🌎 Overheard at LCAW #252

Climate, capital, and carrots in London's new playbook

More net zero commitments, a Nobel for climate, and all of government resilience plans

Happy Monday!

In lieu of carbon taxing, US’ own special envoy for climate Kerry is moving in on a big push of big industry towards low carbon procurement adoption. As we alluded to with Friday’s feature on Activate, procurement - buying goods across supply chains - is big dollars and a big target for carbon reduction. Both innovation and deployment need adoption sooner, and a pro-bono government supported solution is likely a better first swing than heavy taxation, regulation or private sector incentives alone.

In other big moves this week, BP acquired Blueprint Power, and a food waste startup, tire recycler, and sustainable lawn care startup all raised more than $50m each.

In the news this week, a Nobel prize for climate modeling, China potentially soft pedaling some energy transition ambitions, and the UAE and McDonald’s commit to net-zero by 2050.

Thanks for reading!

Not a subscriber yet?

As part of his climate envoy efforts, John Kerry is creating the First Movers Coalition. For the Coalition, Kerry is recruiting industry titans from the hardest to decarbonize sectors – including aviation, shipping, steel and trucking – and tasking them with clean-up responsibilities by committing to use low-carbon products. Companies ranging from shipping behemoth Maersk, commodity giant Trafigura, and cement maker Holcim have already signed up, with the full roster to be unveiled at COP26 in Glasgow next month.

