🌎 Bright spots and sunsets in the OBBB #253

One Big Beautiful Bill ushers in new (and old) energy agenda

Penultimate report heralds methods for mitigating climate change

Happy Monday! This week, we dive deep on IPCC’s third and final report focused on ways of mitigating climate change - tl;dr: venture should fund hardtech not yet available today (carbon removal) while other asset classes beyond venture ought to deploy commercial-ready high emissions reduction solutions (wind and solar).

In the news, 1,100+ scientists commemorated this publication by chaining themselves to bridges, oil-friendly banks, and government buildings making real life all too Don’t Look Up. Biden unleashed a defensive minerals act to jumpstart battery production, and Russian coal was hit with more global energy sanctions.

In funding news, Climeworks, a Switzerland-based carbon removal startup with the largest machine for carbon extraction raises $650m (!!). Grover, a subscription service for renting electronics and reducing waste raises $110m, and Sweep, an emissions and accounting startup raises $70m in their Series B.

Thanks for reading!

Not a subscriber yet?

Last week, the IPCC released its third and final working group report, completing the trilogy for its Sixth Assessment report.

🔬 Working Group I (WG I) in August 2021 covered the underlying science of climate change

🌎 WG II in February 2022 described impacts, adaptation, and vulnerability with regard to climate change

💨 WG III in April 2022 (last week) outlined methods for mitigating climate change

