🌎 Overheard at LCAW #252

Climate, capital, and carrots in London's new playbook

Technology principles for a changing world, how adaptation innovation might save us

Happy Monday!

Exasperated UN Secretary General Antonio Guterres heralds the IPCC’s sixth assessment report ‘an atlas of human suffering’. The bright light? Maybe innovating for adaptation can help increase the likelihood we earn more time.

In deals this week, $200m for Aurora Solar’s software, $75m for Kenya-based M-KOPA’s energy financing platform, $50m for NCX’s carbon marketplace, and $18m for Aether Diamonds’ atmospheric carbon-negative diamonds.

Check out this neat TikTok that Pique Action made of some of our deal highlights this week! And we’re saying it now: the next carbontech startup that makes diamonds from air-captured CO2 should be named Lucy 🤣

In the news, Ford splits its EV operations out, the UN cracks down on plastic pollution (hopefully), and Tesla’s Germany plant gets to work.

Thanks for reading!

Not a subscriber yet?

No more mincing words. “The cumulative scientific evidence is unequivocal: Climate change is a threat to human well-being and planetary health. Any further delay in concerted anticipatory global action on adaptation and mitigation will miss a brief and rapidly closing window of opportunity to secure a liveable and sustainable future for all. (very high confidence).”

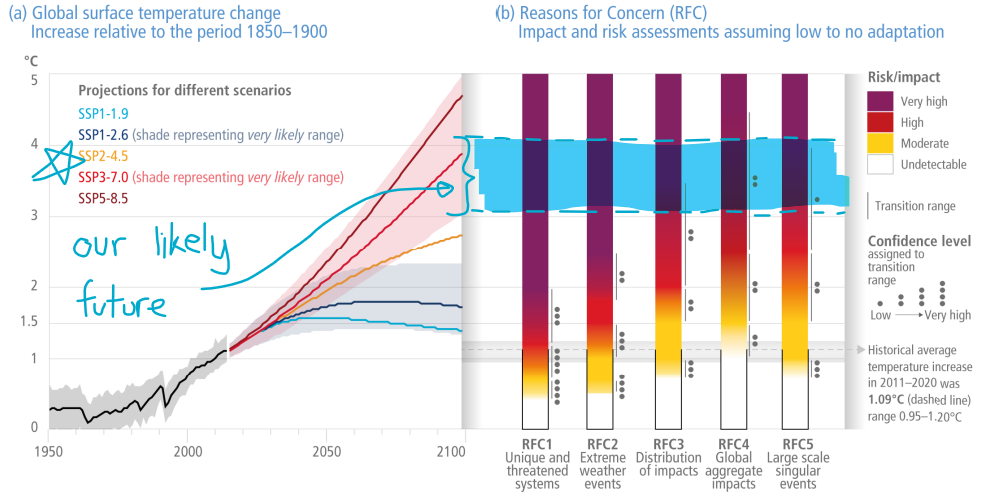

Released on Monday, the second part of the IPCC’s sixth assessment report, Impacts, Adaptation, and Vulnerability, details the manifold impacts of current and future emissions on natural and human systems. The picture painted by the “burning embers” diagrams shows how risk (more purple = more bad) grows with increasing global mean temperature.

We’re on track between ‘representative concentration pathways’ RCP 4.5 and 7.0 (roughly marked in blue above). That’s not RCP 8.5, or nearly 9°F of warming - but still pretty bad. As Robinson Myers writes, “A 40-foot fall is only slightly preferable to a 500-foot fall.”

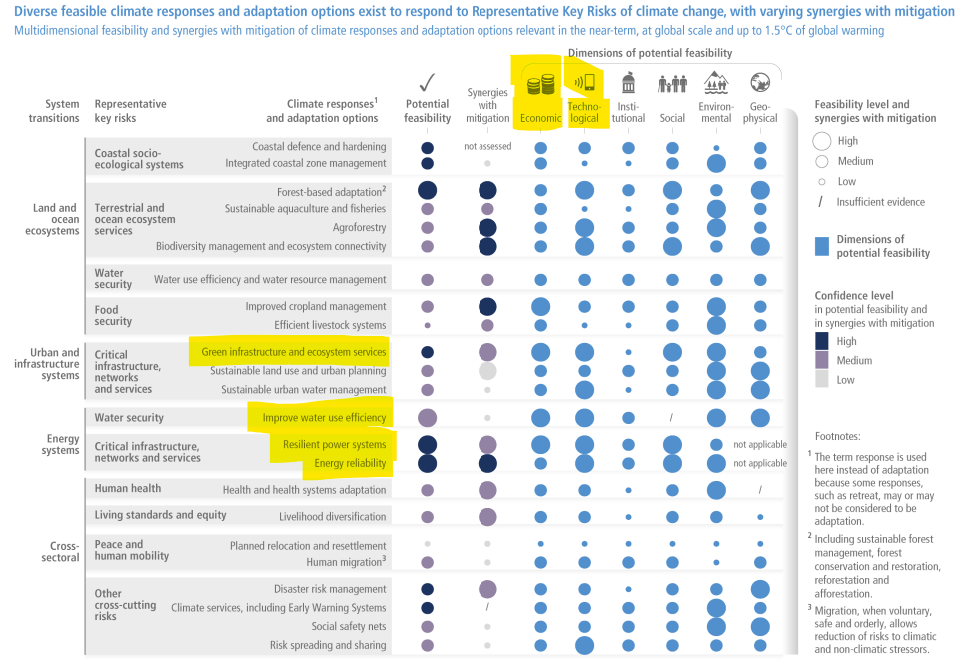

But the report also includes some tangible adaptation options and their economic and technological feasibility. Many of these adaptation approaches are familiar topics in this newsletter - water efficiency, resilient power systems, energy reliability, green urban infrastructure.

Though, as the authors point out, “Many initiatives prioritize immediate and nearterm climate risk reduction which reduces the opportunity for transformational adaptation.”

Successful future climate technology companies will follow baseline principles of adaptation innovation. These companies scale technologies that are:

While most climate tech to date aligns with mitigation priorities, the “rapidly closing window” is signaling the need to start innovating in adaptation tech. As the line between mitigation and adaptation blurs, companies built to be resilient, robust, rebound (fast), and resourceful will evolve our ability to coexist in a volatile very high surface temperature world.

Is reading 20 deals too much for your attention span this morning? Check out this neat TikTok that Pique Action made of some of the fundraising highlights!

☀️ Aurora Solar, a San Francisco, CA-based software services startup for the solar industry, raised $200m in Series D funding from Energize Ventures, Coatue, Fifth Wall, Iconiq, Lux Capital, and Emerson Collective.

⚡ M-KOPA, a Kenya-based financing platform for energy services, raised $75m in funding from the CDC Group, LGT Lightrock, LocalGlobe, HEPCO Capital Management, Generation Investment Management, and Broadscale Group.

🏗️ Biomason, a Durham, NC-based startup using microorganisms to produce cement, raised $65m in Series C funding from 2150, Celesta Capital, Novo Holdings, and Martin Marietta Materials.

⚡ Our Next Energy, a Novi, MI-based energy storage technology company, raised $65m in Series A funding from BMW i Ventures, Coatue Management, Breakthrough Energy Ventures, Assembly Ventures, Flex, and Volta Energy Technologies.

💨 NCX, a San Francisco, CA-based science-driven forest carbon marketplace, raised $50m in Series B funding from Energize Ventures, J.P. Morgan, Intercontinental Exchange, Dalus Capital, Clearvision Ventures, Scribble Ventures, and TIME Ventures.