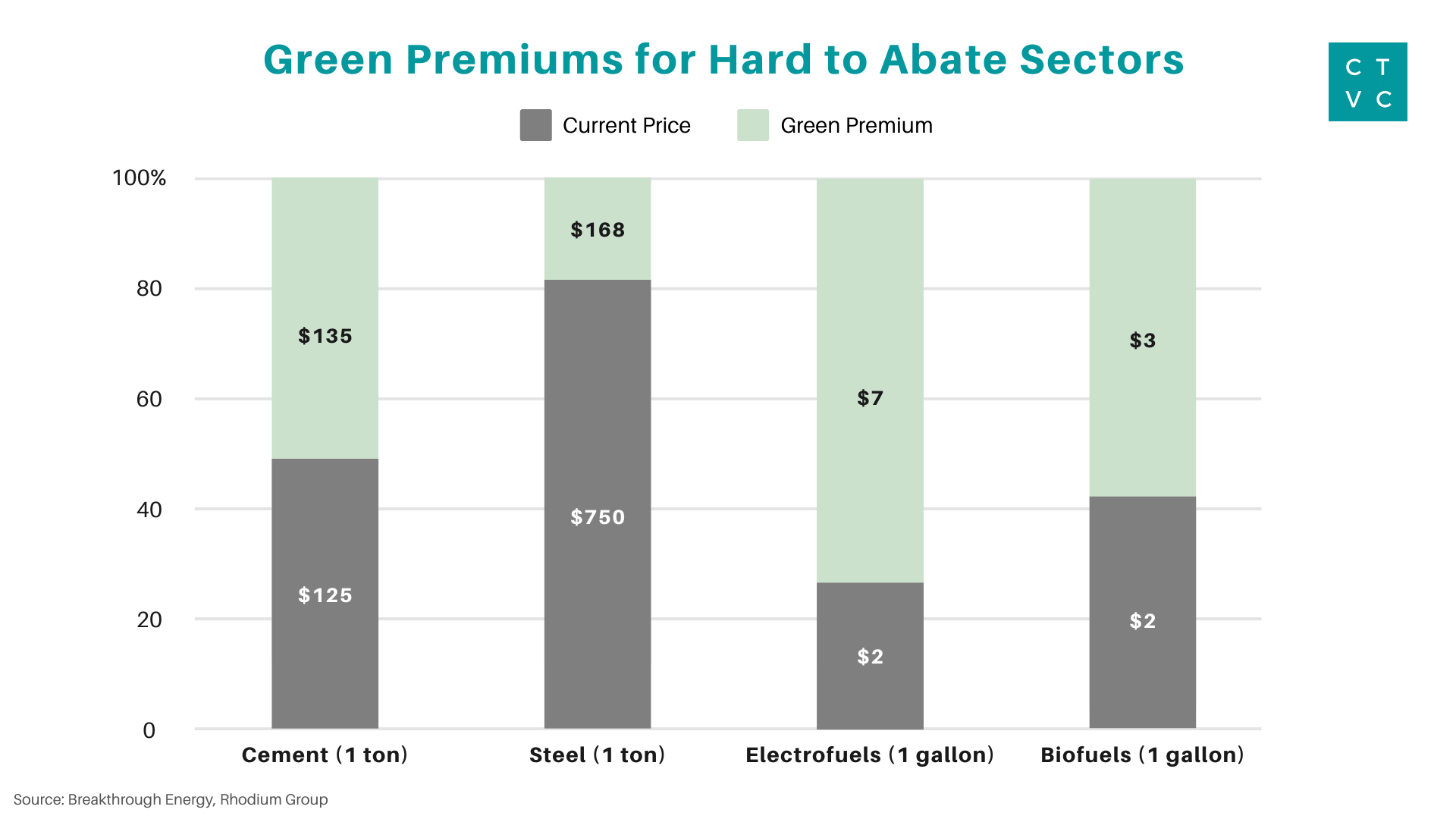

Kerry is strategically targeting the last slice of the emissions pie that’s the hardest to abate. A paper published in Science estimates that 15% of global CO2 emissions come from these segments: iron and steel (5%), cement (4%), shipping (3%), aviation (2%), and long-distance road transportation (1%). While sustainable pathways like carbon capture or green hydrogen exist, these solutions command a “green premium” over their fossil-dirty counterparts and production at scale remains limited.

💸 Procurement is big dollars. With low-carbon products facing the chicken-and-egg problem of supply and demand, corporate climate-centric purchasing decisions send the necessary demand signal to the market. In order for nascent technologies like green hydrogen and sustainable aviation fuel to climb down the cost curve and get to scale, corporate first adopters must be willing to pay the initial price differential. We’ve seen high margin tech cos voluntarily opt into this higher willingness to pay (e.g., Microsoft and Stripe’s carbon removal purchases & Amazon’s early purchase of Rivian delivery trucks) to benefit from better branding and talent. With industrial heavyweights like Maersk and Holcim also jumping on board, corporate procurement could really push the scale on decarbonization.

🏷️ A small price to pay for end customers. While low-carbon alternatives seem expensive at face value, the initial premium becomes negligible when baked into the cost of the end product. For example, using green steel would add ~$180, or about 1%, to a car’s average sticker price. Doubling cement’s price tag to include a $100/ ton abatement cost only adds 0.3% to a building’s construction cost. So the problem isn’t that the premium is the de facto limiter, but rather how efficiently the cost is spread out across players in the supply chain.

🤝 Foreign climate diplomacy scales through companies. We’re quick to turn heads at countries making ambitious high-level commitments, but the FMC goes directly to international industrial polluters to decarbonize. The FMC parallels Obama’s “Mission Innovation”, a diplomatic initiative to get foreign governments including China, India and Brazil to accelerate clean energy innovation - but focuses on decarbonization commitments from foreign companies rather than foreign governments.

🍎 Do Good Foods, a Bedminister, NJ-based food-waste elimination startup, raised $169m from Nuveen.

♻️ Bolder Industries, a Boulder, CO-based company converting end-of-life tires into petrochemicals, steel, and power raised $80m in funding from CIM Group, Aravaipa Ventures, Tauber Oil.

🌱 Sunday, a Denver, CO-based sustainable lawn care startup, raised $50m in Series C funding from BOND, Sequoia Capital, Forerunner Ventures, and Tusk Ventures.

🚗 Infinitum Electric, an Austin, TX-based electric motor producer for commercial and industrial applications, raised $40m in Series C funding from Energy Innovation Capital, Cottonwood Technology Fund, Chevron Technology Ventures, and Ajax Strategies.

🐝 BeeHero, a Fresno, CA-based apiculture startup, raised $15m in Series A funding from ADM Capital, Rabo Food & Agri Innovation Fund, iAngels, FirstTime, J-Ventures, UpWest, Entrée Capital, Good Company, the Arison Group and Gaingels.

🌱 CH4 Global, a Henderson, NV-based company using seaweed to reduce methane emissions, raised $13m in Series A funding from DCVC, DCVC Bio, and others.

💨 Normative, a Sweden-based emissions “accounting engine” tracking supply chain emissions, raised almost $12m from 2150, ETF Partners, Lowercarbon Capital, ByFounders, and Luminar Ventures.

💨 CarbonBuilt, a Los Angeles, CA-based startup embedding CO2 into concrete, raised $10m in Series A funding from Neglected Climate Opportunities, Pritzker Group, Lime Street Ventures, Climate Capital, YouWeb Impact fund, and Foundamental.

🔋 Delft IMP, a Netherlands-based startup developing a nanocoating process to extend battery life, raised $11.6m in Series A funding from Sandwater and Invest-NL.

🛰️ Muon Space, a Mountain View, CA-based climate-focused satellite constellation company, raised $10m in Seed funding from Costanoa Ventures, Space Capital, Congruent VC, Ubiquity Ventures, South Park Commons, and Climactic VC.

☀️ Energetic Insurance, a Boston, MA-based solar insurance startup, raised $7m in Series A funding from Schneider Electric Ventures, MS&AD Ventures, MCJ Collective, Atlantic Global Risk, Congruent Ventures, SCOR P&C Ventures, MUUS Asset Management, Powerhouse Ventures, and Clean Energy Venture Group.

💨 Made of Air, a Germany-based maker of “carbon negative” thermoplastics, raised $5.8m in Seed funding from TD Veen Tuesday Capital, EQT Group, and numerous individual investors.

💨 PathZero, an Australia-based startup helping companies decarbonize, raised $5m in Series A funding from Carthona Capital, Antler Australia, and others.

🔋 AM Batteries, a Boston, MA-based additive manufacturing company focused on the lithium-ion dry electrode market, raised $3m in Seed funding from TDK Ventures and Foothill Ventures.

🌱 Continuum Ag, a Washington, IA-based soil health data startup, raised $200k in pre-Seed funding from Clean Energy Trust.

BP acquired Blueprint Power, a New York City-based startup transforming built environments into flexible power sources.

It’s been over a week since ~130,000 gallons of crude oil spilled off the beaches of Southern California, shutting down Huntington Beach and spurring residents to ask, “We need oil, but there’s always a question: Do we need it there?”

Three climate scientists won the Nobel Prize in Physics for linking the effects of human behavior to climate change and providing the scientific framework for modeling future climate predictions.

Rolling blackouts and increased energy prices in China puts President Xi’s climate ambitions in danger. With many citizens blaming the energy transition as the cause for intermittent darkness, China may make less of a splash at COP26 this year.

UAE becomes first gulf state to commit to net zero by 2050. While the 7th largest oil producing nation will continue to pump out barrels of black gold, Sheikh Mohammed bin Rashid Al Maktoum pledged a $167b investment into renewable energy for his country.

On the corporate side, McDonald’s commits to net-zero by 2050, but among their decarbonization challenge, the company hasn’t yet figured out a sustainable pathway to reduce agriculture footprint to reach net-zero.

Speaking of net-zero pledges, yesterday and today brought some big ones on the corporate side: McDonald's committed to a net-zero target by 2050. To get there, the company will need to continue to wrestle with its agricultural footprint, Andrew writes.

The International Air Transport Association bets on sustainable aviation fuels, electric, and hydrogen planes to achieve their new net-zero emissions by 2050 goal. If achieved, the group of 290 airlines would abate a total of 21 gigatons of CO2e, equivalent to three times US emissions in 2019.

YouTube throws down the gauntlet on climate deniers - The company banned any monetization streams for advertisers and content creators for any content that denies the existence of climate change.

In January this year, Biden asked every federal agency to assess its climate risk exposure and report back - turns out climate-risk impacts the entire federal government. Notably, the Energy Department, operator of all nuclear research facilities, worries wildfires, hurricanes, and heat waves could encroach on nuclear storage sites. The Department of Homeland Security fears surges in migrants fleeing disasters. The Defense Department predicts water scarcity could drive future global conflict.

Just how expensive are catastrophic climate disasters? So far in 2021, “billion-dollar” climate disasters YTD have claimed 538 lives and cost $104.8b in the US alone.

Our friend Jigar Shah on how the DOE Loans Programs Office is back with $40b to fund early clean technologies.

Load up your nightstand. Two big new books have hit the shelves with dueling perspectives on climate action by Paul Hawken (Regeneration) and John Doerr (Speed & Scale).

A must read article from Microsoft in Nature on lessons for net zero carbon removal purchases. Of the 154m tons of proposed CO2 removal from their latest RFP, only 2m tons met the company’s qualification criteria. The authors are critical of biological storage solutions’ lack of “reliable tools for tracking carbon at scale.”

Meanwhile the IEA touts that “the time is ripe to tap into hydrogen’s potential contribution to a sustainable energy system” from its 2021 Global Hydrogen Review.

The IMF calculates that the oil and gas industry receives $11m a minute in government subsidies globally.

We wanted flying cars, instead we got a mass transit future of electric trams, gondolas, buses, and ferries. Which honestly sounds pretty rad and climate resilient!

Speaking of which, a new paper definitively finds that New York's CitiBike bike-sharing system has prevented ~500 tons of CO2e emissions over the past three years. Buckle up your helmet!

Teardown of Rivian’s S-1 from G2 Venture Partners, the first issue of their new Capitalizing Climate series. In their own Rivian series, Bloomberg documents the long road to Rivian’s first electric truck, diving deep into the history and future of the electric vehicle manufacturer.

Sila’s next-gen silicon anode finally hit the market (and the gym) inside the WHOOP 4.0 fitness wearable.

COP Save The Queen. COP26 organizers struggle with how to make the 20,000 person climate summit safe but accessible to representatives from across the world amidst COVID-19 concerns.

Google rolls out sustainability features across the suite, from Search to Maps to Nest, nudging consumers towards carbon-preferenced choices.

🗓️ TDK Ventures Energy Week: Join Oct 18th-22nd for a different topic on each of the five days. Over 30 of the top leaders in the battery and energy field will share their insights into how the industry is changing and what the future holds.

🗓️ SOSV Climate Tech Summit: Join on Oct 20th-21st for a virtual, free event designed to support the emerging climate tech ecosystem with 50 speakers including Bill Gates, Tony Fadell, the Amazon Climate Fund and many top startups and investors.

💡 Breakthrough Energy Catalyst: Apply by Oct 20th for project-level financing for the deployment of technology within the following sectors: green hydrogen, direct air capture, sustainable aviation fuel, long duration energy storage.

💡 BNEF Pioneers 2022: The BNEF Pioneers program identifies game-changing technology innovations with this year’s focus on three challenges: round-the-clock zero-emissions power, scaling long-term carbon removal technologies, and decarbonizing aviation. Apply by Nov 11th.

North American Executive Director @The Climate Group

Business Associate @Phoenix Tailings

Investment Operations Associate / Manager @Prime Impact Fund

Senior Associate @OnePointFive

Buyer Engagement Specialist @Spoiler Alert

Senior Accountant @Sealed

HR and Office Manager @Scoot Science

Senior Electrical Engineer @Gradient Comfort

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond

Groundbreaking results from the geothermal developer’s main project