🌎 Overheard at LCAW #252

Climate, capital, and carrots in London's new playbook

Long Term Stock Exchange insights and a sustainable fashion feature

In this issue, we eye the Long-Term Stock Exchange and explore sustainable fashion (TLDR; materials and circular models create interesting opportunities to redress carbon). This week’s news highlights include Uber’s commitment to EVs, the Democrats’ new THRIVE agenda, along with some satellite advancements for carbon tracking.

We’d also like to (re)introduce some of our co-conspirators in this venture, who’ve been diligently partnering on Climate Tech VC. Kimberly Zou originally founded this newsletter and, as she transitions to Energy Impact Partners, will be coming back into the spotlight. Kobi Weinberg, at Magnolia Land Partners, edits each issue and helps keep quality features and news coming each week.

Also - feel free to join us this week at #ClimateTech: A Conversation with VCs on Climate Innovation on Thursday at 5p ET on the shifting investment landscape in a Biden-Harris administration. As a disclaimer, it’s a fundraiser, but should be a good conversation nonetheless.

Thanks for reading!

On Wednesday, the Long-Term Stock Exchange (LTSE) opened for business, finally bringing to life the vision Eric Ries first pitched in his canonical 2011 book, The Lean Startup. Ries believes that the stock market incentivizes public companies to focus on the immediate future, at the cost of longer-term thinking and, crucially, value creation.

Companies that list their shares on the LTSE will be required to publish a series of policies that focus on long-term value creation. The LTSE’s principles-based approach arrives as the Dow Jones ousts blue chips to add big tech stocks and as top tech startups avoid the traditional IPO in favor of direct listings and SPACs.

Why it matters

What’s next

🐄 NotCo, a Santiago, Chile-based producer of plant-based milk and meat alternatives, raised $85m in Series C funding co-led by Future Positive and L Catterton. TechCrunch has more here.

💡 Ubicquia, a Fort Lauderdale, FL-based smart city, small cell, and smart grid startup, raised $30m in Series C funding from backers like Fuel VC. More here.

🤖 Iron Ox, a San Carlos, CA-based robotic farming company, raised $20m in Series B funding led by Pathbreaker Ventures, with participation from Crosslink Capital, Amplify Partners, ENIAC Ventures, Y Combinator, and others. TechCrunch has more here.

⛈️ Descartes Underwriting, a Paris, France-based insurtech developer specializing in climate risk modeling and data-driven risk transfer, raised $18.5m in Series A funding led by Serena Capital, Cathay Innovation, and BlackFin Capital Partners. Crunchbase has more here.

🚲 BluSmart Mobility, a Mumbai, India-based all-electric ride hailing platform, raised $7m in pre-Series A funding from several investors including Inflection Point Ventures. More here.

☀️ Terabase Energy, a Berkeley, CA-based startup digitizing large scale solar, raised $6m in Series A funding led by SJF Ventures, Powerhouse Ventures, City Light Capital and Trancoso Partners. More here.

🚲 HumanForest, a U.K.-based green e-bike service, raised $2.3m in funding from Cabify founders Juan de Antonio and Vicente Pascual and ex-Volvo president Stefan Tilks. TechCrunch has more here.

General Motors acquired a $2bn (11%) equity stake in EV startup Nikola Motors and will provide electric batteries and help manufacture Nikola’s trucks in exchange. More here.

ArcLight Clean Transition Corp., a renewable energy-focused SPAC formed by ArcLight Capital Partners, filed for a $300m IPO. More here.

Climate Change Crisis Real Impact I Acquisition, a SPAC led by Mary Powell (ex-CEO of Green Mountain Power) and David Crane (ex-CEO of NRG Energy), filed for a $200m IPO. More here.

The $2.5 trillion fashion industry was already facing challenges and deemed “broken” before the pandemic amplified its problems. COVID-19 halted in-store traffic, disrupted value chains, and limited clothing demand from remote and unemployed workers.

With the virus expected to cause double-digit reductions in sales demand, brand-name retailers are shopping for new strategies, namely adopting more sustainable practices to appeal to the ever growing rank of conscious consumers. According to the World Bank, the fashion industry is responsible for 10% of annual global carbon emissions – more than all international flights and maritime shipping combined. It’s also the second-biggest consumer of water globally. With such a hefty environmental footprint, the fashion industry is undergoing a transition towards decarbonizing their value chains.

Where do fashion’s emissions come from?

