🌎 Bright spots and sunsets in the OBBB #253

One Big Beautiful Bill ushers in new (and old) energy agenda

Decarbonization becomes national security

Happy Monday!

In this week’s issue, we break down the Biden administration’s efforts to use defense spending to accelerate clean energy development. Tl;dr - it’s an important, albeit interim, anchoring of climate tech as national security that’ll likely be most relevant for framing future policy gambits. In the short term, this move compensates for a lack of more permanent infrastructure action and through advanced market commitments may hopefully pull some technologies through the valley of death.

In big fundings this week, a Croatian electric sports car maker nets $537m, alongside $150m for microelectromechanical switches, and $100m for recycled cotton fibers. We also have 6 (!) new fund announcements, including $461m for Obvious Ventures’ newest fund and an innovative “Fast Grants model” via Collaborative Fund’s new Shared Future fund.

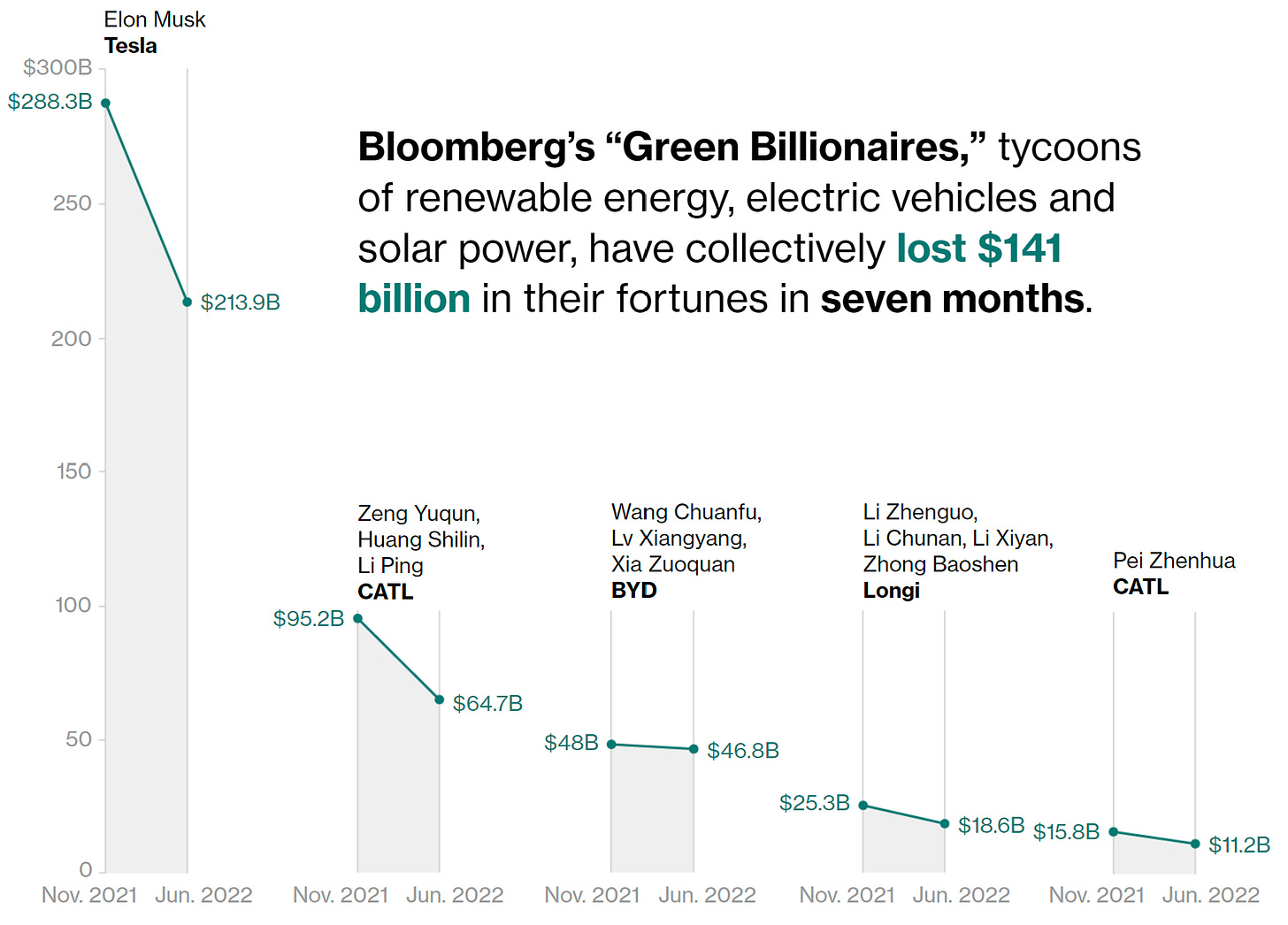

In the news, a new Federal Highway proposal for fast chargers (read: not Tesla) every 50 miles on highways, EU votes to stop internal combustion vehicles by 2035, and the 23 wealthiest climate entrepreneurs are down $141b.

