🌍 Your 2026 prediction bets are in

We asked, you answered, and experts weighed in on 2026

Happy Tuesday!

OpenAI’s new AMD deal made headlines for its size and side-eyes for its circular logic. We’re unpacking what happens when AI demand meets real-world infrastructure.

In deals, $1bn for grid and battery development, $776m for biomethane, and $400m for nuclear.

In other news, tariffs are back, the EU’s sustainability laws face cutbacks, and the DOE cancelled even more loans.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

CTVC is powered by Sightline, the tactical market intelligence platform for energy and investment decision-makers.

In the latest move in the AI compute race, last week, OpenAI and AMD announced a massive deal to deploy 6GW worth of AMD chips — an impressive number for silicon, and the electricity needed to power it. The AI boom is running headlong into infrastructure limitations, and heading for a bubble (see below). For those in the power ecosystem, that opens up both risks and new opportunities for those who move fastest.

The deal starts with a 1GW deployment of AMD’s new MI450 GPUs in 2026, scaling up to 6GW of total compute infrastructure over the next five years. It marks a strategic shift for OpenAI, which has historically relied on NVIDIA. While NVIDIA chips still dominate the model training market, AMD is actively positioning itself as a stronger, more cost-effective option for AI inference. (Training builds the model; inference runs it – and it’s where cost, energy efficiency, and availability matter more than raw horsepower.) The MI450 was designed for AI inference, competing directly with NVIDIA’s top-end chips.

Opening up the chip field could help boost supply chain resilience and stoke innovation competition across hardware and power efficiency. Now, AMD’s chips have OpenAI’s public backing, and a chunk of potential upside: OpenAI gets warrants to buy up to 160 million shares of AMD if performance targets are met. (This strategy is part of the OpenAI playbook: structuring deals to secure warrants in public companies whose stock prices reliably jump after a partnership is announced. First with Oracle, now with AMD, if the stock keeps climbing, OpenAI’s stake grows more valuable, which means it can fund its hardware purchases as well as boost its own valuation.)

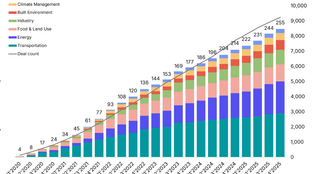

It’s not the first massive AI deal announcement, and it won’t be the last. (Sightline has tracked more than 100GW of data center announcements since 2024.) But it shows just how tangled the multibillion-dollar web is that AI players are weaving.

AMD gets a potential 10% equity buy-in from OpenAI. OpenAI is backed by Microsoft. Microsoft is a top customer of CoreWeave. Nvidia owns a big chunk of CoreWeave — and just invested $100bn into OpenAI infrastructure. Meanwhile, OpenAI is locked into a $300bn compute deal with Oracle, which expects to lose money on the infrastructure it’s building.

That’s hundreds of billions circulating into chips, data centers, and the gigawatts needed to run them, all on the assumption that the AI arms race will continue to drive demand. But the power curve hasn’t caught up with the revenue curve. Hyperscalers are announcing data centers faster than they can be supplied with clean energy — or paying customers. These cross-holdings, power contracts, and speculative buildouts feel frothy, and have many calling it a bubble in the making.

Still, when bubbles burst, they can have a spillover effect. The dot-com crash gave us fiber. The first clean tech bust helped push solar down the cost curve. But AI infrastructure is a different beast, as it depends on hardware that depreciates almost as fast as the models it serves. GPUs lose value in just a few years, as better, faster, cheaper-to-power chips replace them. More durable is the power infrastructure behind it. Sightline’s data center tracker found that more than half of announced data center facilities haven’t yet disclosed their power generation sources. Most projects plan to plug into the grid (subject to multi-year interconnection delays), while others are betting on on-site generation: solar, hydrogen, natural gas (sometimes with CCS, at some point in the future), SMRs, and wind.

For the climate and energy sectors, that creates both risk and opportunity. Overbuilding AI infrastructure could distort near-term energy markets and delay decarbonization. Last year, CarbonCapture suspended its planned DAC facility, Project Bison, in Wyoming, amid competition for clean energy from data centers, for instance. But just last week, Prometheus, Hyperscale, Spiritus, and Casper announced they were building carbon-negative data center and energy infrastructure in Wyoming, with CCS and DAC.

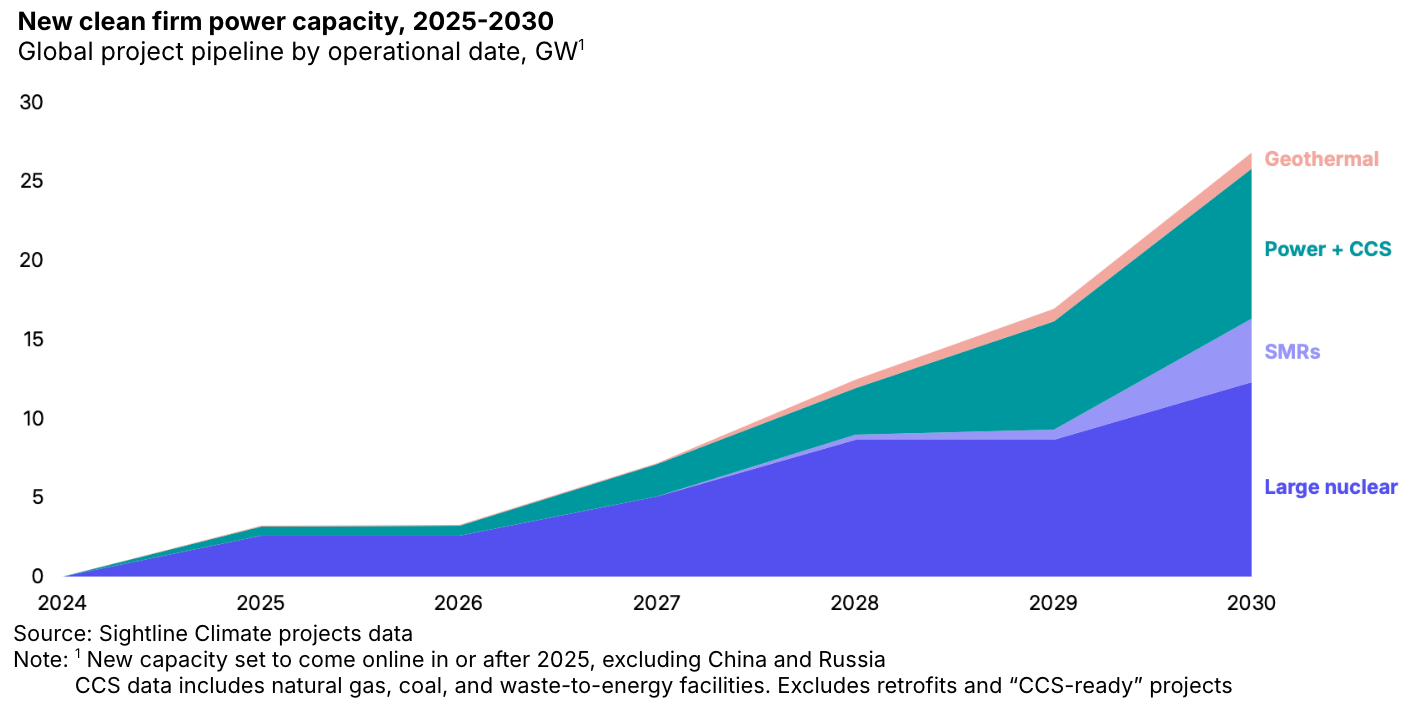

As long as data center developers invest in the infrastructure that can support clean energy projects, like still nascent CCS, even if the bubble bursts, it could set the stage for a longer-term modernized grid with surplus clean capacity. That could help power the projects that need lots of energy, from clean steel to direct air capture. And there’s a lot of net new clean firm power capacity in the pipeline, as Sightline research shows. It’s enough (~27GW of capacity) to meet nearly one-third of data center demand in our project pipeline for 2030 (~85GW).

⚡ Base Power Company, an Austin, TX-based battery-powered home energy service provider, raised $1bn in Series C funding from Addition, 137 Ventures, 1789 Capital, Altimeter, Andreessen Horowitz, and other investors.