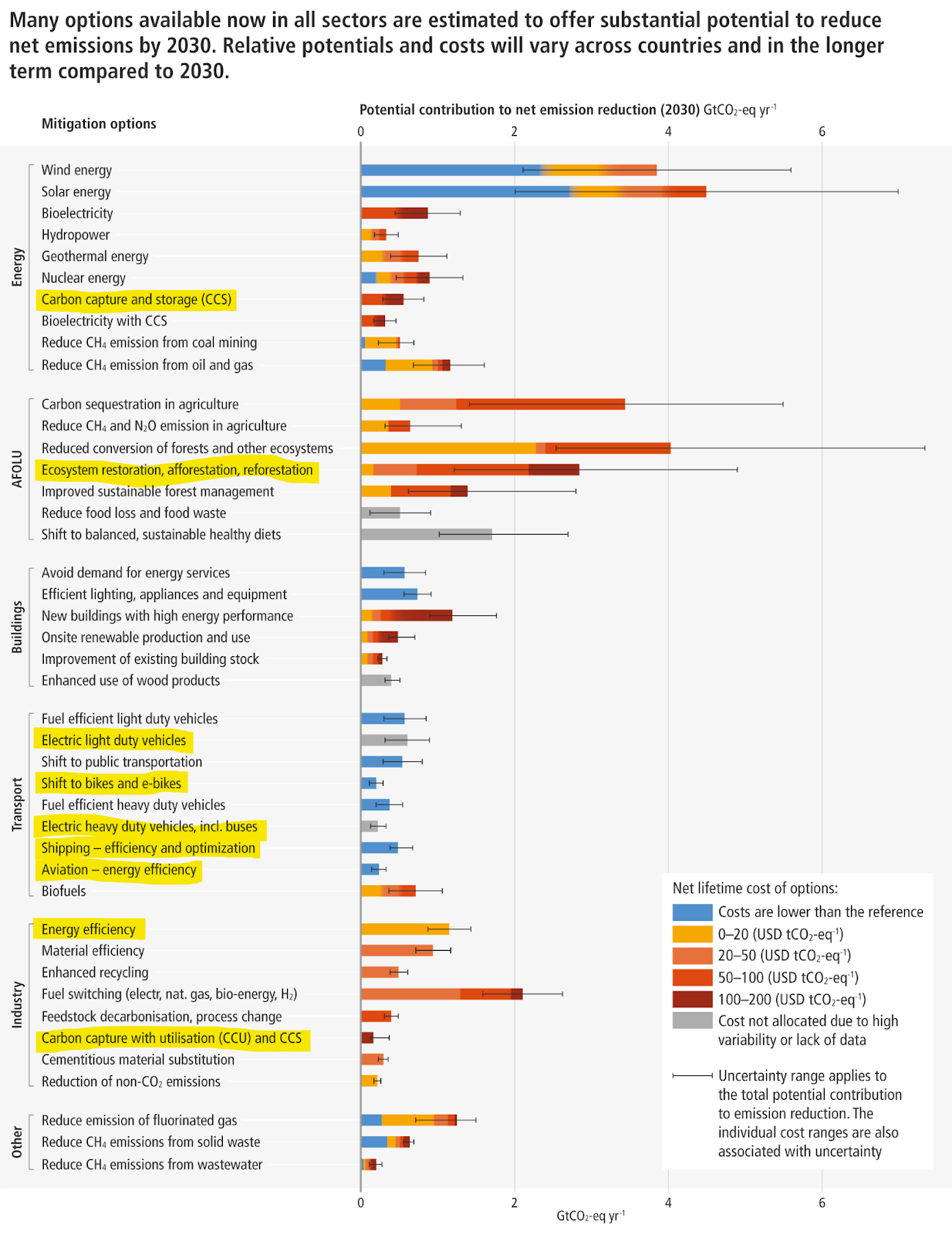

While previous iterations of IPCC reports have centered around sounding the scientific alarm on climate change, the WG III report is more of a “how to avoid the apocalypse” guide as Robinson Meyer described. We honed in on this chart in particular, which maps out an actionable menu of emissions mitigation options to cut emissions by 2030, complete with cost and mitigation potential. Innovators and investors take note - this is fertile hunting ground for where climate tech innovation and deployment should play.

