🌎 Taxing times for CCUS #254

OBBB blows tailwinds through CCUS, but takeoff stalls

Plus, Values vs Value in ESG investing

Happy Monday!

A lot of the content and conversations from this week had us reflecting on the age old question of values vs. value. Are you an investor that cares more about mission, or more about economic return and impact? We also hope it’s not a binary, as it’s getting increasingly harder to silo.

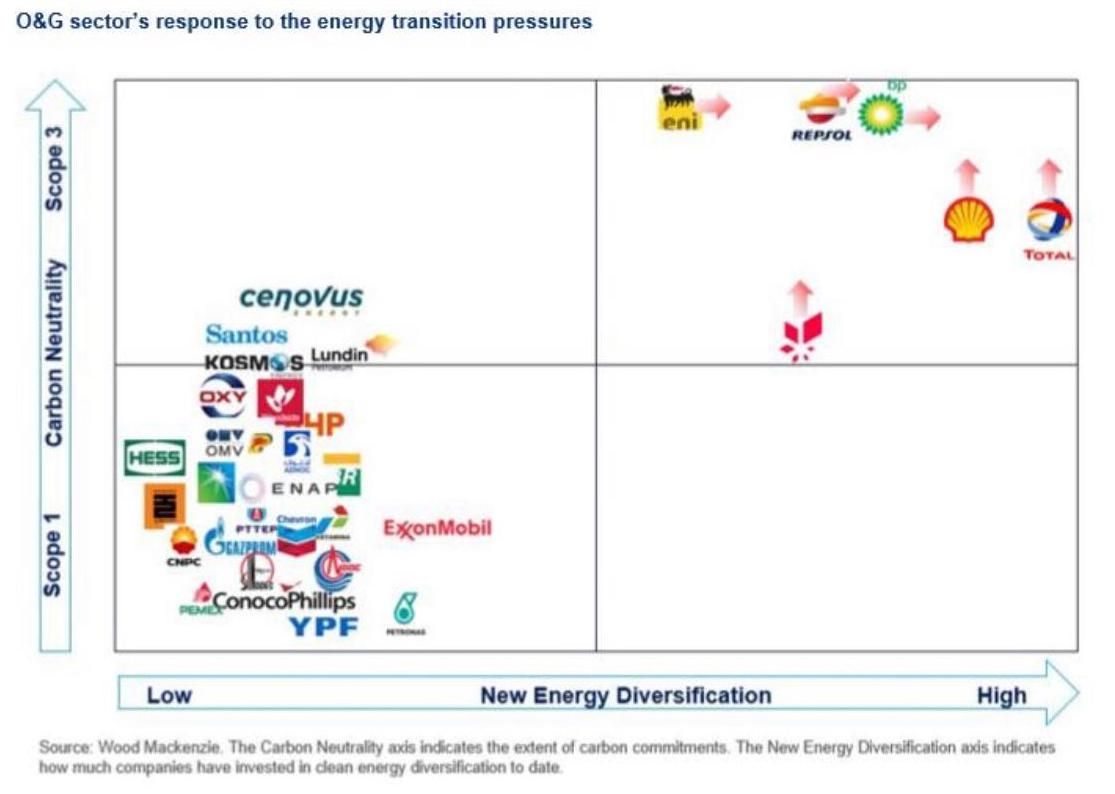

Tl;dr - there’s a lot of interesting work to save the planet emerging from those historically most responsible for breaking it, so do you join them or do you try to beat them?

This week, we dissect the implications of oil & gas majors’ carbon neutrality commitments and share some thoughts on different tribes of sustainable investing to guide reflections on where we individually fit within this big camp of climate tech enthusiasts. Also, more new deals!

Thanks for reading!

Total adopted new climate ambitions to reach net-zero emissions by 2050, following in the footsteps of Shell and BP’s announcements this past quarter. The French oil major announced 60% decarbonization of their worldwide energy products by 2050 (scopes 1, 2, 3). But we were struck by Total’s promise to meet governments’ decarbonization policies and regulations across all of the regions it operates in (essentially committing its European operations to 100% net zero by 2050).

What does this mean?

Why does this matter?

What is likely to happen?

For investors, the questions will likely emerge as:

🏗️ Sidewalk Infrastructure Partners, a spinoff of Alphabet’s cities-of-the-future arm Sidewalk Labs (see below for more on Sidewalk Labs closing its Toronto project), raised $400m in Series A funding from Google and Ontario Teachers Pension Plan. SIP aims to scale technology-enabled infrastructure development across five key verticals: mobility, energy, water & waste, digital infrastructure, and social infrastructure. Fortune has more here.

🛵 Lime, a San Francisco-based electric scooter rental startup, raised $170m in funding from Uber, Alphabet, Bain Capital Ventures, and GV. The potential cash infusion, which would help Lime stay afloat as demand for scooters shrivels due to Covid-19, would value the micromobility company at $510 million, or 79% less than its previous valuation. In exchange for $85 million in emergency funding, Uber would significantly increase its minority stake, get the option to buy Lime between 2022 and 2024, and transfer its own electric bike and scooter division called Jump to Lime. TechCrunch has more here.

♻️ RWDC Industries, an Athens, Ga.-based bioplastics manufacturing startup hoping to replace plastic packaging, raised $133m in Series B funding from Vickers Venture Partners (Ikea’s investment company), a Swiss pension fund, a Northeastern energy provider, and an industrial chemical company owned by Koch Industries. The funding will be used to build a new factory which scales bioplastics production. TechCrunch has more here.

🔋 ZAF Energy Systems, a Montana-based developer of battery tech, raised $22m in Series A funding from Élevage Capital Management, Catalus Capital, Holt Ventures, and Coventry Asset Management. The company develops next-generation battery technologies for applications including electric vehicles, commercial trucking, renewables integration, back-up power, and consumer electronics.

👕 Oxwash, a UK-based laundry startup using ozone to sterilize fabrics, raised $1.7m in Seed funding from TrueSight Ventures, Founders Factory, and other angel investors. The startup has developed a zero net carbon emission laundry process from collection to washing to delivery. TechCrunch has more here.

🔋 Renewance, a Chicago-based software platform for battery lifecycle management, raised $100k in Seed funding from Clean Energy Trust. The company provides clients with industrial batteries with the most cost-effective, environmentally friendly reuse and recycling solutions. More here.

🔲 Iris Light Technologies, a Chicago-based developer of silicon photonics technology, raised $100k in Seed funding from Clean Energy Trust. The Iris Light solution increases the bandwidth and energy-efficiency of light chips key to data center networks. More here.

This past week we mowed the grass (yay, almost summer!) and then hopped on a Zoom panel to discuss the many facets of ESG analysis along with investors from G2VP and Purchase Park Capital.

The conversation spurred a good reflection on the ‘7 Tribes of sustainable investing’, which Yale Professor Cary Krosinsky nicely blogs about here (and which we introduced in our book together, here).

There are many reasons to support climate tech, some overlap, and all are welcome. Instead of re-iterating all seven, it’s worth looking at two in particular in the context of this week’s news:

As the case for climate matures, we’ll see an increasing blend of both theses. The first wave of climate tech companies (Solyndra, Range Fuels) represented a deep commitment to values and speed, without deep tech pragmatics. They proudly showcased their reason for being as a rebuttal of and reprisal to legacy structures. The second wave of investments in energy represented a hybrid approach, with worship of technology and development, largely via companies like Tesla, Proterra, Orsted. Increasingly, we’ll see more legacy players (and polluters) having to reckon with the changing world.

As evidenced in this weeks’ news, this will force investors that previously blacklisted or removed ‘bad’ companies to reevaluate their positions and find overlapping measures. Optionality is expensive, and retaining discretion based on morals alone will be increasingly difficult as more capital looks to deploy quickly in search of bigger solutions (e.g. Bain Cap’s Double Impact fund being slow out of the gates finding meaningful targets).

Ultimately, the challenge of today’s climate tech investment will be less in ‘picking your tribe’ than in figuring out where the tribes overlap, and how the conversation will evolve from energy abolition to energy reconstruction.

Energy Lollipop: Located in Northern California? Check out this Chrome extension which links to your PG&E account to track and optimize your CO2 emissions.

Yale: Looking for a summer opportunity? Check out this list of internships with Yale-affiliated impact ventures.

ReFED: One of the most acute climate impacts of COVID-19 has been massive on-farm food loss driven by supply chain disruption. Know an organization with the chops to rightset the proverbial apple cart? Tell them to apply for a part of the $1M ReFED Food Waste Solutions Fund pie to be distributed over the next 90 days.

ClimateLink: ClimateLink is a Meetup group that features monthly talks and discussions. Tune in on Wednesday, this month featuring two startups tackling food waste.

My Climate Journey: Continuing the examination of how O&G cos are responding to climate change, Jason Jacobs interviewed Alex Dewar from BCG’s Center for Energy Impact. Hot takes ensued from Jigar Shah and Julio Friedmann.

We’ve teamed up with Climate.Careers to highlight the latest jobs in Climate Tech:

Feel free to send us new ideas, recent fundings, or general curiosities. Have a great week ahead!

OBBB blows tailwinds through CCUS, but takeoff stalls

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook