - financially, environmentally and, often, socially. Compared to mined diamonds, regular lab-grown diamonds are a step in the right direction; you don’t have to dig a giant strip mine, destroy local ecologies with acid mine runoff, or suffer human rights abuses. We started Aether because we believed we could go even further.

Two-thirds of the diamonds sold in 2019 were sold to Gen Z and Millennials. These are the first generations willing to vote with their dollars. They want a brand that shares their values, and they're willing to pay more for it. In the luxury jewelry space, they don't have an option to vote for right now. We like to think that we’re the first option that will give them that choice.

How does carbon-to-value scale?

Consumer participation and demand ultimately drive corporate behavior. Corporations drive the vast majority of global emissions, and that won’t change without government regulation and true bottom-up demand. Hopefully, Aether can help spur action.

There aren’t many consumer-facing products that utilize captured carbon. Some corporates are infusing captured CO2 into cement or carbonated beverages. Aether is pushing the boundaries of products with a “wow factor” that consumers can buy directly. As we start to tell that story, we can spread the word about carbon capture to the average person.

Likewise, we’re incredibly proud that the International Gemological Institute certified our first diamond and will be our certification partner for Aether. We’re in initial talks with IGI about changing the standard for diamond certification to include its carbon source and environmental impact, effectively adding a 5th C to the way the world looks at diamonds. This is literally how we change an industry and set a new standard for shoppers.

What’s the consumer demand so far been like?

We’ve had overwhelming demand for our jewelry so far. The website went live on December 21, and, even amidst all of the craziness of the holiday period and news cycles, a record number of people signed up for our waitlist. The numbers exceeded our wildest expectations. It’s both fantastic and scary that we have such a huge waitlist.

Get lost in the Aetherverse on Instagram and at aetherdiamonds.com. To explore partnership or career opportunities as the team expands, reach out here.

Team Biden continues to stack the new White House Office of Domestic Climate Policy bench with climate-heavy hitters: Maggie Thomas (Chief of Staff), Sonia Aggarwal (senior advisor for climate policy and innovation), David Hayes (special assistant for climate policy), Jahi Wise (senior adviser for climate policy and finance), and Cecilia Martinez (senior director for environmental justice).

An early gameplan? Biden plans to block the Keystone XL pipeline as soon as he steps up to the plate.

Despite global GHG emissions falling 10.3% (the largest YOY drop since WWII), 2020 clocked in as the second hottest year on record. In fact, the past 7 years were the 7 hottest years on record, due to cumulative buildup of GHGs in our atmosphere over time - not the emissions in a particular year.

Pressure from investors boosted corporate climate disclosures to an all time high in 2020.

Total and Engie SA are partnering to build France’s largest green hydrogen electrolysis plant. 100 MW of solar farms will power the 40 MW electrolyzer to produce 5 tonnes of green hydrogen per day.

Meanwhile, Siemens Gamesa (the world’s largest offshore wind turbine maker) and Siemens Energy are teaming up to develop a 14 MW offshore wind turbine to produce green hydrogen.

Not to be left out of the fun, Saudi’s Crown Prince MBS unveiled plans for a $5bn hydrogen project to sit at the center of the fabled NEOM zero-carbon city, which would be able to house a million residents.

In an effort to combat wildfires and support grid resiliency, California bookmarked a meager $200m of funding to facilitate microgrid development.

GM dropped its new logo meant to reflect its EV future (remember Word Art, anyone?) along with the BrightDrop launch, an ecosystem of electric delivery products. FedEx is first in line to buy BrightDrop’s software, pallet, and commercial vehicles.

40+ experts authored a phenomenal open-source primer on the fundamentals of carbon dioxide removal (CDR) and its importance in addressing climate change. From the pulpit, Bloomberg Green cautions against overreliance on CDR to reach net-zero commitments, while the NYTimes reports on encouraging CDR prospects - so long as we have a Plan B.

Investors’ ESG resolutions for 2021 include biodiversity, supply chain risk, and …the social impact of gaming?

CES, the annual tech event where the newest gizmos and gadgets are unveiled, has begun to upstage the Detroit Motor Show as the turbocharged venue for debuting EVs.

Is ESG exacerbating “the bear market for humans”? Vincent Deluard argues ESG is biased against human capital, while rewarding companies that automate jobs. Correlation or causation?

A few thoughts on climate SPACs from Yale’s Dan Gross, who supports the Climate Change Crisis Real Impact Acquisition Corporation. We interviewed David Crane about the CLII SPAC.

Missing Monday inspiration? Watch Science Moms’ new climate change campaign that’ll pull at your heart strings.

Ecologists are flying high with the ICARUS project, a satellite and solar powered Noah’s Ark.

The Climate50 initiative launched to rank the most impactful investors leading the world towards a net-zero planet.

The year started strong with the launch of both ClimateRaise, an exclusive newsletter connecting investors with womxn-led climate startups, and Women in Climate Tech, a community to empower and amplify the voices of women working in the space.

💡 End Plastic Waste Innovation Platform: Startups in Europe or the Middle East working to reduce plastic waste anywhere along the plastics value chain can apply by January 22nd to work closely with the Alliance to End Plastic Waste.

💡 AlphaLab Gear Hardware Cup - Cleantech Challenge: Early-stage hardware startups that are tackling cleantech verticals can apply by January 26th to participate in a pitch competition for a cash prize of up to $50,000. To be eligible to compete, startups must have at least one physical product component.

💡 Venture For ClimateTech: Innovators or founders that have a climate tech idea that can help New York State reach its ambitious climate goals can apply by March 12th to join Venture For ClimateTech’s first 6 month, part-time, virtual program (venture studio + accelerator model). They provide access to the tools, talent, and non-dilutive funding you need to launch your climate tech solution.

Investment Principal @Mulago Foundation

Investment Analyst @The Westly Group

Associate @Touchdown Ventures

Impact Associate @Nephila

Investment Operations Intern @Prime Impact Fund

Associate @MUUS

Associate @BMO Impact Fund

Content Manager & Research Analyst @Energy Sage

Exploratory Projects Fellow @Prime Coalition

Sales Performance Data Analyst @Sunlight Financial

Data Scientist @KoBold Metals

Machine Learning Research Engineer @Open Climate Fix

Product Manager @Electriphi

Product, Engineering Manager @Stripe Climate

Ops/Logistics/Warehouse Manager @Dispatch Goods

Manager, Social & Environmental Responsibility @Allbirds

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond