🌎 FEOC in focus #283

Stricter foreign sourcing rules reshape clean energy tax credit eligibility

Happy Monday!

We’re back in your hopefully not-too-crowded inbox with the news you might have missed over the holidays.

The biggest news you missed: Kraken spun out of Octopus Group, Google acquired Intersect Power, and more US offshore wind problems.

Meanwhile, what you've all been waiting for, Sightline’s signature 2025 Climate Tech Investment Trends Report, will be out tomorrow! For the fifth year running, we’re digging into the data to show you what’s actually happening: who’s winning, who’s losing, and where momentum is shifting. Read on for a little New Year’s-themed preview.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

Ahead of publishing our 2025 Climate Tech Investment Trends report tomorrow (!), the new year is a good moment for all of us to look in the mirror and repeat some resolutions and maybe an affirmation or two. Say them with us. (And we’ll back all this up with data tomorrow in the report!)

2025 closed as the second-hottest year on record, capping the three hottest years ever measured. Global temperatures again exceeded 1.5C above preindustrial levels, at least temporarily breaching the world’s most important climate target.

And yet, the investment signal moved in the opposite direction. Decarbonization powered climate tech’s takeoff in 2020, backed by strong policy tailwinds and corporate net-zero commitments. That world no longer exists.

What replaced emissions targets as the primary driver is rapidly rising energy demand. AI, data centers, electrification, and grid stress are pulling capital toward anything that can deliver power fast, reliably, and at a tolerable cost. Buyers are optimizing for speed to electrons, not tons of CO2 avoided. Emissions reduction still matters, but it’s no longer the pitch. That shift explains why the biggest deals of 2025 clustered around firm power, energy security, and system resilience.