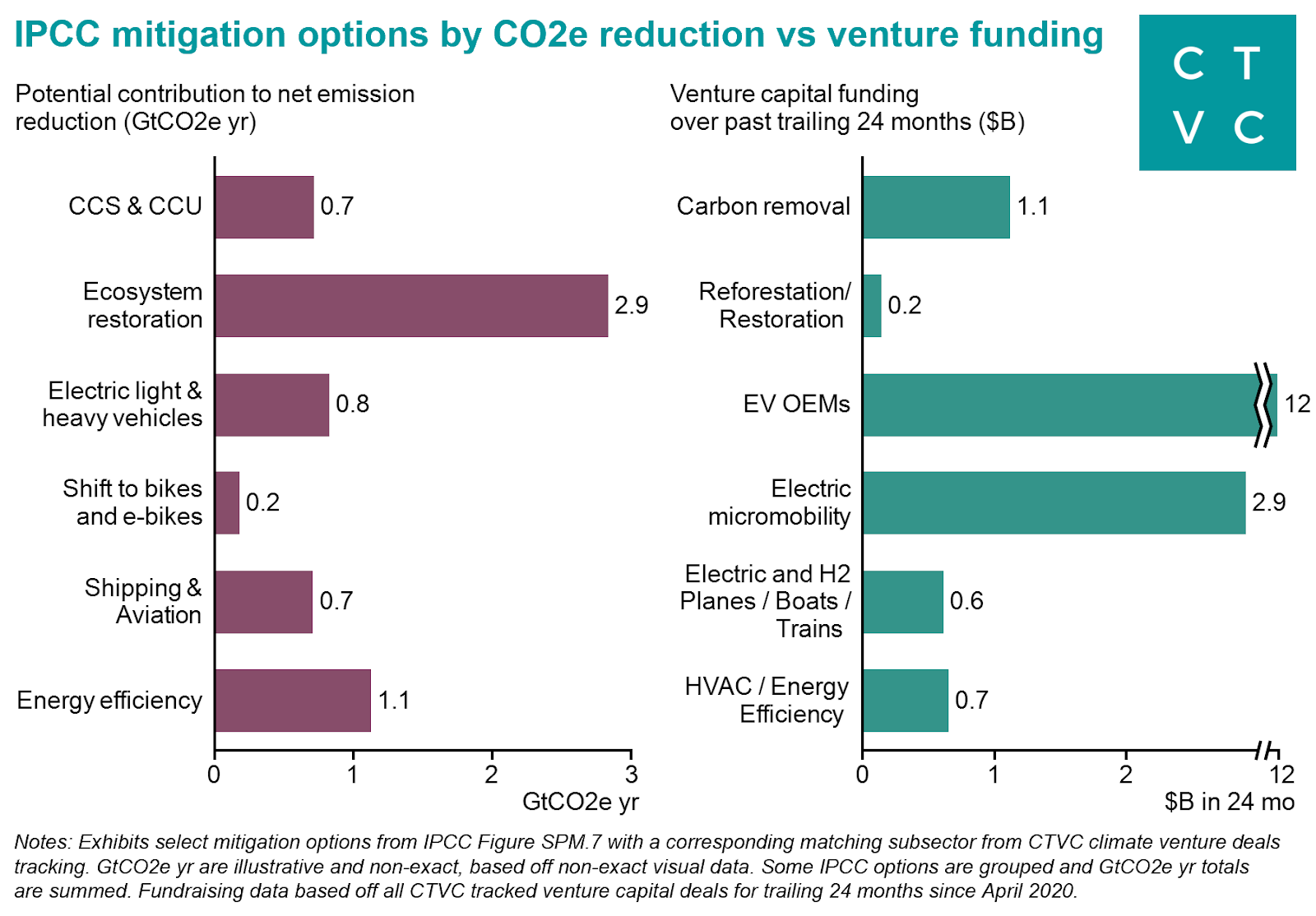

In particular, we’ve highlighted a few mitigation pathways where venture capital dollars have been particularly active over the last 2 years.

Key Takeaways

Mismatch of climate venture dollars to relative emissions impact. The above charts are illustrative and directional, but it doesn’t take a precision ruler to notice the relative differences between emissions impact vs what venture capital funding has been prioritizing. In particular, over the past two years, $16B has been invested in electric mobility subsectors, with a combined ~1.7 GtCOe annual emissions reduction impact ($10B for 1 GtCO2e). Meanwhile, ecosystem restoration holds down 2.9 GtCOe yet received a meager $0.2B in comparative venture investment ($.07B for 1 GtCO2e).

#DeployDeployDeploy for cheap, high reduction. ~30% of the emissions reduction levers are blue colored solutions that are cost-competitive today. These low cost, high impact solutions definitionally draw less venture capital funding because they’re mature. Of the estimated $9T/ yr that we need to deploy on the road to net zero, the bulk of capital should come from commercial deployment dollars.

Keeping an eye on and past the 2030 deadline. The WG III report specifies a science-backed 2030 time horizon for which pathways are most impactful in the next decade. On the other hand, venture capital and innovation takes a longer horizon, especially to get overly expensive but crucial technologies like carbon removal down the cost curve. As Nat Bullard puts it, “capturing carbon dioxide molecules at massive scale, and storing them stably for centuries or longer, is a hard problem to solve. Success will not be quick, and in fact may not come until after the 2030 interval of the IPCC’s report.”

The final trilogy before we blow through 1.5°. After a final synthesis publication due later this year, the IPCC will not publish a major new document for years - making this the last report before the 1.5-degree-Celsius scenario becomes completely infeasible. Call it the IPCC’s final call. Orders in.

💨 Climeworks, a Switzerland-based direct air capture company, raised $650m in funding from Partners Group, GIC, Baillie Gifford, Carbon Removal Partners, Global Founders Capital, John Doerr, M&G, Swiss Re, and BigPoint Holding.

📱 Grover, a Germany-based provider of a circular consumer electronics subscription platform, raised $110m in Series C funding from Energy Impact Partners, Co-Investor Partners, Korelya Capital, LG, Mirae Asset Group, Viola Fintech, Assurant, and coparion.