🐣 In Ovo, a Netherlands-based startup with screening tech that helps produce ‘cull-free chicks’, raised $37m in a Series B funding from European Circular Bioeconomy Fund, Evonik, VisVires New Protein, Demcon, and Libertatis Ergo Holding of Leiden University.

🧀 Better Dairy, a UK-based producer of animal-free cheese, raised $22m in Series A funding from Happiness Capital, RedAlpine, Vorwerk Ventures, Manta Ray, Acequia Capital, and Stray Dog Capital.

🛰️ Satellite Vu, a UK-based thermal imaging satellite startup, raised $21m from Lockheed Martin, In-Q-Tel and Contrarian Capital.

💎 Aether Diamonds, a New York, NY-based producer of diamonds made from atmospheric carbon, raised $18m in Series A funding from Helena, TRIREC, Sound Ventures, Khosla Ventures, and Social Impact Capital. [Read our interview with the founders from January of last year, when they were just getting started!]

☀️ Erthos, a Tempe, AZ-based solar hardware provider, raised $17.5m in Series B funding from Capricorn Investment Group.

🍎 Flashfood, a Canada-based mobile grocery marketplace for expiring food, raised $12.3m in Series A funding from S2G Ventures, ArcTern Ventures, General Catalyst, Food Retail Ventures, and others.

🔋 Coreshell Technologies, a San Leandro, CA-based developer of nanolayer coating technology for rechargeable batteries, raised $12m in Series A funding from Trousdale Ventures, Industry Ventures, Helios Capital Ventures, Entrada Ventures, Foothill Ventures, and Asymmetry Ventures.

⚡ H2U Technologies, a Chatsworth, CA-based company focused on scaling the hydrogen economy, raised $11m in Series A funding from Jericho Energy Ventures, Freeflow Ventures, VoLo Earth Ventures, and Hess Corporation.

🌱 Source.ag, a Netherlands-based agtech startup developing smarter, AI-powered greenhouses, raised $10m in funding from Acre Venture Partners, E14 Fund, Astanor Ventures, Harvest House, Agrocare, and Rainbow Growers.

♻️ Romco, a UK-based metals recycling startup, raised $6.2m in Series A funding from undisclosed investors.

⚡ Bonnet, a UK-based EV charging network, raised $5.5m in funding from Lightspeed Ventures.

♻️ TrueCircle, a UK-based startup using AI for more effective waste sorting, raised $5.5m in pre-Seed funding from Lowercarbon Capital, Passion Capital, Giant Ventures, firstminute Capital, and angel investors.

☀️ Solivus, a UK-based “thin-film” solar specialist, raised $3.2m in Seed funding from Founders Factory, Crowdcube, and G-Force.

🌱 Mi Terro, a City of Industry, CA-based company using ag waste for plastic replacement, animal feed, and more, raised $1.5m in funding from Astanor.

Climate tech VC firm UrbanUs rebranded as Third Sphere, emphasizing their focus on eight key sector categories and their alignment with both the SDGs and UN Climate Change Framework.

This past week, the US Supreme Court heard oral arguments in West Virginia vs EPA that could strip the EPA’s ability to set federal emissions limits on power plants—and predictions aren’t looking good for the climate. If the coalition of 19 mostly Republican-led states win, this could jeopardize Biden’s hope in cutting US emissions in half by 2030. Good news: some of the worst arguments from WV and co. were shot down. Bad news: some are being considered and the outcomes of those are still murky.

In a triumph over single-use plastics, world leaders from 175 nations endorsed a historic resolution at the UN Environment Assembly to work on forging a global legally binding treaty ending plastic pollution. The agreement would improve recycling, clean up plastic waste and curb plastics production.

BP, Shell (barely), Exxon, and Equinor pulled out from any new or existing Russian investments, even willing to take massive losses—but divestment in Russian oil might be worse for the climate. Replacing foreign oil companies with net-zero goals with Russian-owned Rosneft and Gazprom means less transparency on oil drilling practices, basically an extreme version of brownwashing seen in the US.

As a “near-term” energy security measure, Germany earmarked €1.5 billion for new liquified natural gas import terminals and even reconsidering retiring nuclear plants. As impressive as this emergency investment is, no amount can shorten LNG terminal construction times (typically takes 5-10 years) and this won’t stop Russian oil dependency tomorrow.

While Biden delivered his State of the Union amidst a global crisis, Biden only mentioned climate change once during his 62-min speech, a missed opportunity to kickstart new passions for new climate legislation since BBB.

After weeks of speculation, Ford will separate the electric vehicle and internal combustion divisions. Ford CEO, Jim Farley, will continue to manage both divisions—now Ford Blue and Ford E— but the company brought in ex-Tesla veteran, Doug Field, to lead the Ford Model E products and achieve their 2 million EVs by 2026 goal.

After months of delays and lawsuits regarding the plant’s water consumption, the German Tesla plant will finally begin producing 500,000 EVs per year for Europe. Not only is the plant located in the heart of Europe’s automaking mecca, Tesla’s plant sits in the same town as Volkswagen’s headquarters, Europe’s largest supplier of EVs to date.

With animal populations declining, the New York Times maps biodiversity loss across the US.

Using satellites to maintain “whale superhighways” might help with CO2 reduction.

Polestar shoots for the, well, stars with their 0tCO2e initiative for a climate-neutral car.

Someone hacked EV chargers in Russia and made the LED screen read “Putin is a dickhead.”

How hard is it for corporates to consume 100% carbon-free energy? Here’s a deep dive on Google’s efforts and challenges.

Mind the gap. LinkedIn releases Global Green Skills Report, highlighting a growing gap between demand and supply for green jobs.

A momentary silver (or green) lining. Russia’s invasion of Ukraine causes clean-energy stocks to surge.

Nuclear is back in the news, which means it’s time to resurface Mark Tomasovic’s 1 minute primer on nuclear science.

Trying to secure funding from the DoE? Check out this quick video from Jigar Shah on working with the Loan Programs Office.

The climate media posse is growing with RMI’s new Stories page showcasing market-based solutions on climate and Bloomberg Green’s announcement of a new podcast.

💡 AirMiners Launchpad: Apply by Mar 31st to join other up-and-coming carbon removal entrepreneurs and early stage startup teams looking to take off via AirMiner’s engaging 6-week accelerator.

🗓️ Wharton Energy x CTVC: Tune in on Mar 10th to hear CTVC’s very own Co-Founders, Sophie and Kim, discuss the Climate Capital Stack as part of Wharton Energy’s “Intro to Climate Tech” series.

🗓️ Brown University’s Sustainable Investing Conference: Join virtually on Mar 11th to attend the 3rd annual Future of Sustainable Investing Conference (FSIcon) which brings together industry experts, policymakers, academics, and students to mobilize the capital markets for sustainable development.

🗓️ SV2 Investing in Climate Solutions: Join on Mar 14th to hear Sophie, Amy Duffuor from Azolla Ventures, and Amy Francetic of Buoyant Ventures discuss their experience in climate VC while covering funding gaps and impact opportunities.

🗓️ Blackbird Impact Summit: Tune in on Mar 15-17th to hear from a host of leading sustainability experts and climate investors as they dive into topics including measuring a startup’s carbon footprint, corporate sustainability plans, and what investors are looking for in climate tech startups.

Intern @Council on Environmental Quality

Chief of Staff @Kanin Energy

Carbon Capture Analyst @BloombergNEF

Venture Capital Fellowship @At One Ventures

Summer Associate @The Engine

Senior Investment Analyst @Evergreen Climate Innovations

Managing Director @Evergy Ventures

Analyst/Senior Analyst @Salesforce Ventures

Associate/Senior Associate @Powerhouse Ventures

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond

Groundbreaking results from the geothermal developer’s main project