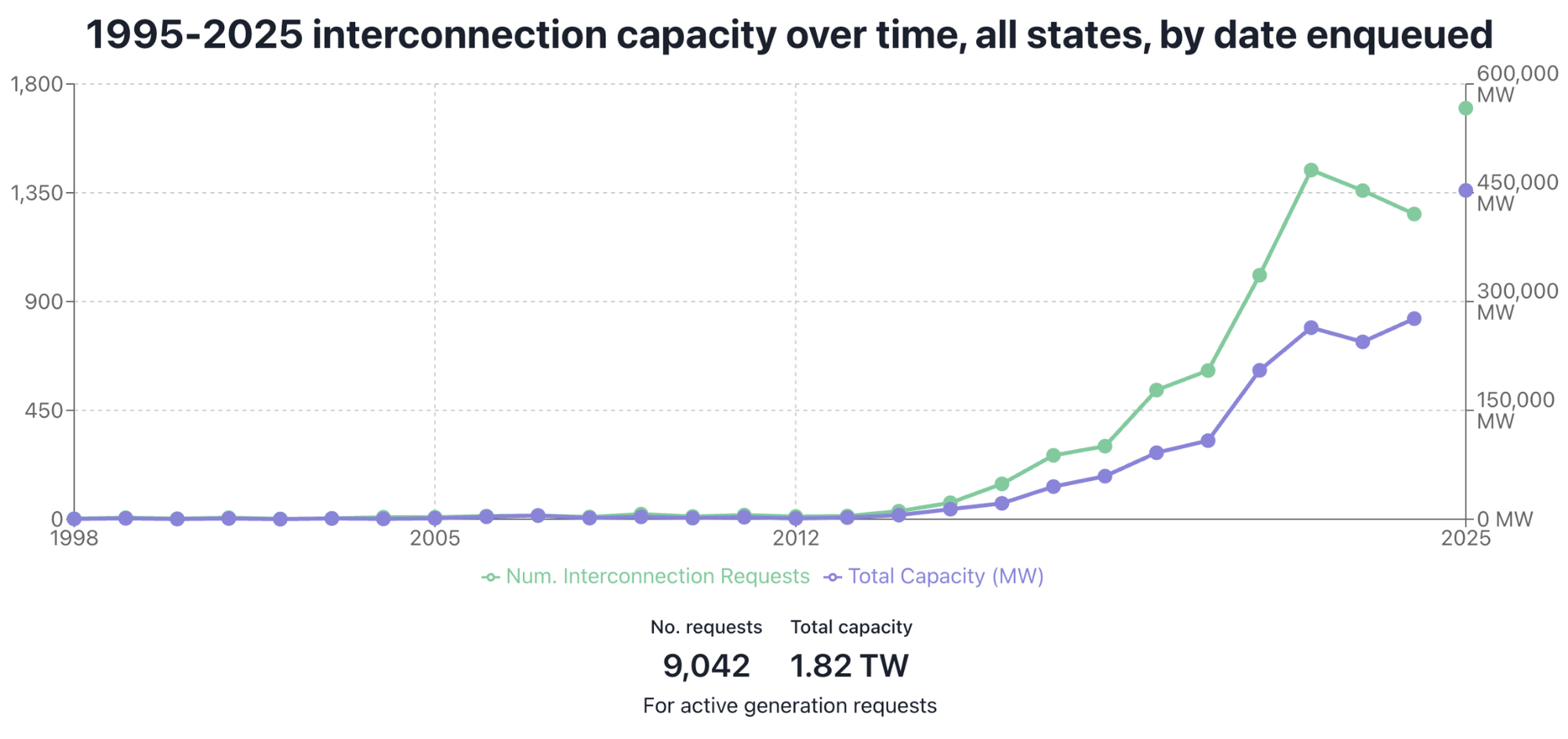

If your plan ignores long interconnection timelines, competition for firm capacity, or grid constraints, it’s not a good plan … unless you have a really smart way to jump the queue.

With power demand rising, the fastest electron will win. Investors and acquirers prioritized technologies that improve reliability and shorten timelines to power, particularly nuclear, geothermal, grid infrastructure, and energy storage. Quick, firm power now commands the premium, when interconnection and the grid are bottlenecks.

The days of cheap money to create, say, some new alt protein or carbon accounting platform are officially over.

Investment rose even as deal activity and early-stage funding slowed, reinforcing a feast-or-famine dynamic where a small cohort of category leaders captured most of the capital. In crowded markets, investors are doubling down on companies with proven technology, viable business models, and credible paths to deployment. New entrants without a clear edge should think twice before burning seed capital. Meanwhile, growth capital is flowing to incumbents with deployment paths, not to the tenth company chasing the same thesis.

Exits are still happening, but they look different: SPACs are out, M&A is in. And the strategic buyers want capacity, projects, and software they can deploy tomorrow, not optionality five years out.

Rather than waiting for home-run IPOs, investors increasingly pursued viable liquidity through tidy acquisitions and a small number of selective public listings. At the same time, 2025 delivered a sobering reminder of what happens when scale, capital intensity, and timing collide, with bankruptcies including former darlings like Northvolt, Li-Cycle, Sunnova, Mosaic, and Powin.

Build for the exit the market is offering in 2026, not the one it used to reward.

With warming below 1.5C increasingly out of reach, the world is shifting from prevention to coping. And it’s finally starting to pay for it.

Adaptation funding jumped sharply in 2025, with capital flowing into wildfire prevention, biodiversity, climate risk, and resilience. It’s a warranted response to the losses that are already showing up on balance sheets, insurance books, and public budgets. Geoengineering even entered the investment conversation for the first time, signaling just how far the Overton window has moved.

It’s not that decarbonization or mitigation no longer matter; instead, it’s a growing recognition that climate damage is no longer a future scenario. Extreme heat, fires, floods, and water stress are already reshaping where people live, how assets are priced, and which risks are insurable. Governments, utilities, insurers, and corporates are being forced to respond in real time, and that creates opportunity. Adaptation technologies sell into urgency.

⚡ Kraken Technologies, a London, England-based energy retail and grid software company, spun out of Octopus Energy Group, with a $1bn raise from investors D1 Capital Partners, Durable Capital Partners, Fidelity International Strategic Ventures, Octopus Energy Group, and Ontario Teachers’ Pension Plan.

⚡Intersect Power, a San Francisco, CA-based utility-scale solar and battery storage developer, was acquired by Google (Alphabet Inc.) for approximately $4.75bn, including cash and assumed debt.

This is a sample of deals available for Sightline clients. Can’t get enough deals?

Two massive deals were announced during the quiet holidays, with Octopus Energy Group raising $1bn to spin out Kraken, its AI-based software platform that provides billing, customer management, and grid services, to utilities worldwide. Additionally, Alphabet acquired Intersect Power, a data center and energy infrastructure developer, for $4.75bn, expanding its ability to bring new power generation and data center capacity online more quickly. The twin deals signal deeper vertical integration and greater reliance on AI-enabled grid management for firms that can coordinate generation, networks, and demand at scale.

The US Interior Department suspended leases for all five offshore wind projects under construction along the East Coast, citing national security concerns that turbines could interfere with radar systems, halting roughly $28bn in committed investment. The move targets projects that had already cleared extensive federal reviews and follows earlier Trump administration efforts to block offshore wind, while developers are already preparing to challenge the move in court.

The DOE issued four new emergency orders, directing utilities to keep more than 2GW of coal-fired capacity online through early 2026. The orders cover coal units in Washington, Indiana, and Colorado that were scheduled to retire at year-end, with DOE citing grid reliability risks tied to accelerating baseload retirements, rising demand, and tightening reserve margins. This adds regulatory uncertainty, higher costs, and legal risk to state-led decarbonization and utility transition plans.

The US House passed the SPEED Act to accelerate federal permitting for energy, mining, and infrastructure projects by narrowing NEPA reviews and imposing deadlines on environmental decisions and legal challenges, though last-minute changes weakened protections for fully permitted projects. The bill keeps permitting reform alive but lost support from clean energy groups and moderate Democrats after provisions were altered to potentially allow a president to revoke completed permits, and it has little chance of passing the Senate as written, where broader negotiations are expected in early 2026.

HSBC partnered with the Port of Rotterdam and Dai-ichi Life to issue the world’s first corporate bond whose proceeds are exclusively for carbon capture and storage, raising €50m ($58m) to finance the port’s equity stake in the Porthos CCS project. It supports transport and permanent storage of up to 2.5m tonnes of CO2 per year from Rotterdam-based industry into depleted North Sea gas fields, with Shell, Air Products, Air Liquide, and Exxon expected end users despite capture facilities not yet being built. While a small amount for this type of infra, it signals growing investor acceptance and could attract more blended finance for Porthos, similar to what HSBC did with Teeside in the UK.

Good news, fully renewable: a roundup of climate wins this year.

Clearing the fog: a teardown of the year’s most confusing climate narratives.

Our friend Michael Liebreich’s take on Venezuela, from an energy perspective.

Soft power, hard watts: a deep dive into Chinese solar in Africa.

A hard limit: A new report says there aren’t enough chips to support the high end of data center projections.

💡SE Ventures Accelerator: Apply to the highly selective 12-week program by January 30th for exceptional pre-seed founders in Energy Tech, Industrial Tech, and Enterprise AI. You'll work closely with SE Ventures, Schneider Electric, and AVEVA to accelerate your journey to product-market-fit, prepare for seed fundraising, and gain access to Schneider Electric's global ecosystem. Includes $100k SAFE.

📅 Decarb Connect North America: Register and join us from February 10th-11th in Houston, TX, to meet industrial offtakers of critical tech and learn which tech pathways and business models are attracting private investment and industrial support.

Senior Software Engineer, @Sightline Climate

Platform Engineer, @Sightline Climate

Marketing Lead, @Sightline Climate

Robot Software Engineer (Platform and Backend), @Planted

Robot Software Engineer (HMI/UI), @Planted

Investment Associate, @Zero Infinity Partners

Electrical Engineer, @Planted

Civil Engineer, @Planted

Solution Engineer, @Planted

Summer Research Analyst – Environmental Markets, @Molecule Ventures

Senior Full-Stack Engineer, @Coral

Full Stack Engineer, @Möbius Industries

Part-Time Inside Sales Representative, @Composer

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

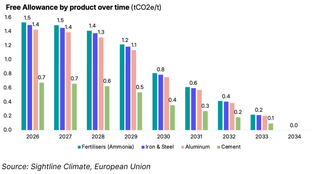

Stricter foreign sourcing rules reshape clean energy tax credit eligibility

We did the EU carbon math

With long duration energy procurement surging, new rankings reveal who's pulling ahead