🌎 Overheard at LCAW #252

Climate, capital, and carrots in London's new playbook

Plus, Amazon announces $2bn Climate Pledge Fund

Happy Monday!

This week we cover Amazon’s $2bn Climate Pledge Fund (given its $1.3T market cap, we view the fund as a promising start) and find companies collecting data across the Earth’s global operating system. We also feature a bevy of new deals, new jobs, and a new ESG fund that seems to bring Billions’ green screen to life.

Amazon has launched a $2bn venture fund, supporting its Climate Pledge to be net zero carbon by 2040. The fund will invest in companies within transportation and logistics, energy generation, storage and utilization, manufacturing and materials, circular economy, and food and agriculture. Read the press release.

What does this mean?

Why does this matter?

What is likely to happen?

🌱 Indigo Ag, a Boston, MA-based agtech startup, raised $300m in Series F funding from Flagship Pioneering, Alaska Permanent Fund, and Riverstone Holdings. The company uses natural microbiology and digital technologies to improve grower profitability, environmental sustainability, and consumer health. Axios has more here.

🌱 Enko Chem, a Boston, MA-based agtech startup, raised $45m in Series B funding from the Bill & Melinda Gates Foundation, Anterra Capital, Rabo Food & Agri Innovation Fund, and Finistere Ventures. The company uses machine learning to help farmers sustainably protect their crops from pests and disease. More here.

⚡ Quidnet Energy, a Houston, TX-based energy startup, raised $10m in Series B funding from Breakthrough Energy Ventures, Evok Innovations, Trafigura, and Grantham Environmental Trust. The company uses drilling technologies to pump water into geological reservoirs to store energy. More here.

♻️ Worn Again, a London-based textile recycling startup, raised $9m from H&M and Sulzer. Its technology converts textiles and PET plastic back into raw materials. More here.

🐄 Connecterra, an Amsterdam-based startup improving the dairy industry, raised $8.8m in Series B funding from ADM Capital, Kersia, Pymwymic, and Sistema VC. The startup provides a predictive intelligence platform for dairy industry enterprises to deploy more sustainable and efficient farming practices. More here.

🌱 SoilCarbon Co, an Australia-based company focused on restoring carbon to soil, raised $6.8m in seed funding from Horizons Ventures, Grok Ventures, Lowercarbon Capital, and the Australian govt’s Clean Energy Finance Corporation. The company converts atmospheric CO2 into soil carbon using microbial fungi, improving soil health and allowing farmers to trade carbon offsets.

🛰️ Satelytics, a Toledo, Ohio-based geospatial analytics startup, raised $5m in funding from BP Ventures. The company uses advanced spectral imagery and machine learning to monitor environmental changes such as methane emissions. More here.

🍼 Biomilq, a Durham, NC-based sustainable infant nutrition producer, raised $3.5m in seed funding from Breakthrough Energy Ventures, Purple Orange Ventures, Blue Horizon Ventures, and Happy Family Brands. The startup creates an infant formula alternative which helps reduce GHG emissions.

⚡ Energicity Corp, a Sierra Leone-based owner and operator of solar powered microgrid utilities, raised $3.3m from Ecosystem Integrity Fund. The company provides affordable, reliable, and scalable energy to off-grid communities in West Africa. TechCrunch has more here.

🍤 Shiok Meats, a Singapore-based alternative proteins startup raised $3m in bridge funding from Agronomics, VegInvest, Impact Venture, and Mindshift Capital Fund. The company has developed a lab-grown shrimp product cultivated from stem cells. More here.

When we imagine climate tech, we often think of innovations that limit emissions and environmental impact. But here, management expert Peter Drucker’s mantra holds true that you can’t manage what you don’t measure. In climate tech, reliable information from devices that collect climate data are essential for making evidence-based decisions about planetary warming. [The newsletter version has been edited lightly for length, so check out our website for the full feature].

According to the Global Climate Observing System (GCOS), 54 climate-related variables should be monitored. GCOS, an initiative to ensure the collection and dissemination of climate information, calls these factors Essential Climate Variables, or ECVs. An ECV is a variable (or a group of linked variables) that contributes to the characterization of Earth’s climate. ECVs can be physical, chemical, or biological.

ECV measurements provide empirical evidence to help understand and predict climate evolution. The data can be used to assess climate risks and to determine causes of climate events. This information can also assist in guiding mitigation and adaptation measures and underpinning climate services.

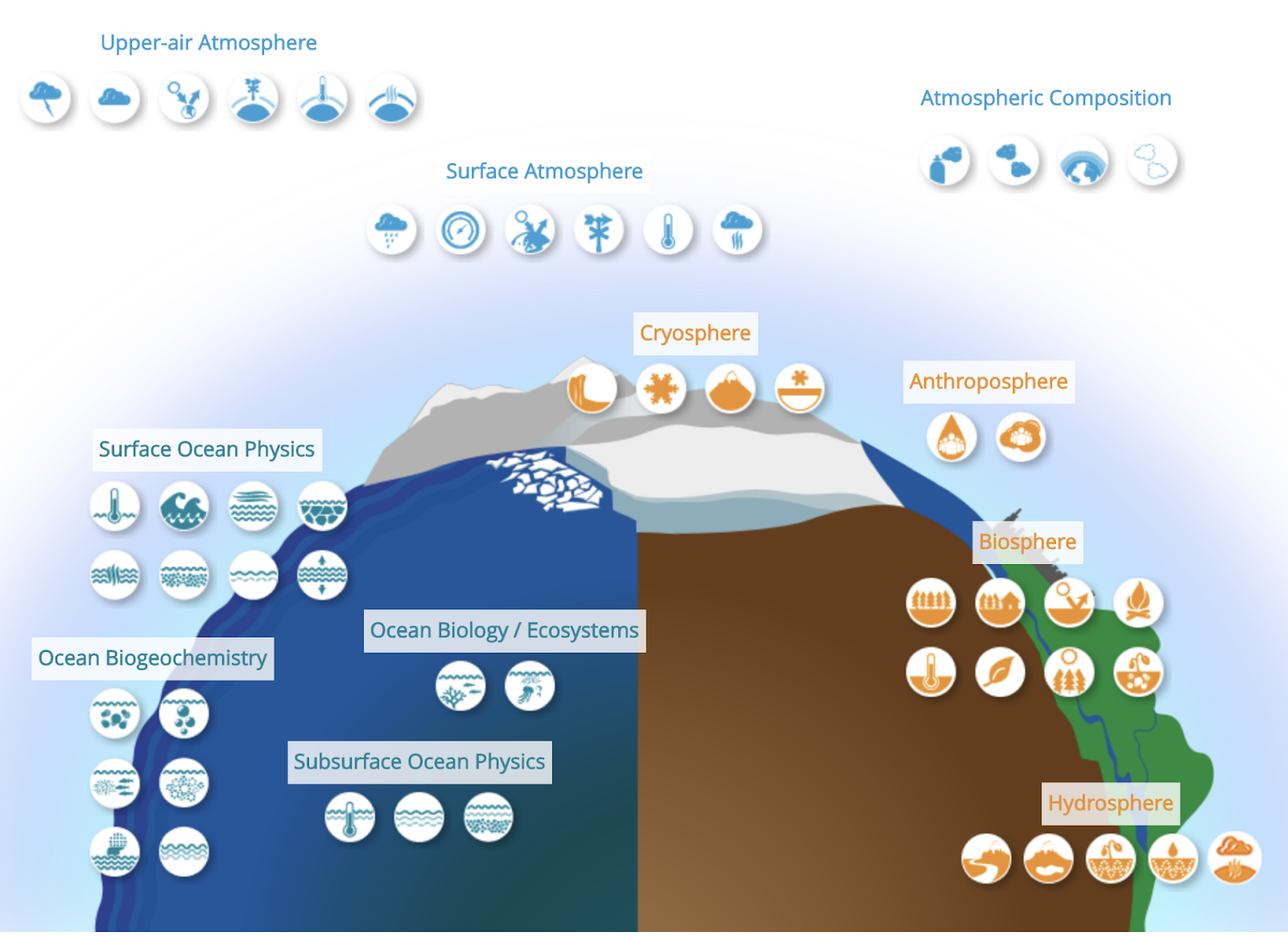

Given the number of ECVs, it is useful to group them into three domains – Land, Air, and Sea. The graphic below illustrates how these 54 ECVs are divided among the three zones:

A number of companies offer products which collect more frequent and precise climate data. Sometimes, these efforts supplement collection initiatives from public agencies. We describe below, for each domain, one company that has been featured in the news recently.

Land: ECVs include above-ground biomass, river discharge, and snow cover.

Planet Labs can monitor changes in these variables and others using more than 150 satellites. The company collects a dataset of Earth observation imagery and land use changes.

The company partnered with the State of California to “develop new satellite technology to monitor climate change.” The company plans to launch a satellite that can detect ‘point source’ climate pollutants, monitor leaks, and identify anomalies at specific locations. These capabilities can help identify polluters and verify compliance with carbon offset agreements.

Planet Labs will soon have 21 high-resolution imagers in orbit. These “SkySats” can see any spot on the ground (clouds permitting) at 50cm resolution up to seven times a day. The high resolution and frequent repeat visits permit monitoring of land changes that is more continuous and closer to real-time.

Air: ECVs include carbon dioxide, methane, and air temperature.

Aclima develops Internet-connected air quality sensors as well as software that helps process the results. The company can map pollutants such as carbon dioxide, methane, and particulate matter.

Last week, Aclima released a new data set that it collected and compiled together with Google over a four-year period. Free to the scientific community, the data includes 42 million air quality measurements for California.

Sea: ECVs include sea-surface temperature, sea-surface salinity, and surface content.

Saildrone collects measurements of water temperature, salinity, ocean surface current, and other factors. The company obtains ocean data using unmanned surface vehicles (USVs). Saildrone is building a fleet of 1,000 USVs “to cover the planet at a six-by-six-degree resolution – (one saildrone per 360 nautical miles squared).” These collection apparatuses will provide around-the-clock observations of the world’s oceans while “lowering the cost of data acquisition by order of magnitude.”

With COVID-19 causing the postponement of ship and aircraft missions, the National Oceanic and Atmospheric Administration (NOAA) announced that it is accelerating the use of unmanned systems, including some from Saildrone, to collect data.

Saildrone focuses on sea surface metrics. Other companies, like Sofar Ocean, collect sub-surface data.

Technologies like those mentioned will significantly increase the amount of ECV data available. Software advances in areas like machine learning and artificial intelligence can assist in synthesizing enormous datasets and automating their review to yield quick insights, such as where pollution or deforestation is occurring.

For climate information to be actionable, it should be accurate and transparent, and it should adhere to common measures. Standardizing measurements will facilitate coordinating data from multiple sources and enable inter-organization or inter-site comparisons.

One possible vision for the burgeoning demand of ECV monitoring data is an integrated, open-source repository. This giant data pool could be updated with new measurements as they are taken and would benefit from ongoing technical advances that improve granularity, reduce uncertainty, and approach real-time monitoring. Users would access the data to produce comprehensive ECV maps that enhance our understanding of Earth’s climate and how to protect it.

Energy Institute at Haas: A new working paper shows the explicit race gap in residential energy expenditures. Black renters and homeowners pay more for energy costs than white residents across the income scale. In response, professor Maximilian Auffhammer writes “so long as this energy cost inequity persists, any future carbon/energy tax, or other policy that raises energy costs, is likely to increase energy expenditures more for Black households — especially poor ones — than for white households in the same income bin."

Barrons: Activist investor Jeff Ubben leaves his $16bn hedge fund, ValueAct, to start a new fund focused on ESG. He’ll bring ValueAct’s tough boardroom approach to Inclusive Capital Partners, much in the long-termist style of tested impact investors like Boston Common Asset Managers. Some commenters cheekily pointed out that Ubben’s seemingly dramatic pivot and strong language against “finance” mimic the recent season of Billions in which ruthless Axe Capital spins out an impact fund to chase gullible new money pouring into ESG.

MarketWatch: Proving the power of well-wielded shareholder engagement, for the first time, a 53% majority of Chevron shareholders voted in favor of a climate resolution. The request to align operations with the Paris climate agreement is far from radical. In fact, many of Chevron’s peers are headed toward some form of net neutrality. This majority vote is setting a new precedent for US investors in oil & gas majors.

Reuters: Always at the forefront of EV innovation, Tesla will introduce a new low-cost, long-life battery which will bring the cost of electric vehicles in line with gasoline cars. These batteries can be repurposed in grid storage systems, providing Tesla with the capability to become a power supplier.

Carbon Commentary: Chris Goodall deep dives into hydrogen use cases in sectors that cannot be electrified (ranging from aviation fuel to steelmaking). The conclusion? Almost all CO2 generating activities can be switched to some combination of electricity or hydrogen.

Apple Maps: Apple is adding an EV routing feature which tracks the user’s current charge and automatically adds charging stops along the route. Apple Maps will also feature a biking option which lets cyclists know if the route includes hills.

Mark Tercek: The latest in Mark Tercek’s (former CEO of The Nature Conservancy) series on investing in nature discusses why companies should be the driving force behind Natural Climate Solutions.

NRDC: The Issue With the Tissue 2.0 explores the link between major US tissue product (i.e., toilet paper) manufacturers and the destruction of Canada’s boreal forest.

Financial Times: Though no surprise to readers here, a nice article on the “transformational attitudinal change” and young innovators’ determination to use technology for social good.

[Opportunity] EV and Battery Challenge: LG Chem, Hyundai, and Kia have teamed up with New Energy Nexus to start a competition which identifies startups working on battery and electric vehicle technology. Apply by August 28.

[Opportunity] Future of Ports: GSVlabs and Gulftainer, a large port and logistics operator, are holding The Future of Ports Startup Challenge. The winning company will receive a cash prize of $10,000 and a paid pilot opportunity with Gulftainer. Apply by August 15.

[Event] MIT “Scaling up low-carbon energy”: Tune into the last of MIT’s special webinar series with energy researchers and experts on July 7 at 10 a.m. ET.

[Event] The Path Forward for Electricity and Smart Cities: Join Women in Cleantech and Sustainability and Plug and Play for a Virtual Happy Hour on July 2, from 5-6 p.m. PT.

[Event] Taking the Carbon Out of Credit: Join Climate Safe Lending Network on July 2 from 8-9:30 a.m. PT to find out how your organization can lead the way to a climate safe future.

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond

Groundbreaking results from the geothermal developer’s main project