🚢 Corvus Energy, a Richmond, Canada-based maritime energy storage solutions provider, raised $60m in Growth funding from Morgan Stanley Investment Management, J. Lauritzen, and Just Climate.

💧 Membrion, a Seattle, WA-based ceramic desalination membrane developer, raised $20m in Series B funding from Ecolab, GiantLeap, Hunter Lewis Family Office, Indico, and other investors.

⚡ Amber Electric, a Melbourne, Australia-based real-time energy pricing platform, raised $7m in Growth funding from E.ON Next and Virescent Ventures.

🏠 Accelsius, an Austin, TX-based thermal management company, raised an undisclosed amount in Growth funding from Johnson Controls.

⚡ Tagaddod, a Cairo, Egypt-based waste-to-energy and circular economy platform, raised $26m in Series A funding from The Arab Energy Fund, A15 Ventures, FMO, and Verod-Kepple Africa Ventures.

🏭 Energy Robotics, a Darmstadt, Germany-based autonomous inspection software provider for industrial robots and drones, raised $14m in Series A funding from Blue Bear Capital, Climate Investment, Futury Capital, and Hessen Kapital.

🥩 Bettani Farms, a Berkeley, CA-based machine learning platform for sustainable proteins, raised $7m in Series A funding from S2G Investments, At One Ventures, Gratitude Railroad, Manta Ray Ventures, and Toba Capital.

☀️ Janta Power, a Dallas, TX-based 3D solar power tower technology developer, raised $6m in Seed funding from MaC Venture Capital and Collab Capital.

💨 Vycarb, a Brooklyn, NY-based ocean-based carbon removal company, raised $5m in Seed funding from Twynam, Clocktower Ventures, Hatch Blue, Idemitsu Kosan, MOL Switch, and other investors.

🥩 Asterix Foods, a Tel Aviv, Israel-based animal-free glycoprotein specialist, raised $4m in Seed funding from CPT Capital, Grok Ventures, ReGen Ventures, and SOSV.

🍎 Kikleo, a Paris, France-based food waste monitoring platform, raised $4m in Seed funding from Newfund, Avelana, and Bpifrance.

♻️ EcoEx, a New Delhi, India-based extended producer responsibility provider, raised $4m in Seed funding from Dovetail Capital, Narnolia, and Nav.

⚡ Clevergy, a Madrid, Spain-based energy consumption optimization platform, raised $4m in Series A funding from Axon Partners Group, Racine2, Angels Capital, Satgana, and Wayra.

🌱 Resourcly, a Mannheim, Germany-based circular supply chain platform, raised $3m in Seed funding from Project A Ventures, D11Z, Fiege Ventures, Knut Alicke, McKinsey & Company, and other investors.

⚡ Verdalia Bioenergy, a Madrid, Spain-based biomethane project developer and operator, raised $776m in PF Equity funding from Goldman Sachs.

⚡ NANO Nuclear Energy, a New York City, NY-based advanced nuclear microreactor developer, raised $400m in Post-IPO Equity funding.

🔋 NineDot Energy, a Brooklyn, NY-based energy storage developer, raised $175m in Debt funding from Deutsche Bank.

⚡ Geopura, a Nottingham, England-based hydrogen-based zero-emission fuels provider, raised $36m in Debt funding from Barclays and EIFO.

⚡ Greenflash, a Houston, TX-based renewable project developer, raised an undisclosed amount in PF Debt funding from Acadia Infrastructure, Wafra International Investment, and Deutsche Bank.

🌱 Daedaline, a Boston, MA-based AI-powered due diligence platform, was acquired by Crux for an undisclosed amount.

🌱 Atlas Metrics, a Berlin, Germany-based ESG reporting platform,was acquired by Novata for an undisclosed amount.

🌐 HyperLume, an Ottawa, Canada-based low-power optical interconnects company, was acquired by Credo Technology Group for an undisclosed amount.

💰 Energy Impact Partners, a New York City, NY-based climate and energy-focused investment firm, raised $1.36bn for Flagship Fund III from over 75 limited partners, focusing on energy innovation and infrastructure.

This is a sample of deals available on Sightline. Can’t get enough deals?

China announced that, starting 1 December 2025, any product containing over 0.1 % rare earths will require a Chinese export license. The move builds on China’s existing dominance in rare earths and magnet production (controlling over 90 % of processing capacity) and effectively gives Beijing a “gatekeeper” role for downstream technology supply chains. For energy‑transition sectors (e.g. EV motors, wind turbines, power electronics), this raises risks of supply bottlenecks, higher costs, and strategic incentives to diversify processing capacity outside China.

EU Parliament lawmakers reached a deal to scale back sustainability reporting and due diligence regulations. The agreement dramatically raises the company size threshold for the CSRD, removing an estimated 80% of companies from its scope. The move follows July’s Turnberry trade deal that limited tariffs on EU exports in return for reduced regulations on American companies.

Despite the scale back, the US made further demands that the EU exempt American companies from key environmental trade rules, including requirements to produce climate transition plans and to meet supply chain due diligence laws under the CSDDD. The European Commission rejected US demands, and tensions continue to build as it becomes clear that July’s agreement was only a temporary solution.

With the US government still shut down, the DOE announced the cancellation of 321 clean energy awards totaling $7.5bn, all for projects based in Democrat-led states. The cuts affect initiatives across multiple DOE offices, including renewable energy, grid resilience, and manufacturing programs, with major losses to several hydrogen hubs and direct air capture projects.

After a catastrophic failure in April, the newest large US coal plant is going dark for nearly two years. Texas’s 932MW Sandy Creek coal plant’s extended outage underscores the reliability and financial risks of coal generation, following a similar long-term shutdown shortly after its construction in 2011. The incident mirrors problems at Colorado’s Comanche 3 plant and shows the reliability issues that coal still faces.

Japan’s newly elected prime minister, Sanae Takaichi, plans to keep nuclear power central to the country’s energy strategy, focusing on energy security and carbon reduction by restarting idled reactors and developing advanced nuclear technologies like fusion. However, restarting reactors faces regulatory and local hurdles, and fusion remains a long-term goal.

California passed a sweeping climate and energy package that extends its cap-and-trade program to 2045, advances regional grid integration, replenishes wildfire funds, and controversially expands oil permitting in Kern County. The reforms aim to thread the needle between climate ambition and affordability, with key provisions designed to lower electricity costs, stabilize gas prices, and future-proof the grid. It highlights the tension between decarbonization and political-economic pragmatism in energy transition.

A Nobel Prize for metal-organic frameworks, with potential for carbon capture.

Fusion revolution: Germany pledges over $2bn to fusion through 2029.

Minor reroutes could nix contrails at cents on the dollar.

Step aside, SpaceX! Here comes the newer, bluer, OceanX!

Solar generation hit its fastest growth on record, according to an Ember report.

Irregular showers bring desert flowers: rain in the world’s driest region.

Is super cheap (terrestrial) solar no more?

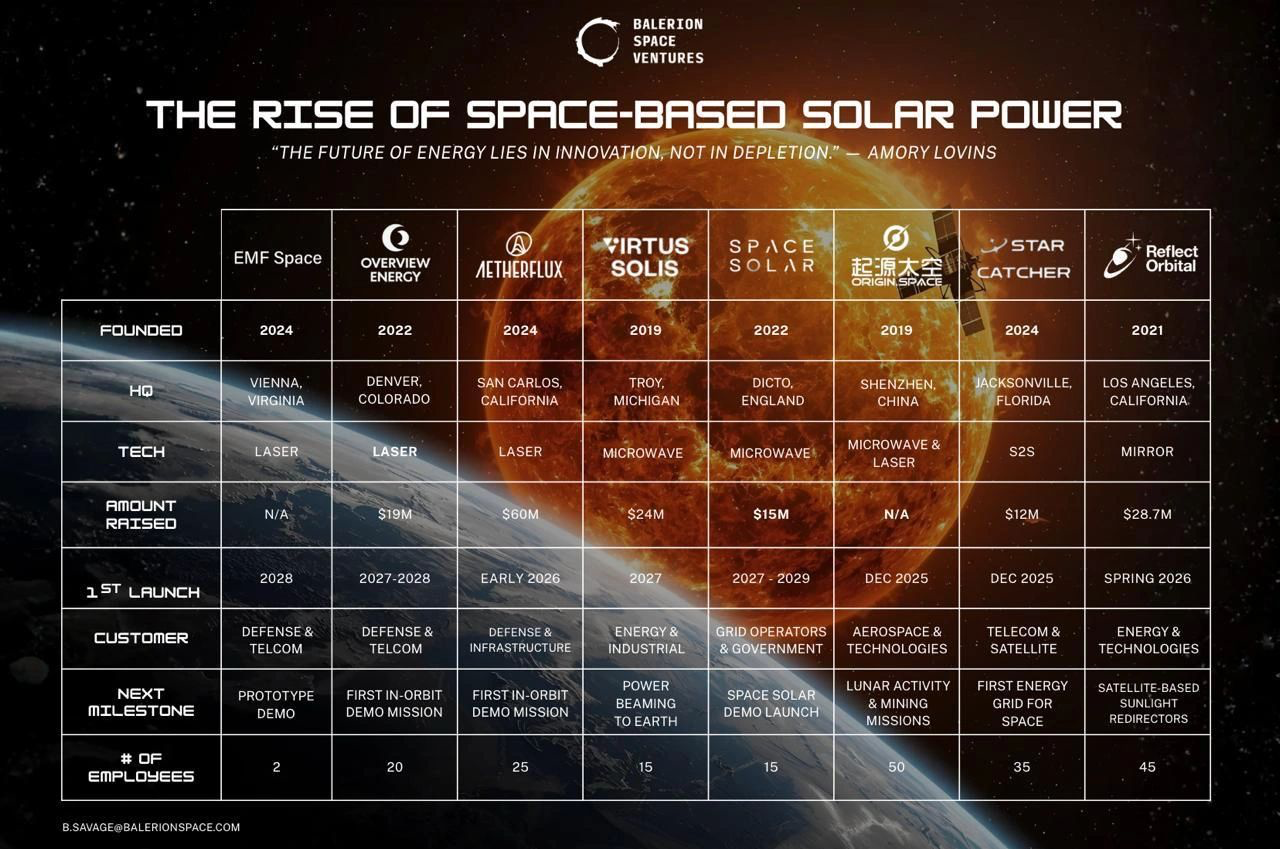

While space-based solar is on the rise:

📅 Dervos: Come to the energy event of the year on Governors Island on Friday, October 17th, for a jam-packed day of speakers and panels, startup demos, and a solar-powered music festival the day after! Use code CTVC_GIVEAWAY for 20% off.

💡 Joules Accelerator: Apply for the 16th Cohort of Joules Accelerator! With no equity or fees and fast intros to utility and industry partners, the accelerator is the perfect opportunity for grid innovators everywhere. Applications accepted through Friday, Oct 31st.

📅 Local Action, Global Lessons: Join New York Area Sustainability Group on Wednesday, October 22nd 5:30-7:30PM to hear speakers from around the world share firsthand how their organizations are tackling urgent climate mitigation and adaptation challenges.

📅 Decarb Connect Canada: Join leading industrial players in Toronto on October 28-29th, along with innovators, investors, and policymakers to share strategies, scale solutions, and accelerate bankable decarbonization.

📅 VERGE at Trellis Impact 25: Join us October 28-30, in San Jose for three events at the intersection of climate and technology. Connect with 5,000+ professionals and 500+ speakers advancing decarbonization strategies and climate tech. Register by October 3rd to save $300 and use our partner code TI25SL for 10% off.

📅 DCD>Connect | Virginia 2025: Join us on November 3–4, 2025 in Virginia for an opportunity to connect with 2,000+ data center leaders, explore sustainability innovations, and attend key panels on hyperscale expansion, legislative uncertainty, and construction strategy in the world’s largest data center hub.

Senior DevOps Engineer @Sightline Climate

Senior Product Designer @Sightline Climate

Senior Software Engineer @Sightline Climate

Content Marketing Manager @Floodbase

GTM Strategy Director @Floodbase

Stewardship & Funder Relations Manager @ClimateWorks Foundation

Staff Commercial Analyst @Form Energy

Head of Marketing @Cloverly

Senior Product Designer @Cloverly

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

We asked, you answered, and experts weighed in on 2026

The real costs of the US exit from the UNFCC

The 2025 Climate Tech Investment Trends report is out now