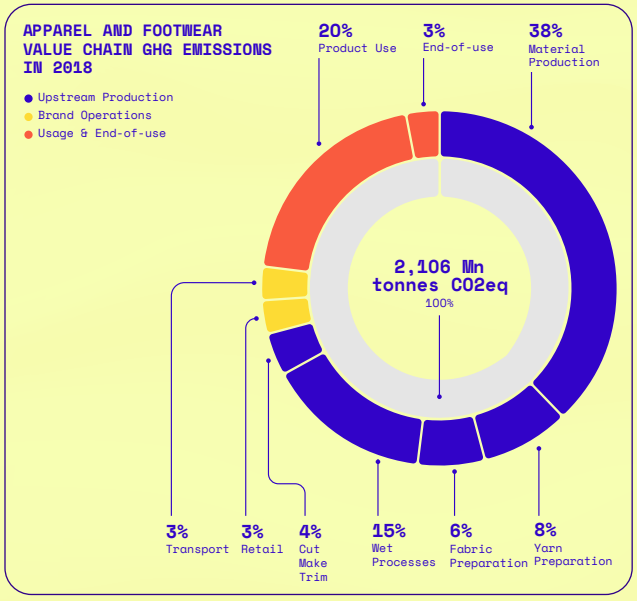

The fashion value chain’s emissions are broken into 70% Upstream and 30% Downstream activities. The majority of upstream emissions are generated from the energy used to produce and process fabrics, as well as to manufacture the garments themselves. Fertilizers and chemicals used to cultivate and treat materials (e.g., cotton) are also significant sources of emissions. Downstream emissions result from the transportation and packaging involved in distribution, product usage itself (e.g., washing and drying), and end of life (e.g., incineration or landfills).

Stitching together fashion decarbonization pathways

Fashion’s emissions from upstream activities like industrial processing and distribution are hardly unique to the industry alone. In fact, long-term pathways to decarbonization will rely on the energy (and vehicle) transition of our economy as a whole, outside of solely the fashion industry. Material processing (e.g., spinning, weaving, and knitting) requires enormous energy usage, as does the HVAC systems in factories. According to McKinsey, ~80% of energy-related savings can be derived from energy efficiency improvements and the transition to 100% renewables. The key decarbonization levers unique to the fashion industry come down to choosing / developing sustainable raw materials and innovating circular closed-loop business models. We’ve outlined below the companies and technologies innovating in these areas.

Upstream solutions: Raw materials

Natural fibres: These plant or animal-based materials, including cotton, hemp, wool, silk, linen, and bamboo, are sustainable alternatives to synthetic fabrics derived from petroleum and require less chemical-intensive treatment procedures. GOTS-certified organic cotton is 50% less emissions-intensive than conventional cotton due to limited use of pesticides and fertilizers.

Recycled polyester (rPET): Made from recycled plastic bottles, rPET is 40% less emissions intensive than regular polyester because of material recycling and closed loop production methods. Brands such as Girlfriend Collective and Rothys are touted for their products made from recycled plastic bottles.

Tencel: Produced by Lenzing, Tencel is a branded form of rayon created by dissolving wood pulp and produces half of the emissions of conventional fibers. This synthetic material is typically used as an alternative to nylon and lycra in activewear (which is mostly derived from crude oil).

Econyl: Created by an Italian textile company, this fabric is recycled from synthetic waste including plastic, waste fabric, and fishing nets into nylon.

Other innovators: Natural Fiber Welding (reuses natural fibers), Bolt Threads (lab-grown fabrics), Evrnu (made from discarded clothing), Modern Meadow (plant-derived proteins), Galy (cotton from cells), Spiber (synthetic spider silk), Pinatex (leather made from pineapple)

Downstream solutions: Circular economy

Re-commerce: Online thrift stores (ThredUp, Thrilling, Renewal Workshop) and resale platforms (Trove) can extend the average product life by 1.7x and eliminate emissions from both ends of the value chain (upstream production and downstream end of life disposal).

The takeaway

Like all early-stage frontier innovation, the fashion industry’s path to decarbonization will accelerate as innovation turns to deployment, and scaling production benefits from the learning curve.

Sustainable textiles are currently more expensive and less yield-intensive compared to traditional petroleum-based fabrics, resulting in a price premium that relegates sustainability to only the high-end spectrum. Looking parallelly, the EV automotive industry models a premium into mass market approach to decarbonization. We’re now in the midst of an EV market gradually coming down from its luxury end-market (the early adopters) to catering to the mainstream, driven primarily by the cost decline of battery technology and widespread demand from sustainability-conscious consumers.

While a few steps behind, fashion industry players have started to scale up adoption of sustainable materials while driving down costs. Consumers are also waking up to climate change and demanding their fashion come from more sustainable, transparent, and circular value chains.

*If you’re interested in how your favorite brands rate in terms of sustainability, check out Good On You (which also delivers ratings through its app).

