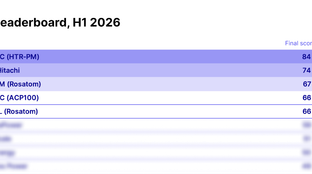

🌎 The SMR shake-up #284

Small reactors, big power rankings

Share your 2026 predictions for the chance to win $50

Happy Tuesday!

It’s a short holiday week in the US, and inboxes everywhere are on half-speed. So we’re keeping things simple and sending out something fun: our annual Climate Tech Oracle. Share your predictions for the year ahead in our survey, and you’ll be entered to win a $50 gift card.

In deals, $2.2bn for AI cloud infrastructure across two deals, $1bn for nuclear, and $470m for utilities.

In other news, COP outcomes (or lack thereof), Lanzajet’s FOAK, and the European Commission’s new ESG investing rule.

Thanks for reading!

Not a subscriber yet?

📩 Submit deals and announcements for the newsletter at [email protected].

💼 Find or share roles on our job board here.

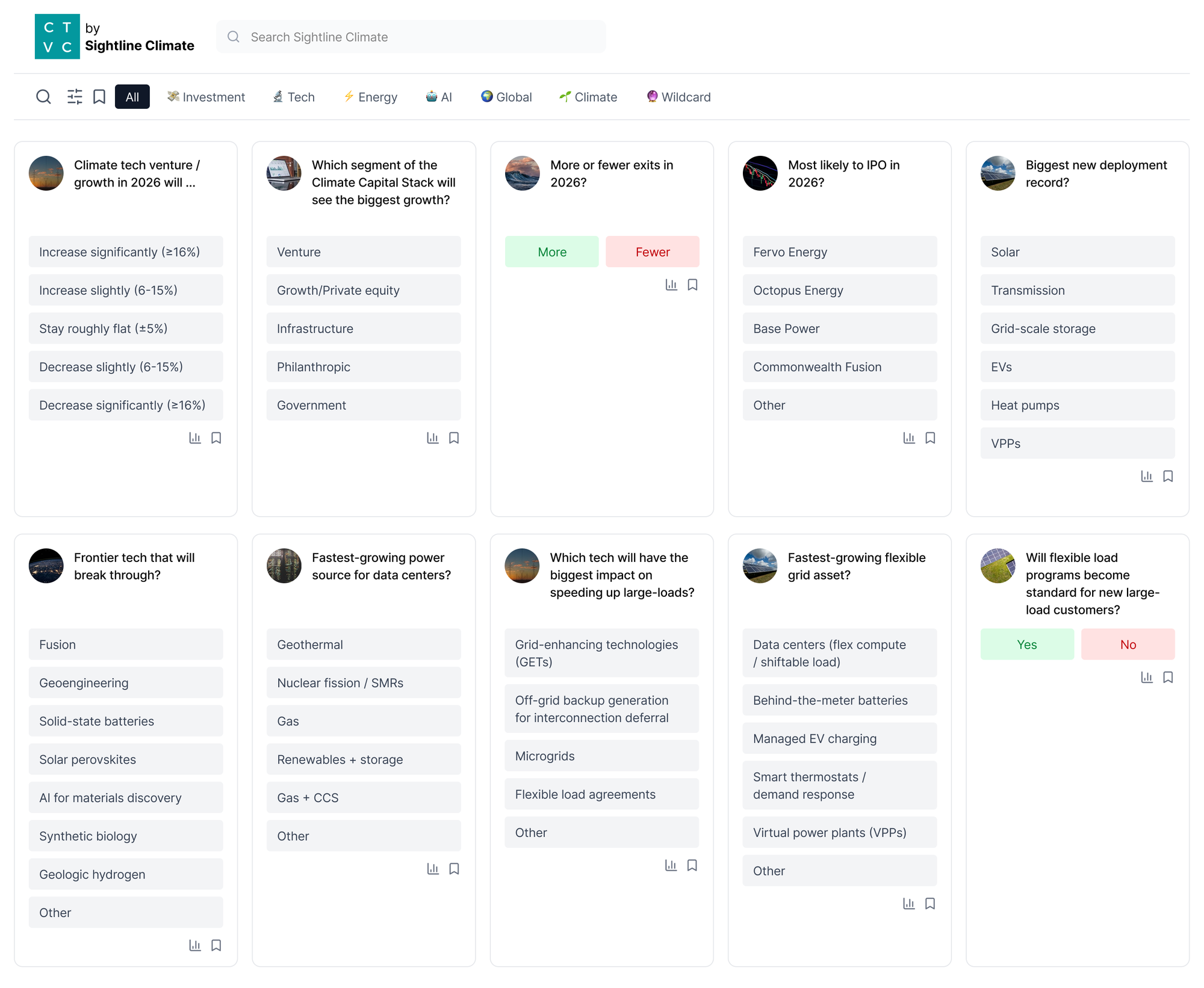

We’re always trading on truth, and with the end of the year approaching, we’re in the market for your predictions for 2026.

That’s right, we’re launching our annual 2026 CTVC Oracle, asking you to bet on the biggest news, market shifts, and technology wins of the coming year.

Feeling lucky? Feeling data-driven? Either way, we want your line: the parlay on policy, the spread on sectors, the odds on offtake, the futures on fusion. Go all-in on your climate convictions, or hedge if you must. Take the long shots or the small stakes. It’s your play.

And you might hit the jackpot: To say thanks, one participant will receive a $50 gift card! If you want to be entered into the lottery, please make sure that you submit your email address at the bottom of the survey. We will choose a winner at random.

Your answers will help shape an upcoming CTVC feature. The survey is 20 multiple-choice, yes/no, and open-ended questions, plus some wild cards. Answer only what you want, and add optional context in the open fields if you have nuance to share. (And you can share feedback at the bottom of the form, as well.) We’ll close it by the end of the year and send out the results.

To see how readers called it last time, check out last year’s CTVC readers' Oracle.

🏠 Crusoe, a Denver, CO-based energy-first AI infrastructure builder and cloud services provider, raised $1.4bn in Growth funding from Mubadala and other investors.

☀️ Holosolis, a Paris, France-based solar module manufacturer, raised $256m in Growth funding from EIT InnoEnergy and other investors.

🌡 RapidSOS, a New York, NY-based emergency data delivery platform, raised $100m in Growth funding from Apax Partners and other investors.

🔋 Nanoramic Laboratories, a Boston, MA-based lithium-ion storage developer, raised $55m in Growth funding from General Motors Ventures and other investors.

♻️ Sortera Technologies, a Markle, IN-based metals recycler, raised $45m in Growth funding from T. Rowe Price and other investors.

🔋 Moment Energy, a Coquitlam, Canada-based EV battery repurposing service provider, raised $5m in Growth funding from TD Innovation Partners and other investors.

⚡ Amperesand, a Singapore-based solid-state transformer developer, raised $80m in Series A funding from Temasek and other investors.

💧 Flocean, an Oslo, Norway-based subsea desalination technology developer, raised $22m in Series A funding from Burnt Island Ventures and other investors.

🌾 Biocentis, a London, England-based genetic insect control developer, raised $13m in Seed funding from Grantham Foundation and other investors.

🏠 Hammerhead AI, a Redwood City, CA-based AI-powered data center optimizer, raised $10m in Seed funding from Buoyant Ventures and other investors.

⚡ PIONIX, a Bruchsal, Germany-based open-source EV charging service, raised $10m in Seed funding from Pale Blue Dot and other investors.

🚗 Voltrac, a Valencia, Spain-based EV developer, raised $9m in Seed funding from Extantia and other investors.

🥩 Chromologics, a Gladsaxe, Denmark-based natural food colorants developer, raised $9m in Seed funding from Novo Holdings and other investors.

🌳 Rhizocore Technologies, an Edinburgh, Scotland-based reforestation fungi developer, raised $6m in Series A funding from Kibo Invest and other investors.