Thanks for reading!

First COVID vaccines, then baby formula, and now clean energy. The White House is playing defense invoking the Defense Production Act (DPA) to boost the manufacturing of decarbonization technology. The 71-year-old law permits the White House to deem certain materials essential for national defense and coordinate with industry to obtain those goods.

🔨 DOE rated orders. The White House granted the DOE authority to tap private businesses to provide the climate tech products listed above. The government gets what the government wants; businesses must fulfill government “rated orders” (or contracts) ahead of any existing ones.

💸 Advanced market commitment. AMCs are back. Remember our feature with Nan from Stripe & Frontier? And Operation Warp Speed for COVID vaccines? Having a guaranteed buyer (at any price) incents private businesses to quickly scale production. There’s ~$900m in the DPA fund now (to be split across other urgent non-climate use cases like baby formula) with pending legislation for an additional $100m in DPA funding earmarked for the clean energy sector.

🚦 Environmental policy used to be all about preventing bad private actors such as the oil and gas majors, now it’s increasingly about incenting climate action from the private sector. As Robinson Myers writes in The Weekly Planet, “The government now has to cajole private actors into doing things—and when they can’t or won’t, the DPA makes sure that the White House can do them on its own.”

🗽 Nothing spurs goodwill for made-in-America clean energy resiliency like a threat to our national security. The DPA fits with the letter of the law in that renewable energy production is definitionally national defense. But between the lines, the real appeal of the DPA is the avoidance of politics - namely tricky actors in Congress like Sen. Manchin, and trippy laws in Judiciary like West Virginia v. EPA.

🔁 What goes around, comes around with executive actions. The DPA that Biden is using to promote solar development is the exact same DPA which Trump used to prop up money-losing coal plants. Who knows how long the clean application will last. The DPA is a short-term cash jumpstart in lieu of long-term federal legislation.

🏎️ Rimac Group, a Croatia-based electric sports car maker, raised $537m from Goldman Sachs, Porsche, and a technology fund advised by SoftBank.

⚡ Menlo Microsystems, an Irvine, CA-based producer of microelectromechanical systems switches, raised $150m in funding from Vertical Venture Partners, Future Shape, Fidelity Management & Research Company, DBL Partners and Adage Capital Management.

♻️ Recover, a Madrid-based maker of recycled cotton fibers, raised $100m in equity funding from Goldman Sachs and Story3 Capital Partners.

🛰️ SkySpecs, an Ann Arbor, MI-based developer of drone inspection technology for renewables asset management raised $80m in Series D funding from Goldman Sachs Asset Management.

🔋 ZincFive, a Tualatin, OR-based producer of nickel-zinc (NiZn) battery-based solutions, is raising $75m in Series D funding from OGCI Climate Investments.

⚡ OhmConnect, an Oakland, CA-based provider of a residential energy flexibility platform, raised $55m in Series D funding from ClearSky, Sidewalk Infrastructure Partners, TELUS Ventures, Carrier, SunPower, City Light Capital, Floodgate, Citi Impact Fund, Elemental Excelerator, Radicle Impact and Japan Energy Fund.

⛵ ZeroNorth, a Boston, MA-based marine vessel optimization software company helping owners and operators reduce CO2 emissions, raised a $50m Series B round led by PSG, A.P. Moller Holding, and Cargill.

🌱 FarmWise, a San Francisco, CA-based startup weed robotics startup, raised $45m in Series B funding from Fall Line Capital, Middleland Capital, GV, Taylor Farms, Calibrate Ventures, Playground Global, and Cavallo Ventures.

🔋 Ion Storage Systems, a Beltsville, MD-based maker of solid state lithium metal batteries, raised $30m in Series A funding from Toyota Ventures, Tenaska and Bangchak Corp.

🌎 Encamp, an Indianapolis, IN-based environmental compliance platform, raised $30m in Series C funding from Drive Capital, OpenView, High Alpha Capital, and Allos Ventures.

🚲 Upway, a Paris-based startup that sells secondhand electric bikes, raised $25m in Series A funding from Exor Seeds and Sequoia Capital.

⚡ Witricity, a Watertown, MA-based wireless charging company, raised $25m in Corporate funding from Siemens.

🥩 SciFi Foods (fka Artemys Foods), a San Francisco, CA-based cultivated meat startup raised $22m in Series A funding from Andreessen Horowitz and Coldplay.

♻️ Rheaply, an enterprise resource platform helping organizations better operationalize reuse, raised $20m in an inter-series round from Revolution’s Rise of the Rest Seed Fund, John Doerr, Coupa Ventures, PSP Growthc Rankin Family Ventures, High Alpha, Salesforce Ventures Impact Fund, Emerson Collective, Techstars, and HPA.

👚 Colorifix, a Norwich, UK-based company removing environmentally hazardous chemicals from the textile dyeing and fixing process, raised $18.9m in Series B funding from H&M Group, Sagana, Cambridge Enterprise, Bombyx Growth Fund, PDS Ventures, and Regeneration.VC.

♻️ Scipher Technologies, a Melbourne-based electronic waste recycling company, raised $15m in Series B funding from Clean Energy Finance Corporation and Australia Business Growth Fund.

🌱 Crop.Zone, a Aachen, Germany-based developer of an electric weeding system, raised $11m in Series A funding from Nufarm, Madaus Capital Partners, and Demeter.

♻️ Novoloop, a Menlo Park, CA-based company upcycling plastic waste into chemicals and materials, raised $10m in a Series A extension round from Hanwha Solutions and Mistletoe, the venture capital firm of Taizo Son (younger brother of SoftBank's Masayoshi Son).

🌱 Brevel, a Tel Aviv-based startup developing a microalgae-based protein, raised $8.4m in Seed funding from FoodHack, Good Startup VC, Tet Ventures, and Nevateam Ventures.

🍎 Strella Biotechnologies, a Philadelphia, PA-based startup developing sensor technology designed to reduce food waste and improve quality, raised an $8m Series A round from Millennium New Horizons, GV, Rich Products Ventures, Mark Cuban, Yamaha Motor Ventures, Catapult Ventures, and Union Labs.

🏗️ Prometheus Materials, a Niwot, CO-based maker of zero-carbon building materials, raised $8m in Series A funding from Sofinnova Partners, Microsoft Climate Innovation Fund, Skidmore, Owings & Merrill (SOM), GAF, and The Autodesk Foundation.

🌬️ Shoreline, a Norway-based workflow automation and asset simulation SaaS company for the wind industry, raised $7.5m in funding from Ecosystem Integrity Fund, Blue Bear Capital, Ferd Capital, Alliance Venture, and Investinor.

♻️ SolarCycle, an Oakland, CA-based startup for recycling and reusing solar panels, raised $6.6m in Seed funding from Urban Innovation Fund, Closed Loop Partners, SolarCity founders Peter and Lyndon Rive, and Sunpower CTO Tom Dinwoodie.

🛰️ Virridy, a Boulder, CO-based developer of technologies for monitoring and managing water, energy and agricultural resources, raised $5.5m in Series A funding from Accord Capital, FHI 360, Cleo Capital, Reverent Rock, Save Earth and VertueLab.

☔ Salient Predictions, a new provider of weather intelligence for the energy, agriculture and insurance industries, raised $5.3m in Seed funding from Wireframe Ventures, Munich Re Ventures, Powerhouse Ventures and Endeavor8.

☀️ SolarSquare, a Mumbai, India-based consumer solar startup raised $4m in Seed funding from Good Capital, Lowercarbon Capital, Symphony Asia, Rainmatter, and Better Capital.

🛢️ Noble Gas Systems, a Novi, MI-based developer and manufacturer of hydrogen gas storage tanks, raised $3.5m in Series A funding from AP Ventures.

🌎 Datia, a Sweden-based sustainability calculation fintech, raised $3.4m in Seed funding from Nauta Capital, Accel Starter Ramzi Rizk, Zenloop’s founder Paul Schwarzenholz, Söderberg & Partners and Sting.

🐟 Seafood Reboot, a Paris-based startup developing plant-based seafood products, raised $3.4m in Pre-seed funding from Demeter Partners, SENSEII Ventures, Founders Future Good, and Beyond Impact.

🥛 Brown Foods, a Delhi, India-based company developing milk using mammalian cell culture technology, raised $2.4m in Seed funding from Y Combinator, AgFunder, SRI Capital, Amino Capital, and Collaborative Fund.

Obvious Ventures raised a total of $461m for its fourth flagship fund and its second opportunities fund focused on funding world positive solutions.

Collaborative Fund launched Shared Future Fund, a new platform that will programmatically support 100 climate companies with $100,000 each just this year. Collab announced that Shared Future has partnered with two innovation hubs, Activate and Y Combinator, and that climate startups in these accelerators are eligible for funding.

Apparel Impact Institute raised a $250m fashion climate fund including LPs such as H&M and Lululemon.

Vale, a global mining company, launched a $100m corporate venture capital fund focused on sustainable mining.

Los Angeles Cleantech Incubator (LACI) raised a $6m green-loan program for Black, brown and women early-stage startup founders.

FoodHack, a Switzerland-based foodtech community, raised a $1m investment platform ala AngelList for food and climate tech startups.

The Federal Highway Administration proposed new standards for a nationwide EV charging network that requires common (read: not Tesla-exclusive) fast chargers to be built 50 miles apart on highways, including in rural areas. The standards are part of a large national buildout as the Biden administration pursues a goal of ensuring 50% of new vehicles sold in 2030 are electric.

Further down the road of clean transportation, the EU parliament voted to stop the sale of new internal combustion engine cars and vans by 2035.

Though, other European climate legislation has faltered amidst the macroeconomic downturn and what the FT calls the "politically complicated" task of passing carbon trading and border taxes amid high energy costs.

Finland is close to making history as the first country to legally commit to carbon neutrality by 2035 and carbon negativity by 2040. With parliament signed off, it’s over to the desk of President Sauli Niinistö.

The US DOE Loan Programs Office closed a $504m loan to Advanced Clean Energy Storage to develop the world’s largest industrial green hydrogen facility using geological salt domes for long-duration storage of green H2. It’s the first completed loan in 10 years out of the powerhouse office.

In the current market downturn, the world’s 23 wealthiest climate entrepreneurs have collectively lost $141 billion.

Who created the now famous climate stripes graphic?

According to former EPA regional administrator Judith Enck, “Plastics recycling will never work.” Though superworms - which have just been found capable of surviving on a diet of exclusively Styrofoam - can help.

LocalGlobe published a nifty graphic titled The Climate Equation as a framework for climate tech investing.

Scientists successfully grow plants in lunar soil, raising the potential for astro agriculture. Though, last we asked #climatetwitter, y’all voted nay for space ag as not climate tech.

Plant-based food stocks are struggling as consumers gravitate towards cheaper, traditional food options. However, as the cost of meat rises with inflation, could plant-based alternatives become competitive?

Occidental subsidiary 1PointFive and Carbon Engineering announce a "franchise-like model" for direct air capture deployment.

Fast Company details the origin story of our friends at Work on Climate.

Carbon cargo. Mitsubishi plans to ship liquified, captured CO2 on custom-built ocean liners.

Green beans. A cup of carbon? Coffee makers will need to grow new types of beans to withstand the effects of climate change.

Who else noticed this emoji Easter Egg that we’ve been leaving y’all? 🌎🌍🌏

🗓️ Techcrunch Sessions: Climate: Join TechCrunch on June 14 for a deep dive into the market forces, planet-aiding startups and the psychology motivating this new era of climate tech innovation. Use code CTVC for 50% off passes.

🗓️ Elemental Live: Join on June 23 for this deep dive on the Critical Minerals for the Energy Transition Deep Dive with Ford, Nth Cycle, and Lilac Solutions.

🗓️ Direct Air Capture Summit: Register to attend the third edition of this one-of-a-kind meeting to hear from leading voices in the DAC industry including Climeworks, Heirloom, Microsoft, Potsdam Institute, and the European Commission on June 30.

🗓️ Carbon Markets Summit: Register to hear from corporate sustainability, policy, and financial market leaders’ discussion of the state of VCMs on June 30.

💡 The Future of ClimateTech: Pre-seed and seed startups should apply by June 13 to pitch top-tier investors as part of this global climate tech competition.

Senior Analyst / Associate @Angeleno Group

Head of Research @RightHandGreen

Account Executive - US Market @Waterplan

Finance and Operations Analyst @Blackhorn Ventures

Manager, Investor Relations @Unreasonable Group

Head of Investor Relations @G2 Venture Partners

Principal (Investor) @BHP

Investment Director @BHP

Business Development and Partnerships Lead @Heirloom

Chief of Staff @Sourcemap

Senior Account Executive @Forerunner

Feel free to 📩 send us new ideas, recent fundings, events & opportunities, or general curiosities. Have a great week ahead!

One Big Beautiful Bill ushers in new (and old) energy agenda

Climate, capital, and carrots in London's new playbook

US plays popcorn politics with biofuels and beyond