Uber: Following in the wake of Lyft’s announcement, Uber also commits to 100% EVs on its global platform by 2040 (2030 in US, Canada, and Europe). The ride hailing platform took its pledge one step further by contributing $800m for vehicle discounts and fare surcharges on electric vehicles. Riders can also opt to pay extra for a “green trip”.

Thrive: Democrats unveiled a new progressive agenda THRIVE (Transform, Heal, and Renew by Investing in a Vibrant Economy) simultaneously addressing the pandemic recovery, climate change, and systematic injustice. The agenda is intended as a roadmap for future policy, similar to the Green New Deal.

NYTimes: Following the August blackout and public safety power shutoffs in California, many blamed California’s renewable goals as the root cause of the blackouts, but Steve Berberich, the CEO of the California Independent System Operator, has firmly defended the state’s renewables, “This is a resource issue, not a renewables issue.”

Financial Times: BP is making good on its transition to net zero by entering its first offshore wind power agreement. The reinvented oil major will buy a 50% stake from Equinor for $1.1bn in two wind projects offshore from Massachusetts and New York as part of its plan to increase renewable power development.

Carbon Tracker: Are plastics the next stranded asset? Oil majors’ projected oil demand growth relies heavily on ‘non-combusted’ uses, namely plastics. BP’s own model of a worldwide single use plastics ban indicates that 2019 represented ‘peak oil.’ Yet, the petrochemicals industry continues to invest in plants to produce more ethylene and plastic precursor chemicals.

Springer Link: A study from the University of British Columbia shows just how poorly average citizens rank the relative significance of climate actions. The authors write that the public is “largely incapable of making tradeoffs between different actions (e.g., the number of hamburgers that would be equivalent to a trans-Atlantic flight in terms of climate impact).”

Fast Company: Jigar Shah makes the case for climate change as both the biggest threat and greatest economic opportunity of our time. By addressing climate change, pursuing innovation, and deploying technology, America can generate jobs and leverage its “industrial capacity that is sorely underutilized.” Check out our spotlight on Jigar last week here.

Beyond Meat is making its biggest push to enter the Chinese market by opening up two facilities and targeting the pork market. Meanwhile, you can now pick up Impossible Foods meat from your local Walmart, Kroger, Trader Joe’s, Target, and more.

Satellite imagery is the key to creating carbon market transparency and uncovering value. It limits skepticism around trees’ ability to permanently capture CO2 by monitoring for distances.

Fortune reflects on the meat shortage’s role in presidential elections during WWII, and predicts how they'll influence politics this time around in light of mounting environmental concerns.

Seafood is the world’s most traded food commodity, but suffers from a broken supply chain driven by COVID-19. Disruptions like striking Chilean truckers and a 50% increase in air freight mean that the 2020 seafood trade will certainly shrink.

We also want to pay homage to climate policy champion Ted Halsted, who passed away this week. Halsted facilitated bipartisan climate action and founded New America and the Climate Leadership Council. We celebrate his life and all he has done for the climate movement.

💡 Big Idea Ventures New Protein Accelerator: Early stage plant-based and cell-based food, ingredient and technology startups can apply for Big Idea Ventures’ 5-month long accelerator program.

💡 The Community Fund: The folks at Community Fund are looking for aspirational investors from diverse networks to invest in early-stage, community-driven companies. We think that there’s space for a climate tech angle here. If that’s you, go ahead and apply!

🗓️ 9/16 Climate Returns: Tune in for episode 3, where Abe Yokell, Managing Partner of Congruent Ventures, will be joined by Nick Grossman, Partner at USV.

🗓️ 9/17 The New Hydrogen Economy: Join Terra.do for a free teaser class of their new 4-week online program on hydrogen. If last week’s interview with Jigar Shah got you excited to learn more, Terra.do will dig deeper on hydrogen's relevance in a decarbonizing economy.

🗓️ 9/17 Clean Energy for Biden: Join me (Sophie) as I moderate a discussion on how the investment landscape will change with a Biden-Harris victory. Panelists include Shayle Kann (Energy Impact Partners), Sierra Petersen (Lionheart Ventures), Dan Goldman (Clean Energy Ventures), and Clay Dumas (Lowercarbon Capital). Drop me a note to let me know that you’re coming!

Policy Fellow @Evergreen

Head of Software Engineering @ClimateAI

Customer Success Lead @ClimateAI

Head of Marketing @Climate Neutral

Business Development Manager @Myst AI

Research Associate @C16 Biosciences

City Advisor, Inclusive Climate Action @C40 Cities Climate Leadership Group

Senior Product Designer @Overstory

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond

Groundbreaking results from the geothermal developer’s main project