🏠 RIFT, an Eindhoven, Netherlands-based autonomous drone monitoring platform, raised $6m in Seed funding from AlleyCorp and other investors.

💰 Constellation Energy, a Baltimore, MD-based energy generation firm, raised $1bn in Project Finance Debt funding from US DOE Loan Programs Office.

⚡ PT PLN, a Jakarta, Indonesia-based electric utility, raised $470m in Debt funding from Asian Development Bank and other investors.

🧱 Algoma, a Sault Ste. Marie, Canada-based steelmaker, raised $400m in Debt funding from CEEFC.

🔋 Eos Energy Enterprises, an Edison, NJ-based battery storage developer, raised $78m in Post-IPO Equity.

⚡ Mulilo Energy Holdings, a Cape Town, South Africa-based renewable energy developer, raised $75m in PE Expansion from Norfund.

⚡ Aukera Energy, a Brussels, Belgium-based renewable energy developer, raised $70m in PF Debt from Kommunalkredit.

🧱 Cimsa Building Materials, an Amsterdam, Netherlands-based Turkish cement producer, raised $58m in Debt funding from EBRD.

🥩 Sampoerna Agro, a Palembang, Indonesia-based palm oil and seeds producer, was acquired by POSCO for $883m.

🥩 Miyoko's Creamery, a Petaluma, CA-based plant-based dairy alternatives producer, was acquired by Prosperity Organic Foods for an undisclosed amount.

🥩 JULIENNE BRUNO, a London, England-based dairy-free cheese alternatives maker, was acquired by Harvey & Brockless for an undisclosed amount.

🔧 BrightLoop, a Paris, France-based electrification systems provider, was acquired by ABB for an undisclosed amount.

Brookfield Asset Management, a Toronto, Canada-based alternative asset manager, closed $100m for the Emerging Markets Climate Solutions Fund from International Finance Corporation (IFC), focusing on clean energy and transition assets in underserved emerging economies.

EIT Urban Mobility, a Brussels, Belgium‑based innovation initiative of the European Institute of Innovation and Technology (EIT), raised $48m for investment over the next three years in scalable urban mobility solutions.

Touchstone Partners, a Singapore & Ho Chi Minh City‑based venture firm, closed $10m for its Green Transition Fund, focusing on sustainable agriculture, circular economy, waste management and new energy technologies in Vietnam and Southeast Asia.

This is a sample of the deals available for Sightline clients. Can’t get enough deals?

COP30 in Belém, Brazil, ended with a compromise deal with increased adaptation finance for vulnerable countries but no explicit language on phasing out fossil fuels. Brazil’s push for binding “roadmaps” on fossil fuel transition and deforestation was blocked by major producers such as Saudi Arabia, Russia, and India, while the absence of the US from the talks further underscored deep geopolitical rifts and a shift toward “coalitions of the willing.”

LanzaJet began full commercial operations at its Freedom Pines Fuels plant in Georgia, becoming the first in the world to produce on-spec jet fuel from ethanol at scale. Although 18 months late, the milestone caps 15 years of development of its Alcohol-to-Jet technology and gives the green light to FID for the rest of its project pipeline.

The European Commission proposed SFDR 2.0 for the investment industry, introducing a three-tier fund labeling system (sustainable, transition, ESG basics) while scrapping most entity-level adverse-impact reporting in favor of CSRD data. The rules require at least 70% portfolio alignment with stated ESG strategy and tighten exclusions for fossil-fuel expansion, reflecting the EU’s shift away from earlier, more stringent climate-reporting ambitions.

New York has paused enforcement of its landmark all-electric building code until a federal appeals court rules on a lawsuit challenging the state’s gas ban. The delay marks a reversal for Gov. Kathy Hochul, who argues the pause could prevent a longer legal freeze, even as critics say it undermines climate commitments and follows other recent decisions favoring fossil fuels.

The US DOE will loan $1bn to Constellation Energy to help restart the shuttered Three Mile Island Unit 1 reactor, which will supply power to Microsoft data centers under a 20-year deal. The plant, mothballed since 2019, is slated to return in 2027 amid a broader policy push by the Trump administration to strengthen nuclear and meet soaring AI-driven power demand.

Germany awarded BMW €273m ($315m) to develop a hydrogen fuel-cell powertrain that can be built on the same production lines as its battery-electric vehicles. The “HyPowerDrive” system aims to cut manufacturing costs by integrating H2 models, such as a hydrogen version of the iX5, into existing EV production infrastructure. It signals Germany’s continued bet on hydrogen mobility despite weak global fuel-cell car sales and stalled hydrogen momentum.

Heidelberg Materials has paused its flagship CCS project at the Slite cement plant after Sweden’s Energy Agency rejected its bid for co-funding under the Industrial Step program. The decision stalls a retrofit that would have cut Sweden’s emissions by 1.8 Mt per year. It reflects possible project risk and low cement prices threatening momentum for Europe’s hardest-to-abate sectors.

Rio Tinto shelved its $3bn Jadar lithium project after years of political pushback, stalled permitting, and rising costs, ending Europe’s best shot at a major domestic lithium mine. The pause deepens the EU’s supply-chain gap, leaving it more dependent on imports. It shows how local opposition and capital discipline can derail critical battery-materials capacity, even as DLE projects elsewhere gain traction.

Australia and Turkey finally reached a COP-promise to co-host COP31.

Sightline’s Globalization Report takes the mic in this new podcast.

EPA puts the Endangered Species Act and Wetlands Protection Act in danger.

There’s a new NRC commissioner in town.

New interactive NYT on rising climate risk-related insurance prices.

Iran makes it rain with new cloud seeding project.

Climate candidate investor Tom Steyer is running for CA governor.

Growth industry? New biomanufacturing projects in China.

IEA scenarios > forecasts, or you get fueled with the wrong assumptions, according to Hannah Ritchie (and us last week).

MIT Technology Review’s best deal of the year has arrived. For a limited time, subscribe and save 50% on 1 year of unlimited access, plus bonus AI content, including in-depth digital reports and a session recording from the EmTech AI event.

📅 Carbon to Value Initiative Year 5 Kickoff Event: Meet the 10 new startups shaping the future of carbontech — and the large industrial partners they’ll be collaborating with — at Greentown Boston on Thursday, December 4, from 5:30–8:00pm ET.

💡 Norrsken Fixathon: Join 200+ change-makers coming together to build AI-powered solutions from December 5 – 6 at Norrsken House in Stockholm, Sweden).

📅 Boston Climate Week: New Climate Week in Boston on May 3–10, 2026, gathering of 10,000+ attendees exploring academic and research-driven climate solutions from across New England.

Platform Engineer @Sightline Climate

Senior Product Designer @Sightline Climate

Senior Software Engineer @Sightline Climate

Associate @Carbon Business Council

Senior Manager of Partnerships @Carbon Business Council

Analyst @DBL Partners

Sales Associate @Voltus, inc

Growth Marketing Manager @Adventure Scientists

Data Engineer @Greenlight America

Reporting Manager, Analytics @Greenlight America

EDF Climate Corps Fellow @Environmental Defense Fund

📩 Feel free to send us deals, announcements, or anything else at [email protected]. Have a great week ahead!

Small reactors, big power rankings

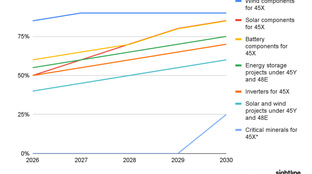

Stricter foreign sourcing rules reshape clean energy tax credit eligibility

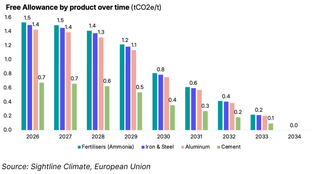

We did the EU carbon math