💨 Sweep, a France-based emissions accounting and management platform, raised $73m in Series B funding from Coatue, Future Shape, Balderton Capital, New Wave, La Famiglia, and 2050.

🌱 ClimeCo, a Boyertown, PA-based environmental commodities trading company, raised over $50m in funding from Warburg Pincus and The Heritage Group.

🔋 Blue Current, a Hayward, CA-based solid-state battery developer, raised $30m in funding from Koch Strategic Platforms.

🔋 E-Zinc, a Canada-based developer of zinc-air batteries, raised $25m in Series A funding from Anzu Partners, BDC Capital, Toyota Ventures, Eni Next, and Energy Foundry.

⚡ ARC Clean Energy Canada, a Canada-based advanced small modular reactor technology provider, raised $24m in funding from Province of New Brunswick.

🐜 Better Origin, a UK-based developer of AI powered-insect farms, raised $16m in Series A funding from Balderton Capital, Fly Ventures, and Metavallon VC.

🌱 Leaft Foods, a New Zealand-based plant based protein startup, raised $15m in Series A funding from Khosla Ventures.

💨 Brilliant Planet, a UK-based startup using algae for carbon capture, raised $12m in funding from USV, Toyota Ventures, Future Positive Capital, AiiM Partners, S2G Ventures, Hatch, and Pegasus Tech Ventures (see our feature on BP here).

🔋 Liminal (fka Feasible), an Emeryville, CA-based battery manufacturing intelligence company, raised $8m in Series A funding from Good Growth Capital, The University of Tokyo Edge Capital Partners, Volta Energy Technologies, Helios Capital Ventures, Impact Science Ventures, Chrysalix Ventures, Elemental Excelerator, and Incite.org.

🥀 Phool, an India-based startup using floral waste for organic fertilizer, raised $8m in Series A funding from Sixth Sense Ventures.

💧 Waterplan, a San Francisco, CA-based AI startup focused on climate and water data models, raised $7m in Seed funding from Giant Ventures, Transition Global, Leonardo DiCaprio, and the Branson family.

⚡ Fibersail, a Portugal based startup using data-driven shape sensing tech to monitor and improve the efficiency of wind turbines, raised $5.4m in funding from FORWARD.one, Rockstart, Innoenergy, Caixa Capital, and others.

🚲 Swytch, a UK-based startup producer of a pocket-sized ebike battery that turns any bike into an electric bike, raised $4.9m in funding from Green Angel Syndicate, Calyx Venture Fund, One Planet Capital, and others.

💧 Wisewell, a Brooklyn, NY-based clean water tech company, raised $2m in pre-Seed funding from BECO Capital.

💨 Kwota, an Estonia-based startup offering digital validation and trading services for recycled material CO₂ emissions, raised $1.6m in a pre-Seed funding from Change Ventures, Wise Guys Ventures, Lemonade Stand, Greenco Ventures, Vestman Energy, and others.

🌲 Lord of the Trees, an Australia-based startup restoring damaged ecosystems using drones and engineered seed pods, raised $1.25m in pre-Seed funding from Draper Associates.

♻️ Deluxe Recycling, an India-based plastics recycling company, raised an undisclosed amount in funding from Circulate Capital.

Check out the TikTok version of CTVC deals in Attention Economy-sized video chunks.

Wireframe Ventures raised $77m for a pre-Seed and Seed fund focused on climate tech, health, and other verticals.

New climate focused firm Voyager Ventures raised $100m for its first fund aimed at early-stage companies working to decarbonize transportation, energy systems and food and materials production, among other sectors.

Right after the IPCC released their grim report, 1,000+ scientists chained themselves to bridges, government buildings, and oil-friendly banks across the world, participating in the largest ever scientist-led civil disobedience campaign. Peter Kalmus, a NASA climate data scientist, said, “It’s the 11th hour in terms of Earth breakdown, and I feel terrified for my kids, and terrified for humanity”.

We will hit 420 parts per million CO2 by the end of the month, the highest observed CO2 levels ever in the past 4.5 million years (We repeat: 4,500,000 years).

Global methane emissions spiked in 2021, the single largest jump since scientists started recording in 1983—and money to track, regulate, and scrub methane couldn’t come any sooner. The new, philanthropic-funded $340m Global Methane Hub aims to accelerate efforts to reduce methane by 30% by 2030.

Energy sanctions continue to pile on for Russia in hopes to end the atrocities in Ukraine. This time, Europe and Japan banned Russian coal, costing Russia about $4B annually. Meanwhile, the UK government unveiled their energy security strategy, explained here by CarbonBrief.

In order to meet the huge demand for batteries in the next few decades, Biden unleashed the Defense Production Act to unlock US production of vital minerals for domestic battery production.

Floods, fires, and droughts are also keeping staff at the US Office of Management and Budget up at night. In OMB’s first-ever climate change assessment, the White House estimated climate change could cost the US budget 7.1% in annual revenue loss, or $2T in damages per year.

Less than two weeks after the SEC released a proposed rule on climate risk disclosure, the International Sustainability Standards Board (ISSB) published proposed standards on sustainability and climate disclosures.

Swedish lawmakers set the world’s first consumption-based emissions target, meaning carbon-intensive imported goods could draw a penalty based on total emissions.

Climate tech made a splash in TIME’s 100 most influential companies list - including BlocPower, Climeworks, and Redwood Materials.

Crypto was supposed to clean up the offset market, but accidentally muddied it more.

As Grist presents the climate case for seizing super yachts, California imposes new air quality rules on harbor boats.

Microsoft selects ten companies for its AI for Environmental Sustainability Accelerator programme.

Canary Media explores how companies are working towards 24/7 clean energy.

A deep dive into the carbon markets value chain from our friends at Patch.

Experts describe new “indigenous-branded” crypto carbon credits initiative from Canadian company Delta Cleantech as “greenwash, topped with more greenwash, garnished with blockchain.”

A new report from Circular Carbon Network provides a comprehensive overview of circular carbon solutions, tracking 403 companies and 221 deals across 38 countries.

A winner of the French lottery used their €200m pot of gold to create an environmental foundation to protect forests and boost biodiversity.

The top 100 women in sustainability, according to Sustainability Magazine.

Marine snow filled with microplastics is affecting the ocean’s cooling capacity.

💡 Third Derivative Accelerator: Apply by Apr 12th to D3’s June 2022 Cohort or the Carbon Capture Cohort to engage in an 18-month accelerator with access to an unparalleled network of strategic corporate partners, tailored training, and capital mobilization.

💡 Climate Launchpad: Apply by Apr 22nd to one of the most successful cleantech and green business competitions in the world and receive training, mentoring and opportunities to scale ideas into business plans.

🗓️ The Clean Fight: Attend this NYC-based event on Apr 12th to hear about the most favorable solutions for building decarbonization and speak with other real estate owners, developers, and contractors about the problems associated with decarbonizing a building’s operations.

🗓️ Protocol Climate Tech: Join on Apr 19th to hear from experts from Salesforce, Kyndryl, and Project Drawdown on the role that tech companies have in the climate crisis and how specific tech corporations and companies are measuring and tracking their climate goals.

Senior Technical Recruiter @Mitra Chem

Sr. Director of Client Success @Shifted Energy

Portfolio Engagement Lead @Toyota Ventures Climate Fund

Fractional COO @Trailhead Capital

Venture Associate, Climate Innovation @Wellington Capital

Founding Engineer @Carbon Calories

Project Lead/Senior Consultant @Aurora Energy Research

Associate @Voyager Ventures

Venture Capital Associate @Blue Bear Capital

Sustainable Investments Manager @Pepsico

PSA - Lowercarbon is hiring a Chief of Staff

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond