🌎 Overheard at LCAW #252

Climate, capital, and carrots in London's new playbook

Key development signals across nuclear, DAC, geothermal, and DLE

Happy Monday!

Did you see the Northern Lights this weekend? We’re seeing some green lights for emerging climate tech sectors, with milestones across advanced nuclear, DAC, geothermal, and direct lithium extraction that represent major steps towards commercialization.

In deals, a $1.5bn energy transition fund, $111m for energy efficient electrolyzers, and $100m for fungi-based meats.

In other news, a platinum deficit that threatens EV manufacturing, a huge week for nuclear, and Climeworks’ biggest DAC plant to date.

ICYMI, we've been busy at Sightline Climate, hosting a webinar, "Line of Sight: to FOAK and beyond,” last week to wrap up our FOAK series. If you couldn't make it, watch it here. We even compiled the series into a FOAK Guide to serve as your go-to resource, which you can download here. Plus, we're hiring: Check out our open roles, including Senior Research Associate, Research Analyst, and Data Engineer.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

It’s been an eventful week in climate tech, marked by a surge of big commercialization milestones in emerging climate tech sectors, like nuclear, direct air capture, geothermal, and direct lithium extraction.

At Sightline Climate, we’ve been starting to build a mental framework around sector readiness that tracks “commercialization signals,” which we broadly categorize into these areas:

This week, we’ve approached several green lights on the road to readiness.

Advanced nuclear

Direct Air Capture (DAC)

Geothermal

Direct Lithium Extraction

What’s next?

The hard behind-the-scenes work in these sectors is coming to fruition. Oklo’s SPAC, for instance, had been in the works for nearly a year.

That’s not to say that there isn’t more work to be done — Climeworks’ Mammoth plant still costs $1,000 per removed ton of carbon, for example, far above the Department of Energy’s price goal of $100 per ton.

Plus, these positive signals come alongside negative ones, like the UK’s canceled plans for the country's biggest hydrogen home heating trial.

But overall, these promising sector readiness signals indicate that emerging climate tech sectors are beginning to follow the path to scaling up, similar to that of solar and wind over the last few decades.

Any commercialization signal categories that we're missing? As always, feel free to reach out and let us know.

⚡ Hysata, a Wollongong, Australia-based energy efficient electrolyzers developer, raised $111m in Series B funding from Templewater, bp Ventures, IDO Investments, IMM Investment, IP Group Australia, and others.

🥩 Meati, a Boulder, CO-based fungi-based meat company, raised $100m in Series C funding from Grosvenor Food & AgTech, BOND, Congruent Ventures, Prelude Ventures, and Revolution Growth.

⚡ EnviroSpark, a Clarion County, PA-based EV charging installation and services platform, raised $50m in PE Expansion funding from Basalt Infrastructure Partners.

🔋 Li Industries, a Blacksburg, VA-based lithium-ion battery recycler, raised $36m in Series B funding from Bosch Ventures, Anglo American, Chevron Technology Ventures, Formosa Smart Energy, Khosla Ventures, and LG Technology Ventures.

⚡ Zanskar, a Provo, UT-based AI-enabled geothermal scouting platform, raised $30m in Series B funding from Clearvision Ventures, First Star Ventures, Lowercarbon Capital, Munich Re Ventures, Obvious Ventures, and others.

🌳 Dendra Systems, an Oxford, England-based ecosystem restoration analytics company, raised $16m in Series B funding from Zouk Capital, Airbus Ventures, Aramco Ventures, Helium-3 Ventures, and Understorey Ventures.

🌾 Carbon Robotics, a Seattle, WA-based AI precision weed control robot maker, raised an undisclosed amount in post-Series C funding from NVentures.

🐄 Arkea Bio, a Reno, NV-based maker of cow vaccines for enteric emissions, raised $26m in Series A funding from Breakthrough Energy Ventures, AgriZeroNZ, Grantham Foundation, Overview Capital, Rabo Ventures, and The51 Food and AgTech Fund.

🍎 Superplum, a Noida, India-based agritech supply chain platform, raised $15m in Series A funding.

🌾 Rize, a Singapore, Singapore-based decarbonized rice cultivator, raised $14m in Series A funding from Breakthrough Energy Ventures, GenZero, Temasek Holdings, and Wavemaker Impact.

🏭 Rapid Liquid Print, a Cambridge, MA-based 3D liquid printer, raised $7m in Series A funding from HZG Group, BMW i Ventures, and MassMutual.

♻️ Mycocycle, a Bolingbrook, IL-based fungi-based remediation solutions company, raised $3.6m in Seed funding from Closed Loop Partners, Illinois Department of Commerce and Economic Opportunity INVENT Fund, TELUS Pollinator Fund for Good, and U.S. Venture Partners.

⚡ zepp.solutions, a Delft, Netherlands-based hydrogen fuel cell systems maker, raised $3.2m in Seed funding from Energie transitie fonds Rotterdam and InnovationQuarter.

🍎 Poshn, a Dwarka, India-based food supply chain emissions monitoring platform, raised $4m in Seed funding and $2m in Debt funding from Prime Venture Partners and Zephyr Peacock India.

⚡ everyone energy, a Berlin, Germany-based renewable energy consultancy, raised $1.1m in Seed funding from High-Tech Grunderfonds and neoteq ventures.

⚡ Electric Hydrogen, a Natick, MA-based building green hydrogen electrolyzers maker, raised $100m in Debt funding from HSBC, Hercules Capital, JPMorgan, and Stifel Bank.

⚡ Aura Power, a Bristol, England-based solar and battery storage provider, raised $10m in Debt funding from Novuna Business Finance.

⚡ Oklo, a Sunnyvale, CA-based small modular reactors developer, announced a SPAC.

⚡ NANO Nuclear Energy, a New York City, NY-based advanced nuclear microreactors developer, announced an IPO.

🔋 Ambri, a Marlborough, MA-based liquid metal battery technology maker, filed for Chapter 11 Bankruptcy.

EnCap Energy Transition, a Houston, TX-based investment firm, held a final close of their $1.5bn energy transition fund.

Portland Seed Fund, a Portland, OR-based investment firm, announced the launch of a $4m fund to invest in climate tech startups.

Can’t get enough deals? See full listings and deal analytics on Sightline Climate

It was huge week for nuclear:

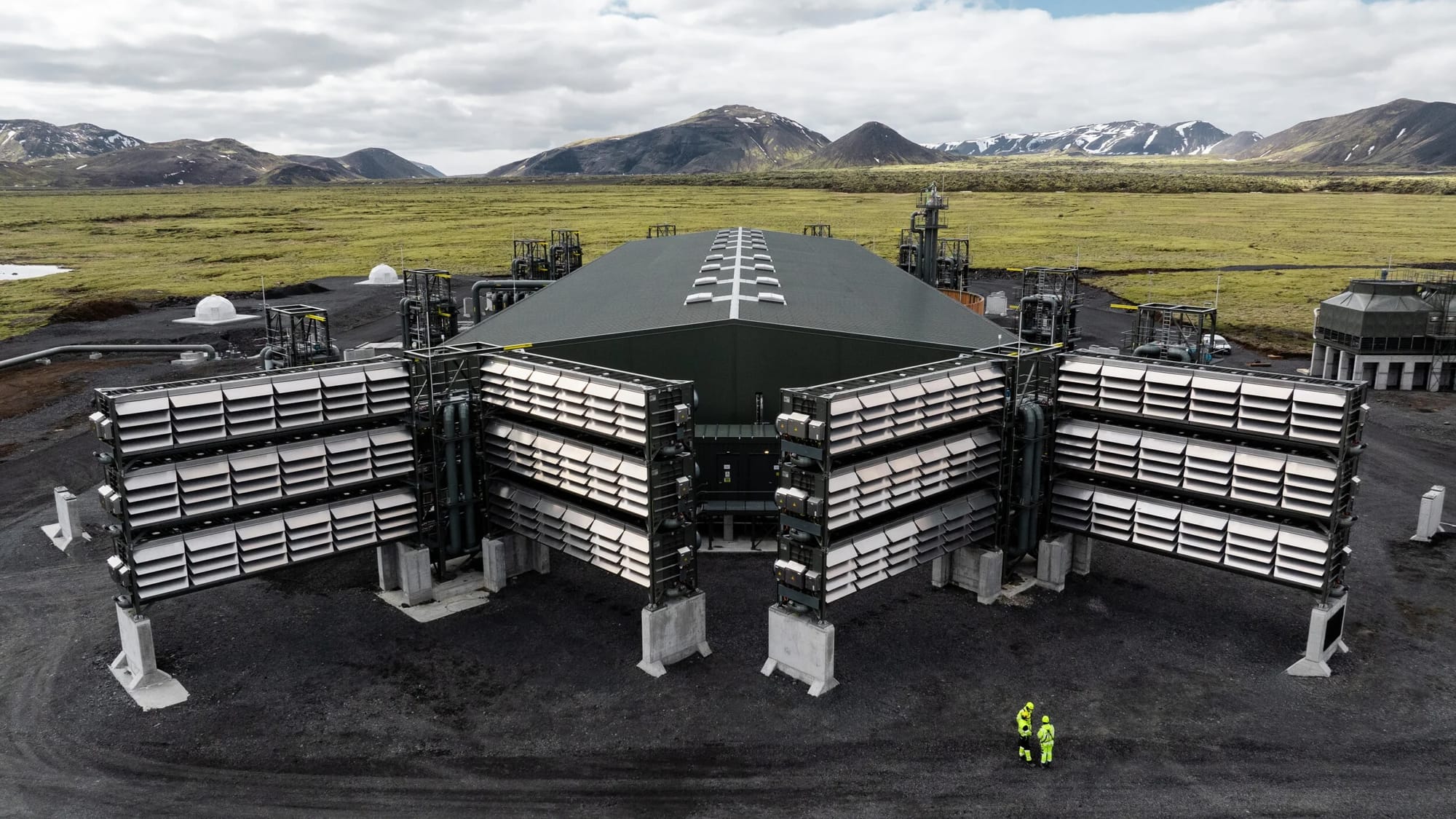

Climeworks opened its largest direct air capture (DAC) plant to date, “Mammoth,” which has a tenfold capacity of its predecessor, “Orca” (and made it onto SNL’s Weekend Update). In other DAC news, Holocene cut the ribbon on its first industrial-scale direct air capture pilot.

The platinum market is poised for its largest deficit in a decade, driven by robust industrial demand and stabilizing shipments from Russia. This supply crunch is expected to significantly impact prices and industries reliant on platinum.

An analysis of public data revealed that less than 17% of the allocated $1.1 trillion in the IRA, BIL, and CHIPS act has been spent after nearly two years. Further, Donald Trump said he would plan to repeal many climate laws if a group of oil and gas majors raised $1bn for his campaign.

Equinor entered the Direct Lithium Extraction (DLE) game after it signed an agreement with Standard Lithium to acquire a 45% stake in two lithium project companies. Equinor will invest up to $133 million to support the development of these projects in Arkansas and Texas.

Eavor Technologies obtained a €45m loan from the European Investment Bank to advance its Eavor-Loop geothermal energy project in Germany. This funding is part of a €130m package supported by other banks including the Japan Bank for International Cooperation, and the EU Innovation Fund.

The UK Department for Energy Security and Net-Zero (DESNZ) canceled its biggest town-scale hydrogen heating trial, following the discontinuation of village-sized trials due to significant local opposition, delays, and cost overruns. The pilot project will now be postponed until after 2026.

Stockholm Exergi announced a landmark agreement with Microsoft to remove 3.3 million tons of carbon using bioenergy carbon capture and storage (BECCS) technology. This deal, the largest of its kind, is set to start in 2028 at the Värtan site in Stockholm and will continue for a decade.

BP is reportedly eager to snap up Tesla’s Supercharging sites across the U.S. The company plans to acquire both the site and the staff, and has pledged over $1bn to expand its network of chargers, possibly as part of one of its five growth pillars, EV charging.

A Greenpeace investigation revealed that a Shell carbon capture and storage (CCS) project in Alberta, Canada, sold $200m of phantom carbon credits. The investigation found that over half of the CO2 credits sold from the facility had been generated, but never captured — while the project received a subsidy from the Canadian government.

80-year-old Just Stop Oil activists take a crack at the Magna Carta with a hammer and chisel.

Watt’s up 2023: Ember’s Global Electricity Review sheds light on the world’s electricity use.

The Goldman Prize, aka the Nobel prize for environmentalism, named this year's eco-champions.

Twenty teams left in XPRIZE carbon removal competition.

Durable CDR methodology madness.

A new board for the Foundation For Energy Security And Innovation (FESI).

Happy birthday to the patron saint of the environment, David Attenborough.

NASA could lose some sight of Earth as three long-running satellites sign off.

How ice cream saved drought-hit farmers in India.

This week’s climate kit: sunscreen, sunglasses, and snake repellent.

Dams are out, floating solar is in in Africa.

Malaysian palm oil purchases now come with an orangutan.

📅 Global CemCCUS Conference: Register to attend the Global CemCCUS Conference from May 14-15th to for an opportunity to delve into carbon capture, utilization, and sequestration tailored for the cement and lime industries.

📅 Debt Deep Dive: Register to attend the Debt Deep Dive for Climate Founders on May 16th for an opportunity to engage with Dan Rosen and Mairi Robertson from Ezra Climate, discussing debt financing structures and options for scaling growth stage climate solutions.

📅 Stanford Sustainability Innovation Conference: Apply to attend the Stanford Graduate School of Business Scaling Sustainability Innovation Conference on May 17th to engage with ecopreneurs, scholars, and business leaders.

📅 SAF Congress: Register to attend the Sustainable Aviation Fuels Congress from May 21-23rd gathering over 200 experts from the aviation and energy sectors to discuss Sustainable Aviation Fuel (SAF), eFuels, hydrogen.

📅 Industrial Decarbonization Conference: Register to attend Industrial Decarbonization Europe on May 22-23rd in Amsterdam to explore deep-dive workshops, dedicated networking sessions, and innovative strategies for a decarbonized industry.

💡 Carbon to Value Initiative: Apply to be a part of the fourth C2V Initiative cohort by June 21st to participate in a transformative program designed for up-and-coming climate tech startups at Technology Readiness Level 4-7 in sectors like energy and agriculture.

Senior Research Associate, Research Analyst, Data Engineer, Data Operations Associate @Sightline Climate

Mechanical Engineer; Solar Project Lead; Direct-Air-Capture Lead @Rivan Industries

Head of Origination @Noria Energy

Investment Analyst @The Nature Conservancy

Associate, Energy Markets @CleanCapital

Marketing and Policy Intern @National Offshore Wind Research & Development Consortium

Associate or Analyst @Allied Climate Partners

Chief of Staff @Fervo Energy

Content & Social Media Manager @Aigen

Investment Associate (Sustainable Investing - Transition Economy Design) @Ontario Teachers' Pension Plan

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond

Groundbreaking results from the geothermal developer’s main project